Can Uber Stock Survive A Recession? A Look At Analyst Predictions

Table of Contents

The looming threat of a recession has investors worldwide reassessing their portfolios. For those holding Uber stock, a crucial question arises: can Uber survive a recession? This article delves into analyst predictions and examines the factors that could impact Uber's performance during an economic downturn. We'll explore the company's strengths, weaknesses, and the potential scenarios facing its stock price.

Uber's Strengths During Economic Downturns

Resilience of Ride-Sharing Demand

Even during recessions, essential transportation remains necessary. Ride-sharing services like Uber often fill a crucial gap, providing transportation for essential commutes, emergencies, and other time-sensitive needs.

- Inelasticity of Demand: While price sensitivity exists, the demand for ride-sharing isn't entirely elastic. People still need to get to work, hospital appointments, or other crucial destinations, even during economic hardship.

- Shift in Demand: We might see a shift from luxury rides to more budget-friendly options within Uber's offerings. This necessitates Uber's ability to adapt its pricing strategies and cater to this changing demand.

- Essential Service Positioning: Uber's strategic marketing emphasizing its role in providing essential transportation can help maintain demand even in challenging economic times.

Diversification of Revenue Streams

Uber's business model extends far beyond just ride-sharing. This diversification is a significant strength during economic uncertainty.

- Uber Eats: The food delivery segment has shown resilience in past economic downturns, as people tend to order in more frequently when cutting back on dining out.

- Uber Freight: This segment, focusing on logistics and transportation of goods, is less directly impacted by consumer discretionary spending and can provide stability during a downturn.

- Other Services: Uber's continued expansion into new areas, such as micromobility (e.g., scooters and bikes) and other transportation-related services, offer further diversification and potential buffers against economic shocks. The success of these ventures, however, will need careful observation.

Cost-Cutting Measures and Efficiency Improvements

Uber has demonstrated an ability to adapt and implement cost-cutting measures. This financial flexibility is crucial during economic uncertainty.

- Marketing Optimization: Reducing marketing spend during a downturn while maintaining brand awareness is a key strategy.

- Driver Compensation Models: Optimizing driver compensation models to balance driver satisfaction and profitability is vital.

- Operational Efficiency: Uber's continued investment in technology to improve operational efficiency can lead to significant cost savings. This includes improving route optimization and reducing operational overhead.

- Past Performance: Examining Uber's past responses to economic headwinds will indicate their capacity for similar strategies during the next downturn.

Potential Risks to Uber During a Recession

Impact on Discretionary Spending

Reduced consumer spending on non-essential services is a significant threat to Uber.

- Ride-Sharing Reduction: Non-essential rides, such as those for entertainment or social events, are likely to decrease sharply during a recession.

- Uber Eats Downturn: While generally resilient, spending on food delivery may also decrease as consumers seek cheaper alternatives.

- Shift to Public Transport: A potential increase in the use of public transportation could directly impact Uber's ride-sharing market share.

Increased Competition and Pricing Pressure

Intensified competition from rivals and pressure on pricing are major concerns.

- Aggressive Pricing Strategies: Competitors may engage in aggressive pricing strategies to gain market share, potentially triggering price wars that hurt profitability.

- Market Share Battles: The fight for market share could lead to reduced margins and pressure on Uber's profitability.

- New Entrants: Economic downturns can sometimes lead to new entrants seeking to capitalize on the weakened market, increasing competition.

Impact on Driver Earnings and Supply

A recession can significantly impact driver earnings, potentially leading to driver shortages.

- Reduced Driver Income: Lower demand and potential price wars could negatively impact driver income, causing some to leave the platform.

- Driver Retention: Maintaining driver retention becomes crucial during a recession. Uber will need strategies to support its drivers and keep them on the platform.

- Supply Chain Disruptions: Economic instability can cause ripples throughout various sectors. Uber needs to account for possible supply chain disruptions that can impede its operations.

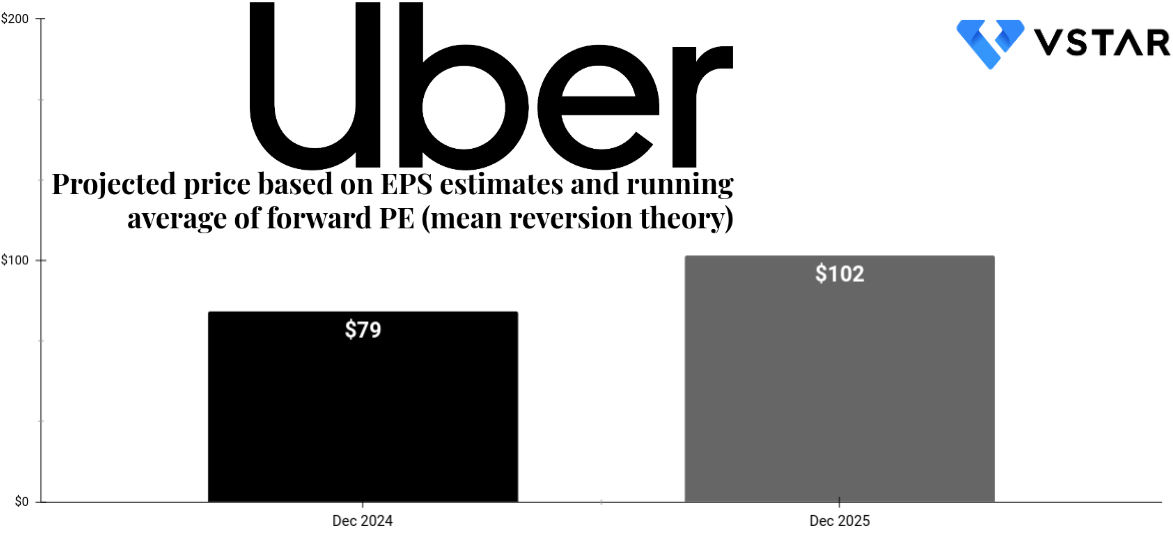

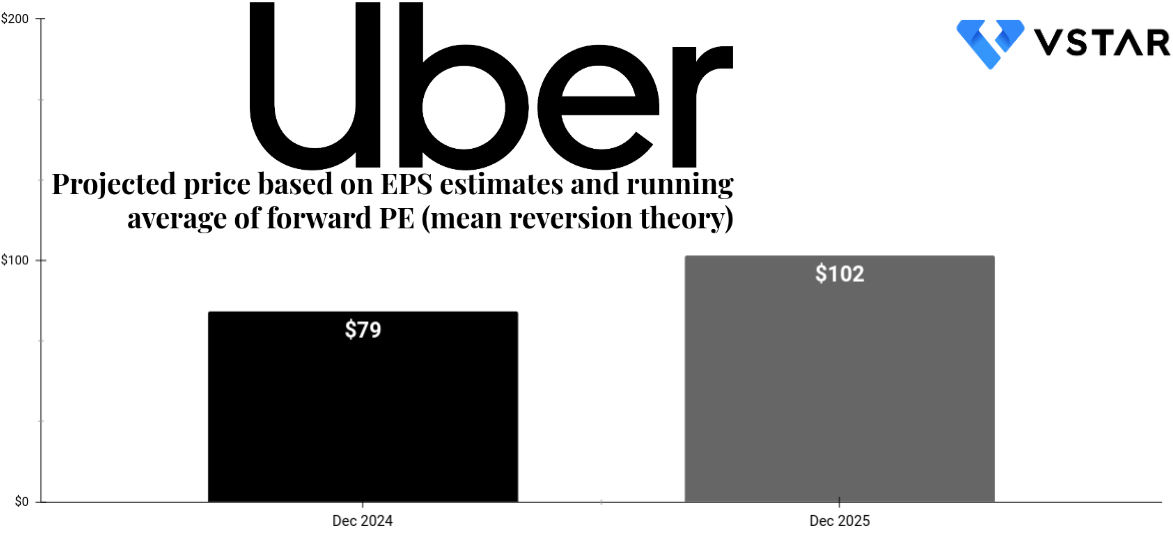

Analyst Predictions and Stock Price Outlook

Summary of Key Analyst Opinions

Analyst opinions on Uber's recession resilience vary considerably.

- Bullish Forecasts: Some analysts remain bullish, citing Uber's diversification and cost-cutting potential. These forecasts often hinge on the assumption that Uber can effectively navigate the economic headwinds.

- Bearish Forecasts: Others express concerns about the impact on discretionary spending and the competitive landscape, predicting a decline in Uber's stock price.

- Neutral Forecasts: Many analysts adopt a neutral stance, emphasizing the uncertainty surrounding the severity and duration of any potential recession. They often highlight the need for more data before giving a definitive prediction.

Factors Influencing Analyst Forecasts

Several key factors drive analyst predictions.

- Macroeconomic Indicators: GDP growth, inflation rates, and unemployment figures heavily influence forecasts.

- Uber's Financial Performance: Key performance indicators (KPIs) like revenue growth, profitability, and cash flow are closely scrutinized.

- Market Sentiment: Overall investor sentiment towards the technology sector and the broader economy plays a significant role.

- Competitive Analysis: Analysts carefully examine the competitive landscape, assessing the strategies of Uber's rivals.

Conclusion

This article explored the potential resilience of Uber stock during a recession, analyzing both its strengths (revenue diversification, cost-cutting potential, essential service nature) and weaknesses (reliance on discretionary spending, competitive pressures, driver supply). While analyst predictions vary, the overall outlook depends heavily on the severity and duration of any economic downturn and Uber's ability to adapt its strategies.

Understanding the potential impact of a recession on Uber stock is crucial for informed investment decisions. Continue your research on Uber stock and recession preparedness to make the best choices for your portfolio. Consider consulting with a financial advisor before making any investment decisions.

Featured Posts

-

Maastricht Airport Minder Passagiers Verwacht In 2025

May 19, 2025

Maastricht Airport Minder Passagiers Verwacht In 2025

May 19, 2025 -

Visit Orlando 2025 Travel And Tourism Event Pictures Orlando Sentinel

May 19, 2025

Visit Orlando 2025 Travel And Tourism Event Pictures Orlando Sentinel

May 19, 2025 -

Watch Final Destination 5 Your Guide To Showtimes And Streaming Availability

May 19, 2025

Watch Final Destination 5 Your Guide To Showtimes And Streaming Availability

May 19, 2025 -

Dr John Delonys Cnn Interview Exploring The Loneliness Epidemic

May 19, 2025

Dr John Delonys Cnn Interview Exploring The Loneliness Epidemic

May 19, 2025 -

Judge To Decide Epics Case To Bring Fortnite Back To The Us App Store

May 19, 2025

Judge To Decide Epics Case To Bring Fortnite Back To The Us App Store

May 19, 2025