Bubble Blasters And The Ripple Effect Of US-China Trade Tensions

Table of Contents

The Direct Impact on Bubble Blasters

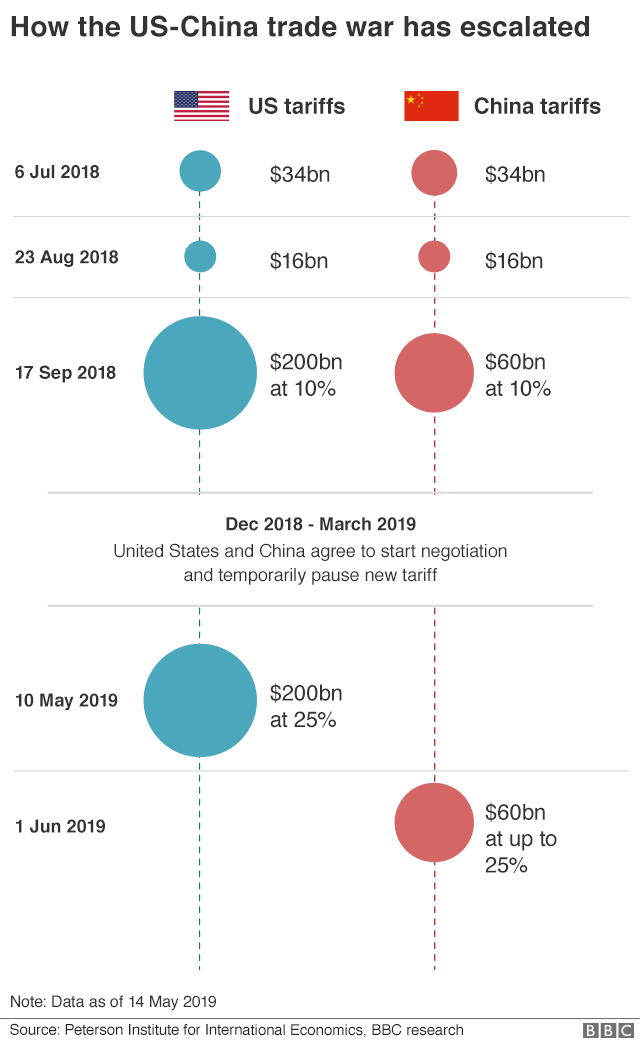

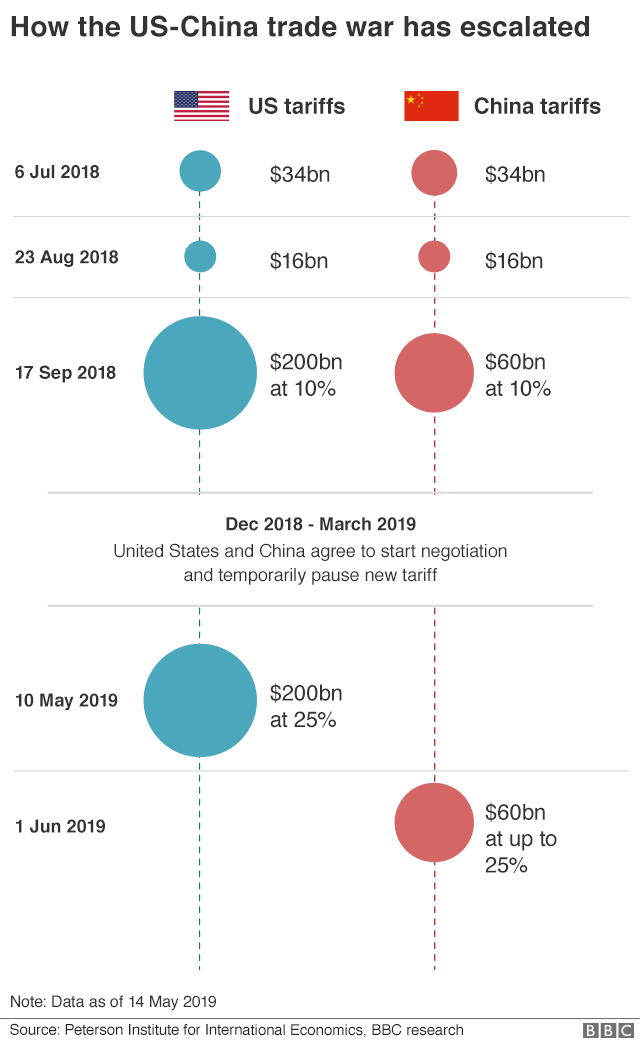

The escalating trade war has directly impacted numerous sectors, causing significant disruptions and uncertainty. The most immediate consequence is the imposition of tariffs.

Tariffs and their Cascading Effects

Tariffs, essentially taxes on imported goods, have significantly increased the cost of products sourced from either the US or China, depending on the specific agreement. This leads to reduced competitiveness for businesses involved in cross-border trade.

- Example 1: The increased tariffs on steel and aluminum impacted the US automotive industry, raising production costs and impacting affordability.

- Example 2: Chinese tariffs on soybeans significantly hurt American farmers, reducing export volumes and impacting farm incomes.

- Example 3: Technology companies reliant on specific components from China faced production delays and increased costs due to tariff imposition.

These examples illustrate how "Bubble Blasters," including agriculture, manufacturing, and technology, have borne the brunt of these tariff increases. Statistics from the World Trade Organization show a significant decrease in bilateral trade volume between the US and China following the imposition of tariffs.

Supply Chain Disruptions

The interconnected nature of global supply chains makes them highly susceptible to disruptions stemming from US-China trade tensions. Many businesses rely on a complex web of suppliers across both countries.

- Challenge 1: Sourcing raw materials and components has become significantly more challenging and expensive due to trade restrictions.

- Challenge 2: Companies face increased lead times for production and delivery, leading to stock shortages and production delays.

- Challenge 3: The increased uncertainty surrounding trade policy has forced many businesses to explore "nearshoring" and "reshoring" – shifting production closer to home to reduce dependence on distant suppliers. This is a costly and time-consuming endeavor.

Investment Uncertainty and Capital Flight

The trade war has created significant uncertainty for investors, impacting foreign direct investment (FDI) and capital flows between the US and China.

- Decreased Investment Confidence: Businesses are hesitant to invest in either country due to the unpredictable nature of trade relations, hindering economic growth.

- Potential Capital Flight: Capital may flow out of one country and into another, driven by perceptions of increased risk or reduced profitability.

- Statistical Evidence: Data from the International Monetary Fund (IMF) reflects a slowdown in FDI flows to both the US and China during periods of heightened trade tensions. This uncertainty undermines long-term economic planning and stability.

The Ripple Effect Across Global Markets

The consequences of US-China trade tensions extend far beyond the immediate impact on "Bubble Blasters," creating a ripple effect across the global economy.

Inflationary Pressures

Increased costs due to tariffs and supply chain disruptions are inevitably passed on to consumers in the form of higher prices.

- Increased Costs: Businesses struggling with higher input costs often raise prices to maintain profitability, contributing to inflation.

- Broader Economic Consequences: Persistent inflation can erode purchasing power, reduce consumer confidence, and potentially lead to economic stagnation.

- Global Supply Chain Issues: The interconnectedness of global supply chains means that inflationary pressures in one region can quickly spread to others.

Geopolitical Instability

The trade war has exacerbated geopolitical tensions between the US and China, potentially leading to further instability.

- Increased Tensions: The trade dispute has become intertwined with broader geopolitical issues, further straining relations between the two superpowers.

- Implications for Other Countries: Other countries are caught in the crossfire, facing potential disruptions to their own trade relations.

- Potential for Escalation: The risk of further escalation, including potential trade restrictions beyond tariffs, remains a significant concern.

Consumer Impact

Consumers in the US, China, and globally are feeling the impact of US-China trade tensions.

- Increased Prices: Higher prices for goods and services reduce consumer purchasing power and limit consumer choice.

- Consumer Choice Limitations: Supply chain disruptions can limit the availability of certain goods and services.

- Shifts in Consumer Behavior: Consumers may start buying domestic products or substitutes in response to increased prices and product scarcity.

Mitigating the Blast: Understanding the Future of US-China Trade

The impact of US-China trade tensions on "Bubble Blasters" and the global economy is profound and multifaceted. Understanding the ripple effect is crucial for navigating this turbulent economic climate. Mitigating the negative impacts requires a multi-pronged approach: diversifying supply chains, forging improved trade agreements, and pursuing diplomatic solutions to reduce geopolitical tensions.

Stay informed about the evolving landscape of US-China trade relations and how it affects the future of Bubble Blasters. Continue researching this critical topic to understand its implications for your business and the global economy. Further research into the World Trade Organization's reports and the International Monetary Fund's analyses will provide valuable insights.

Featured Posts

-

Nottingham Attacks Judge Who Jailed Becker To Oversee Inquiry

May 10, 2025

Nottingham Attacks Judge Who Jailed Becker To Oversee Inquiry

May 10, 2025 -

How Figmas Ai Is Disrupting The Design Landscape

May 10, 2025

How Figmas Ai Is Disrupting The Design Landscape

May 10, 2025 -

Apples Ecosystem And Google S A Study In Interdependence

May 10, 2025

Apples Ecosystem And Google S A Study In Interdependence

May 10, 2025 -

Behind The Scenes With Judge Jeanine Pirro Fears Love And Fox News

May 10, 2025

Behind The Scenes With Judge Jeanine Pirro Fears Love And Fox News

May 10, 2025 -

Planned Elizabeth Line Strikes Travel Advice For February And March

May 10, 2025

Planned Elizabeth Line Strikes Travel Advice For February And March

May 10, 2025