Can Palantir Reach A Trillion-Dollar Valuation By 2030?

Table of Contents

Palantir's Current Market Position and Growth Trajectory

Palantir's current success is a testament to its unique data integration and analysis platforms, catering to both government and commercial clients. Understanding its growth trajectory is critical to assessing its trillion-dollar potential.

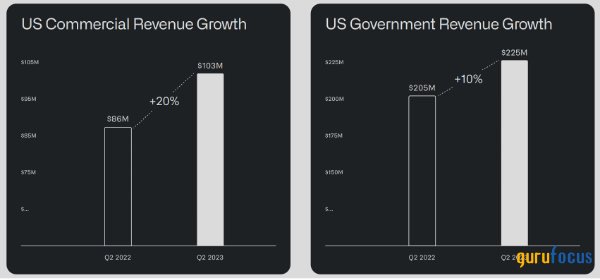

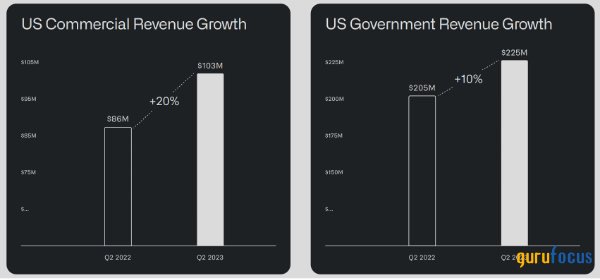

Revenue Growth and Profitability

Palantir has demonstrated consistent revenue growth, though profitability has been a fluctuating factor. Analyzing recent financial reports reveals a positive trend:

- Revenue: Consistent year-over-year increases demonstrate a strong demand for Palantir's services. [Insert specific figures from recent financial reports here, citing the source].

- Net Income: [Insert specific figures and analysis of net income trends, highlighting profitability improvements or challenges].

- Operating Margin: [Insert specific figures and analysis of operating margin, showing the efficiency of Palantir's operations].

This growth is fueled by securing new contracts with both existing and new clients, expanding its customer base across various sectors, and continuous product innovation to meet evolving market demands. Sustaining this growth rate will be crucial for achieving a trillion-dollar valuation.

Competitive Landscape and Market Share

Palantir operates in a fiercely competitive data analytics market, facing established players like Databricks, Snowflake, and the cloud giants, such as AWS. However, Palantir possesses several key advantages:

- Proprietary Technology: Its unique data integration and analysis platforms provide a competitive edge.

- Government Partnerships: Its strong relationships with government agencies provide a stable revenue stream and access to large datasets.

- Focus on complex problems: Palantir specializes in solving complex data problems, a niche that many competitors don't fully address.

While precise market share figures are difficult to obtain, Palantir's expanding customer base and strategic partnerships suggest significant potential for market expansion and increased share in the coming years. Maintaining this competitive edge is essential to its future growth and achieving the trillion-dollar milestone.

Factors Contributing to a Potential Trillion-Dollar Valuation

Several factors could propel Palantir towards a trillion-dollar valuation. However, it's crucial to analyze these opportunities realistically.

Technological Innovation and Product Development

Palantir's commitment to research and development (R&D) is a key driver of its growth potential. Ongoing investments in AI, machine learning, and advanced data integration techniques promise significant advancements:

- AI-powered analytics: The integration of AI into its platforms is poised to significantly enhance analytical capabilities and automate processes.

- New product offerings: Expansion into adjacent markets with new product offerings will further diversify its revenue streams.

- Improved data integration: Enhanced data integration capabilities will attract more clients seeking streamlined solutions.

These technological leaps could lead to substantial revenue increases and solidify Palantir's position as a leader in the data analytics space.

Government and Commercial Market Opportunities

Palantir's dual focus on government and commercial markets presents significant opportunities for growth.

- Government sector: The increasing demand for advanced data analytics within government agencies presents a large and relatively stable market.

- Commercial sector: Expansion into the commercial sector offers significant growth potential, particularly in industries with complex data needs (healthcare, finance, etc.).

Securing large, long-term contracts in both sectors is critical for sustaining the aggressive growth trajectory required to achieve a trillion-dollar valuation.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships can accelerate Palantir's growth and technological advancements:

- Acquisitions: Acquiring complementary technologies or companies could enhance its product offerings and expand its market reach.

- Partnerships: Collaborating with technology leaders could leverage their expertise and expand access to new markets.

Challenges and Risks to Achieving a Trillion-Dollar Valuation

While the potential is significant, several challenges could hinder Palantir's journey to a trillion-dollar valuation.

Competition and Market Saturation

The data analytics market is highly competitive, and increasing market saturation could put pressure on margins and growth rates. New entrants and existing competitors continuously innovate, demanding constant adaptation and improvement from Palantir.

Economic Downturn and Geopolitical Risks

Economic downturns and geopolitical instability could significantly impact spending on data analytics solutions, particularly in the government sector.

Regulatory and Compliance Issues

Navigating the complex regulatory landscape surrounding data privacy and security is a critical challenge. Non-compliance could lead to significant financial penalties and reputational damage.

Conclusion

Palantir's potential to reach a trillion-dollar valuation by 2030 is a compelling yet complex question. Its consistent revenue growth, technological innovation, and strategic market positioning offer a strong foundation for ambitious growth. However, fierce competition, economic uncertainties, and regulatory challenges pose significant risks. While achieving such a valuation presents a considerable hurdle, Palantir's trajectory and innovative spirit warrant continued observation. Keep an eye on Palantir's valuation and its progress toward this ambitious goal. Follow Palantir's journey towards a trillion-dollar market cap and learn more about the potential of Palantir to become a trillion-dollar company. The coming years will be critical in determining whether this data analytics giant can truly achieve this remarkable milestone.

Featured Posts

-

Draisaitls Injury Update On Edmonton Oilers Leading Goal Scorer

May 10, 2025

Draisaitls Injury Update On Edmonton Oilers Leading Goal Scorer

May 10, 2025 -

The Impact Of Caravan Sites On A Uk City A Community Divided

May 10, 2025

The Impact Of Caravan Sites On A Uk City A Community Divided

May 10, 2025 -

Accident A Dijon Vehicule Projete Contre Un Mur Declaration Du Conducteur

May 10, 2025

Accident A Dijon Vehicule Projete Contre Un Mur Declaration Du Conducteur

May 10, 2025 -

Caso De Universitaria Transgenero Arresto Por Uso De Bano Femenino Genera Controversia

May 10, 2025

Caso De Universitaria Transgenero Arresto Por Uso De Bano Femenino Genera Controversia

May 10, 2025 -

A Candid Conversation Judge Jeanine Pirro On Life Fears And Love At Fox News

May 10, 2025

A Candid Conversation Judge Jeanine Pirro On Life Fears And Love At Fox News

May 10, 2025