Canadian Dollar Forecast: Minority Government's Impact

Table of Contents

Political Instability and its Effect on the CAD

A minority government inherently introduces increased uncertainty into the Canadian economy, significantly impacting the Canadian dollar forecast. This uncertainty stems from the difficulties in passing legislation and implementing consistent economic policies.

Increased Uncertainty

The inherent instability of a minority government translates to several key challenges:

- Increased volatility in the currency exchange rate: The lack of a clear, consistent policy direction makes the CAD more susceptible to market fluctuations and speculation. Investors react to uncertainty by adjusting their exposure to the Canadian dollar, leading to volatility.

- Potential for delayed economic reforms and infrastructure projects: Passing crucial legislation often requires compromises and negotiations, leading to delays in implementing vital economic reforms and infrastructure projects that could boost long-term economic growth and the CAD's value.

- Uncertainty surrounding fiscal and monetary policy: The lack of a stable majority can make it difficult to predict government spending and tax policies, impacting investor confidence and influencing the Bank of Canada's monetary policy decisions. This uncertainty directly affects the Canadian dollar forecast.

Potential for Frequent Elections

The ever-present threat of snap elections adds another layer of uncertainty:

- Short-term investment strategies may be favored over long-term ones: Investors might shy away from long-term commitments, opting for shorter-term, more flexible investment strategies due to the unpredictable political climate.

- Increased risk premium for Canadian assets: The heightened uncertainty increases the perceived risk associated with Canadian assets, leading investors to demand a higher return for bearing that risk. This can depress the value of the CAD.

- Potential capital flight if political instability intensifies: If political instability escalates, investors might move their capital to perceived safer havens, putting downward pressure on the Canadian dollar.

Impact on Key Economic Sectors

A minority government's policies significantly influence key sectors of the Canadian economy, with ripple effects on the CAD.

Energy Sector

The Canadian economy, and the CAD, are heavily reliant on the energy sector. Government decisions directly impact this sector:

- Changes in pipeline approvals and carbon pricing schemes: Government policy changes regarding pipeline construction and carbon pricing can significantly affect oil production, exports, and foreign investment in the Canadian energy sector, thereby influencing the Canadian dollar.

- Impact on foreign investment in the Canadian energy sector: Political uncertainty can deter foreign investment, hampering the growth of the energy sector and impacting the CAD's value.

- Fluctuations in oil prices directly impacting the CAD value: Oil price volatility, further exacerbated by policy uncertainty, can create significant swings in the CAD's exchange rate.

Housing Market

Government intervention in the housing market also affects the overall economy and the CAD:

- Potential for stricter regulations or incentives affecting housing prices: Government policies aimed at cooling or stimulating the housing market can significantly impact housing prices, consumer spending, and overall economic growth.

- Impact of interest rate changes on mortgage affordability: Interest rate adjustments by the Bank of Canada, often in response to government policies or economic conditions, affect mortgage affordability and consumer spending, indirectly impacting the CAD.

- Indirect effect on consumer spending and economic growth: The housing market’s health has a substantial bearing on consumer confidence and overall economic growth, impacting the CAD indirectly.

Fiscal and Monetary Policy under a Minority Government

A minority government's fiscal and monetary policies present unique challenges for the Canadian dollar forecast.

Budgetary Constraints

The difficulties in passing budgets under a minority government lead to various economic consequences:

- Potential for delayed infrastructure projects and social programs: Budgetary constraints can lead to delays in crucial infrastructure projects and social programs, slowing down economic growth.

- Impact on consumer confidence and spending: Uncertainty surrounding government spending can negatively affect consumer confidence and reduce consumer spending, impacting economic growth and the CAD.

- Effects on government debt levels: The inability to pass timely budgets can affect government debt levels, potentially impacting investor confidence in the Canadian economy.

Bank of Canada's Response

The Bank of Canada plays a critical role in navigating the economic uncertainties created by a minority government:

- Interest rate adjustments in response to economic uncertainty: The Bank of Canada might adjust interest rates to stabilize the economy and manage inflation in response to the uncertainty caused by the minority government.

- The Bank of Canada's role in mitigating economic risks: The central bank's actions aim to mitigate the economic risks stemming from the political instability, influencing the Canadian dollar forecast.

- Potential influence on inflation and the CAD's value: The Bank of Canada's policies directly influence inflation and, subsequently, the value of the Canadian dollar.

Conclusion

The Canadian dollar forecast under a minority government is inherently more uncertain and volatile than under a majority government. Navigating this complex political landscape requires a keen understanding of the potential impacts on key economic sectors and the government’s ability to implement effective fiscal and monetary policies. While challenges exist, understanding these dynamics is crucial for making informed decisions regarding investment and trading the Canadian dollar. Stay informed about the evolving political and economic climate to effectively manage your exposure to the CAD and stay ahead of the curve with your Canadian dollar forecast. Continue monitoring developments to refine your Canadian dollar trading strategy and manage your risk effectively. Understanding these factors is key to a successful strategy for trading the Canadian dollar.

Featured Posts

-

Boostez Vos Thes Dansants Grace Au Numerique

May 01, 2025

Boostez Vos Thes Dansants Grace Au Numerique

May 01, 2025 -

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

May 01, 2025

Kentucky Facing Storm Damage Assessment Backlog Causes And Solutions

May 01, 2025 -

Neal Pionks Performance A Season Highlights Review

May 01, 2025

Neal Pionks Performance A Season Highlights Review

May 01, 2025 -

Islensk Fotboltadagskra Valur Stefnir A 2 0 Sigur

May 01, 2025

Islensk Fotboltadagskra Valur Stefnir A 2 0 Sigur

May 01, 2025 -

Tongas Victory Sis Olympic Qualification In Jeopardy

May 01, 2025

Tongas Victory Sis Olympic Qualification In Jeopardy

May 01, 2025

Latest Posts

-

Louisville Residents How To Report Storm Damage And Debris

May 01, 2025

Louisville Residents How To Report Storm Damage And Debris

May 01, 2025 -

Severe Weather Cleanup Louisville Launches Debris Pickup Program

May 01, 2025

Severe Weather Cleanup Louisville Launches Debris Pickup Program

May 01, 2025 -

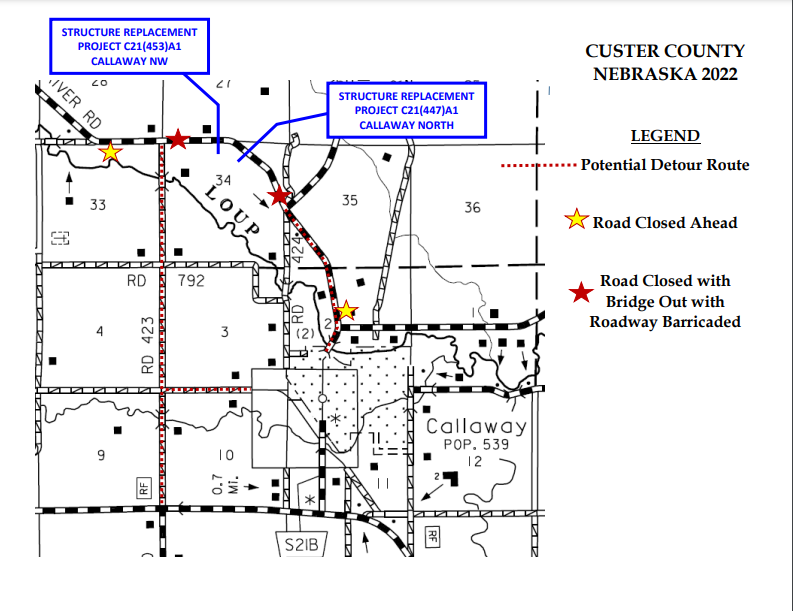

Louisvilles River Road Closure A Crisis For Local Restaurants

May 01, 2025

Louisvilles River Road Closure A Crisis For Local Restaurants

May 01, 2025 -

Louisville Declares State Of Emergency Tornado Aftermath And Major Flooding Expected

May 01, 2025

Louisville Declares State Of Emergency Tornado Aftermath And Major Flooding Expected

May 01, 2025 -

Louisville Storm Debris Pickup Submit Your Request Now

May 01, 2025

Louisville Storm Debris Pickup Submit Your Request Now

May 01, 2025