Broadcom's VMware Deal: Significant Price Increase Concerns AT&T

Table of Contents

The Direct Impact of Increased VMware Licensing Costs on AT&T

VMware's Central Role in AT&T's Infrastructure

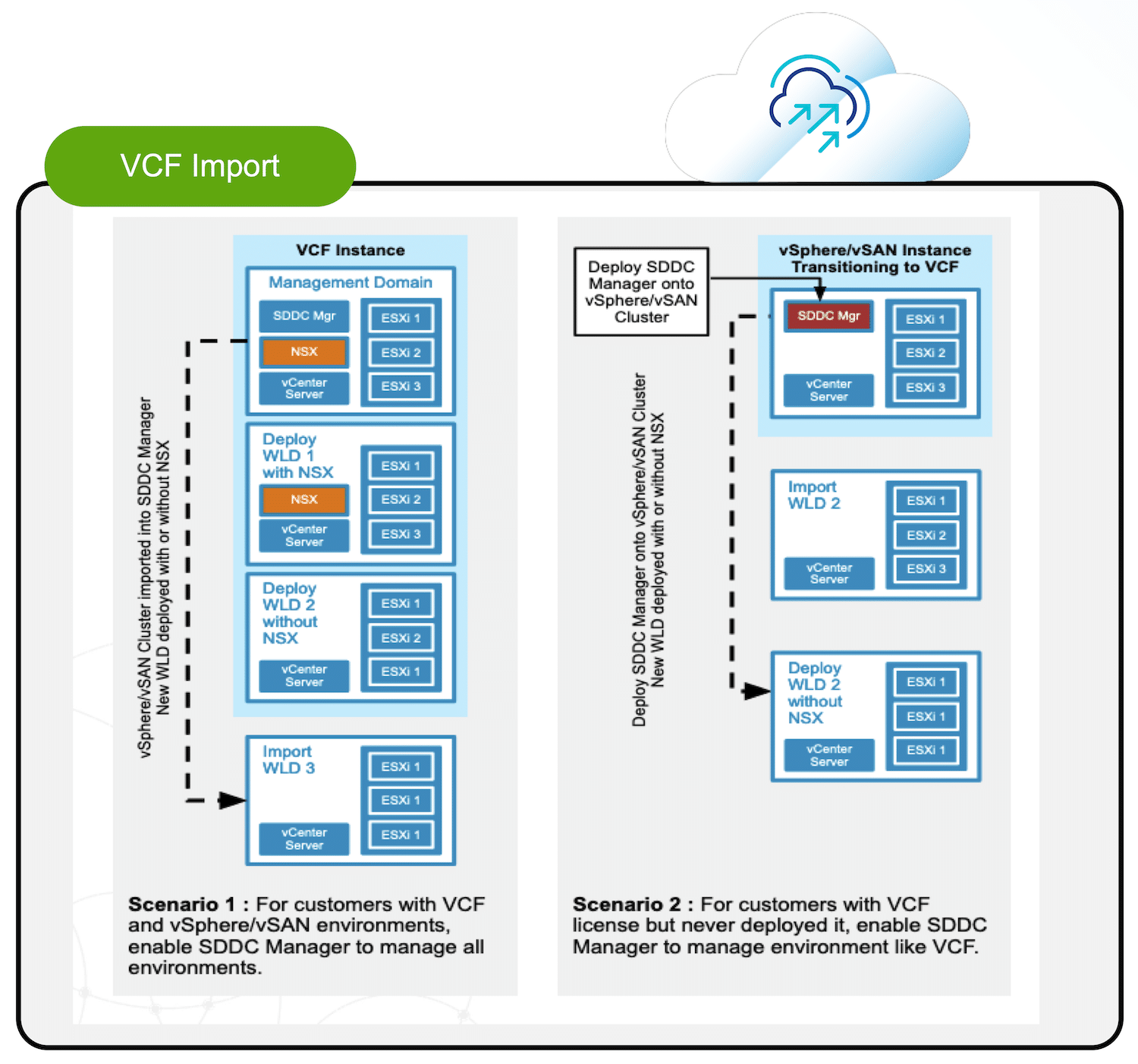

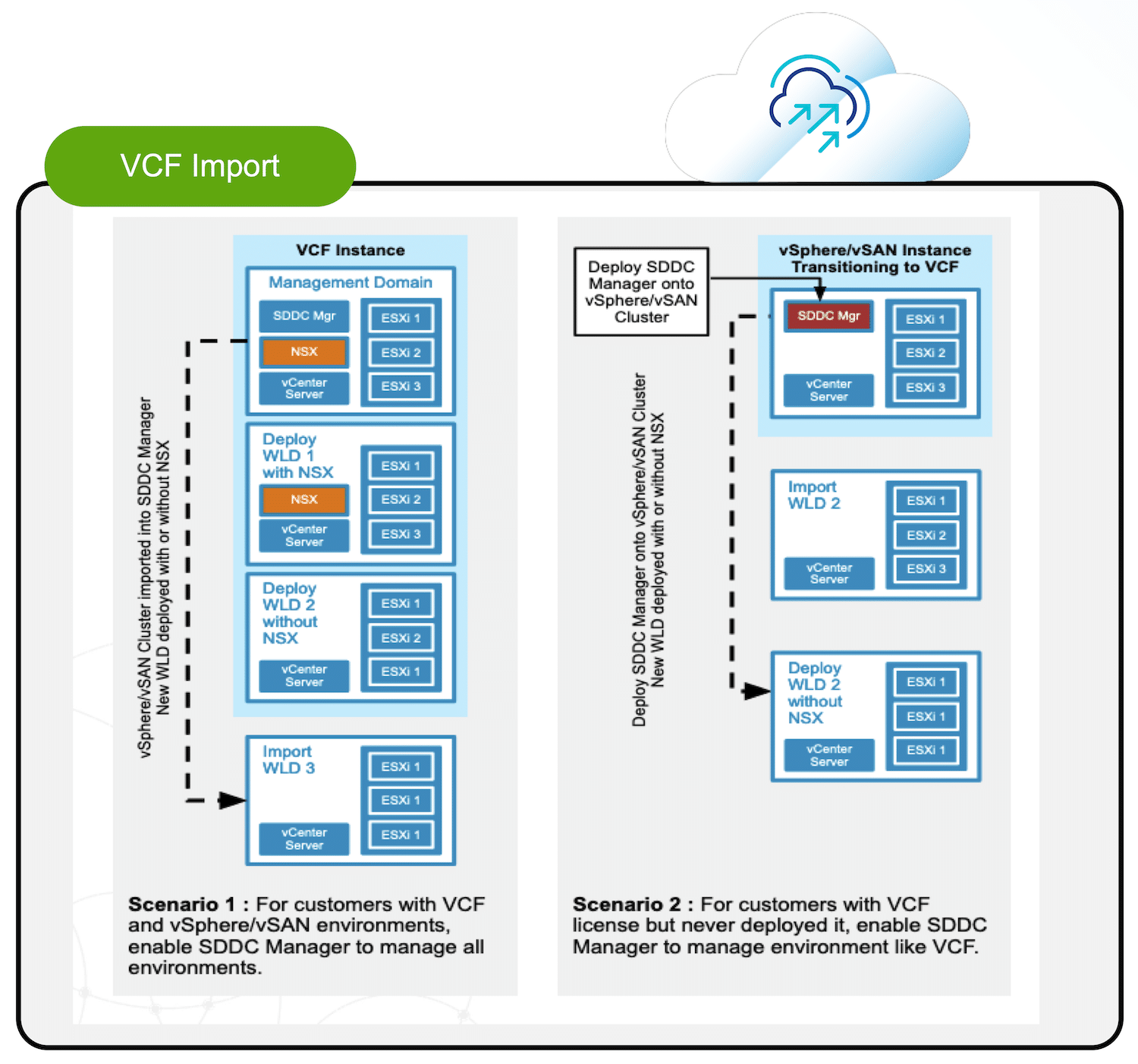

AT&T heavily relies on VMware's virtualization technology to power its network operations, data centers, and cloud services. This extensive reliance makes it particularly vulnerable to any price increases resulting from the Broadcom acquisition.

- Specific VMware Products Used by AT&T: vSphere (for server virtualization), vSAN (for software-defined storage), and NSX (for network virtualization) are likely key components of AT&T's infrastructure.

- Scale of AT&T's VMware Deployment: While precise figures aren't publicly available, it's safe to assume AT&T utilizes thousands, if not tens of thousands, of VMware licenses across its vast network. This scale significantly amplifies the impact of any price increases. This critical infrastructure underpins AT&T's core services, making any disruption incredibly costly and damaging.

Anticipated Price Increases Post-Acquisition

Broadcom has a history of raising prices after acquiring companies. This pattern raises serious concerns about the future cost of VMware licensing for AT&T.

- Examples of Previous Broadcom Price Hikes: Broadcom's track record shows a tendency to consolidate market share and leverage its position to increase prices, often significantly. Analyzing these past acquisitions provides a strong indication of what AT&T might face.

- Potential Percentage Increases and Financial Implications: While precise predictions are difficult, even a moderate (e.g., 10-20%) increase in VMware licensing fees could translate to hundreds of millions, if not billions, of dollars in additional costs for AT&T annually. This directly impacts profitability and investment capabilities.

Limited Vendor Alternatives and Negotiation Power

Migrating away from VMware is a complex and costly undertaking, limiting AT&T's negotiation power. The lack of readily available, comparable alternatives reinforces this vendor lock-in.

- Challenges and Complexities of Infrastructure Migration: Migrating a large-scale infrastructure like AT&T's is an incredibly complex, time-consuming, and expensive process. Downtime risks, compatibility issues, and integration challenges significantly hinder the possibility of a quick switch.

- Lock-in Effects and Investment Required: Switching vendors necessitates a massive investment in new hardware, software, and extensive retraining of staff. This significant sunk cost effectively locks AT&T into VMware, making it highly susceptible to price hikes.

Broader Implications for AT&T's Business Strategy and Financial Performance

Impact on AT&T's Cloud Strategy

Increased VMware costs will directly impact AT&T's cloud computing initiatives, potentially hindering its competitiveness.

- Cost Increases for Cloud Services: Higher VMware licensing fees will inevitably translate to higher costs for AT&T's cloud offerings, potentially making them less attractive to customers compared to competitors.

- Hindered Competitiveness and Market Share: Increased costs could force AT&T to raise prices for its cloud services, potentially leading to lost customers and reduced market share in a fiercely competitive landscape.

Potential for Reduced Profit Margins and Shareholder Value

The increased operating costs stemming from higher VMware licensing fees will undoubtedly squeeze AT&T's profit margins.

- Pressure on AT&T's Stock Price: Reduced profitability could lead to decreased investor confidence and put downward pressure on AT&T's stock price.

- Impact on Financial Statements: The increased costs will be clearly reflected in AT&T's financial statements, impacting key metrics like operating income and net income. This could negatively affect credit ratings and borrowing costs.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware deal is subject to regulatory scrutiny and antitrust concerns. This could potentially impact the price increases.

- Ongoing Investigations and Potential Legal Challenges: Regulatory bodies are carefully examining the potential anti-competitive implications of this merger. Any resulting legal challenges or imposed restrictions could influence the extent of future price increases.

- Influence on Price Increases: Regulatory intervention could limit Broadcom's ability to raise prices to the extent it desires, potentially offering some relief to AT&T.

Conclusion

The Broadcom-VMware acquisition presents a significant challenge for AT&T. The potential for substantial price increases in VMware licensing poses a serious threat to its infrastructure, cloud strategy, and financial performance. The lack of readily available alternatives and the high cost of migration significantly limit AT&T's options. The ongoing regulatory scrutiny offers some potential for mitigation, but the situation remains precarious.

The Broadcom VMware deal's implications for AT&T are far-reaching and demand close monitoring. Staying informed about the unfolding situation is crucial for understanding its impact on the telecom giant and the broader technology landscape. Subscribe to our newsletter for expert analysis and further updates on this developing story.

Featured Posts

-

Bianca Censoris Sister Angelina Poses In A Striking Cutout Outfit

May 04, 2025

Bianca Censoris Sister Angelina Poses In A Striking Cutout Outfit

May 04, 2025 -

Peter Distad To Lead Foxs New Direct To Consumer Streaming Service

May 04, 2025

Peter Distad To Lead Foxs New Direct To Consumer Streaming Service

May 04, 2025 -

Kentucky Derby 2025 Odds Top Contenders And Betting Predictions

May 04, 2025

Kentucky Derby 2025 Odds Top Contenders And Betting Predictions

May 04, 2025 -

Ufc 314 Main Event Odds A Closer Look At Volkanovski Vs Lopes

May 04, 2025

Ufc 314 Main Event Odds A Closer Look At Volkanovski Vs Lopes

May 04, 2025 -

Deutschland Start Der Chefsache Esc 2025 Sonderedition

May 04, 2025

Deutschland Start Der Chefsache Esc 2025 Sonderedition

May 04, 2025

Latest Posts

-

Final Destination Bloodline Trailer Tony Todds Last Performance

May 04, 2025

Final Destination Bloodline Trailer Tony Todds Last Performance

May 04, 2025 -

Final Destination 6 Bloodline Sets New Runtime Standard

May 04, 2025

Final Destination 6 Bloodline Sets New Runtime Standard

May 04, 2025 -

Final Destination Bloodlines Runtime Breaks Franchise Record

May 04, 2025

Final Destination Bloodlines Runtime Breaks Franchise Record

May 04, 2025 -

High Stakes For The 666 M Horror Franchise The Monkeys Impact On The Upcoming Reboot

May 04, 2025

High Stakes For The 666 M Horror Franchise The Monkeys Impact On The Upcoming Reboot

May 04, 2025 -

The Monkeys Legacy Pressure Mounts On The 666 M Horror Franchise Reboot

May 04, 2025

The Monkeys Legacy Pressure Mounts On The 666 M Horror Franchise Reboot

May 04, 2025