Buffett's Apple Investment: A Masterclass In Value Investing

Table of Contents

The Rationale Behind Buffett's Apple Investment

Buffett's move into Apple wasn't a spur-of-the-moment decision; it was a calculated investment based on a deep understanding of the company's underlying strengths and long-term potential. This wasn't just about looking at the numbers; it was about recognizing the powerful competitive advantages Apple possessed.

Beyond the Numbers: Understanding Apple's Moat

Apple's success isn't solely driven by impressive financial figures. A significant part of its enduring value lies in its powerful "moat," a term Buffett uses to describe a company's sustainable competitive advantage. This moat protects Apple from competition and ensures long-term profitability. Key components of Apple's moat include:

- Strong Brand Recognition: The Apple brand is synonymous with quality, innovation, and user-friendliness, commanding significant brand loyalty.

- User Loyalty to iOS: The seamless integration within the Apple ecosystem encourages users to remain within the Apple environment, creating a sticky user base.

- The App Store Ecosystem: The App Store generates a significant and recurring revenue stream for Apple, further enhancing its profitability.

- Innovative Product Launches: Apple consistently releases innovative products that maintain its leading edge in the technology industry.

- Recurring Revenue Streams from Services: Services like iCloud, Apple Music, and Apple TV+ provide consistent revenue streams, reducing reliance on hardware sales alone.

These factors contribute to long-term value creation and significantly reduce the investment risk associated with holding Apple stock in a diversified stock portfolio. This is a crucial element of Buffett's investment strategy.

Analyzing Apple's Intrinsic Value

Buffett's investment decisions are never based on short-term market fluctuations. He focuses on a company's intrinsic value – its true worth based on its assets, earnings, and future potential. This is where rigorous financial analysis comes into play. It's highly probable that Buffett and his team employed tools like discounted cash flow analysis to estimate Apple's intrinsic value. This involved:

- Review of Apple's Financial Statements: A thorough examination of Apple's balance sheets, income statements, and cash flow statements is essential.

- Discussion of Key Financial Ratios: Analyzing key ratios such as the Price-to-Earnings (P/E) ratio and free cash flow helps determine if Apple was trading below its intrinsic value.

- Comparison to Industry Peers: Benchmarking Apple against its competitors helps determine its relative valuation and competitive position.

By focusing on long-term fundamentals and comparing the market price to the calculated intrinsic value, Buffett likely identified a significant margin of safety—a crucial principle in value investing—before making the investment in Apple stock.

The Long-Term Perspective: Patience and Value Investing

Buffett's investment approach is characterized by a long-term perspective. His Apple investment perfectly exemplifies his "buy and hold" strategy.

Buffett's Approach to Long-Term Holding

Buffett's philosophy centers around holding investments for the long haul, allowing the power of compounding returns to work its magic. This contrasts sharply with short-term trading strategies. His approach to the Apple investment reflects this:

- Examples of Other Long-Term Investments by Berkshire Hathaway: Berkshire Hathaway's portfolio is filled with long-term holdings in companies like Coca-Cola and American Express, showcasing Buffett's consistent approach.

- Explanation of the Benefits of Long-Term Investing (Compounding Returns): The longer an investment is held, the more significant the impact of compounding returns becomes.

- Avoidance of Market Timing: Buffett famously avoids trying to time the market, focusing instead on identifying fundamentally strong companies and holding them through market cycles.

Patience and discipline are crucial aspects of successful value investing. This long-term approach minimizes the impact of short-term market volatility.

Riding the Growth Wave: Apple's Consistent Performance

Since Berkshire Hathaway's initial investment, Apple has consistently delivered strong financial results, justifying Buffett's investment thesis.

- Chart Showing Apple's Stock Price Performance Over the Years: (Insert chart here showcasing Apple's stock price growth since Berkshire Hathaway's investment.)

- Discussion of Dividend Payments and Stock Buybacks: Apple's return of capital to shareholders through dividends and buybacks has further enhanced returns for investors.

- Analysis of Apple's Expansion into New Markets and Services: Apple's expansion into new markets and services has broadened its revenue streams and growth opportunities.

This consistent performance reinforces the validity of the value investment thesis and demonstrates the rewards of patience and long-term thinking.

Lessons Learned: Applying Buffett's Apple Strategy

Buffett's Apple investment provides invaluable lessons for all investors, regardless of experience.

Identifying Undervalued Companies

The ability to identify undervalued companies with strong fundamentals is crucial to successful value investing. This requires a systematic approach:

- Steps Involved in Fundamental Analysis: This includes analyzing a company's financial statements, assessing its competitive landscape, and projecting future cash flows.

- Importance of Due Diligence: Thorough research and due diligence are essential before investing in any company.

- Identifying Key Metrics to Evaluate a Company's Financial Health: Understanding and utilizing key financial ratios and metrics is critical in evaluating a company's financial strength.

These steps, when performed diligently, will improve your chances of uncovering undervalued gems like Apple.

The Power of Long-Term Thinking

The most significant takeaway from Buffett's Apple investment is the power of long-term thinking. Market volatility is inevitable, but a long-term perspective helps navigate these ups and downs:

- Strategies for Managing Emotions During Market Downturns: Develop strategies to avoid emotional decision-making during market corrections.

- The Benefits of Ignoring Short-Term Noise: Focus on the long-term fundamentals of a company rather than reacting to daily market fluctuations.

- The Importance of Having a Clear Investment Plan: A well-defined investment plan helps to maintain discipline and consistency.

Developing a long-term perspective is key to successfully applying Buffett's investment strategies.

Conclusion

Buffett's Apple investment serves as a powerful testament to the effectiveness of value investing. By focusing on a company's intrinsic value, understanding its competitive advantages, and adopting a long-term perspective, Berkshire Hathaway achieved remarkable returns. The key takeaways are: focus on identifying companies with strong fundamentals and sustainable competitive advantages, embrace a long-term investment horizon, and maintain discipline in the face of market volatility. This approach, as demonstrated by Buffett's Apple investment, is a blueprint for long-term financial success.

Ready to learn more about implementing Warren Buffett's value investing strategies? Start your research into finding your own undervalued gems today!

Featured Posts

-

How To Watch The Celtics Vs Suns Game On April 4th

May 06, 2025

How To Watch The Celtics Vs Suns Game On April 4th

May 06, 2025 -

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

May 06, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

May 06, 2025 -

Nepotism Debate Patrick Schwarzeneggers White Lotus Casting Sparks Discussion

May 06, 2025

Nepotism Debate Patrick Schwarzeneggers White Lotus Casting Sparks Discussion

May 06, 2025 -

Is This The Best Website Sequel Ever A Critical Review

May 06, 2025

Is This The Best Website Sequel Ever A Critical Review

May 06, 2025 -

The Hidden History Of Princess Dianas Daring Met Gala Gown

May 06, 2025

The Hidden History Of Princess Dianas Daring Met Gala Gown

May 06, 2025

Latest Posts

-

Mindy Kalings Peplum Look At Hollywood Walk Of Fame Ceremony

May 06, 2025

Mindy Kalings Peplum Look At Hollywood Walk Of Fame Ceremony

May 06, 2025 -

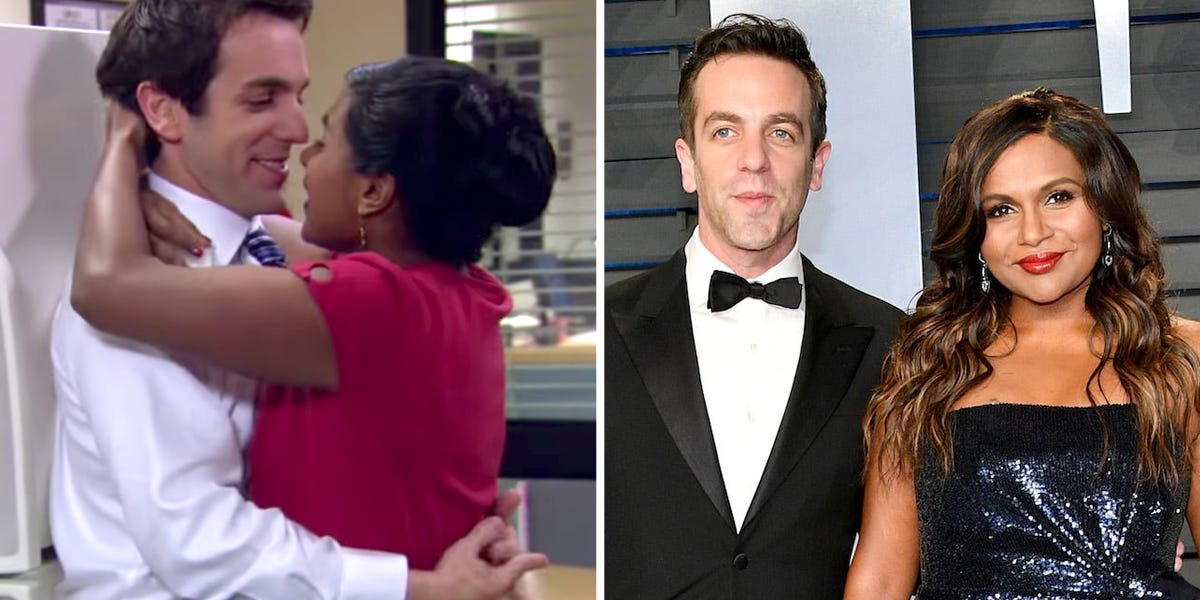

Understanding The Public Perception Of Bj Novak And Delaney Rowes Romance

May 06, 2025

Understanding The Public Perception Of Bj Novak And Delaney Rowes Romance

May 06, 2025 -

Bj Novak And Delaney Rowes Relationship Public Reaction And Analysis

May 06, 2025

Bj Novak And Delaney Rowes Relationship Public Reaction And Analysis

May 06, 2025 -

Bj Novak And Delaney Rowe A Normal Relationship

May 06, 2025

Bj Novak And Delaney Rowe A Normal Relationship

May 06, 2025 -

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025