CAC 40 Index Finishes Week Lower, But Shows Weekly Resilience (March 7, 2025)

Table of Contents

Factors Contributing to CAC 40's Weekly Resilience

Despite the overall negative movement, several factors contributed to the CAC 40's relative resilience.

Strong Performance of Key Sectors

Certain sectors within the CAC 40 significantly outperformed others, offsetting some of the negative pressure. This sector performance played a crucial role in preventing a more substantial decline.

- Luxury Goods: The luxury goods sector experienced robust growth, driven by strong demand from Asian markets and positive earnings reports from leading brands. This sector saw a 3% increase, significantly bolstering the overall index. Strong brand loyalty and a continued desire for luxury goods even amidst economic uncertainty proved beneficial.

- Technology: Technology stocks within the CAC 40 also demonstrated resilience, with a 1.8% increase. Several companies announced positive technological advancements and strategic partnerships, boosting investor confidence. This sector's growth demonstrates the continued importance of innovation and technology in the global market.

Influence of Global Market Trends

Global market trends played a significant role in shaping the CAC 40's weekly trajectory.

- Interest Rate Decisions: While the European Central Bank’s (ECB) interest rate decision to maintain rates was largely expected, it still created a degree of uncertainty in the market. This uncertainty had a dampening effect on some sectors, but the impact was mitigated by the strength of others.

- Geopolitical Factors: Easing geopolitical tensions in Eastern Europe contributed positively to investor sentiment, reducing risk aversion and supporting stock market performance. This positive news helped to offset some of the negative pressures from other global events.

Investor Sentiment and Trading Activity

Analyzing investor behavior provides valuable insights into the CAC 40's weekly resilience.

- Trading Volume: While trading volume remained relatively high, it did not exhibit the panic selling often associated with significant market downturns. This suggests investors were not overly concerned about the short-term prospects.

- Bullish Sentiment (Partial): While not entirely bullish, investor sentiment showed some resilience. There was evidence of investors “buying the dip” in certain sectors, demonstrating confidence in the long-term potential of some CAC 40 components.

Analysis of CAC 40's Weekly Losses

Despite the resilience, the CAC 40 did experience losses. Understanding the contributing factors is crucial for a complete analysis.

Impact of Specific Company Performances

Several companies within the CAC 40 underperformed, negatively impacting the index.

- Disappointing Earnings Reports: A few prominent companies released disappointing earnings reports, leading to a sell-off in their shares. These negative reports contributed to the overall decline of the index, highlighting the importance of individual company performance on the market.

- Negative News: Negative news surrounding specific companies, such as regulatory investigations or product recalls, further influenced the overall index performance.

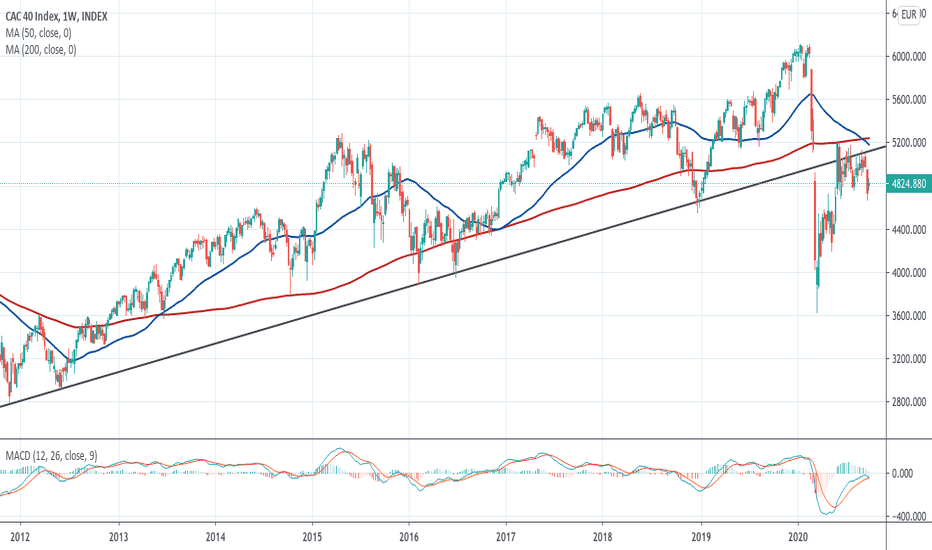

Technical Analysis of the CAC 40 Chart

A brief technical analysis provides further perspective.

- Support and Resistance: The CAC 40 found support at the 7,200 level, preventing a more significant drop. Resistance is currently seen around 7,400.

- Chart Patterns: While no clear chart patterns emerged this week, monitoring these patterns can offer further insight for future trading decisions.

Conclusion: Understanding the CAC 40's Weekly Resilience

The CAC 40's weekly performance highlighted a complex interplay of factors. While the index finished lower, the resilience displayed amidst various market pressures was notable. Strong performances in key sectors like luxury goods and technology offset some of the negative influences from disappointing company performances and global uncertainties. The relatively moderate decline suggests a degree of investor confidence. However, maintaining vigilance and tracking the CAC 40 remains important. Monitoring key sectors, global events, and investor sentiment will be crucial in predicting future market movements. To stay updated on CAC 40 trends and analyze CAC 40 performance, continue monitoring financial news and tracking the index closely. [Link to relevant financial news website] Stay informed and track the CAC 40 index for informed investment decisions.

Featured Posts

-

Konchita Vurst Prognozi Peremozhtsiv Yevrobachennya 2025 Vid Unian

May 25, 2025

Konchita Vurst Prognozi Peremozhtsiv Yevrobachennya 2025 Vid Unian

May 25, 2025 -

Finding Affordable Flights Around Memorial Day 2025

May 25, 2025

Finding Affordable Flights Around Memorial Day 2025

May 25, 2025 -

Change At The Top Guccis Supply Chain Chief Massimo Vian Resigns

May 25, 2025

Change At The Top Guccis Supply Chain Chief Massimo Vian Resigns

May 25, 2025 -

Mathieu Avanzi Le Francais Une Langue Vivante Et Accessible A Tous

May 25, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Et Accessible A Tous

May 25, 2025 -

Annie Kilners Posts Following Kyle Walker Night Out Allegations Of Poisoning

May 25, 2025

Annie Kilners Posts Following Kyle Walker Night Out Allegations Of Poisoning

May 25, 2025

Latest Posts

-

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025 -

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025 -

The Woody Allen Controversy Sean Penns Stance And The Resurfacing Of Abuse Claims

May 25, 2025

The Woody Allen Controversy Sean Penns Stance And The Resurfacing Of Abuse Claims

May 25, 2025 -

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025