Buy-and-Hold: Facing The Painful Truth Of Long-Term Investing

Table of Contents

The Illusion of "Set it and Forget it": Understanding the Emotional Rollercoaster of Buy-and-Hold

The buy-and-hold strategy, while potentially lucrative, demands significant emotional resilience. The "set it and forget it" mentality often touted is a dangerous oversimplification. The truth is, long-term investing is an emotional rollercoaster.

Volatility and Market Corrections

Market downturns are inevitable. History is replete with examples: the 1987 Black Monday crash, the dot-com bubble burst of 2000, and the 2008 global financial crisis. These events dramatically impacted even the most well-diversified portfolios. During these periods, watching your investments plummet can be incredibly stressful.

- The Psychological Toll: The fear of losing money can be overwhelming, leading to impulsive decisions.

- Risk Tolerance: A robust risk tolerance, coupled with a long-term perspective, is crucial for weathering these storms. Understanding your own risk profile is paramount before embracing any long-term investment strategy, especially buy and hold.

- The Temptation to Panic Sell: Panic selling during market dips is a common mistake. Selling low locks in losses and prevents you from participating in the inevitable market recovery.

Opportunity Cost and Missed Gains

Rigidly adhering to buy-and-hold can mean missing potentially lucrative opportunities. While the buy and hold strategy is designed for the long term, market conditions can change dramatically, and remaining static might not always be the best approach.

- Active vs. Passive Investing: Buy-and-hold is a passive investing strategy. However, active management allows for adjustments based on market changes.

- Alternative Investment Strategies: Strategies like value investing or momentum trading could offer higher returns, but they carry significantly higher risk.

- Regular Portfolio Review and Rebalancing: Regularly reviewing and rebalancing your portfolio allows you to adapt to changing circumstances and potentially improve your returns. This proactive approach is crucial for maximizing gains within a buy-and-hold framework.

The Hidden Costs of Buy-and-Hold: Fees, Taxes, and Inflation

While the potential for long-term growth is attractive, several hidden costs can significantly erode your returns if not properly managed.

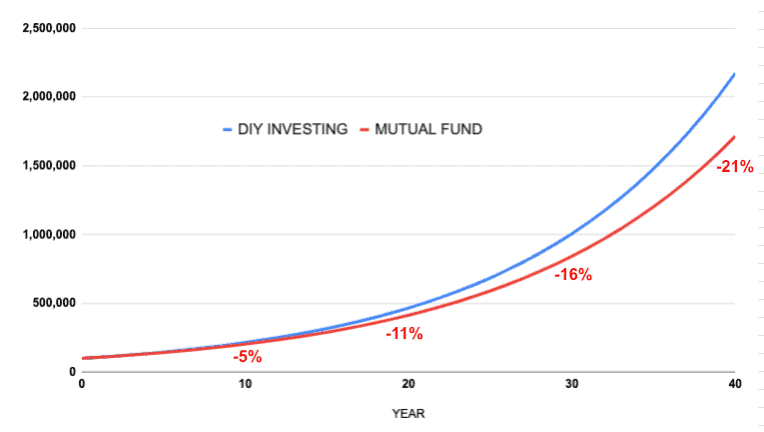

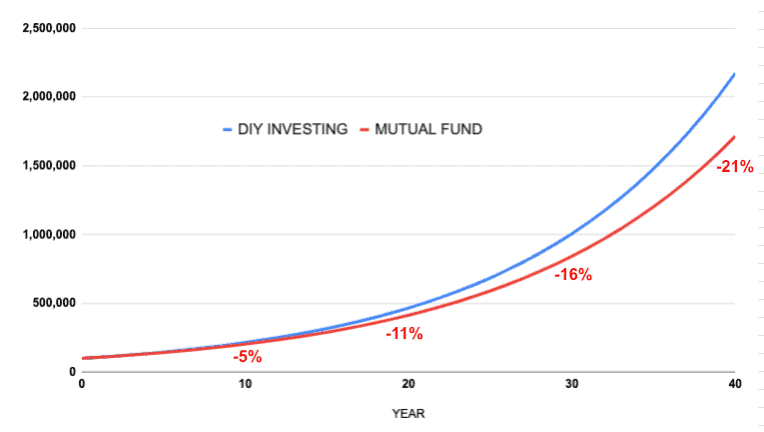

Investment Fees and Expenses

Various fees eat into your investment gains. Understanding these costs is critical for maximizing your returns.

- Management Fees: Mutual funds and actively managed ETFs charge management fees. Index funds and passively managed ETFs generally have lower fees.

- Transaction Costs: Brokerage commissions, bid-ask spreads, and other transaction costs add up over time.

- Minimizing Fees: Choosing low-cost investment vehicles is crucial for long-term success. The seemingly small difference in fees can compound significantly over decades.

The Erosive Power of Inflation

Inflation gradually diminishes the purchasing power of your investment returns. This is a silent thief that can significantly impact your long-term wealth.

- Impact on Returns: A 3% annual return might sound good, but if inflation is also 3%, your real return is zero.

- Inflation-Protected Securities: Investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), can help mitigate the effects of inflation.

- Real Returns: Always consider real returns (returns adjusted for inflation) when evaluating your investment performance over the long term.

Tax Implications of Long-Term Investments

Capital gains and dividends are taxable events. Failing to plan for these taxes can significantly reduce your net returns.

- Tax-Advantaged Accounts: Utilize tax-advantaged accounts such as 401(k)s and IRAs to reduce your tax liability.

- Tax Planning: Consider working with a financial advisor to create a tax-efficient investment strategy. Tax-loss harvesting is a key strategy for mitigating the tax burden from buy-and-hold investments.

Adapting the Buy-and-Hold Strategy: A More Realistic Approach

Buy-and-hold isn't about complete inaction; it's about strategic patience and proactive adjustments.

Strategic Rebalancing

Regularly rebalancing your portfolio maintains your desired asset allocation.

- Mitigating Risk: Rebalancing helps mitigate risk by selling some assets that have performed well and buying assets that have underperformed.

- Taking Advantage of Market Fluctuations: Rebalancing allows you to capitalize on market swings by buying low and selling high.

- Examples: A simple rebalancing strategy might involve adjusting your portfolio back to your target allocation once a year or when any asset class deviates by more than 5% from its target weight.

Regular Portfolio Reviews

Ongoing monitoring and adjustments are essential for a successful buy-and-hold approach.

- Adapting to Change: Market conditions, personal circumstances, and financial goals change over time. Your investment strategy should adapt accordingly.

- Seeking Professional Advice: Consider seeking guidance from a qualified financial advisor to ensure your strategy aligns with your goals and risk tolerance.

Conclusion

Buy-and-hold investing can be a powerful tool for long-term wealth creation, but it's not a passive endeavor. Successfully navigating the long-term investment journey requires understanding the emotional challenges, managing costs effectively, and adapting your strategy over time. While the potential for long-term growth with buy-and-hold is significant, remember that a well-informed approach, including diversification and realistic expectations, is critical.

Call to Action: While buy-and-hold investing offers potential for long-term growth, remember to carefully consider your risk tolerance, investment goals, and diversify your portfolio. Learn more about effective buy-and-hold strategies and financial planning to achieve your financial objectives. Consider seeking professional advice before making any investment decisions. Don't let the "set it and forget it" myth mislead you; a proactive and informed approach to buy and hold will significantly improve your chances of success.

Featured Posts

-

Charentaises De Saint Brieuc Resistance Et Savoir Faire Au Fil Du Temps

May 26, 2025

Charentaises De Saint Brieuc Resistance Et Savoir Faire Au Fil Du Temps

May 26, 2025 -

Gideon Glicks Stellar Performance In Amazon Primes Etoile

May 26, 2025

Gideon Glicks Stellar Performance In Amazon Primes Etoile

May 26, 2025 -

Crowd Violence At Paris Roubaix Mathieu Van Der Poel Seeks Justice After Bottle Attack

May 26, 2025

Crowd Violence At Paris Roubaix Mathieu Van Der Poel Seeks Justice After Bottle Attack

May 26, 2025 -

Rowing For A Cure A Fathers 2 2 Million Challenge Cnn

May 26, 2025

Rowing For A Cure A Fathers 2 2 Million Challenge Cnn

May 26, 2025 -

Forget Footballers F1 Drivers Are This Seasons Style Icons

May 26, 2025

Forget Footballers F1 Drivers Are This Seasons Style Icons

May 26, 2025

Latest Posts

-

Le Samsung Galaxy S25 256 Go A 775 E Vaut Il Le Coup

May 28, 2025

Le Samsung Galaxy S25 256 Go A 775 E Vaut Il Le Coup

May 28, 2025 -

Smartphone Samsung Galaxy S25 512 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 512 Go Avis Prix Et Bon Plan

May 28, 2025 -

18 000

May 28, 2025

18 000

May 28, 2025 -

Avis Samsung Galaxy S25 256 Go 775 E Performances Et Prix

May 28, 2025

Avis Samsung Galaxy S25 256 Go 775 E Performances Et Prix

May 28, 2025 -

18

May 28, 2025

18

May 28, 2025