Canada's Fiscal Future: A Need For Responsible Liberal Policy

Table of Contents

Managing the National Debt and Deficit

Current Debt Levels and Projections

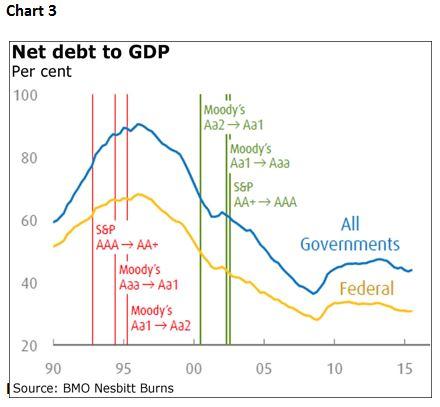

Canada's national debt, while manageable, presents a significant long-term concern. The debt-to-GDP ratio, a key indicator of fiscal health, is projected to increase in the coming years.

- Statistics: Canada's current debt-to-GDP ratio is approximately [insert current statistic, cite source]. Projections indicate an increase to [insert projected statistic, cite source] within the next [timeframe]. These projections are subject to economic volatility and government spending decisions.

- Potential Risks: High debt levels increase vulnerability to economic shocks. Rising interest rates significantly impact debt servicing costs, diverting funds from crucial social programs and infrastructure investments. This can lead to a vicious cycle of increased borrowing and decreased economic growth. The need for fiscal responsibility cannot be overstated.

- Impact of Interest Rate Hikes: Recent interest rate increases by the Bank of Canada have already impacted debt servicing costs, putting further pressure on the federal budget. This highlights the importance of proactive debt management strategies within a responsible liberal policy framework.

Strategies for Debt Reduction

Reducing the national debt requires a multi-pronged approach combining fiscal prudence and strategic investments.

- Policy Options:

- Targeted Spending Cuts: Identifying areas of government spending that can be streamlined without compromising essential services. This requires careful analysis and prioritization, focusing on efficiency gains rather than drastic cuts.

- Tax Reforms: Re-evaluating the tax system to ensure fairness and efficiency. This could involve adjustments to tax brackets, corporate taxes, or the introduction of new taxes on environmentally damaging activities, contributing to both revenue generation and environmental responsibility.

- Economic Growth Initiatives: Investing in areas that stimulate long-term economic growth, such as infrastructure development and innovation, increasing the tax base organically.

- Economic Impact: Each strategy has potential economic impacts. Spending cuts could lead to short-term economic contraction but improve long-term fiscal sustainability. Tax increases can reduce disposable income but increase government revenue. Investment in growth initiatives promises long-term economic returns but may involve short-term costs. A balance needs to be carefully struck. A responsible liberal policy in Canada must consider these trade-offs thoughtfully.

Investing in Sustainable Economic Growth

Investing in Infrastructure

Investing in modern infrastructure is crucial for long-term economic prosperity.

- Economic Returns: Studies consistently show significant economic returns from infrastructure investments. [Cite relevant studies showcasing positive economic impact from infrastructure projects]. These returns include increased productivity, job creation, and enhanced competitiveness.

- Public-Private Partnerships: Public-private partnerships (PPPs) can effectively leverage private sector expertise and capital to deliver infrastructure projects efficiently. However, careful oversight and transparent contracting are vital to ensure value for money. A responsible liberal policy in Canada must consider the appropriate roles for public and private involvement.

Promoting Innovation and Technology

Fostering innovation is key to maintaining Canada's global competitiveness.

- Government Initiatives: The government can support innovation through various initiatives such as:

- Increased funding for research and development (R&D).

- Tax incentives for businesses investing in innovation.

- Programs to support the growth of the technology sector.

- Skills Development: A highly skilled workforce is essential. Investing in education and skills training programs is crucial to equip Canadians for the jobs of the future. This includes promoting STEM education and reskilling programs for workers in transitioning industries. A responsible liberal policy must prioritise human capital development.

Strengthening Social Programs and Healthcare

Addressing Healthcare Costs

Canada's healthcare system faces increasing pressure due to an aging population and rising costs.

- Healthcare Spending: Statistics show a steady rise in healthcare spending. [Cite Statistics Canada data on healthcare spending]. An aging population and advancements in medical technology contribute to these rising costs.

- Sustainable Funding Models: Exploring sustainable funding models is critical. This includes exploring options like improving healthcare efficiency through technology and preventing illness through preventative care. A responsible liberal policy in Canada must address the long-term sustainability of its healthcare system.

Supporting Social Safety Nets

Maintaining robust social safety nets is vital for vulnerable populations.

- Social Programs: Programs such as Employment Insurance, social assistance, and affordable housing require adequate funding to support vulnerable Canadians.

- Poverty Reduction: Effective social safety nets play a critical role in poverty reduction and social equity. A responsible liberal policy in Canada emphasizes social justice and inclusion while pursuing fiscal responsibility.

Promoting Fiscal Transparency and Accountability

Improving Budget Transparency

Open and transparent budgeting is essential for responsible fiscal management.

- Mechanisms for Transparency: Improving public access to government budget information is key. This includes clear and concise budget documents, online budget tracking tools, and independent audits of government spending.

- Independent Oversight: Strengthening the role of independent oversight bodies, such as the Auditor General, ensures accountability and prevents wasteful spending.

Strengthening Public Engagement

Involving the public in fiscal policy discussions improves decision-making.

- Methods for Public Engagement: Town halls, online consultations, and citizen advisory boards can facilitate public participation.

- Informed Decision-Making: Public engagement fosters informed decision-making and promotes trust in government. A responsible liberal policy in Canada values citizen input and participatory governance.

Conclusion

Canada's fiscal future depends heavily on the implementation of a responsible liberal policy. Balancing immediate needs with long-term sustainability requires a holistic approach encompassing debt management, investment in sustainable economic growth, and the fortification of social programs. By embracing transparency, accountability, and meaningful public engagement, Canada can secure a strong and prosperous future for all its citizens. Let's advocate for a responsible liberal policy in Canada to ensure our nation's economic well-being for generations to come. We must actively participate in shaping a strong and sustainable fiscal future rooted in the principles of responsible liberal policy in Canada.

Featured Posts

-

John Travoltas Daughter Ella Bleu 24 Shows Off Drastic Makeover In Magazine Debut

Apr 24, 2025

John Travoltas Daughter Ella Bleu 24 Shows Off Drastic Makeover In Magazine Debut

Apr 24, 2025 -

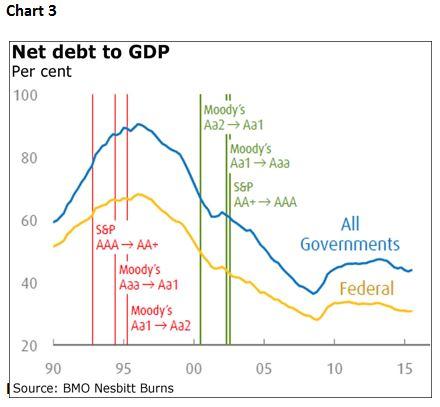

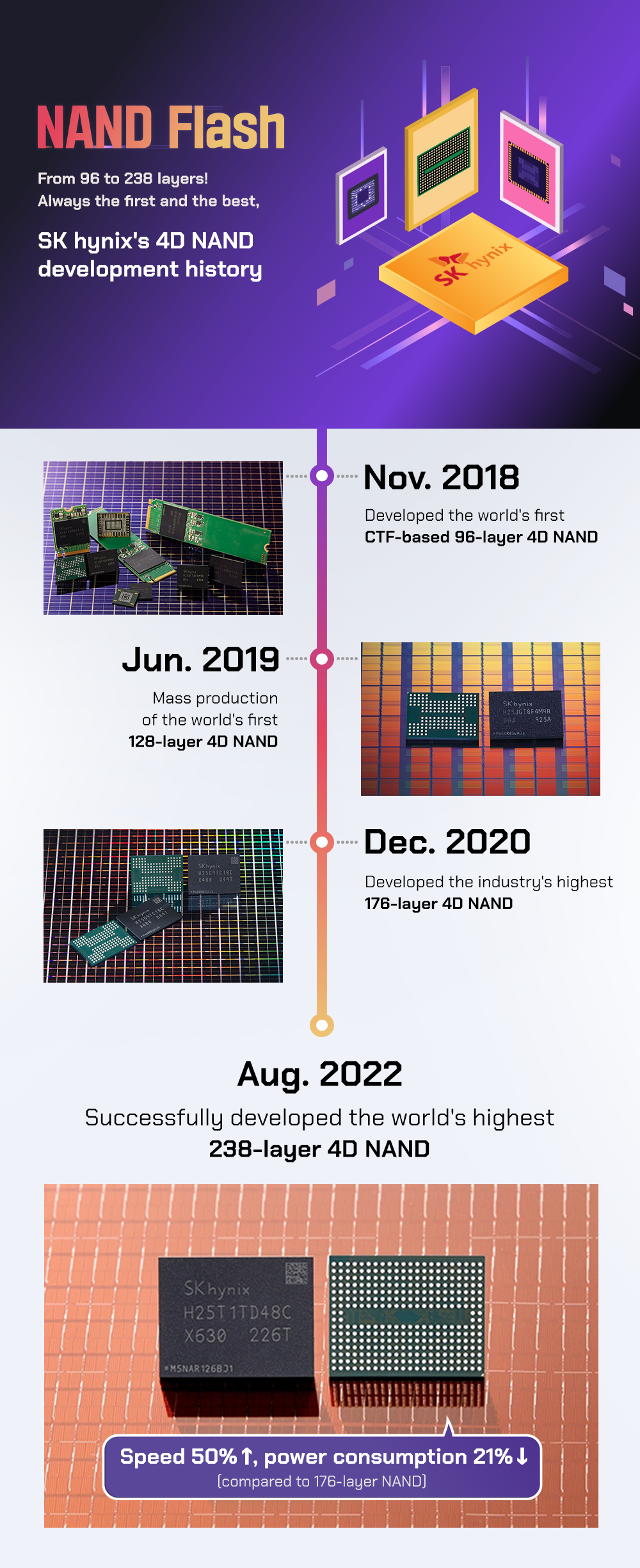

Dram Market Shift Sk Hynix Emerges As Potential Leader With Ai Boost

Apr 24, 2025

Dram Market Shift Sk Hynix Emerges As Potential Leader With Ai Boost

Apr 24, 2025 -

Harvard Lawsuit Vs Trump Administration Potential For Negotiation

Apr 24, 2025

Harvard Lawsuit Vs Trump Administration Potential For Negotiation

Apr 24, 2025 -

Is The Canadian Dollars Rise Against The Us Dollar Sustainable

Apr 24, 2025

Is The Canadian Dollars Rise Against The Us Dollar Sustainable

Apr 24, 2025 -

White House Announces Drop In Illegal Border Crossings Between U S And Canada

Apr 24, 2025

White House Announces Drop In Illegal Border Crossings Between U S And Canada

Apr 24, 2025