Canadian Conservative Platform: Focus On Tax Cuts And Fiscal Responsibility

Table of Contents

Proposed Tax Cuts and Their Impact

The Canadian Conservative Party's economic platform prioritizes significant tax reductions to stimulate economic growth and improve the financial well-being of Canadians. Their proposed tax cuts target individuals and businesses, aiming to create a more competitive and prosperous economy.

Personal Income Tax Reductions

The Conservative party typically proposes reductions in personal income tax rates across various income brackets. Specific proposals vary from election to election, but the overall aim remains consistent: to provide tax relief for Canadian families and individuals.

- Examples of Proposed Cuts (Illustrative): A reduction in the highest marginal tax rate, a targeted cut for middle-income earners, or an increase in the basic personal amount. (Note: Specific numbers are omitted here as they change frequently. Consult the official party platform for the most up-to-date information.)

- Potential Benefits and Drawbacks: Lower tax rates could boost disposable income, leading to increased consumer spending and economic activity. However, critics argue that such reductions disproportionately benefit higher-income earners and could strain government finances. The impact on lower-income individuals would need careful examination and depends heavily on the specifics of the plan. A focus on targeted tax credits (discussed below) often attempts to mitigate this.

- Keyword Integration: "Conservative tax plan," "Canadian income tax cuts," "personal tax reduction"

Corporate Tax Rate Reductions

Reducing the corporate tax rate is a central plank of the Conservative economic strategy. The party argues that lowering the rate encourages business investment, job creation, and overall economic growth.

- Proposed Corporate Tax Rate (Illustrative): The Conservative party usually advocates for a lower corporate tax rate than the current rate. (Again, consult the party platform for specific numbers.) The aim is to make Canada more attractive to businesses, both domestically and internationally.

- Potential Impacts: Proponents claim that lower corporate taxes incentivize businesses to expand, invest in new technology, and hire more employees. This could lead to increased economic productivity and higher wages. Opponents, however, may argue that this approach benefits large corporations disproportionately and may not sufficiently trickle down to the average worker. Furthermore, potential revenue losses for the government need to be considered.

- Keyword Integration: "corporate tax cuts Canada," "business tax reduction," "Conservative economic policy"

Targeted Tax Credits and Deductions

Beyond broad-based tax cuts, the Conservative platform frequently features targeted tax credits and deductions designed to provide relief for specific groups or situations.

- Examples of Tax Credits (Illustrative): Enhanced child tax benefits, tax credits for home renovations, or tax incentives for specific industries. These often vary depending on the specific needs highlighted at election time.

- Targeted Benefits and Government Costs: The advantage of targeted tax credits is their ability to provide support to specific demographics or sectors that the government deems most in need. However, the government must carefully balance the costs associated with these credits against the overall fiscal impact.

- Keyword Integration: "tax credits Canada," "Canadian Conservative tax policy," "targeted tax relief"

Fiscal Responsibility and Debt Management

A key component of the Canadian Conservative Platform is its emphasis on fiscal responsibility and sound debt management. This involves careful control of government spending and the implementation of strategies to reduce the national debt.

Spending Priorities

The Conservative party typically outlines specific spending priorities, with a focus on areas deemed critical to economic growth and national security.

- Key Areas of Spending (Illustrative): Healthcare, infrastructure development (roads, bridges, public transit), and national defense are often cited as priority areas. However, the specific allocation of funds will vary according to the government’s economic priorities at the time.

- Balancing Budget Projections: The Conservative party aims to balance the budget through a combination of spending restraint and economic growth spurred by their tax cut proposals. This requires careful scrutiny of their revenue and expenditure projections to assess the feasibility of their plan.

- Keyword Integration: "fiscal responsibility Canada," "Conservative government spending," "debt reduction plan"

Deficit Reduction Strategies

The Conservative approach to deficit reduction typically focuses on a combination of spending cuts and increased efficiency measures within government operations.

- Specific Strategies (Illustrative): Identifying and eliminating wasteful spending, improving the efficiency of government programs, and reviewing the effectiveness of existing regulations are common strategies.

- Projected Timelines and Economic Consequences: The Conservative party usually provides estimates for the time it will take to eliminate the deficit, and how their plan impacts the broader economy. Assessing the accuracy and feasibility of these projections is crucial.

- Keyword Integration: "Canadian budget deficit," "fiscal sustainability," "Conservative debt management"

Crown Corporation Reform

The Canadian Conservative Party often proposes reforms to Crown corporations, aiming to improve efficiency and reduce government spending.

- Specific Corporations and Proposed Changes (Illustrative): Specific proposals will target individual Crown corporations, with suggestions ranging from increased accountability to privatization.

- Intended Benefits and Potential Risks: The goal of these reforms is generally to enhance efficiency, reduce costs, and potentially increase competitiveness. However, concerns about the potential impact on jobs, services, and public ownership should be considered.

- Keyword Integration: "Crown corporation reform," "Canadian government efficiency," "Conservative privatization"

Conclusion

The Canadian Conservative Party’s platform centers on a clear vision of achieving economic growth through targeted tax cuts and a commitment to fiscal responsibility. Their proposals for personal and corporate tax reductions, coupled with their strategies for deficit reduction and efficient government spending, aim to stimulate the economy and improve the lives of Canadians. However, the success of their plan hinges on the feasibility of their spending projections and the effectiveness of their proposed reforms. To gain a complete understanding of their economic policies and their potential impact on you, further research into specific policy details is recommended. Understanding the nuances of the Canadian Conservative Platform is vital for informed voting. Learn more about the Conservative party's tax cuts and their broader economic strategy today!

Featured Posts

-

Eu Targets Russian Gas Spot Market Phaseout Plans

Apr 24, 2025

Eu Targets Russian Gas Spot Market Phaseout Plans

Apr 24, 2025 -

Blazers Fall To Warriors Hield And Paytons Impact Off The Bench

Apr 24, 2025

Blazers Fall To Warriors Hield And Paytons Impact Off The Bench

Apr 24, 2025 -

Broadcoms Proposed V Mware Price Increase At And T Details Extreme Costs

Apr 24, 2025

Broadcoms Proposed V Mware Price Increase At And T Details Extreme Costs

Apr 24, 2025 -

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

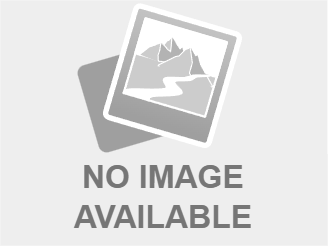

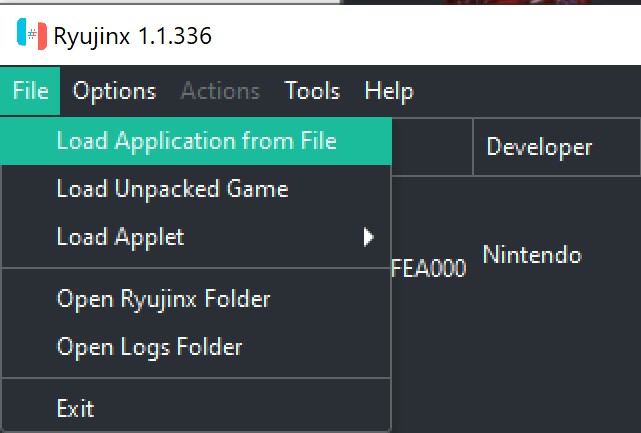

Ryujinx Emulator Development Halted Nintendos Involvement Investigated

Apr 24, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Investigated

Apr 24, 2025