Canadian Dollar: Minority Government Threat To Its Stability?

Table of Contents

Main Points:

2.1. Minority Government and Policy Uncertainty:

Increased Volatility in Policy Decisions:

Minority governments, by their nature, require compromise and coalition-building to pass legislation. This often leads to unpredictable policy shifts, creating volatility in the market and impacting the Canadian dollar. The need for constant negotiation can result in delayed decision-making, hindering effective responses to economic challenges.

- Example 1: Past instances of sudden changes in environmental regulations under minority governments have led to uncertainty for resource-based companies, affecting investment and potentially the CAD exchange rate.

- Example 2: Shifting stances on trade agreements, a key component of the Canadian economy, can trigger market fluctuations as investors assess the implications for exports and imports.

- Potential areas of policy volatility affecting the CAD include:

- Significant changes in fiscal policy, such as altering tax rates or government spending.

- Renegotiation or withdrawal from international trade agreements.

- Implementation of stricter environmental regulations impacting resource extraction and energy production.

Difficulty in Implementing Long-Term Economic Strategies:

The inherent instability of minority governments makes it challenging to develop and implement long-term economic strategies crucial for sustainable currency stability. The constant threat of an election can overshadow long-term planning, leading to a focus on short-term political gains rather than sustainable economic growth.

- Examples of long-term economic initiatives vulnerable under a minority government:

- Large-scale infrastructure projects requiring sustained government commitment.

- Comprehensive pension reforms demanding consistent policy implementation.

- Strategies aimed at diversifying the Canadian economy beyond resource dependence.

- Frequent elections create uncertainty for investors, potentially leading to decreased investment and increased volatility in the CAD exchange rate. Investors prefer stable political environments for long-term commitments.

2.2. Impact on Investor Confidence and Foreign Investment:

Decreased Investor Confidence and Capital Flight:

Political uncertainty associated with minority governments can significantly deter foreign investment. Investors are hesitant to commit capital in environments characterized by unpredictable policy changes and potential shifts in government priorities. This can lead to capital flight, reducing demand for the Canadian dollar and weakening its value.

- Investors react to political risk by:

- Delaying investment decisions until political clarity emerges.

- Diversifying their portfolios to reduce exposure to Canadian assets.

- Demanding higher returns to compensate for the increased risk.

- Statistics demonstrating a correlation between government stability and foreign direct investment in Canada could further support this point. (Data should be sourced and cited appropriately).

Credit Rating Downgrades and Increased Borrowing Costs:

Political instability can prompt credit rating agencies to downgrade Canada's sovereign debt rating. This reflects an increased perception of risk associated with lending to the Canadian government. A lower credit rating, in turn, leads to higher borrowing costs for the government, impacting the overall economy and potentially putting downward pressure on the CAD.

- The impact of higher borrowing costs:

- Reduces government spending on essential services and infrastructure projects.

- Increases the overall cost of debt for businesses and individuals.

- Creates a less attractive investment climate, further impacting the CAD.

- Examples of countries experiencing similar situations resulting in currency devaluation could strengthen this argument.

2.3. Specific Sectors Vulnerable to Minority Government Policies:

Natural Resources and Energy:

The Canadian natural resources sector is particularly sensitive to fluctuating government policies. Environmental regulations, pipeline approvals, and resource taxation policies can significantly impact investment decisions and production levels, thus affecting the CAD.

- Examples of policies impacting the sector:

- Changes in environmental impact assessments for resource projects.

- Shifting taxation policies on resource extraction.

- Approval or rejection of major pipeline projects.

Financial Services:

Canada's financial sector is sensitive to policy uncertainty. Changes in banking regulations, financial market supervision, and tax policies can significantly affect the sector’s stability and investor confidence, influencing the CAD's performance.

- Regulatory changes impacting the sector:

- Amendments to banking regulations affecting lending practices.

- Changes in tax policies impacting financial institutions.

- Alterations in consumer protection laws affecting financial products.

Conclusion: Navigating the Uncertainties of the Canadian Dollar under Minority Rule

Minority governments, while a part of Canada's parliamentary system, introduce an element of uncertainty that can potentially threaten the stability of the Canadian dollar. The volatility in policy decisions, decreased investor confidence, and increased vulnerability of key economic sectors all contribute to this risk. However, it's crucial to acknowledge the resilience of the Canadian economy and its ability to adapt to political changes.

To navigate these uncertainties, it's essential to stay informed about Canadian political developments and their potential impact on the CAD. Monitoring the CAD exchange rate and considering hedging strategies if necessary are prudent steps for businesses and investors concerned about currency fluctuations. Understanding the potential ramifications of a minority government on the Canadian dollar (CAD) is key to effective financial planning and risk management in this dynamic political environment.

Featured Posts

-

Chung Ket Bong Da Sinh Vien Soi Dong Tran Dau Mo Man

May 01, 2025

Chung Ket Bong Da Sinh Vien Soi Dong Tran Dau Mo Man

May 01, 2025 -

Solid Skenes Start Not Enough As Team Suffers Defeat

May 01, 2025

Solid Skenes Start Not Enough As Team Suffers Defeat

May 01, 2025 -

Juridische Strijd Kampen Dagvaardt Enexis Voor Problemen Met Stroom

May 01, 2025

Juridische Strijd Kampen Dagvaardt Enexis Voor Problemen Met Stroom

May 01, 2025 -

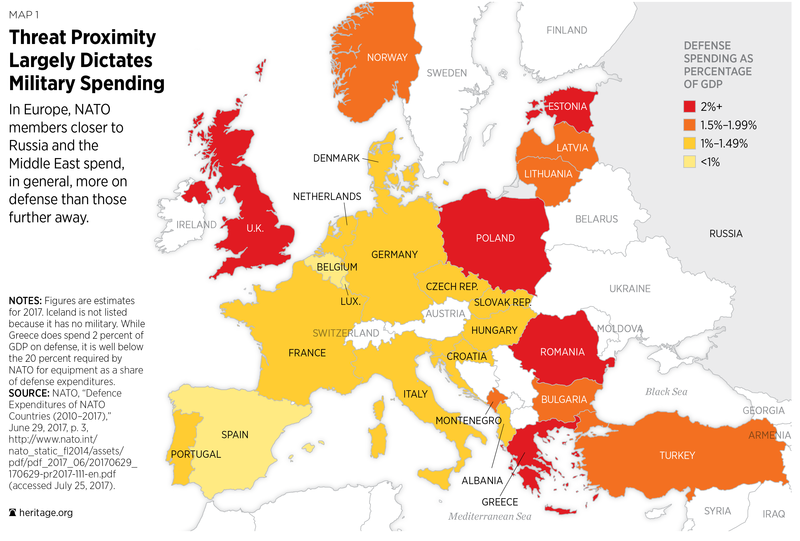

Europes Rising Military Spending A Reaction To The Russian Threat

May 01, 2025

Europes Rising Military Spending A Reaction To The Russian Threat

May 01, 2025 -

Actress Priscilla Pointer Passes Away Tributes Pour In

May 01, 2025

Actress Priscilla Pointer Passes Away Tributes Pour In

May 01, 2025

Latest Posts

-

Louisville Restaurant Owners Face Hardship Due To River Road Project

May 01, 2025

Louisville Restaurant Owners Face Hardship Due To River Road Project

May 01, 2025 -

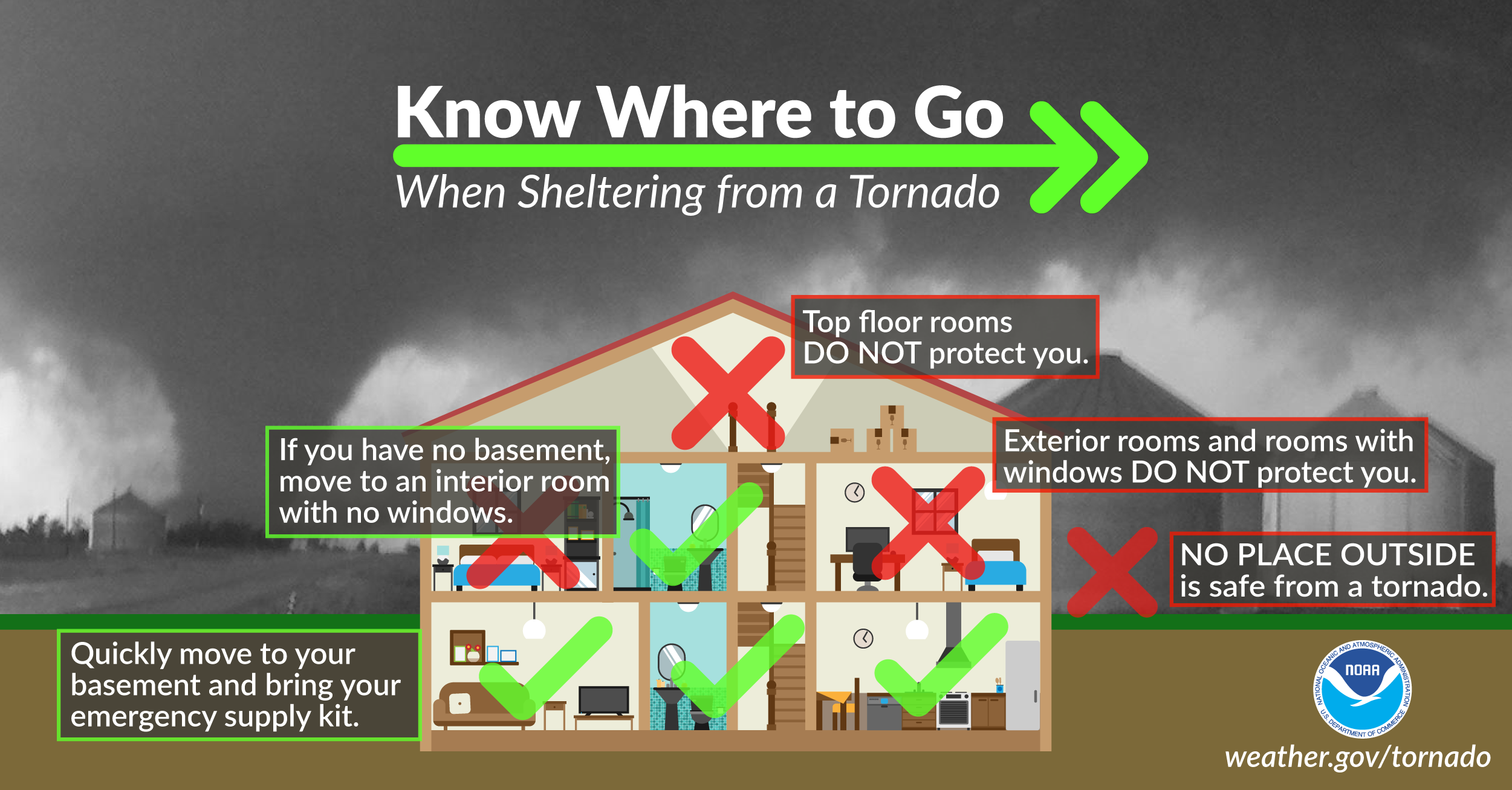

Remembering Past Tragedies Louisville Residents Under Shelter In Place

May 01, 2025

Remembering Past Tragedies Louisville Residents Under Shelter In Place

May 01, 2025 -

Louisvilles Shelter In Place A Time For Remembrance And Community

May 01, 2025

Louisvilles Shelter In Place A Time For Remembrance And Community

May 01, 2025 -

Louisville Residents Under Shelter In Place Order Reflect On Past Events

May 01, 2025

Louisville Residents Under Shelter In Place Order Reflect On Past Events

May 01, 2025 -

Nws Kentucky Get Ready For Severe Weather Awareness Week

May 01, 2025

Nws Kentucky Get Ready For Severe Weather Awareness Week

May 01, 2025