Canadian Dollar Under Pressure: Minority Government Election Concerns

Table of Contents

Political Instability and Investor Sentiment

Minority governments often lead to policy gridlock, hindering swift and decisive economic decision-making. This inherent instability creates a climate of uncertainty that significantly impacts investor sentiment. The inability to quickly implement necessary economic policies can deter both domestic and foreign investment.

- Difficulty passing budgets and crucial economic legislation: A minority government requires broader consensus to pass legislation, leading to delays and potential compromises that may not be in the best interest of long-term economic growth. This can negatively impact investor confidence.

- Increased risk of snap elections and further uncertainty: The constant threat of another election adds to the instability and makes long-term planning challenging for businesses. This uncertainty discourages investment and capital expenditure.

- Negative impact on investor confidence and foreign investment: Uncertainty breeds risk aversion. Investors are less likely to commit capital to a country perceived as politically unstable. This can lead to a flight of capital, further weakening the CAD.

- Potential for decreased credit rating impacting the CAD: A prolonged period of political instability could lead to a downgrade in Canada's credit rating, making it more expensive for the government to borrow money and potentially impacting the CAD's value.

These factors combine to directly affect the CAD's value. The lack of clear policy direction and the perceived increased risk discourage foreign investment and can lead to a sell-off of the Canadian dollar.

Economic Outlook and the Canadian Dollar

The current economic indicators for Canada are also playing a significant role in the CAD's performance. Factors such as inflation, interest rates, and the trade balance all influence the currency's strength.

- Impact of global economic conditions on the Canadian economy: Canada's economy is closely tied to global markets. Recessions or slowdowns in major economies can negatively impact Canadian exports and economic growth, thus weakening the CAD.

- Analysis of Canada's key export sectors (e.g., energy, natural resources) and their vulnerability to global events: Fluctuations in global commodity prices, especially for oil and lumber – key Canadian exports – directly impact the CAD's value. A drop in commodity prices can severely impact the CAD.

- Relationship between economic performance and CAD strength: A strong economy generally supports a strong currency. Positive economic growth, low unemployment, and a healthy trade balance typically strengthen the CAD.

The interplay between these economic factors and the political uncertainty further complicates the outlook for the Canadian dollar. A weak economic outlook, exacerbated by political gridlock, puts even more downward pressure on the CAD.

Impact of Commodity Prices on the CAD

Canada's economy is heavily reliant on commodity exports. Fluctuations in global commodity prices, therefore, have a significant impact on the CAD.

- Canada's reliance on commodity exports and their influence on the currency: A significant portion of Canada's exports consists of commodities like oil, lumber, and natural gas. Changes in the price of these commodities directly affect the country's trade balance and, consequently, the CAD.

- Explain the correlation between commodity prices and the CAD's exchange rate: Generally, higher commodity prices lead to a stronger CAD, while lower prices weaken it. This is because increased demand for Canadian commodities increases the demand for the CAD.

- Discuss how global demand for commodities influences the CAD: Global economic growth and industrial activity influence demand for commodities. Strong global demand boosts commodity prices and strengthens the CAD, while weak global demand has the opposite effect.

The current climate of political uncertainty exacerbates the impact of commodity price fluctuations on the CAD. If political instability discourages investment, it further reduces the demand for the CAD, even when commodity prices are high.

Strategies for Navigating CAD Volatility

The fluctuating CAD presents challenges and opportunities for investors and businesses. Effective strategies are crucial for managing risk and capitalizing on potential gains.

- Diversification strategies to mitigate risk: Diversifying investments across different asset classes and currencies can help reduce exposure to CAD volatility.

- Hedging techniques to protect against CAD losses: Hedging involves using financial instruments, such as futures contracts or options, to offset potential losses from CAD fluctuations.

- Importance of monitoring economic indicators and political developments: Staying informed about key economic indicators and political developments is crucial for making informed decisions.

- Advice on currency exchange transactions: Consider using forward contracts or other hedging strategies to lock in exchange rates for future transactions.

By actively monitoring economic indicators, political developments, and utilizing appropriate risk management strategies, investors and businesses can navigate the volatility of the Canadian dollar more effectively.

Conclusion

The Canadian dollar is currently under pressure due to a confluence of factors: political uncertainty stemming from the possibility of another minority government, fluctuating commodity prices impacting Canada's key export sectors, and the overall global economic climate. These elements are interconnected, creating a complex landscape that significantly impacts the CAD's value. Understanding these interdependencies is crucial for navigating this period of uncertainty.

Call to Action: Stay informed about developments impacting the Canadian dollar. Monitor economic news and political updates to make informed decisions regarding investments and currency exchange. Understanding the factors affecting the Canadian dollar is crucial for navigating the current economic climate. Learn more about managing risk in a volatile CAD market by [link to relevant resource/further reading].

Featured Posts

-

Your March Roster Roundup Dancers And Directors On The Move

Apr 30, 2025

Your March Roster Roundup Dancers And Directors On The Move

Apr 30, 2025 -

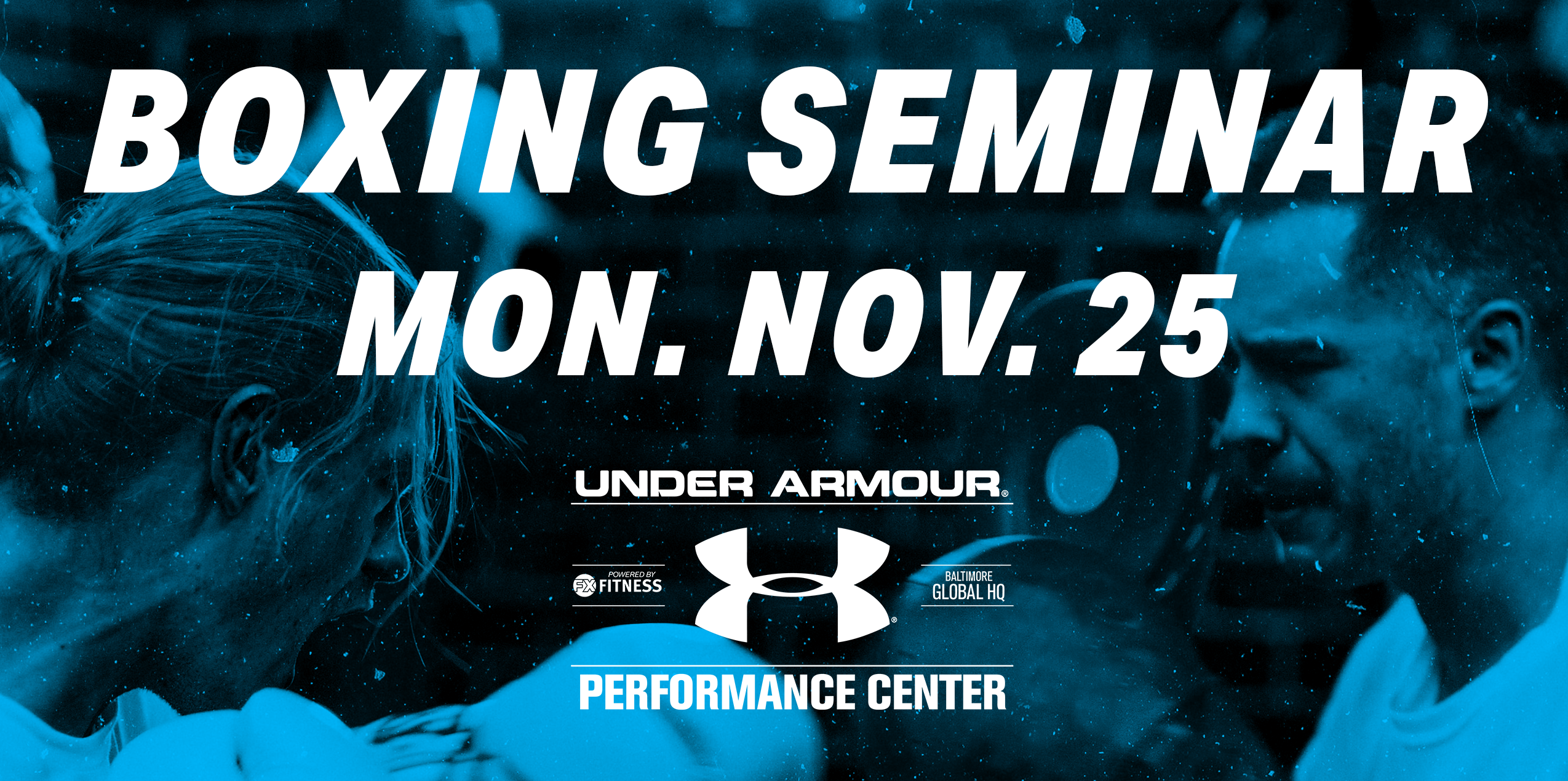

March 26th Ace Power Promotion Presents A Boxing Seminar

Apr 30, 2025

March 26th Ace Power Promotion Presents A Boxing Seminar

Apr 30, 2025 -

Tanner Bibees First Pitch Homer Guardians Defeat Yankees 3 2

Apr 30, 2025

Tanner Bibees First Pitch Homer Guardians Defeat Yankees 3 2

Apr 30, 2025 -

4 Kwietnia Dzien Zwierzat Bezdomnych Solidarnosc Z Bezdomnymi Pupilami

Apr 30, 2025

4 Kwietnia Dzien Zwierzat Bezdomnych Solidarnosc Z Bezdomnymi Pupilami

Apr 30, 2025 -

Meet Amanda Clive And Their Children A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And Their Children A Day In The Life Of Our Farm Next Door

Apr 30, 2025