Canadian Funds Flood US Stock Market: Trade War Impact Analyzed

Table of Contents

Why Canadian Investors are Turning to US Markets

Several factors contribute to the surge in Canadian investment in US stocks. Canadian investors are actively seeking opportunities to mitigate risks and capitalize on growth potential in a period of significant global economic uncertainty.

Diversification Strategy: Reducing Reliance on a Potentially Volatile Canadian Economy

- Over-reliance on resources: The Canadian economy is heavily reliant on natural resources, making it vulnerable to fluctuations in commodity prices. This inherent volatility presents significant risks for investors heavily invested in the domestic market.

- Diversification benefits: Investing in the US market offers diversification, reducing the overall portfolio risk. By spreading investments across multiple economies and sectors, Canadian investors aim to mitigate losses stemming from downturns in the Canadian economy. This strategy seeks to achieve higher returns while simultaneously minimizing potential losses.

- Geographic diversification: The US provides a geographically diversified investment opportunity, reducing risk associated with regional economic downturns within Canada.

Seeking Opportunities in US Sectors: Identifying Undervalued Assets and Growth Potential

- Technology sector: The US technology sector, with its innovative companies and strong growth prospects, has attracted significant Canadian investment. Companies in this sector often demonstrate consistent innovation and higher growth potential than some comparable Canadian enterprises.

- Healthcare sector: The US healthcare sector, characterized by its size and innovation, is another area attracting considerable Canadian investment. This reflects the belief that the sector offers strong growth prospects and attractive returns.

- Robust regulatory environments: The relatively stable and well-regulated US markets are seen as a significant advantage compared to some emerging markets, providing a sense of security for Canadian investors.

US Dollar Strength: The Impact of a Strong US Dollar on Canadian Investment Returns

- Currency exchange rate: A strong US dollar compared to the Canadian dollar increases the return on investment for Canadian investors when converting profits back to Canadian currency. This exchange rate advantage makes US investments even more attractive.

- Benefits and drawbacks: While a strong US dollar provides short-term gains, it also carries risks. Fluctuations in the exchange rate could negatively impact returns in the long term, adding a layer of complexity to investment decisions. Therefore careful monitoring of exchange rates is crucial.

The Trade War's Influence on Investment Decisions

The ongoing trade war significantly influences Canadian investment decisions, acting as a catalyst for the shift towards the US market.

Safe Haven Effect: The US Stock Market as a Perceived Safe Haven During Global Trade Uncertainty

- Relative stability: During times of global trade conflict, the US stock market is often viewed as a relatively stable investment haven compared to other, more exposed markets.

- Market resilience: The large and diversified US economy tends to demonstrate more resilience to trade shocks than smaller economies, making it an appealing destination for capital seeking safety and stability.

- Geopolitical factors: The perceived stability of the US economy during periods of global trade tension encourages capital inflows from countries like Canada, seeking protection from instability.

Shifting Investment Strategies: How Trade Tensions are Forcing a Reassessment of Global Investment Portfolios

- Adapting to uncertainty: Canadian investors are actively adjusting their strategies in response to trade war uncertainties, shifting investments towards markets perceived as less vulnerable.

- Sectoral shifts: Investments are shifting away from sectors directly impacted by trade tariffs towards more resilient sectors like technology and healthcare. This reflects a tactical adaptation to the new trade landscape.

- Diversification beyond borders: The trade war acts as an incentive for increased diversification beyond national borders, furthering the trend of Canadian capital flowing into the US stock market.

Potential Risks: Analyzing the Downside Risks of Increased Investment in the US Market During a Trade War

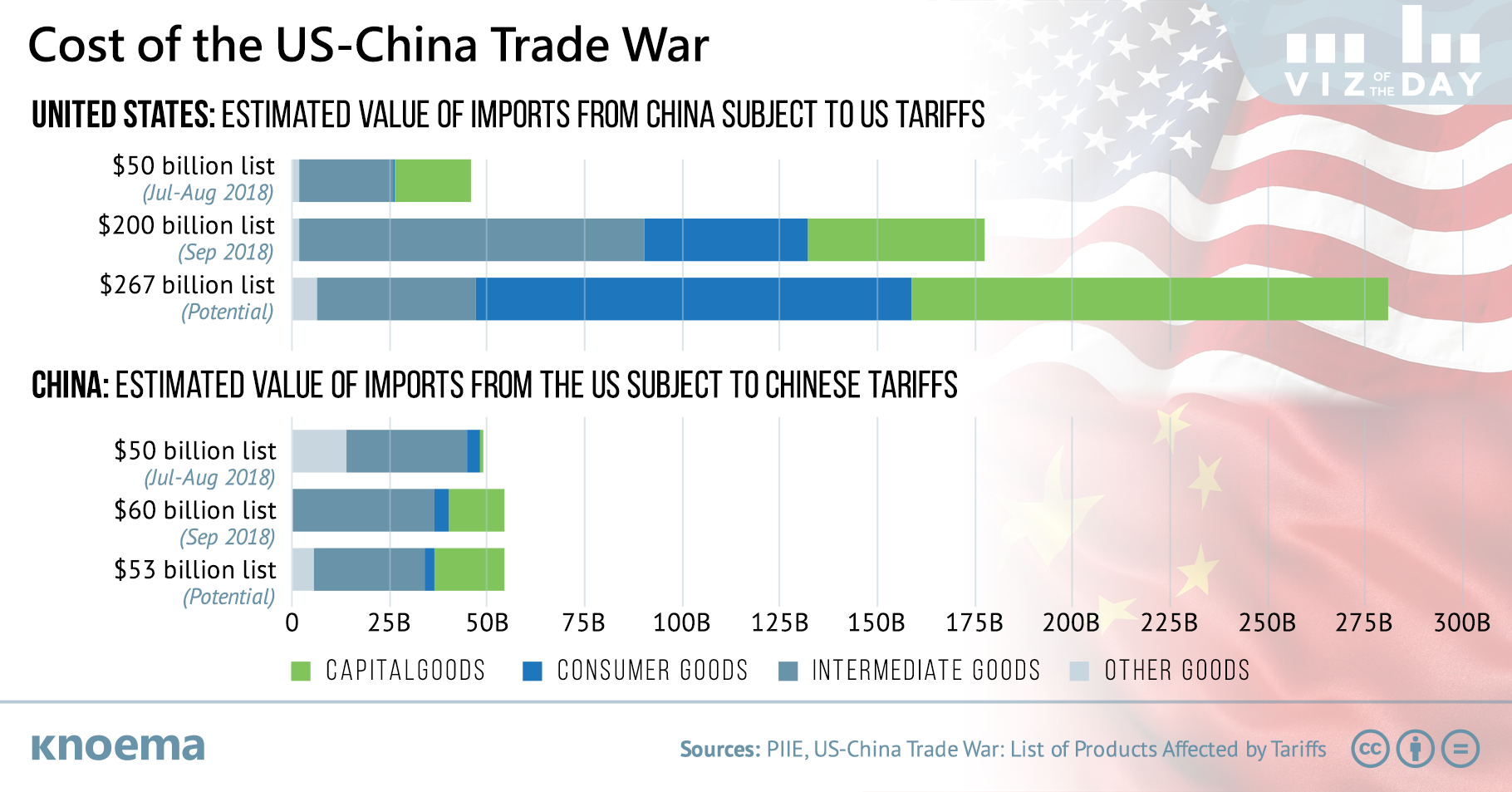

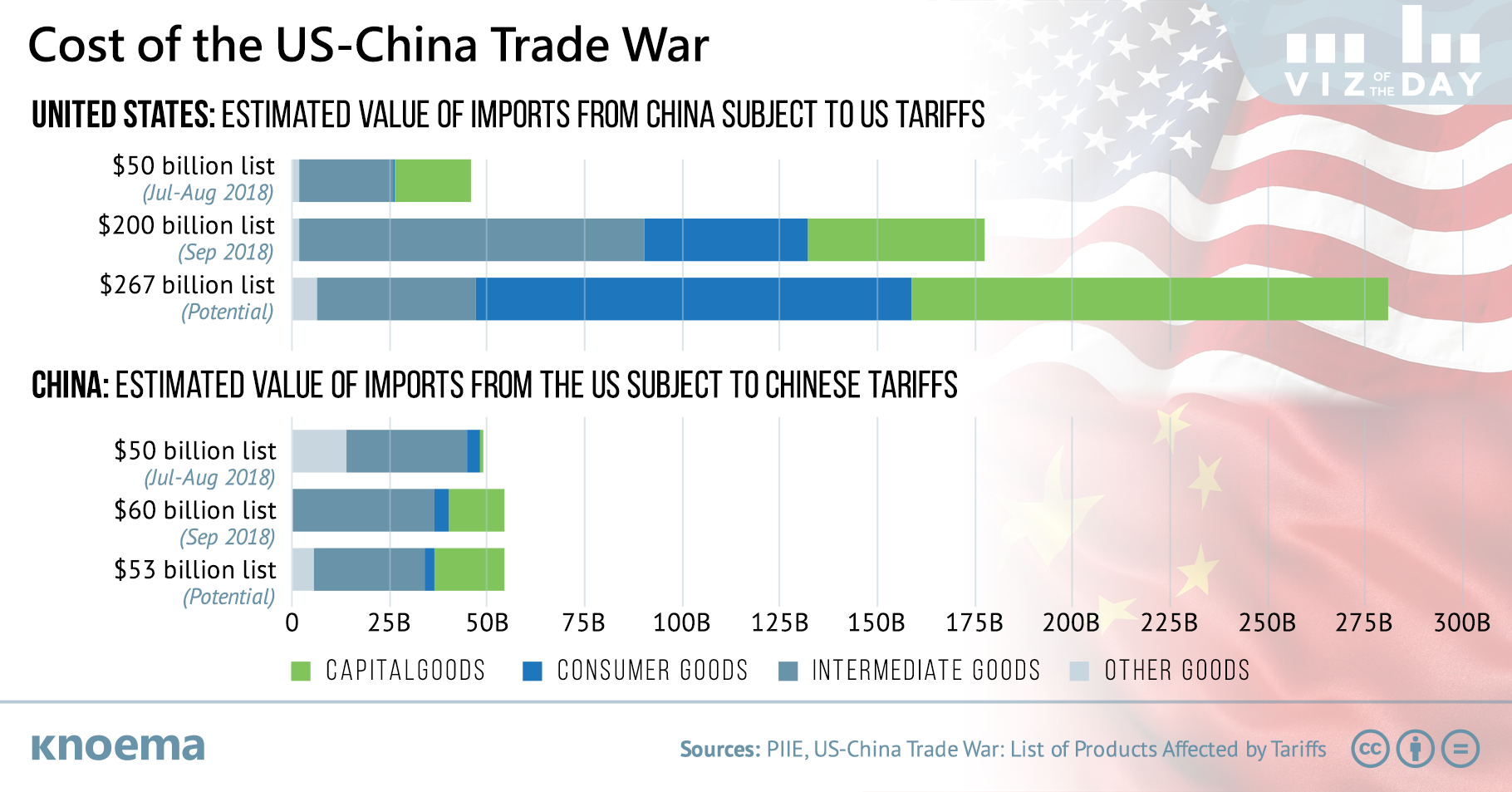

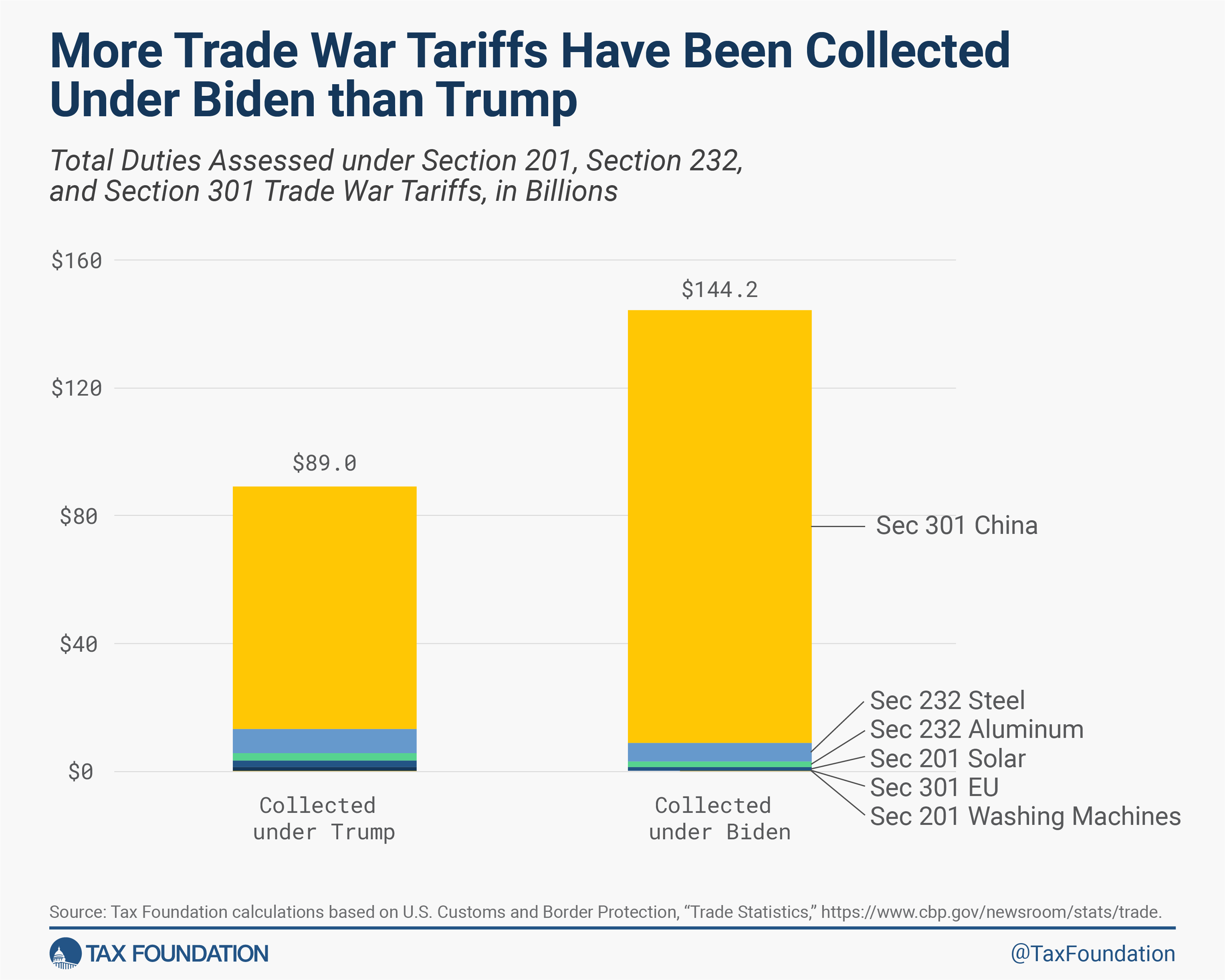

- Trade policy impacts: Negative impacts of trade policies on US markets could significantly impact Canadian investors holding US assets. A potential escalation of trade tensions presents a tangible risk.

- Geopolitical risks: Geopolitical risks, including trade disputes and broader international conflicts, introduce an element of unpredictability and volatility into the market, impacting investment returns.

- Market corrections: Periods of increased uncertainty can trigger market corrections, affecting both short-term and long-term investment returns for Canadian investors.

Economic Implications: Impacts on Both Canadian and US Economies

The influx of Canadian capital has significant implications for both the Canadian and US economies.

Impact on Canadian Economy: Examining the Effects of Capital Outflow on the Canadian Economy

- Capital outflow: The significant outflow of capital to the US could potentially slow down domestic investment and economic growth in Canada.

- Return on investment: However, increased returns from US investments could offset this, potentially benefiting the Canadian economy in the long term through higher returns for investors and increased tax revenues. This presents a complex interplay of positive and negative effects.

Impact on US Economy: Analyzing the Consequences of Increased Foreign Investment on the US Economy

- Capital inflow: The influx of Canadian capital provides a boost to the US economy, increasing investment and potentially stimulating economic growth. This represents a significant inflow of foreign direct investment.

- Inflationary pressures: Increased capital inflow could potentially lead to inflationary pressures in the US, depending on the scale and speed of the investment.

- Economic stimulus: The increase in foreign investment can act as a crucial stimulus to various US economic sectors, potentially creating jobs and accelerating growth.

Conclusion: Understanding the Canadian Funds Influx into the US Stock Market

In conclusion, the surge in Canadian funds flooding the US stock market is a complex phenomenon driven by multiple factors. Canadian investors are seeking diversification to mitigate risks associated with a volatile domestic economy and are attracted by growth opportunities in specific US sectors. The ongoing trade war significantly influences this trend, with the US market acting as a perceived safe haven. The economic implications are significant for both countries, presenting both opportunities and challenges. The interplay between trade tensions, investment strategies, and economic outcomes necessitates continued monitoring. To make informed investment decisions, stay informed about the evolving situation and consider consulting with a financial advisor. Understanding the dynamics of how Canadian funds flood the US stock market is crucial for investors and policymakers alike.

Featured Posts

-

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025 -

Will Google Be Broken Up Examining The Growing Risks

Apr 22, 2025

Will Google Be Broken Up Examining The Growing Risks

Apr 22, 2025 -

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 22, 2025

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 22, 2025 -

Understanding The Just Contact Us Phenomenon Tik Toks Response To Trump Tariffs

Apr 22, 2025

Understanding The Just Contact Us Phenomenon Tik Toks Response To Trump Tariffs

Apr 22, 2025 -

Generating A Poop Podcast How Ai Simplifies The Process Of Transforming Repetitive Documents

Apr 22, 2025

Generating A Poop Podcast How Ai Simplifies The Process Of Transforming Repetitive Documents

Apr 22, 2025

Latest Posts

-

Mtv Cribs Unveiling The Architectural Marvels Of Celebrity Homes

May 12, 2025

Mtv Cribs Unveiling The Architectural Marvels Of Celebrity Homes

May 12, 2025 -

Mtv Cribs Highlighting The Opulence Of Coastal Living

May 12, 2025

Mtv Cribs Highlighting The Opulence Of Coastal Living

May 12, 2025 -

Mtv Cribs A Look Inside Mind Blowing Mansions

May 12, 2025

Mtv Cribs A Look Inside Mind Blowing Mansions

May 12, 2025 -

The Best Beach Houses Seen On Mtv Cribs

May 12, 2025

The Best Beach Houses Seen On Mtv Cribs

May 12, 2025 -

Inside The Luxurious Beach Houses Of Mtv Cribs

May 12, 2025

Inside The Luxurious Beach Houses Of Mtv Cribs

May 12, 2025