Broadcom's VMware Deal: An Extreme Price Hike Of 1,050%

Table of Contents

VMware's Journey: From IPO to Acquisition

VMware, a pioneer in virtualization technology, has had a remarkable journey. Founded in 1998, the company quickly established itself as a leader in providing software to virtualize computer hardware, enabling businesses to run multiple operating systems on a single physical server. This significantly improved efficiency and reduced IT infrastructure costs. VMware's initial public offering (VMware IPO) marked a significant milestone, setting the stage for substantial growth. The subsequent years saw VMware solidify its position in the virtualization market and expand into cloud computing solutions.

- Key Milestones:

- 1998: VMware founded.

- 2000: VMware launches ESX Server.

- 2007: VMware goes public (IPO).

- 2012: VMware introduces vCloud Suite.

- 2022: Dell Technologies spins off VMware.

- 2023: Broadcom acquires VMware.

The VMware stock price experienced significant fluctuations throughout its history, reflecting the dynamic nature of the technology industry and the evolving landscape of virtualization and cloud computing. Understanding this trajectory is crucial to grasping the magnitude of the Broadcom acquisition. The journey from VMware IPO to acquisition showcases incredible growth, making the final sale price all the more remarkable in relation to the original VMware stock price. Analyzing the VMware history is essential to putting this massive price hike into perspective.

Broadcom's Strategic Rationale: Why Such a High Price?

Broadcom's acquisition of VMware is a strategic move aimed at expanding its presence in the lucrative enterprise software market. Broadcom, known for its semiconductor and infrastructure software businesses, saw VMware's virtualization and cloud technologies as a perfect complement to its existing portfolio. The synergy between Broadcom's infrastructure offerings and VMware's software solutions promises significant benefits.

- Synergies and Benefits for Broadcom:

- Expanded market share in enterprise software.

- Access to VMware's extensive customer base.

- Diversification of revenue streams.

- Potential for cross-selling and upselling opportunities.

- Strengthened competitive position against other major tech players.

Broadcom's strategic decision to pay such a premium reflects its belief in VMware's long-term growth potential and the significant value it brings to the table. The competitive landscape in the enterprise software market is intense, and this acquisition positions Broadcom for future growth and dominance.

The 1050% Price Hike: A Deep Dive into the Numbers

The Broadcom VMware acquisition price represents an astonishing 1050% increase over VMware's initial IPO price. This staggering figure underscores the significant growth VMware experienced and the premium Broadcom was willing to pay to secure this strategic asset. The premium paid reflects the value of VMware's established market position, its strong customer relationships, and the potential for future growth in the evolving cloud computing market.

- Factors Contributing to the High Price:

- VMware's market leadership in virtualization.

- Strong and established customer base.

- Significant growth potential in the cloud computing market.

- Strategic fit with Broadcom's existing portfolio.

- Competitive bidding environment.

Analyzing the valuation metrics employed in this deal, such as revenue multiples and discounted cash flow analysis, helps to understand the justification for the acquisition cost. Comparing this deal to other major tech acquisitions in recent years provides further context and reveals the high premium paid for VMware's unique strengths and market position.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom VMware acquisition is facing significant regulatory scrutiny and antitrust concerns. Authorities are closely examining the potential impact on competition in the virtualization and networking markets. Concerns exist that the combined entity could leverage its market power to stifle innovation and harm consumers.

- Potential Antitrust Concerns:

- Reduced competition in the virtualization market.

- Potential for anti-competitive pricing practices.

- Impact on innovation and the development of competing technologies.

- Concerns regarding market dominance.

Ongoing investigations and regulatory reviews are underway in various jurisdictions, and the outcome of these processes will significantly impact the future of the acquisition. The merger approval process is likely to be lengthy and complex given the magnitude of the deal and the potential implications for competition.

Long-Term Implications for VMware and the Tech Industry

The Broadcom VMware acquisition will have profound long-term implications for VMware's customers, employees, and product roadmap. Customers may see changes in pricing, product offerings, and support services. The integration of VMware's technology into Broadcom's portfolio could lead to innovations in the cloud computing space, but it also raises concerns about reduced competition and potential limitations on innovation. The future of VMware's independence and its continued leadership in the virtualization market remain open questions.

- Potential Long-Term Effects:

- Changes to VMware's product roadmap and innovation strategy.

- Potential impact on customer relationships and support services.

- Shifts in competitive dynamics within the virtualization and cloud computing markets.

- Long-term implications for the overall technological landscape.

Conclusion

The Broadcom VMware acquisition stands as a landmark event in the tech industry, characterized by a staggering 1050% price increase over VMware's IPO price. Broadcom's strategic rationale, the significant regulatory challenges, and the potential long-term consequences for the tech landscape are all key factors to consider. This acquisition reshapes the competitive dynamics of the virtualization and cloud computing sectors, prompting close observation of its impact on innovation and market competition. The high price reflects the immense value placed on VMware's technology and market position.

Stay informed about the ongoing developments in the Broadcom-VMware merger and its impact on the future of virtualization. Follow us for further analysis and updates on this monumental deal and other significant developments in the tech world. Learn more about the implications of the Broadcom VMware price hike by subscribing to our newsletter. Continue your research into the complexities of this massive Broadcom VMware acquisition.

Featured Posts

-

Pogacars Raw Tour Of Flanders Data A Strava Analysis

May 26, 2025

Pogacars Raw Tour Of Flanders Data A Strava Analysis

May 26, 2025 -

Link Nonton Moto Gp Argentina 2025 Siaran Langsung Balapan Dini Hari

May 26, 2025

Link Nonton Moto Gp Argentina 2025 Siaran Langsung Balapan Dini Hari

May 26, 2025 -

Saksikan Aksi Moto Gp Inggris 2025 Jadwal Tayang Di Tv

May 26, 2025

Saksikan Aksi Moto Gp Inggris 2025 Jadwal Tayang Di Tv

May 26, 2025 -

Martin Compston And The Unexpected Los Angeles Feel Of His Glasgow Set Thriller

May 26, 2025

Martin Compston And The Unexpected Los Angeles Feel Of His Glasgow Set Thriller

May 26, 2025 -

Barcelona Atletico Madrid Maci Canli Yayinini Kacirmayin Fanatik

May 26, 2025

Barcelona Atletico Madrid Maci Canli Yayinini Kacirmayin Fanatik

May 26, 2025

Latest Posts

-

Beyond The Baseline Examining The Impact Of Crowd Behavior On French Open Matches

May 30, 2025

Beyond The Baseline Examining The Impact Of Crowd Behavior On French Open Matches

May 30, 2025 -

Is Jon Jones Scared Of Tom Aspinall Gustafsson Offers Insight

May 30, 2025

Is Jon Jones Scared Of Tom Aspinall Gustafsson Offers Insight

May 30, 2025 -

Ufc Heavyweight Unhappy With Jon Jones Latest Development

May 30, 2025

Ufc Heavyweight Unhappy With Jon Jones Latest Development

May 30, 2025 -

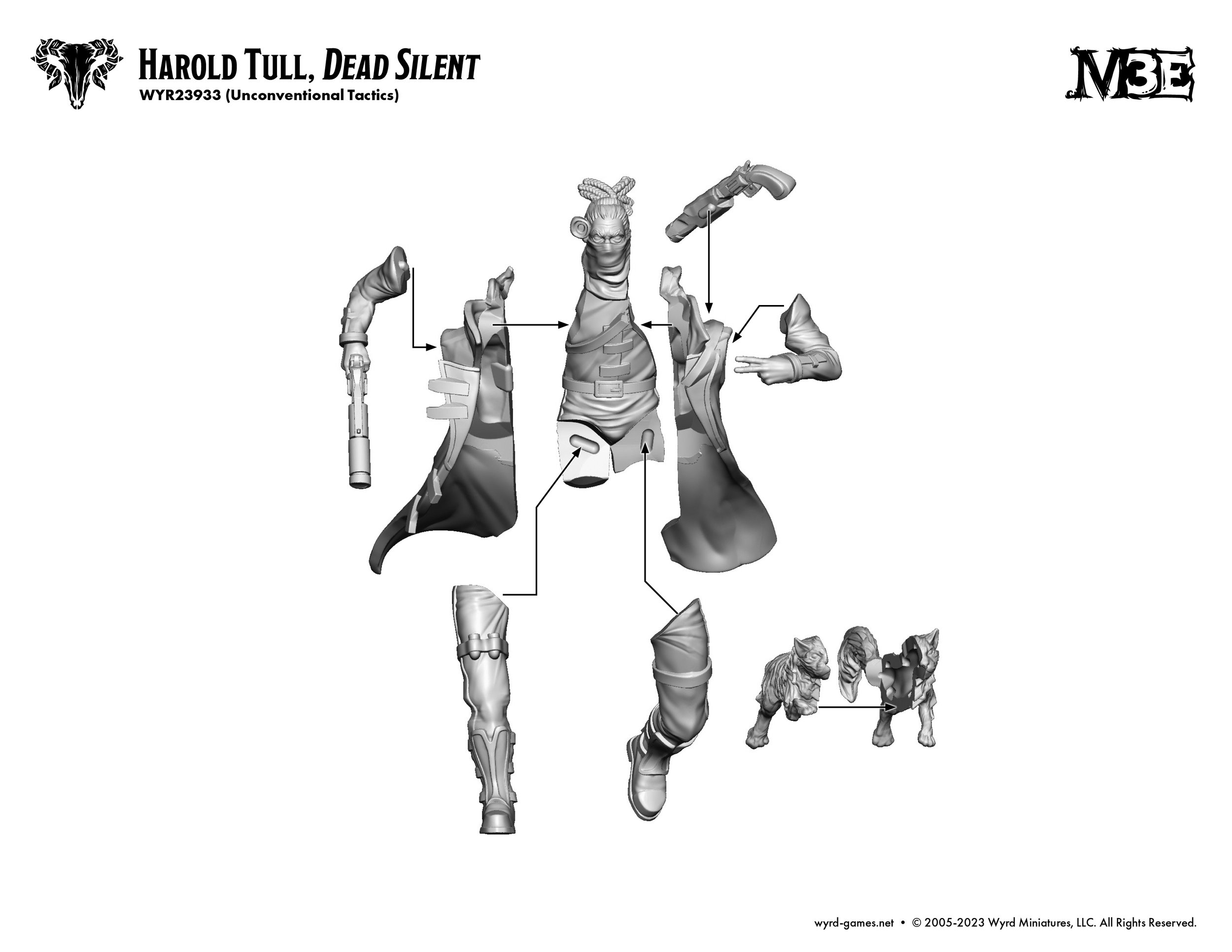

French Open Opponents Dealing With Hostile Crowds And Unconventional Tactics

May 30, 2025

French Open Opponents Dealing With Hostile Crowds And Unconventional Tactics

May 30, 2025 -

The Dark Side Of Roland Garros How Opponents Face Harassment

May 30, 2025

The Dark Side Of Roland Garros How Opponents Face Harassment

May 30, 2025