Canada Rejects Oxford Report: Most US Tariffs Remain

Table of Contents

The Oxford Report's Findings and Canada's Counterarguments

The Oxford report claimed that the impact of US tariffs on the Canadian economy was less severe than initially predicted. It suggested that Canadian businesses had successfully adapted and that the overall economic fallout was manageable. However, the Canadian government strongly disagrees with this assessment.

Canada's rebuttal centers on several key points:

- Specific data points from the Oxford report that Canada disputes: The report allegedly underestimated the job losses in the lumber and dairy industries, using outdated employment figures and failing to account for indirect job losses in related sectors.

- Evidence presented by Canada to contradict the report's findings: Canada cited its own economic data, including industry-specific reports showing significant declines in exports and increased production costs directly attributable to the tariffs. These reports highlighted a marked decrease in competitiveness for Canadian businesses in the US market.

- Key differences in methodology or data interpretation: Canada argues that the Oxford report used an overly simplistic model, failing to account for the complex interconnectedness of the Canadian and US economies. They also criticized the report's narrow focus on direct impacts, neglecting the wider ripple effects across various industries.

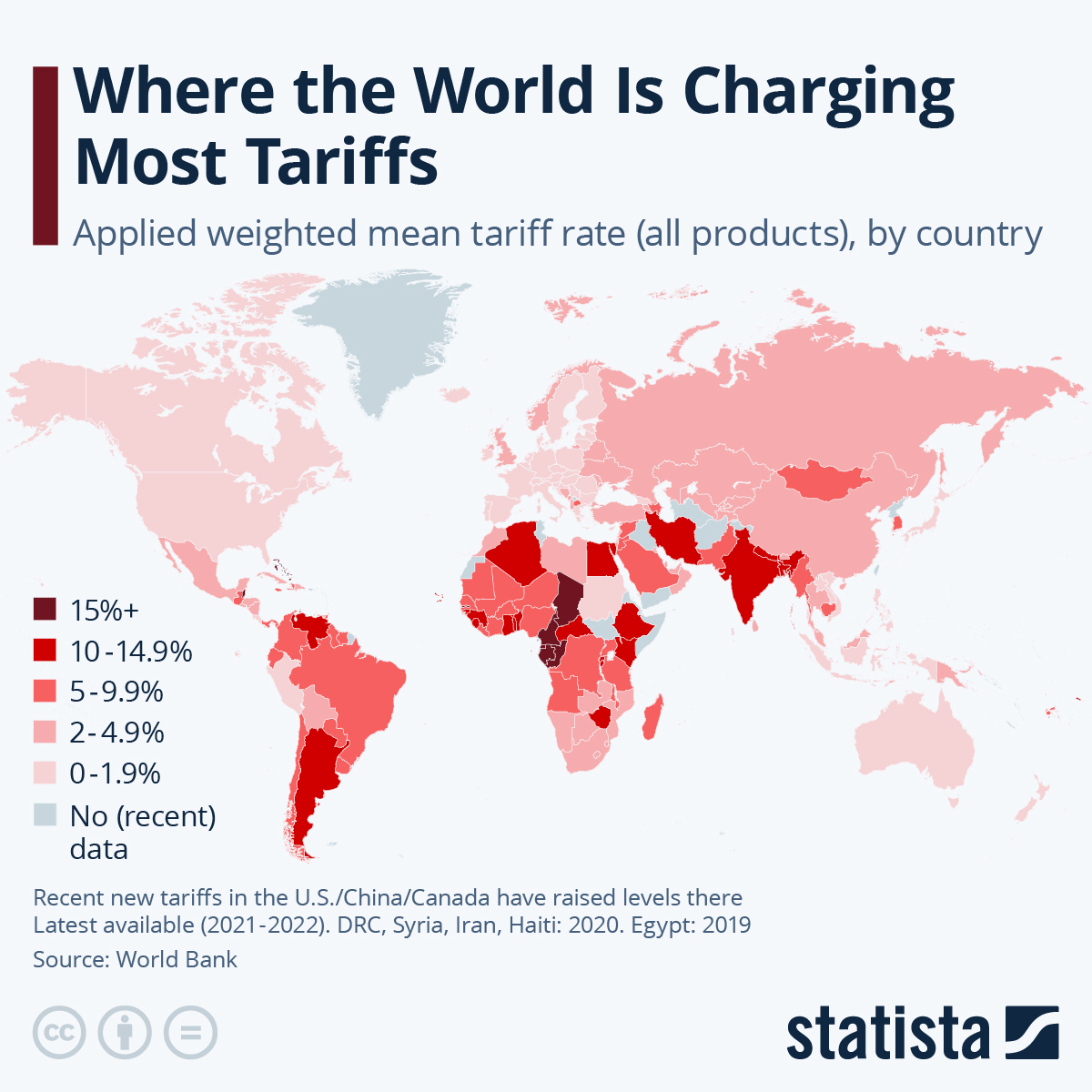

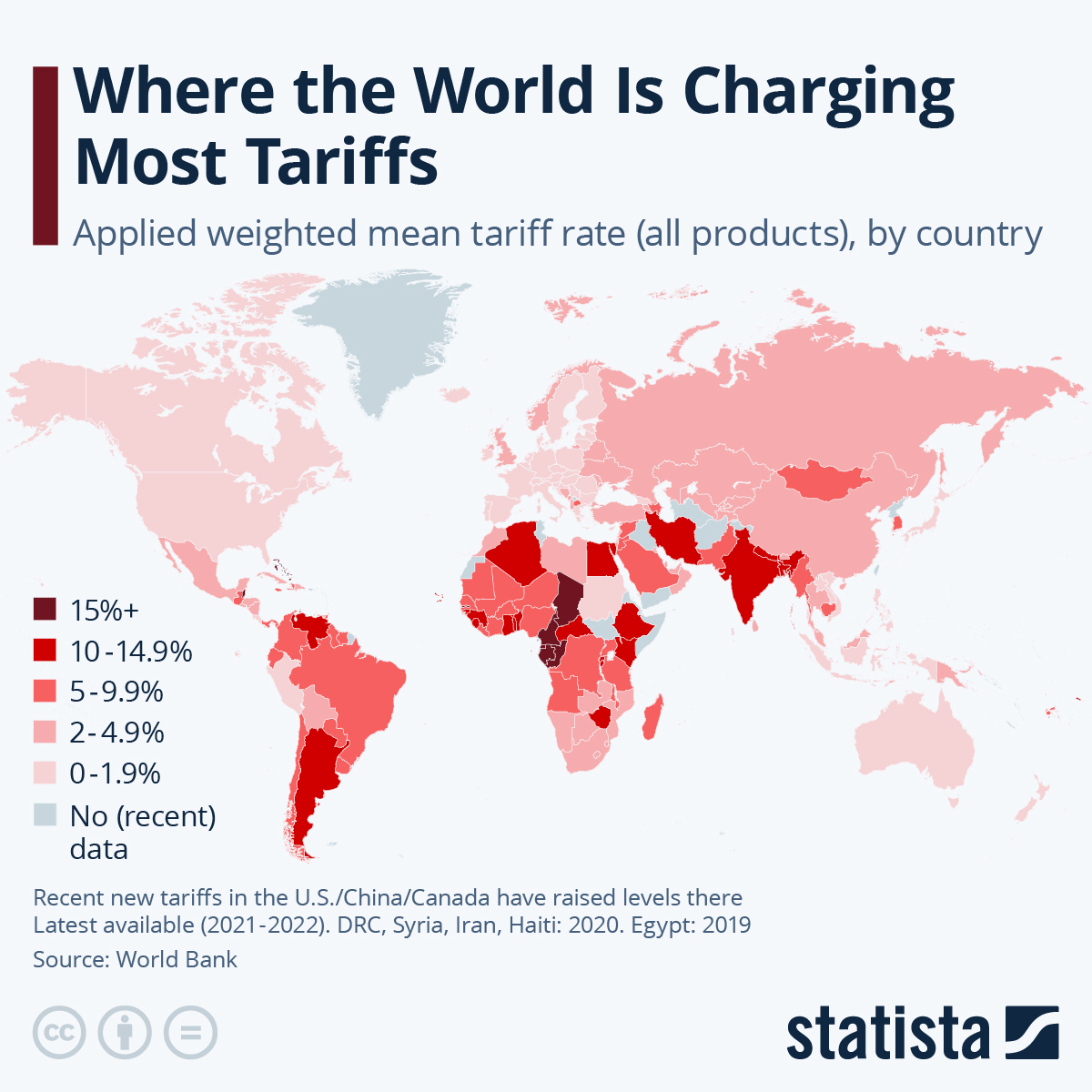

Which US Tariffs Remain and Their Impact on Key Canadian Sectors

Despite some easing of tensions, several key Canadian sectors continue to face significant US tariffs:

- Lumber: High tariffs remain on Canadian softwood lumber exports, significantly impacting the forestry sector. This has resulted in job losses in logging, milling, and transportation. The tariff rate currently stands at approximately 20%, significantly impacting profitability.

- Aluminum: While some tariffs have been reduced, significant tariffs remain impacting the aluminum industry, a crucial part of the Canadian manufacturing sector. These tariffs have led to reduced production and plant closures.

- Dairy: US tariffs on Canadian dairy products continue to restrict market access and affect Canadian dairy farmers. The reduced export capacity has led to surplus production and price instability.

The quantifiable impacts are substantial:

- Job losses: Thousands of jobs have been lost across affected sectors, leading to increased unemployment and regional economic hardship.

- Decreased exports: Canadian exports to the US have plummeted, leading to decreased revenue for businesses and impacting overall economic growth.

- Long-term consequences: Continued tariffs threaten the long-term viability of affected industries, potentially leading to permanent job losses and diminished competitiveness in the global market. This could negatively impact Canadian GDP for years to come.

Canada's Response and Future Strategies Regarding US Tariffs

Canada has responded to these tariffs through various diplomatic channels, including:

- Ongoing trade negotiations or disputes with the US: Canada continues to engage in bilateral discussions with the US government, seeking to resolve the tariff issues through negotiation and compromise. However, progress has been slow.

- Diversification of trade partners: Canada is actively pursuing new trade agreements and strengthening relationships with other countries to diversify its export markets and reduce its dependence on the US. This includes focusing on trade with Asia and Europe.

- Domestic policy adjustments to support affected industries: The Canadian government has implemented various support programs to assist businesses and workers impacted by the tariffs. These include financial aid, job training initiatives, and tax breaks.

- Potential for legal challenges to the tariffs: Legal avenues are being explored to challenge the tariffs on grounds of unfair trade practices.

The Broader Implications of the Trade Dispute

The Canada-US tariff dispute has far-reaching implications:

- Potential effects on supply chains and consumer prices: Disruptions to North American supply chains are leading to higher prices for consumers in both countries.

- Impact on investor confidence in both countries: The ongoing trade uncertainty has negatively impacted investor confidence, potentially hindering economic growth in both Canada and the US.

- The broader geopolitical implications of the trade friction: The strained trade relationship between Canada and the US has wider geopolitical ramifications, impacting the stability of North American economic integration and influencing relations between other trading partners.

Conclusion

Canada's rejection of the Oxford report underscores the persistent and significant impact of US tariffs on the Canadian economy. Key sectors like lumber, aluminum, and dairy continue to struggle under the weight of these tariffs, resulting in job losses, reduced exports, and long-term economic uncertainty. While Canada is pursuing various strategies to mitigate the damage, the need for a resolution to this trade dispute remains paramount. Stay updated on the latest developments regarding Canada US tariffs and the ongoing negotiations impacting Canada US trade relations. Learn more about the effects of US tariffs on the Canadian economy and how these trade disputes impact your daily life.

Featured Posts

-

Canada Post Financial Troubles The Future Of Letter Mail Delivery

May 19, 2025

Canada Post Financial Troubles The Future Of Letter Mail Delivery

May 19, 2025 -

The Rise Of Abusa Analyzing The Ditch America Trade Phenomenon

May 19, 2025

The Rise Of Abusa Analyzing The Ditch America Trade Phenomenon

May 19, 2025 -

Real Madrids Post Mbappe Arsenal Match Transfer Targets

May 19, 2025

Real Madrids Post Mbappe Arsenal Match Transfer Targets

May 19, 2025 -

Baby Lasagna Se Vraca Na Eurosong Sto Mozemo Ocekivati

May 19, 2025

Baby Lasagna Se Vraca Na Eurosong Sto Mozemo Ocekivati

May 19, 2025 -

India Restricts Imports From Bangladesh Strained Relations Lead To Trade Barriers

May 19, 2025

India Restricts Imports From Bangladesh Strained Relations Lead To Trade Barriers

May 19, 2025