California Revenue Loss: The Impact Of Trump's Tariffs

Table of Contents

Agricultural Sector Hit Hard

California's agricultural industry, a cornerstone of the state's economy, suffered immensely under the weight of Trump's tariffs. The resulting California revenue loss in this sector was substantial and far-reaching.

Declining Exports and Reduced Farm Income

Tariffs on agricultural products led to decreased exports to key trading partners like China and Mexico. This significantly impacted California farmers, leading to lower prices for their produce and a dramatic reduction in farm income.

- Almonds: Tariffs imposed by China, a major importer of California almonds, resulted in a sharp decline in exports and depressed almond prices, directly impacting the livelihoods of thousands of almond farmers.

- Wine Grapes: Similarly, the imposition of tariffs on California wines impacted exports to both China and the European Union, leading to lower revenue for California vineyards and wineries.

- Dairy Products: Reduced demand from international markets due to tariffs also impacted California's dairy industry, leading to decreased milk prices and farm closures.

Data from the California Department of Food and Agriculture revealed a significant drop in agricultural exports during the period of tariff implementation. This export decline directly translated to a substantial California revenue loss and a considerable reduction in farm jobs, further exacerbating the economic hardship faced by agricultural communities.

Increased Input Costs

Adding insult to injury, tariffs on imported goods essential for agricultural production further squeezed farmers' profit margins. Increased costs for crucial inputs significantly reduced profitability.

- Agricultural Machinery: Tariffs on imported tractors, harvesters, and other machinery increased the cost of essential equipment, making it harder for farmers to afford upgrades and maintain productivity.

- Fertilizers: Tariffs on imported fertilizers added to the already high cost of production, particularly impacting smaller farms that lacked the resources to absorb these increased costs.

- Packaging Materials: Even seemingly minor inputs like packaging materials faced tariff increases, adding up to considerable additional expenses for farmers.

These increased input costs, combined with reduced export revenues, led to a perfect storm for California farmers, exacerbating the California revenue loss and threatening the long-term viability of many farms.

Manufacturing Sector Suffers

California's manufacturing sector, another significant contributor to the state's economy, also experienced substantial setbacks due to Trump's tariffs.

Reduced Competitiveness and Job Losses

Tariffs on imported materials increased production costs for California manufacturers, making them less competitive in the global market. This resulted in job losses and a decline in manufacturing output.

- Aerospace: The aerospace industry, a key component of California's manufacturing base, faced higher costs for imported components, reducing its ability to compete with international manufacturers.

- Electronics: The electronics industry, another significant sector, also experienced increased costs, leading to reduced production and job cuts.

- Automotive Parts: The California automotive parts industry faced similar challenges, with tariffs on imported materials impacting their competitiveness and contributing to job losses.

The impact was widespread and severe. Reports from various industry associations detailed significant job losses in several sectors. This decline in manufacturing output directly contributed to the overall California revenue loss.

Increased Prices for Consumers

Tariffs didn't just hurt businesses; they also led to increased prices for consumers on a wide range of manufactured goods. This impacted purchasing power and reduced overall consumer demand, creating a ripple effect throughout the economy.

- Clothing and Footwear: Tariffs on imported textiles and footwear increased the prices of these everyday items, impacting household budgets.

- Electronics and Appliances: The increased cost of imported components led to higher prices for electronics and household appliances.

- Construction Materials: Tariffs on imported steel and lumber increased construction costs, affecting housing affordability and impacting the construction sector.

These price increases further dampened consumer spending, creating additional pressure on businesses and the overall economy, furthering the California revenue loss.

Ripple Effects Across the California Economy

The impact of Trump's tariffs extended far beyond the agricultural and manufacturing sectors, creating a domino effect across the entire California economy.

Reduced State Tax Revenue

The decline in various sectors directly impacted state tax revenue. Lower profits for businesses, reduced employment, and decreased consumer spending all contributed to a shortfall in state tax collections. This reduced the state's ability to fund essential public services.

- Corporate Income Tax: Reduced profits for businesses resulted in lower corporate income tax revenues for the state.

- Sales Tax: Decreased consumer spending led to a drop in sales tax revenue.

- Personal Income Tax: Job losses and lower wages reduced personal income tax revenue.

This decrease in state tax revenue forced difficult choices in budget allocation and negatively impacted the provision of critical public services.

Long-term Economic Uncertainty

The lasting impact of the tariffs on California's economic outlook remains a significant concern. The damage to key industries and the reduction in state revenue created long-term economic uncertainty.

- Economic Recovery: Recovering from the economic damage inflicted by the tariffs requires a multifaceted strategy, including investments in infrastructure, support for affected industries, and efforts to diversify trade relationships.

- Future Trade Disputes: The experience with Trump's tariffs underscores the vulnerability of the California economy to future trade disputes and highlights the importance of proactively managing trade relations.

- Expert Opinions: Economists and policymakers alike warn of the long-term risks associated with protectionist trade policies, emphasizing the need for a more balanced approach that promotes both domestic production and international trade.

Conclusion

Trump's tariffs resulted in a significant California revenue loss, impacting the state’s agricultural and manufacturing sectors profoundly. The ripple effects caused a decrease in state tax revenue and created long-term economic uncertainty. The damage to these core industries, combined with reduced consumer spending and increased prices, significantly harmed California's economy. Understanding the ramifications of such policies is crucial. We must advocate for policies that protect California's economic interests and promote sustainable and equitable trade practices. Further research into the impact of trade policies on state economies is critical to prevent future instances of devastating California revenue loss and to build a more resilient and prosperous future for the Golden State.

Featured Posts

-

Shohei Ohtanis Touching Home Run Celebration A Sweet Reason For A Teammate

May 15, 2025

Shohei Ohtanis Touching Home Run Celebration A Sweet Reason For A Teammate

May 15, 2025 -

Kinopoisk Darit Soski S Ovechkinym Novorozhdennym V Chest Rekorda N Kh L

May 15, 2025

Kinopoisk Darit Soski S Ovechkinym Novorozhdennym V Chest Rekorda N Kh L

May 15, 2025 -

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025 -

Dodgers Left Handed Power Outage Can They Rebound

May 15, 2025

Dodgers Left Handed Power Outage Can They Rebound

May 15, 2025 -

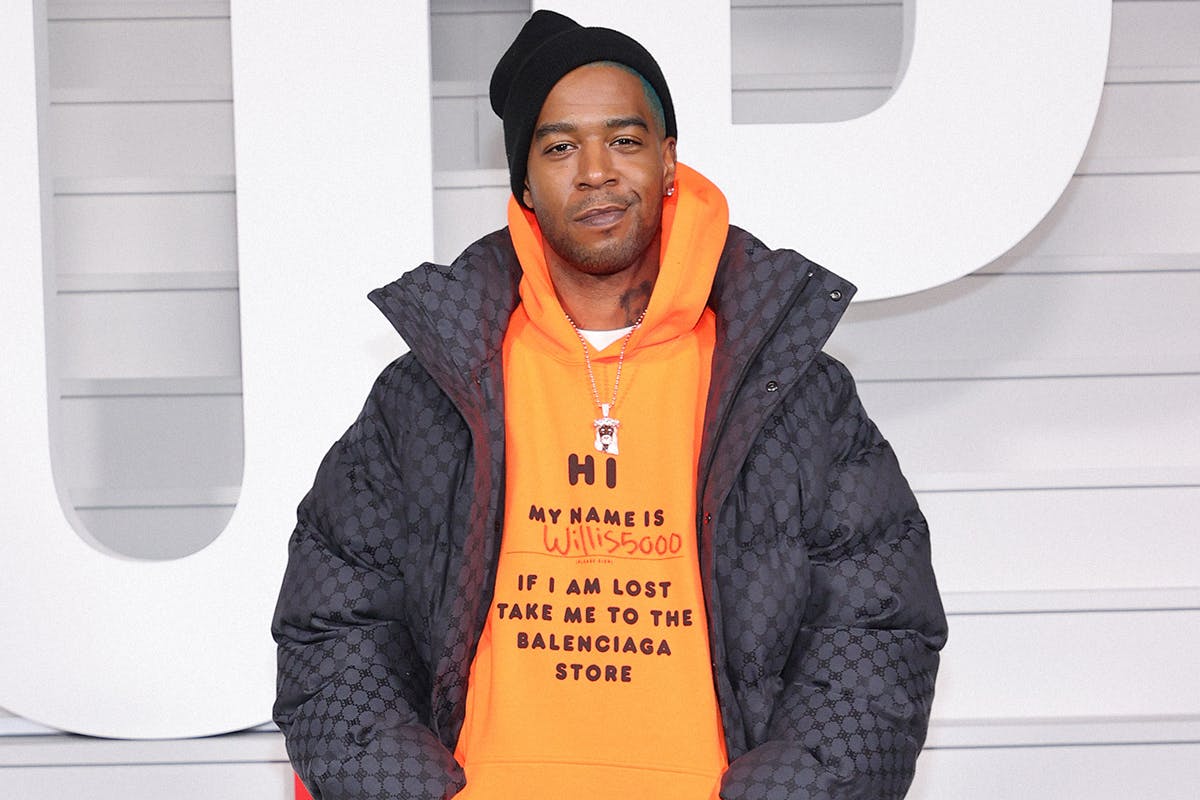

Record Breaking Prices For Kid Cudis Personal Items At Auction

May 15, 2025

Record Breaking Prices For Kid Cudis Personal Items At Auction

May 15, 2025