Canada's Economy: Ultra-Low Growth Predicted For Next Year

Table of Contents

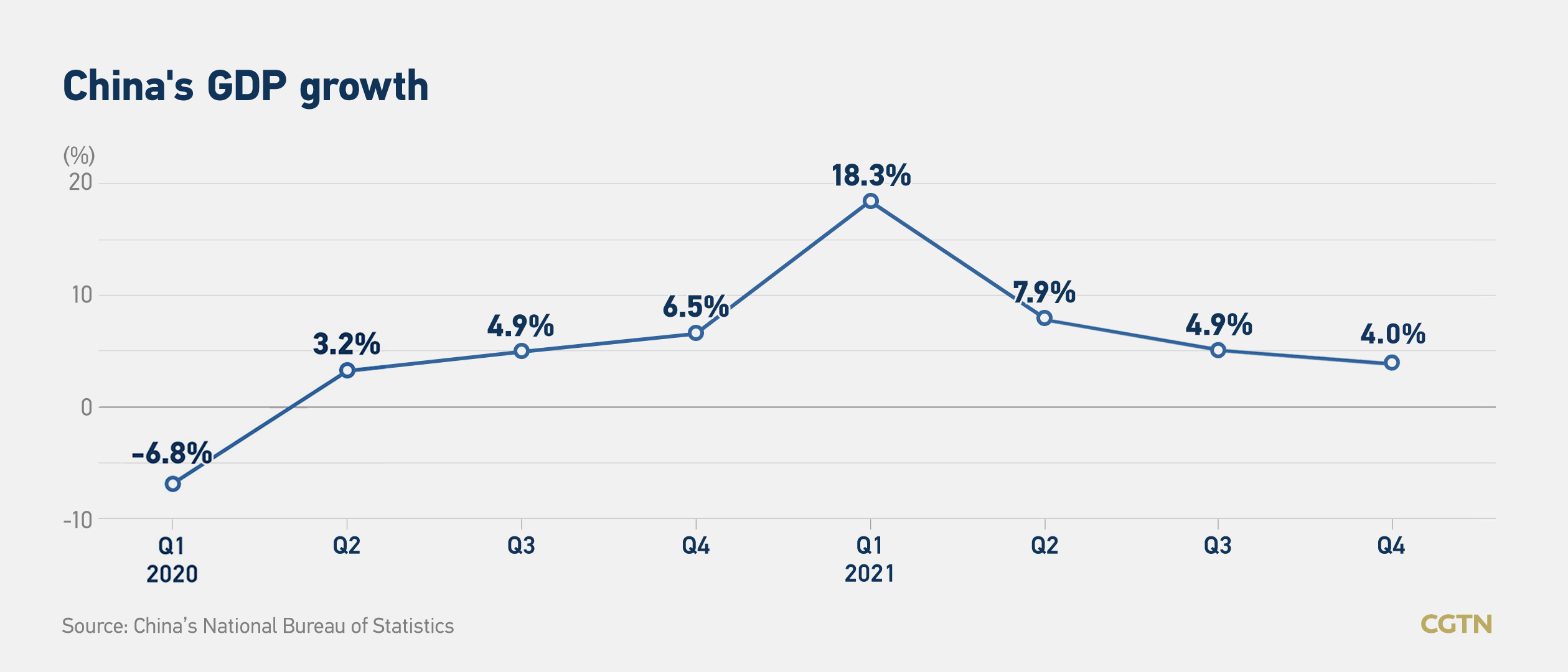

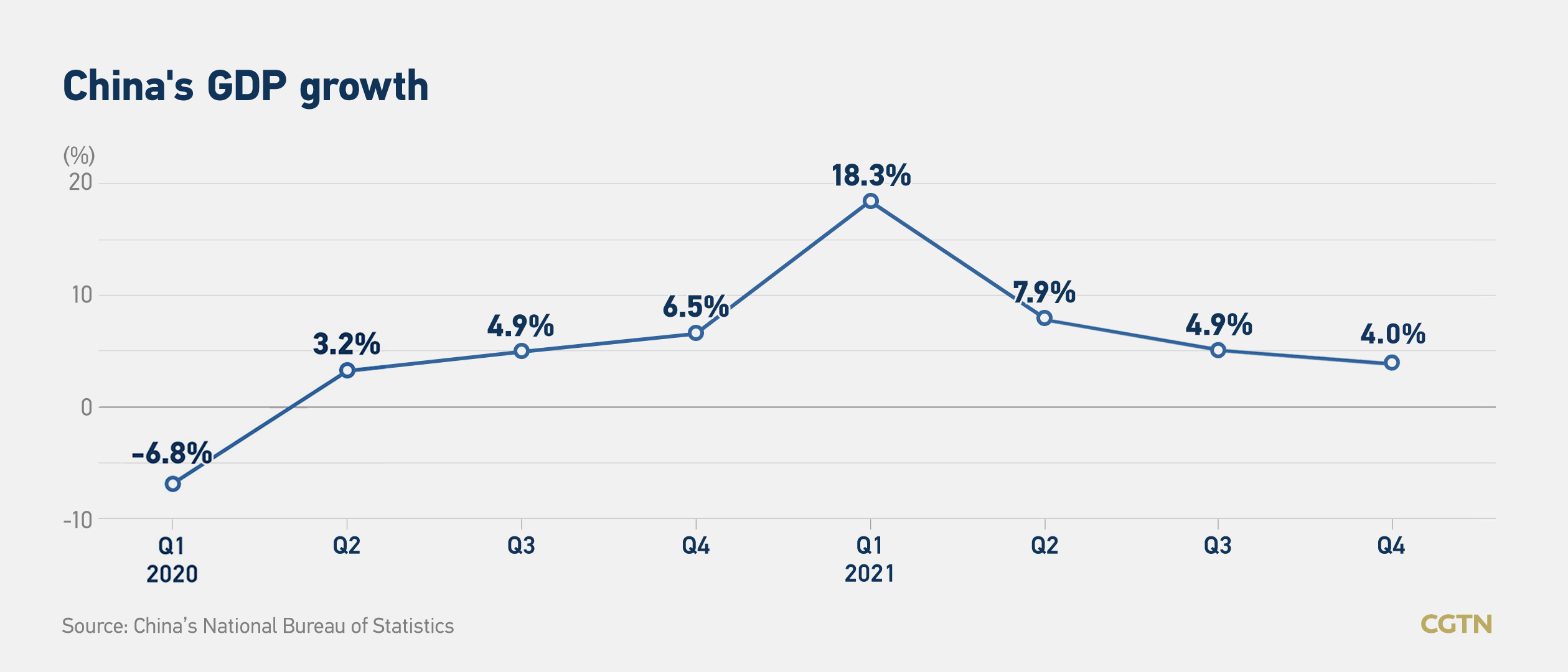

Impact of Global Economic Slowdown on Canada's Economy

Canada's economy, while relatively robust, is deeply intertwined with the global economic landscape. Recessionary fears in major economies like the US and Europe directly impact Canadian growth. This global economic slowdown translates into several key challenges:

- Reduced demand for Canadian exports: Slower growth abroad means less demand for Canadian goods and services, particularly in resource-intensive sectors. This impacts industries reliant on exports, leading to potential job losses and reduced economic activity.

- Increased import costs impacting inflation: Global supply chain disruptions and increased energy prices worldwide contribute to higher import costs for Canadian businesses and consumers, fueling inflationary pressures. This further dampens consumer spending and business investment.

- Uncertainty impacting investment decisions: The uncertainty surrounding the global economic outlook makes businesses hesitant to invest, delaying or cancelling expansion projects and hindering job creation. This lack of investment translates to slower economic growth.

- Potential ripple effects on various sectors: The impact is not limited to specific sectors. Manufacturing, resources, and even the service sector experience knock-on effects from reduced demand, higher costs, and decreased investment. This creates a widespread economic slowdown.

High Inflation and Interest Rate Hikes: Stifling Canadian Economic Growth

Persistent inflation remains a significant headwind for the Canadian economy. The Bank of Canada has responded aggressively with multiple interest rate hikes aimed at cooling down the economy and bringing inflation back to its target level. However, these hikes have unintended consequences:

- Increased borrowing costs for businesses and consumers: Higher interest rates make borrowing more expensive for businesses, reducing investment capacity, and for consumers, decreasing spending power, particularly on big-ticket items like houses and cars.

- Reduced consumer spending and investment: As borrowing becomes more expensive, both consumers and businesses cut back on spending and investment, leading to a decrease in aggregate demand and slowing economic growth. This creates a vicious cycle of reduced activity.

- Potential for a slowdown in the housing market: The housing market, a key driver of the Canadian economy, is particularly vulnerable to higher interest rates. Increased borrowing costs cool down demand, leading to a potential slowdown or even a correction in house prices.

- Impact on employment rates and wage growth: Reduced economic activity can lead to job losses or slower wage growth, further impacting consumer spending and overall economic health. This creates a challenging environment for workers and households.

Housing Market Correction and its Economic Implications

The Canadian housing market, known for its volatility, is experiencing a correction after several years of rapid growth. This cooling-off period has significant implications for the broader economy:

- Decreased construction activity: Lower demand for housing leads to reduced construction activity, impacting employment in the construction sector and related industries like lumber and building materials.

- Impact on related industries (e.g., real estate, finance): The slowdown affects related industries such as real estate agencies, mortgage lenders, and furniture retailers. This ripple effect widens the economic impact.

- Potential for job losses in the housing sector: Reduced construction and related activities can result in job losses, impacting employment rates and potentially increasing unemployment claims.

- Effect on consumer confidence: A weakening housing market can negatively impact consumer confidence, leading to further reductions in spending and investment, exacerbating the economic slowdown.

Potential for a Recession in Canada and Mitigation Strategies

The risk of a recession in Canada is a growing concern given the current economic climate. While not inevitable, the confluence of factors discussed above increases the probability. The government can implement various mitigation strategies:

- Government spending initiatives: Targeted government spending in infrastructure projects or social programs can stimulate demand and create jobs, offsetting the impact of the slowdown.

- Monetary policy adjustments: The Bank of Canada may adjust its monetary policy stance, potentially pausing or slowing down interest rate hikes if inflation shows signs of cooling.

- Support for vulnerable sectors: Government support programs can help vulnerable sectors, such as those heavily reliant on exports, weather the economic storm and mitigate job losses.

- Long-term economic planning and diversification: Investing in long-term economic planning and diversifying the Canadian economy can help reduce its vulnerability to future global economic shocks.

Conclusion: Navigating Canada's Economic Challenges: Preparing for Ultra-Low Growth

The predicted ultra-low growth for Canada's economy in the next year is a serious concern, driven by a combination of global economic slowdown, high inflation, interest rate hikes, and a housing market correction. These challenges require careful navigation and proactive strategies. Understanding the interconnectedness of these factors and the potential mitigation strategies discussed is crucial. Stay informed about the evolving economic landscape and prepare for potential challenges by following reputable financial news sources and consulting with financial advisors to navigate Canada's economy and its predicted ultra-low growth effectively. Understanding Canada's economy and the predicted ultra-low growth is crucial for informed decision-making. Learn more about mitigating risks and opportunities by [link to relevant resource].

Featured Posts

-

The China Factor Challenges And Opportunities For Premium Auto Brands Like Bmw And Porsche

May 02, 2025

The China Factor Challenges And Opportunities For Premium Auto Brands Like Bmw And Porsche

May 02, 2025 -

Green Day And Weezer Lead Riot Fest 2025s Star Studded Lineup

May 02, 2025

Green Day And Weezer Lead Riot Fest 2025s Star Studded Lineup

May 02, 2025 -

Fatherhood Glastonbury And The New Loyle Carner Album An Overview

May 02, 2025

Fatherhood Glastonbury And The New Loyle Carner Album An Overview

May 02, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months After

May 02, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months After

May 02, 2025 -

Daisy May Cooper Faces Legal Action Over House Paint

May 02, 2025

Daisy May Cooper Faces Legal Action Over House Paint

May 02, 2025

Latest Posts

-

Souness Picks His Favourite Premier League Player Of All Time

May 02, 2025

Souness Picks His Favourite Premier League Player Of All Time

May 02, 2025 -

Souness Names His Top Premier League Player

May 02, 2025

Souness Names His Top Premier League Player

May 02, 2025 -

Graeme Souness Reveals His Premier League Favourite

May 02, 2025

Graeme Souness Reveals His Premier League Favourite

May 02, 2025 -

Dundee Graeme Sounes Receives Prison Sentence For Sexual Assault

May 02, 2025

Dundee Graeme Sounes Receives Prison Sentence For Sexual Assault

May 02, 2025 -

Graeme Sounes Jailed For Dundee Sex Attack

May 02, 2025

Graeme Sounes Jailed For Dundee Sex Attack

May 02, 2025