Bulldog Banker Takes On Canada's Resource Sector Crisis

Table of Contents

The Scale of the Crisis in Canada's Resource Sector

The Canadian resource industry, encompassing mining, oil and gas, forestry, and fisheries, is facing unprecedented challenges. The downturn isn't just about fluctuating commodity prices; it's a complex issue with far-reaching consequences. The Canadian mining crisis, for example, has seen significant job losses in several provinces, impacting communities heavily reliant on these industries. Similarly, the Canadian oil and gas downturn has led to reduced investment and economic stagnation in regions previously fueled by energy extraction. These challenges are further exacerbated by increasing environmental regulations and social pressures.

The crisis is quantifiable through several key indicators:

- Decreased commodity prices impacting profitability: Lower global demand and increased supply have significantly reduced the profitability of resource extraction, forcing companies to cut costs and lay off workers.

- Increased environmental regulations and scrutiny: Growing awareness of the environmental impact of resource extraction has led to stricter regulations, increasing the cost and complexity of new projects.

- Challenges in securing financing for new projects: Investors are hesitant to commit capital to projects facing environmental and social risks, further hindering growth in the Canadian resource industry.

- Growing social and political opposition to resource extraction: Indigenous communities and environmental groups are increasingly vocal in their opposition to resource projects, leading to delays, protests, and increased regulatory hurdles. This contributes to the overall challenges faced by the Canadian resource sector.

The Bulldog Banker's Strategy: A Three-Pronged Approach

Facing this multifaceted crisis, the Bulldog Banker—a figure known for their aggressive yet strategic approach to financial challenges—has devised a three-pronged strategy focused on strategic investment, innovative financing, and stakeholder engagement. This approach aims to address the core issues plaguing the Canadian resource sector and pave the way for sustainable growth. Their expertise in crisis management and risk mitigation strategies makes them uniquely positioned to tackle this complex problem.

Strategic Investment and Restructuring

The Bulldog Banker's strategy begins with identifying undervalued assets within the struggling Canadian resource industry. Through mergers and acquisitions, debt restructuring, and operational improvements, they aim to revitalize underperforming companies and unlock their potential. This involves a deep understanding of the individual companies' financial health and the market conditions to make informed decisions.

- Mergers and acquisitions: Combining smaller, struggling companies to create larger, more efficient entities.

- Debt restructuring: Negotiating with creditors to alleviate financial burdens and improve the companies' long-term viability.

- Operational improvements: Implementing cost-cutting measures and efficiency upgrades to improve profitability.

Innovative Financing Solutions

Attracting investment in the resource sector requires innovative approaches to financing. The Bulldog Banker is exploring several avenues, including:

- Green financing: Securing funding specifically earmarked for environmentally responsible resource projects.

- Impact investing: Attracting investors focused on generating both financial returns and positive social and environmental impact.

- Public-private partnerships: Collaborating with governments to share the financial risk and responsibilities of major resource projects. These partnerships provide a crucial framework for balancing resource development with environmental and social considerations.

Engagement with Stakeholders

Addressing the social and environmental concerns surrounding resource extraction is critical to long-term success. The Bulldog Banker's strategy includes:

- Community engagement: Working with local communities to address their concerns and build support for resource projects. This fosters trust and addresses local anxieties regarding environmental impact and economic opportunities.

- Environmental sustainability initiatives: Implementing rigorous environmental protection measures to minimize the impact of resource extraction on ecosystems.

- Transparency and accountability: Ensuring open communication and clear reporting to build trust with all stakeholders. Openness regarding both successes and shortcomings is crucial for sustainable development and positive stakeholder relations.

Potential Outcomes and Challenges

The Bulldog Banker's strategy holds significant potential for positive outcomes, including economic recovery and job creation within the Canadian resource sector. However, several challenges remain:

- Potential for economic recovery and job creation: Successful implementation could revitalize the industry, creating jobs and boosting regional economies.

- Challenges in navigating complex regulatory environments: Obtaining necessary permits and approvals can be time-consuming and costly.

- Risks associated with volatile commodity markets: Commodity prices are inherently unpredictable, creating inherent financial risk.

- Potential for backlash from environmental groups or communities: Resistance from stakeholders concerned about environmental or social impacts may impede progress.

Conclusion: Overcoming Canada's Resource Sector Crisis: A Bulldog Banker's Approach

The Bulldog Banker's aggressive, three-pronged approach offers a potential pathway towards overcoming Canada's resource sector crisis. By combining strategic investment, innovative financing, and robust stakeholder engagement, this strategy aims to create a more sustainable and prosperous future for the Canadian resource industry. However, success will depend on navigating complex regulatory environments, mitigating risks associated with volatile commodity markets, and effectively addressing the concerns of various stakeholders. Learn more about how the Bulldog Banker is tackling Canada's resource sector crisis and how you can be a part of the solution—a sustainable future for Canada's resource sector is within reach.

Featured Posts

-

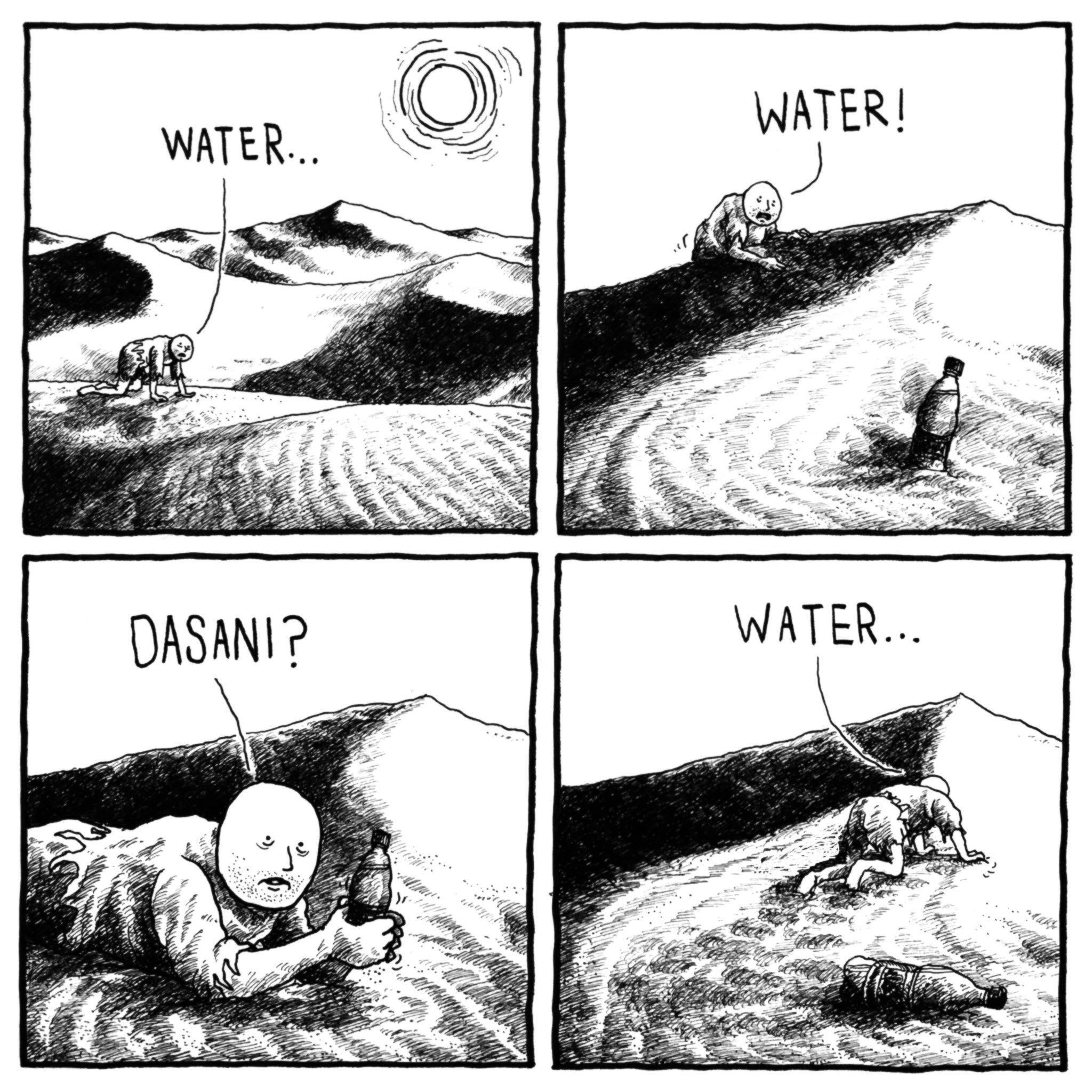

The Coca Cola Bottled Water Brand Missing From Uk Shelves Dasani

May 15, 2025

The Coca Cola Bottled Water Brand Missing From Uk Shelves Dasani

May 15, 2025 -

Celtics Vs 76ers Prediction A Comprehensive Game Preview

May 15, 2025

Celtics Vs 76ers Prediction A Comprehensive Game Preview

May 15, 2025 -

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025 -

Public Transport Update Bvg Strike Concludes S Bahn Services Affected

May 15, 2025

Public Transport Update Bvg Strike Concludes S Bahn Services Affected

May 15, 2025 -

Athletic Club De Bilbao News Analysis And Match Updates From Vavel Usa

May 15, 2025

Athletic Club De Bilbao News Analysis And Match Updates From Vavel Usa

May 15, 2025