Brookfield's US Manufacturing Investment: Tariffs Weigh Heavily

Table of Contents

The Scale of Brookfield's US Manufacturing Investments

Brookfield's investment in US manufacturing is substantial. While precise figures aren't always publicly available due to the diverse nature of their portfolio, reports suggest billions of dollars invested across numerous facilities. Their investments span various crucial sectors, including:

- Logistics: Warehousing and distribution centers supporting supply chains across the country.

- Food processing: Investments in facilities involved in the production and packaging of food products.

- Industrial manufacturing: Supporting the production of various goods, encompassing diverse sub-sectors.

This geographically diverse portfolio ensures Brookfield is present in key manufacturing hubs across the nation, mitigating some regional risks but also exposing them to varying tariff impacts depending on local supply chains. Their investments are not concentrated in a single state but rather spread across multiple regions to diversify risk and capitalize on local opportunities. Understanding the scale of these investments is crucial to grasping the magnitude of the tariff impact.

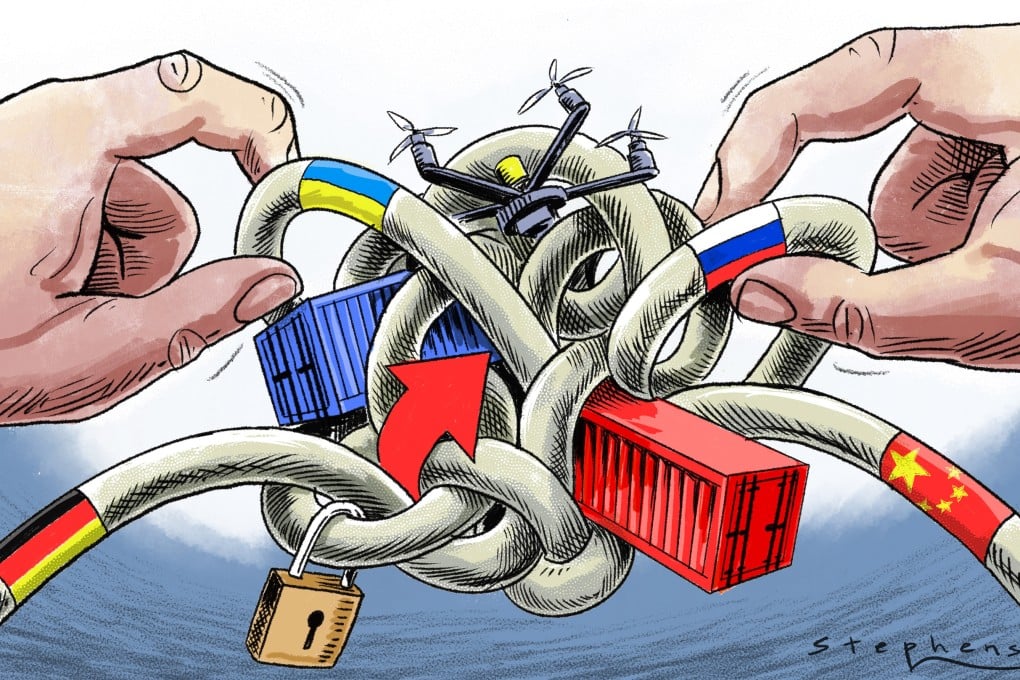

The Impact of Tariffs on Input Costs

Tariffs imposed on imported goods significantly impact Brookfield's manufacturing investments. The increased cost of imported raw materials and components directly affects profitability. Specific examples include:

- Steel: Tariffs on imported steel increase the cost of manufacturing goods requiring steel components, impacting industries like construction and automotive parts.

- Electronics: Tariffs on imported electronic components raise the cost of production for numerous manufactured goods, impacting numerous sectors.

- Plastics and Chemicals: The cost of essential plastics and chemical inputs, often sourced internationally, has also been significantly influenced by tariffs.

These increased input costs force manufacturers to either absorb the higher prices, reducing profitability, or pass on the increased costs to consumers, potentially reducing demand. This delicate balance significantly influences Brookfield's investment strategies and return expectations.

Brookfield's Strategic Responses to Tariffs

Faced with the challenges of tariffs, Brookfield has implemented several strategic responses to mitigate the negative impact:

- Domestic Sourcing: Increasingly, Brookfield is prioritizing sourcing raw materials and components from domestic suppliers. This reduces reliance on imported goods and minimizes tariff exposure, although it might lead to higher domestic sourcing costs.

- Contract Negotiation: Brookfield actively negotiates contracts with suppliers to share the burden of increased input costs and secure favorable pricing terms.

- Lobbying Efforts: Participating in industry lobbying efforts to advocate for policies that promote fair trade and reduce the burden of tariffs.

- Diversification: Expanding investments into sectors less susceptible to tariff impacts, spreading their risk profile.

The effectiveness of these strategies varies across different sectors and investment locations. Continuous adaptation and strategic flexibility are crucial for navigating the volatile tariff landscape.

The Broader Economic Context: US Manufacturing Sector and Global Trade

The impact of tariffs extends far beyond Brookfield's investments. The US manufacturing sector as a whole faces significant challenges, with tariffs influencing:

- Job Creation: Increased costs and reduced competitiveness can lead to job losses in affected industries.

- Economic Growth: The overall impact on manufacturing productivity and economic growth is a subject of ongoing debate among economists.

Brookfield's experience reflects broader trends in global trade and the challenges of navigating protectionist policies. The company's ability to adapt and respond effectively will influence not only its own success but also contribute to the ongoing resilience of the US manufacturing sector.

Future Outlook for Brookfield's US Manufacturing Investments

Predicting the future of Brookfield's US manufacturing investments requires considering several factors: the evolution of trade negotiations, economic forecasts, and the continued adaptation of their investment strategies. Several scenarios are possible:

- Tariff Reduction: A decrease in tariffs could significantly boost profitability and lead to further expansion in the sector.

- Continued Tariff Volatility: Fluctuating tariffs will necessitate continued strategic adaptation, possibly slowing expansion in some sectors.

- Reshoring and Nearshoring: Brookfield may further prioritize reshoring and nearshoring efforts to mitigate future tariff risks.

Brookfield's long-term strategy will depend on its ability to accurately predict and respond to these evolving economic conditions and global trade policies.

Conclusion: Navigating the Tariff Landscape for US Manufacturing Investment

The significant impact of tariffs on Brookfield's US manufacturing investments is undeniable. The increased costs of imported inputs, combined with the necessity for strategic responses such as domestic sourcing and contract renegotiation, significantly influences their operational strategies and profitability. Understanding the challenges and the effective responses adopted by Brookfield provides valuable insights into the broader impact of tariffs on the US manufacturing sector. Stay informed about the evolving landscape of US manufacturing investment and the impact of tariffs on key players like Brookfield to better understand this critical economic sector.

Featured Posts

-

Wzyraezm Ka Byan Kshmyr Bhart Ka Hsh Nhyn Bn Skta

May 02, 2025

Wzyraezm Ka Byan Kshmyr Bhart Ka Hsh Nhyn Bn Skta

May 02, 2025 -

Xrp Distribution Sbi Holdings Latest Move Impacts Ripple Xrp News

May 02, 2025

Xrp Distribution Sbi Holdings Latest Move Impacts Ripple Xrp News

May 02, 2025 -

Facelift Gone Wrong Public Outrage Over Actresss Altered Appearance

May 02, 2025

Facelift Gone Wrong Public Outrage Over Actresss Altered Appearance

May 02, 2025 -

Mqbwdh Kshmyr Eyd Pr Bharty Ryasty Dhsht Grdy Ka Slslh Jary

May 02, 2025

Mqbwdh Kshmyr Eyd Pr Bharty Ryasty Dhsht Grdy Ka Slslh Jary

May 02, 2025 -

Nikki Burdine Departs Wkrn News 2 Morning Show After Seven Years

May 02, 2025

Nikki Burdine Departs Wkrn News 2 Morning Show After Seven Years

May 02, 2025

Latest Posts

-

Uk Reform And X Dissecting Rupert Lowes Messaging Strategy

May 02, 2025

Uk Reform And X Dissecting Rupert Lowes Messaging Strategy

May 02, 2025 -

Reform Uk And Bullying Allegations Police Investigation Into Rupert Lowe

May 02, 2025

Reform Uk And Bullying Allegations Police Investigation Into Rupert Lowe

May 02, 2025 -

Nhs Gender Identity Policy Challenged Norfolk Mps Supreme Court Fight

May 02, 2025

Nhs Gender Identity Policy Challenged Norfolk Mps Supreme Court Fight

May 02, 2025 -

Rupert Lowe And Uk Reform Analyzing The Effectiveness Of His X Platform Communication

May 02, 2025

Rupert Lowe And Uk Reform Analyzing The Effectiveness Of His X Platform Communication

May 02, 2025 -

Bullying Allegations Against Reform Uks Rupert Lowe Police Involved

May 02, 2025

Bullying Allegations Against Reform Uks Rupert Lowe Police Involved

May 02, 2025