Canadian Investment In US Stocks: A New High Despite Trade Tensions

Table of Contents

Record Levels of Canadian Investment in US Equities

The growth in Canadian investment in US stocks is undeniable. Data from Statistics Canada and the Investment Industry Regulatory Organization of Canada (IIROC) reveal a significant upward trend, exceeding previous peaks despite ongoing trade negotiations and uncertainties. The exact figures fluctuate, but the overall direction points to a substantial increase in Canadian capital flowing south. We need to track the current numbers from the official sources to insert the most up-to-date figures here. For example, [Insert link to Statistics Canada data]. This unprecedented flow of investment underscores the attractiveness of the US market to Canadian investors.

Quantifiable Data:

[Insert up-to-date data on the increase in Canadian investment in US stocks, referencing the sources mentioned above. Include percentage increases and relevant figures to illustrate the growth]. This substantial influx highlights a continued confidence in the US market amongst Canadian investors.

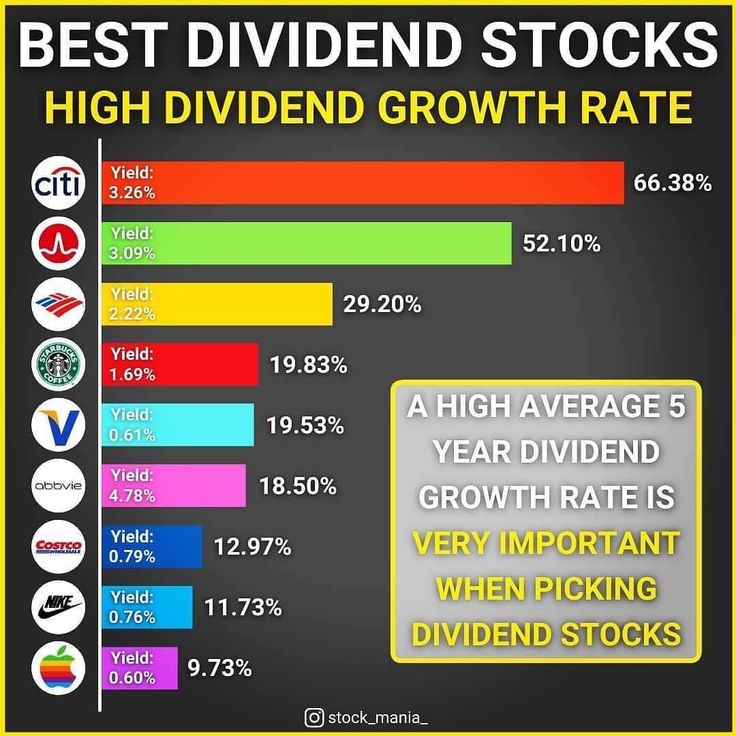

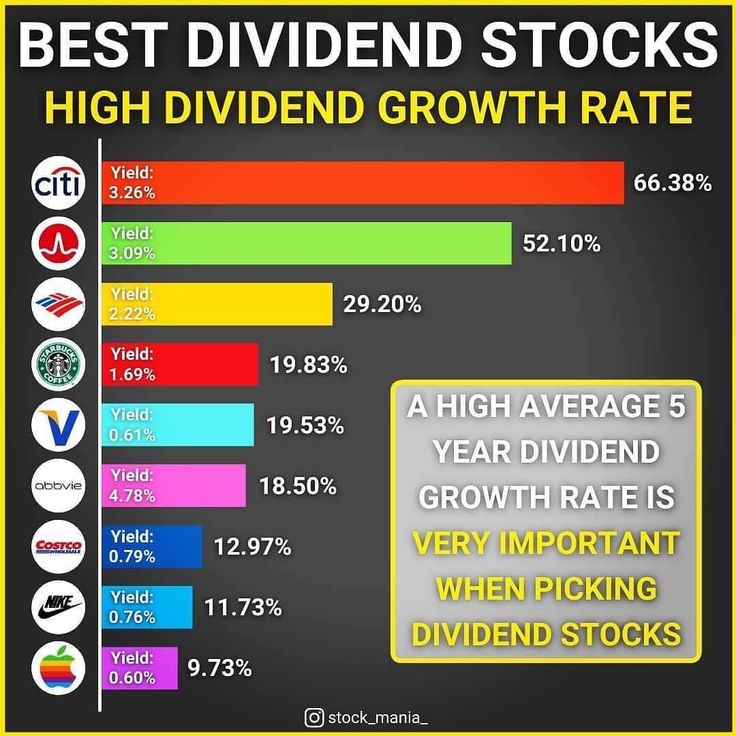

Sectoral Breakdown:

Canadian investment isn't evenly distributed across all US stock sectors. Several key sectors are attracting a disproportionate share of the capital. These include:

- Technology: The robust growth potential of US technology companies, coupled with the presence of established tech giants, makes this sector incredibly appealing. The promise of high returns outweighs many of the perceived risks associated with international investment.

- Energy: Despite trade tensions, Canadian investors are diversifying their energy portfolios by investing in US energy companies. This reflects a strategic move to mitigate risk and access diverse energy assets.

- Healthcare: The consistently growing demand for healthcare services in the US, fuelled by an aging population and technological advancements, provides a stable and potentially lucrative investment opportunity.

- Financials: The stability and significant size of the US financial sector continues to attract a significant portion of Canadian investment.

Investor Profiles:

This surge in Canadian investment in US stocks isn't driven by a single type of investor. Instead, a diverse range of players are contributing to the trend:

- Institutional Investors: Large pension funds, insurance companies, and mutual funds are significant players, allocating substantial portions of their portfolios to US equities.

- Individual Investors: Driven by access to online brokerage services and a belief in the long-term growth of the US economy, individual investors are also participating actively.

- High-Net-Worth Individuals: Sophisticated investors are actively seeking diversification and returns within the US market.

Factors Driving Canadian Investment Despite Trade Uncertainty

Despite the inherent uncertainties associated with trade policy fluctuations and geopolitical events, several factors explain the continued strong Canadian interest in US stocks:

Attractive US Market Performance:

The US stock market has historically demonstrated strong performance, offering attractive returns for investors. This consistent growth makes it a compelling investment option, even when considering geopolitical risks. The sheer size and liquidity of the US market provide a level of stability not easily replicated elsewhere.

Diversification Strategies:

Diversification is a cornerstone of sound investment strategy. Investing in US stocks allows Canadian investors to diversify their portfolios, reducing overall risk and increasing resilience to potential downturns in the Canadian market. Geographical diversification is a key strategy for reducing risk.

Currency Exchange Rates:

Fluctuations in the Canadian dollar (CAD) against the US dollar (USD) influence investment decisions. Favorable exchange rates can enhance the returns for Canadian investors, making US investments even more attractive. Conversely, unfavorable exchange rates can have a negative impact. Close monitoring of the CAD/USD exchange rate is crucial for effective investment strategies.

Long-Term Investment Outlook:

Despite trade tensions, many investors maintain a positive long-term outlook on the US economy, driven by several key factors:

- Resilient US Economy: The US economy has historically shown resilience in the face of various challenges.

- Innovation and Technological Advancements: The US remains a global leader in innovation, fostering technological advancements that drive economic growth.

- Strong Consumer Spending: Robust consumer spending contributes significantly to the US economy's strength.

Potential Risks and Challenges

While the potential rewards are substantial, Canadian investors must also acknowledge the potential risks and challenges associated with investing in US stocks:

Trade Policy Volatility:

Unpredictable trade policies between Canada and the US can create significant uncertainty and negatively impact investment returns. Any significant changes in trade relations could ripple through the markets.

Geopolitical Risks:

Global economic slowdowns, international conflicts, or other geopolitical events can also influence investment returns, impacting the performance of US stocks and, consequently, Canadian investments. Careful consideration of these global factors is important.

Market Corrections:

The possibility of market corrections or even more significant downturns in the US stock market should always be factored into investment strategies. No investment is risk-free, and losses are a potential outcome.

Conclusion: Navigating Canadian Investment in US Stocks

This analysis shows a clear trend: Canadian investment in US stocks is reaching record highs, despite existing trade tensions. This surge is driven by the strong performance of the US market, the need for diversification, and a positive long-term outlook for the US economy. However, potential risks, including trade policy volatility and geopolitical events, need careful consideration.

Key Takeaways:

- Diversification remains crucial for mitigating risk in any investment strategy.

- A long-term investment horizon is generally recommended for navigating market fluctuations.

- Careful monitoring of economic indicators and geopolitical events is essential.

Learn more about optimizing your Canadian investment in US stocks strategy today and navigate the market effectively. Consult with a qualified financial advisor to create a personalized investment plan that aligns with your risk tolerance and financial goals.

Featured Posts

-

Open Ais 2024 Developer Event Simplifying Voice Assistant Creation

Apr 22, 2025

Open Ais 2024 Developer Event Simplifying Voice Assistant Creation

Apr 22, 2025 -

Is Blue Origins Downfall Larger Than Katy Perrys Public Image Issues

Apr 22, 2025

Is Blue Origins Downfall Larger Than Katy Perrys Public Image Issues

Apr 22, 2025 -

Hegseth Faces Backlash Over Signal Chat And Pentagon Allegations

Apr 22, 2025

Hegseth Faces Backlash Over Signal Chat And Pentagon Allegations

Apr 22, 2025 -

Aramco And Byd Join Forces To Explore Electric Vehicle Innovations

Apr 22, 2025

Aramco And Byd Join Forces To Explore Electric Vehicle Innovations

Apr 22, 2025 -

Open Ai And Chat Gpt The Ftc Investigation Explained

Apr 22, 2025

Open Ai And Chat Gpt The Ftc Investigation Explained

Apr 22, 2025

Latest Posts

-

Za Dengi Sfotografirovatsya S Borisom Dzhonsonom Pravda Ili Vymysel

May 12, 2025

Za Dengi Sfotografirovatsya S Borisom Dzhonsonom Pravda Ili Vymysel

May 12, 2025 -

Tekhasskoe Puteshestvie Dzhonsonov Eksklyuzivnye Fotografii

May 12, 2025

Tekhasskoe Puteshestvie Dzhonsonov Eksklyuzivnye Fotografii

May 12, 2025 -

Chto Delali Boris I Kerri Dzhonson V Tekhase Novye Foto

May 12, 2025

Chto Delali Boris I Kerri Dzhonson V Tekhase Novye Foto

May 12, 2025 -

Zhena Borisa Dzhonsona V Tekhase Fotografii Iz Poezdki

May 12, 2025

Zhena Borisa Dzhonsona V Tekhase Fotografii Iz Poezdki

May 12, 2025 -

Payton Pritchard A Case For The Celtics Sixth Man Of The Year Award

May 12, 2025

Payton Pritchard A Case For The Celtics Sixth Man Of The Year Award

May 12, 2025