Brookfield Re-evaluates US Manufacturing Due To Tariffs

Table of Contents

The Impact of Tariffs on Brookfield's US Manufacturing Investments

Tariffs have undeniably impacted Brookfield's profitability in the US manufacturing sector. Increased costs related to imported raw materials and components have significantly squeezed profit margins. This is not merely an abstract concern; it's a quantifiable challenge.

-

Increased Raw Material Costs: Tariffs on steel, aluminum, and other essential materials have directly increased production costs for numerous Brookfield-owned manufacturing facilities. This effect is amplified by the fact that many US manufacturers rely heavily on imported components.

-

Higher Import Costs: The cost of importing machinery, specialized parts, and other vital inputs has risen substantially, directly impacting operational efficiency and profitability. This is particularly true for industries with complex supply chains reliant on global sourcing.

-

Profit Margin Compression: The combined effect of increased raw material and import costs has resulted in a noticeable compression of profit margins at several Brookfield-owned US manufacturing plants. While precise figures remain confidential, internal reports suggest a significant negative impact on overall Return on Investment (ROI).

-

Data & Statistics: While Brookfield hasn't publicly released specific financial data related to tariff impacts, industry reports suggest a widespread decline in profitability within affected sectors. Further analysis is needed to fully quantify the precise effect on Brookfield's portfolio.

Brookfield's Re-evaluation Process: Strategies and Considerations

In response to these challenges, Brookfield is undertaking a comprehensive re-evaluation of its US manufacturing strategy. This involves a multi-pronged approach encompassing supply chain diversification, cost optimization, and a careful consideration of potential relocation.

-

Supply Chain Diversification: Brookfield is actively exploring alternative sourcing options for raw materials and components, aiming to reduce reliance on tariff-affected countries. This may involve sourcing from different regions, including nearshoring and reshoring strategies.

-

Cost Optimization: The company is implementing various cost-cutting measures, including streamlining processes, negotiating better deals with suppliers, and investing in automation and technology to improve efficiency.

-

Relocation Considerations: Brookfield is carefully assessing the potential for relocating some manufacturing operations to countries with more favorable trade policies and lower production costs. This is a complex decision balancing the potential for cost savings against the loss of existing infrastructure and workforce.

-

Nearshoring and Reshoring: While offshore manufacturing remains an option, Brookfield is actively investigating nearshoring (relocating production to nearby countries) and reshoring (returning production to the US). Both options present unique advantages and challenges that require careful evaluation. The decision will be based on a holistic assessment of costs, infrastructure, workforce availability, and geopolitical stability.

Economic Implications of Brookfield's Decision

Brookfield's decision will have significant ripple effects throughout the US economy. The potential outcomes range from job losses in affected regions to a broader impact on US manufacturing competitiveness.

-

Job Creation/Loss: Relocation of manufacturing operations could lead to job losses in certain regions. Conversely, investments in automation and technology may offset some of these losses, but potentially with changes in the skillsets required.

-

Impact on US Manufacturing: Brookfield's actions reflect a broader trend among manufacturers reassessing their US operations due to tariffs. This could negatively affect the overall health of the US manufacturing sector in the long run.

-

US Competitiveness: The shift in manufacturing investment could impact the long-term competitiveness of US-made goods in the global market. The combination of increased costs and potential relocation could compromise the US's manufacturing dominance in certain sectors.

-

Ripple Effects: Changes in Brookfield's supply chains will have a ripple effect throughout related industries, impacting suppliers, distributors, and potentially creating challenges for supporting industries.

The Future of US Manufacturing in Light of Tariff Policies

The long-term implications of current tariff policies on US manufacturing remain uncertain. The current volatility creates significant challenges for investors like Brookfield.

-

Trade Policy Uncertainty: The fluctuating nature of trade policy creates instability and makes long-term investment planning difficult. This uncertainty discourages investment and hinders growth in the manufacturing sector.

-

Long-Term Investment Decisions: The current environment makes it difficult to forecast future costs and returns, impacting the willingness of businesses to invest in expansion or new projects.

-

Market Volatility: The combination of trade wars, fluctuating currency exchange rates and tariff changes create significant market volatility, making the US manufacturing sector a less attractive environment for investment compared to others.

Conclusion

Brookfield's re-evaluation of its US manufacturing investments underscores the profound impact of tariffs on the US economy. The company's strategic adjustments – encompassing supply chain diversification, cost optimization, and relocation considerations – will have significant implications for both Brookfield and the broader US manufacturing landscape. The potential for job displacement and the broader impact on US competitiveness demand careful monitoring and analysis. To stay informed about this evolving situation and the ongoing effects of tariffs on US manufacturing, follow Brookfield's official announcements and engage with credible economic research and industry reports. Understanding Brookfield's response to tariffs on US manufacturing is crucial for navigating the complexities of this shifting economic landscape.

Featured Posts

-

Rust A Critical Analysis Of The Completed Film Project

May 02, 2025

Rust A Critical Analysis Of The Completed Film Project

May 02, 2025 -

Tuerkiye De 1 Mayis Emek Ve Dayanisma Guenue Gecmisten Guenuemueze Bir Bakis

May 02, 2025

Tuerkiye De 1 Mayis Emek Ve Dayanisma Guenue Gecmisten Guenuemueze Bir Bakis

May 02, 2025 -

Funding Crisis For Indigenous Arts Festival Amidst Economic Difficulty

May 02, 2025

Funding Crisis For Indigenous Arts Festival Amidst Economic Difficulty

May 02, 2025 -

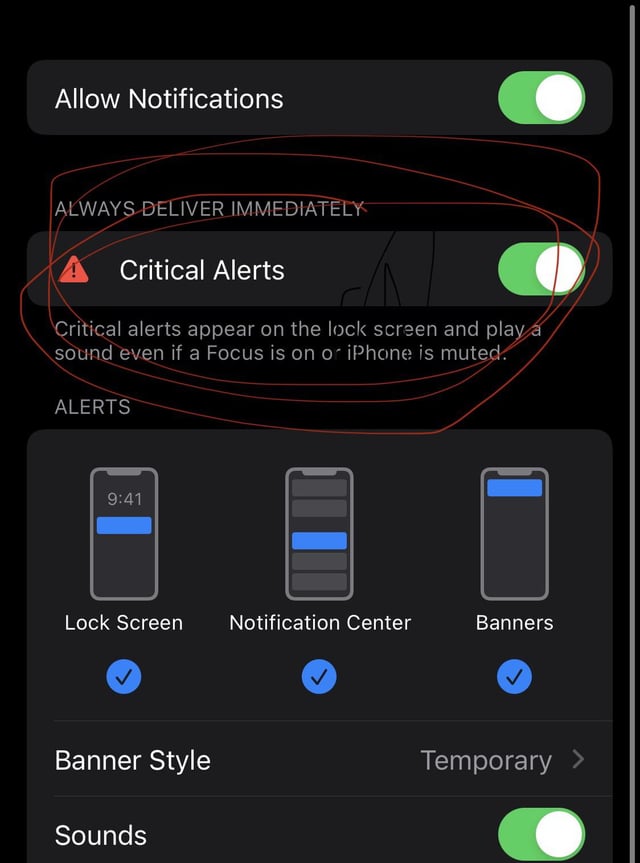

Crooks Office365 Exploit Millions In Losses For Executives

May 02, 2025

Crooks Office365 Exploit Millions In Losses For Executives

May 02, 2025 -

Tulsa Winter Preparedness 66 Salt Spreaders Keep Roads Clear

May 02, 2025

Tulsa Winter Preparedness 66 Salt Spreaders Keep Roads Clear

May 02, 2025

Latest Posts

-

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025 -

North Carolina Supreme Court Gop Candidate Challenges Recent Orders

May 02, 2025

North Carolina Supreme Court Gop Candidate Challenges Recent Orders

May 02, 2025 -

Understanding The Gop Candidates Appeal In The North Carolina Supreme Court Race

May 02, 2025

Understanding The Gop Candidates Appeal In The North Carolina Supreme Court Race

May 02, 2025 -

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 02, 2025

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 02, 2025 -

Florida And Wisconsin Voting Data Understanding The Shifting Political Dynamics

May 02, 2025

Florida And Wisconsin Voting Data Understanding The Shifting Political Dynamics

May 02, 2025