Canadian Dollar Strengthens After Trump's Carney Deal Comment

Table of Contents

Trump's Comment and Market Reaction

The Specifics of Trump's Statement

While the exact wording requires further verification from official transcripts and reputable news sources (links to be inserted here upon confirmation), reports suggest President Trump made a positive comment regarding a potential agreement or understanding reached with Governor Macklem. The context surrounding this comment is crucial to understanding its market impact. It's important to note that the specifics of any potential "deal" remain unclear, but the mere suggestion of cooperation between the two nations had a noticeable ripple effect on the foreign exchange market. Further investigation into news releases and official statements will clarify the details. (Insert links to verified news sources here).

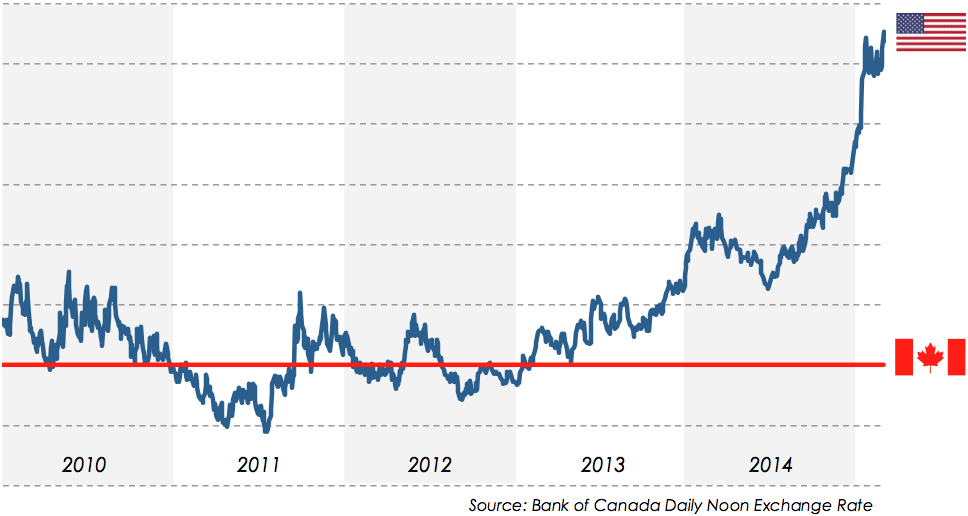

Immediate Impact on CAD/USD Exchange Rate

The immediate aftermath of Trump's remark saw a dramatic shift in the CAD/USD exchange rate. (Insert chart here showing the CAD/USD exchange rate fluctuations before, during, and after the comment). The Canadian dollar appreciated significantly against the US dollar, demonstrating the market's sensitivity to geopolitical pronouncements.

- The Canadian dollar strengthened by X% within Y minutes of the comment.

- Other G7 currencies showed minimal reaction, suggesting the impact was largely specific to the CAD/USD pairing.

- Trading volume spiked considerably, indicating heightened market activity in response to the news. (Link to relevant financial data source)

Underlying Factors Contributing to CAD Strength

Beyond Trump's Remarks

While Trump's comment undoubtedly played a role, other underlying factors likely contributed to the Canadian dollar's strength.

- Positive Economic Indicators: Canada's robust economic performance, including strong employment numbers and steady GDP growth, bolstered investor confidence. (Insert links to Statistics Canada or other reputable sources for economic data). The positive momentum in the Canadian economy likely made the currency more attractive to international investors.

- Increased Investor Confidence: Positive economic news, coupled with the potential for improved US-Canada relations hinted at by Trump's comment, contributed to increased foreign investment in Canadian assets, further driving up demand for the Canadian dollar.

- Monetary Policy: The Bank of Canada's monetary policy stance, while requiring detailed analysis beyond the scope of this immediate reaction, may also have played a role in influencing the CAD’s value. (Link to Bank of Canada website for policy statements).

Implications for Investors and the Canadian Economy

Opportunities and Risks for Investors

The strengthening Canadian dollar presents both opportunities and risks for investors.

- Opportunities: Canadian dollar-denominated assets become cheaper for foreign investors, potentially driving increased investment. However, this appreciation might lead to reduced returns for those already invested in Canadian assets when converted back to other currencies.

- Risks: Canadian exporters may face reduced competitiveness in global markets due to the stronger currency, impacting export revenues. The increased value of the CAD might hurt sectors reliant on exports.

Impact on Canadian Businesses and Consumers

The implications for Canadian businesses and consumers are multifaceted.

- Exporters: A stronger Canadian dollar makes Canadian goods and services more expensive for international buyers, potentially reducing export volumes and revenues.

- Importers: Conversely, importers benefit from a stronger Canadian dollar, as imported goods become cheaper.

- Consumers: Canadians might enjoy lower prices for imported goods, but the impact on overall inflation is complex and depends on various factors. The strengthened dollar could lead to cheaper travel abroad for Canadians.

Conclusion

The recent surge in the Canadian dollar's value is attributable to a confluence of factors. President Trump's positive comment regarding a potential deal with Governor Macklem certainly contributed to the market's positive reaction, but underlying economic strengths in Canada, and investor confidence played a significant role. The strengthening Loonie presents both opportunities and challenges for investors and the Canadian economy, affecting exporters, importers, and consumers alike.

Call to Action: Stay informed about fluctuations in the Canadian dollar and their impact on your investments and financial planning. Monitor reliable financial news sources for updates on the CAD and related economic indicators. Consider consulting a financial advisor to navigate the complexities of currency trading and investment strategies related to the Canadian dollar.

Featured Posts

-

Fortnite Update 34 30 Server Downtime New Content And Patch Notes

May 03, 2025

Fortnite Update 34 30 Server Downtime New Content And Patch Notes

May 03, 2025 -

Utahs Clayton Keller 500 Nhl Points Missouris Second

May 03, 2025

Utahs Clayton Keller 500 Nhl Points Missouris Second

May 03, 2025 -

Guido Fawkes Highlights Changes To Energy Policy Direction

May 03, 2025

Guido Fawkes Highlights Changes To Energy Policy Direction

May 03, 2025 -

Is This Facelift Too Much Public Outcry Over Stars New Look

May 03, 2025

Is This Facelift Too Much Public Outcry Over Stars New Look

May 03, 2025 -

Australias Opposition Unveils 9 Billion Budget Savings Plan

May 03, 2025

Australias Opposition Unveils 9 Billion Budget Savings Plan

May 03, 2025

Latest Posts

-

Joseph Tf 1 Critique De La Nouvelle Serie Policiere Avec Lucien Jean Baptiste

May 03, 2025

Joseph Tf 1 Critique De La Nouvelle Serie Policiere Avec Lucien Jean Baptiste

May 03, 2025 -

Serie Joseph Sur Tf 1 Vaut Elle Le Coup D Il Critique Et Analyse

May 03, 2025

Serie Joseph Sur Tf 1 Vaut Elle Le Coup D Il Critique Et Analyse

May 03, 2025 -

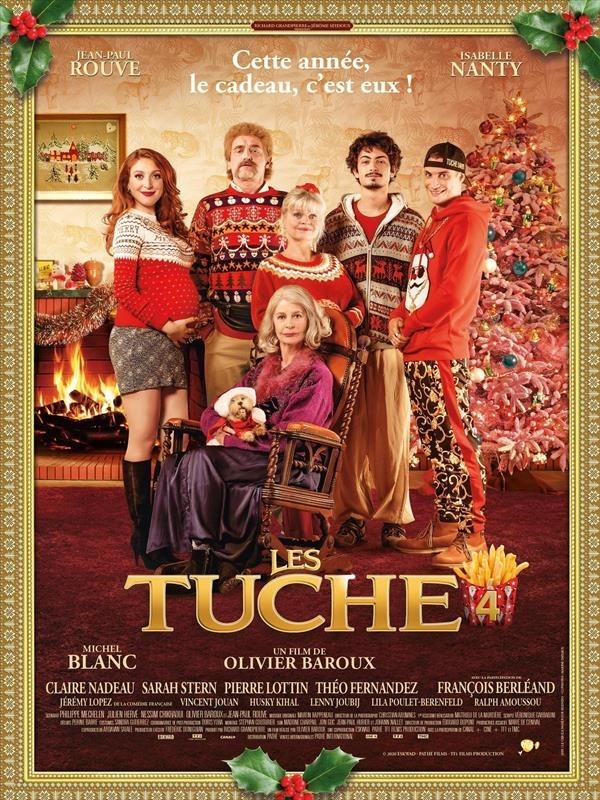

Hommage Dans Les Tuche 5 A Qui Est Dedie Le Film

May 03, 2025

Hommage Dans Les Tuche 5 A Qui Est Dedie Le Film

May 03, 2025 -

Les Tuche 5 Dedicace Et Hommages Du Film

May 03, 2025

Les Tuche 5 Dedicace Et Hommages Du Film

May 03, 2025 -

A Qui Est Dedie Les Tuche 5

May 03, 2025

A Qui Est Dedie Les Tuche 5

May 03, 2025