Canadian Mortgage Preferences: The Case Against 10-Year Terms

Table of Contents

The Risk of Interest Rate Fluctuations and Prepayment Penalties

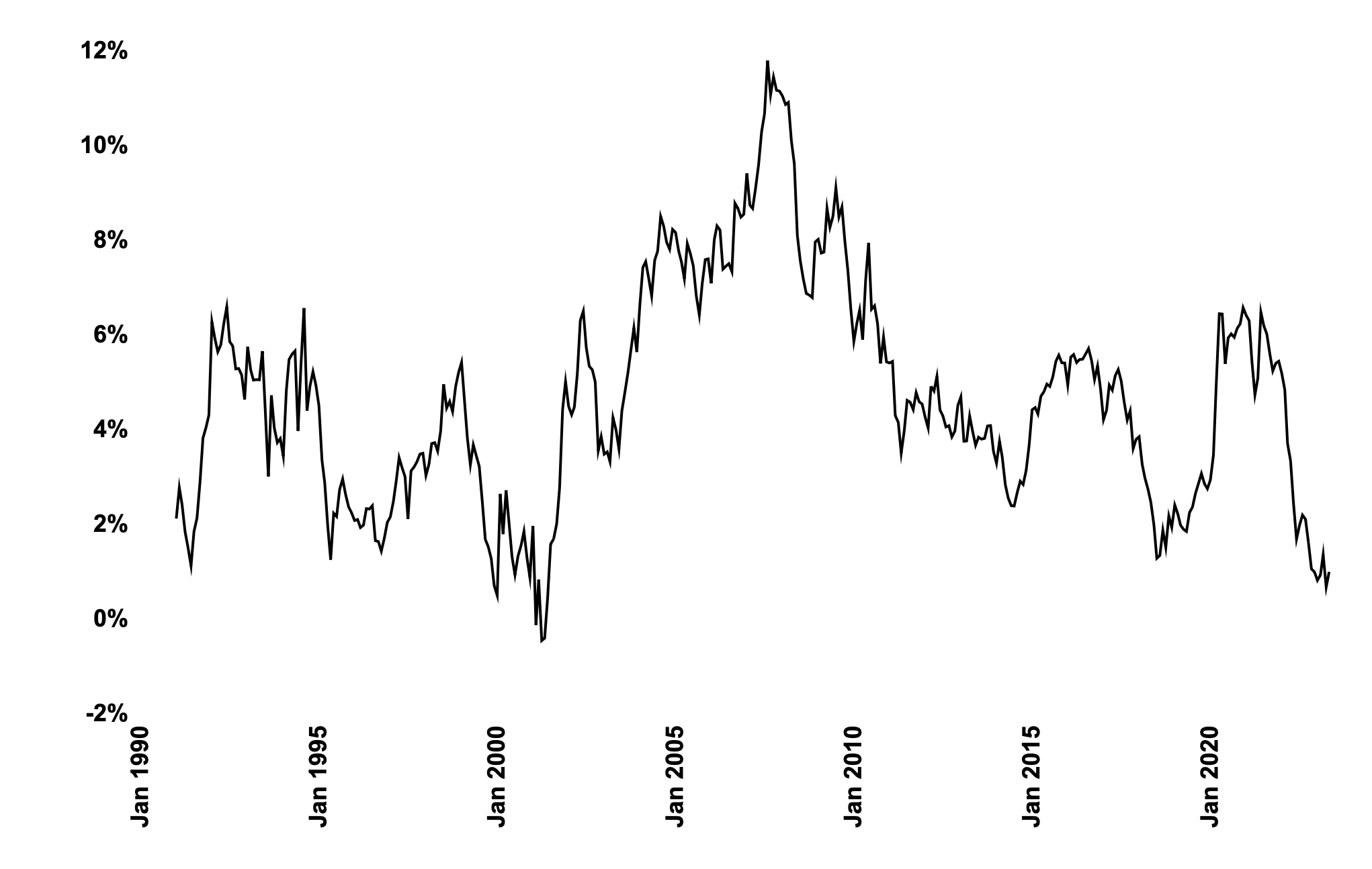

Locking into a 10-year fixed-rate mortgage in Canada might seem like a secure option, but the Canadian economy’s volatility presents significant risks. Interest rates are constantly fluctuating, and committing to a decade-long term means you could be stuck with a high interest rate even if rates drop significantly during your mortgage term. This risk is particularly pertinent given the unpredictable nature of the Canadian housing market and the potential for economic downturns.

Furthermore, the prepayment penalties associated with breaking a 10-year mortgage term early are substantial. These penalties can severely impact your finances, making it difficult to refinance even if a more favorable interest rate becomes available.

- Higher interest rates compared to shorter-term options: Locking in a rate for 10 years often results in a higher initial rate than shorter-term options.

- Potential for significant financial loss if rates drop: If interest rates decrease after you've secured your 10-year mortgage, you'll miss out on potentially significant savings.

- Difficulty in refinancing due to penalties: Breaking a 10-year fixed-rate mortgage early often involves steep penalties, making refinancing a costly endeavor.

- Impact on financial flexibility and home equity access: A long-term mortgage can limit your ability to access home equity for renovations, investments, or other opportunities.

Limited Flexibility and Adaptability

Life is unpredictable. A 10-year mortgage offers minimal flexibility to adapt to changing circumstances. Job loss, unexpected medical expenses, or a significant change in income can severely strain your finances when you’re locked into a fixed payment plan for a decade. Adjusting payments or refinancing becomes incredibly challenging, potentially leading to financial distress.

- Difficulty adjusting payments if income decreases: A sudden drop in income makes fixed monthly payments difficult to manage with a long-term mortgage.

- Limited ability to access home equity for renovations or investments: The inflexibility of a 10-year mortgage restricts your ability to leverage your home's equity for other financial opportunities.

- Inability to take advantage of lower interest rates if they become available: You are locked into your initial interest rate, even if better rates become available during your mortgage term.

- Potential for financial strain during unforeseen events: Unexpected life events can create significant financial burdens when you lack the flexibility offered by a shorter-term mortgage.

The Case for Shorter-Term Mortgages

Shorter-term mortgages, such as 5-year terms, provide significantly more flexibility and adaptability. By reassessing your mortgage options every few years, you can take advantage of potential interest rate drops and adjust your payments to suit your changing financial situation. This approach allows you greater control over your finances and reduces the risk associated with long-term commitments.

- Lower prepayment penalties: Shorter-term mortgages typically have significantly lower prepayment penalties.

- Greater flexibility to adjust payments and refinance: You have the option to renegotiate terms or refinance to a lower interest rate when your term expires.

- Opportunity to secure better interest rates in the future: Interest rates fluctuate, and shorter terms allow you to benefit from future rate reductions.

- Increased financial control and adaptability: Shorter terms provide more control over your financial situation and better protection against unexpected events.

Exploring Alternative Mortgage Options in Canada

The Canadian mortgage market offers a variety of options beyond the traditional 10-year fixed-rate mortgage. Understanding these alternatives is crucial for making informed decisions.

- Variable-rate mortgages: These offer lower initial interest rates, but carry the risk of higher payments if interest rates rise.

- Blended mortgages: These combine fixed and variable-rate components, offering a balance between risk and stability.

- Open mortgages: These offer greater flexibility but generally come with higher interest rates.

- Closed mortgages: These provide lower interest rates but limit flexibility in terms of prepayment and refinancing.

Conclusion: Making Informed Choices About Your Canadian Mortgage Preferences

Choosing a mortgage is a significant financial decision. This article highlighted the substantial risks associated with committing to a 10-year fixed-rate mortgage in Canada, emphasizing the importance of considering interest rate fluctuations, prepayment penalties, and the lack of flexibility in such a long-term commitment. Before committing to a long-term mortgage, carefully evaluate your financial situation, risk tolerance, and long-term goals.

Consider your options carefully. Explore shorter-term Canadian mortgage options and find the best fit for your financial future. Don’t let a 10-year mortgage lock you into a potentially unfavorable financial situation. Choose a mortgage term that aligns with your financial goals and offers the adaptability you need to navigate life’s unexpected turns.

Featured Posts

-

Illegal To Revoke Harvards Tax Exempt Status Says University President

May 04, 2025

Illegal To Revoke Harvards Tax Exempt Status Says University President

May 04, 2025 -

Ufc 314 Complete Fight Card And Predictions For Volkanovski Vs Lopes

May 04, 2025

Ufc 314 Complete Fight Card And Predictions For Volkanovski Vs Lopes

May 04, 2025 -

Understanding Lizzos Relationship With Myke Wright His Background And Wealth

May 04, 2025

Understanding Lizzos Relationship With Myke Wright His Background And Wealth

May 04, 2025 -

Manfaatkan Limbah Rumah Tangga Cangkang Telur Untuk Pupuk Alami

May 04, 2025

Manfaatkan Limbah Rumah Tangga Cangkang Telur Untuk Pupuk Alami

May 04, 2025 -

Lizzos Latest Song A Fiery Return

May 04, 2025

Lizzos Latest Song A Fiery Return

May 04, 2025

Latest Posts

-

Charissa Thompsons Departure From Fox The Full Story

May 04, 2025

Charissa Thompsons Departure From Fox The Full Story

May 04, 2025 -

Trumps Actions Towards Putin Fallicas Sharp Rebuke

May 04, 2025

Trumps Actions Towards Putin Fallicas Sharp Rebuke

May 04, 2025 -

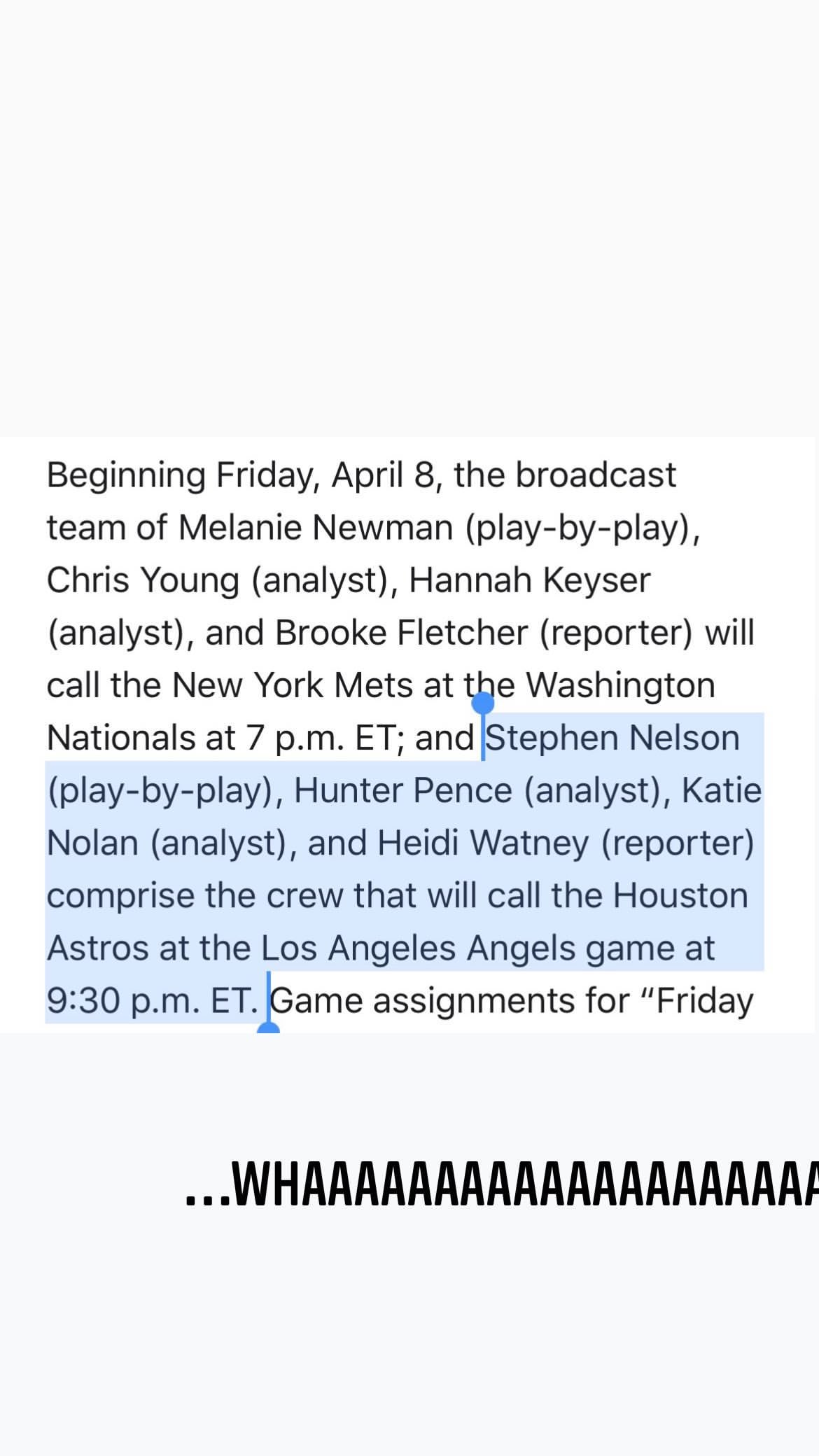

Katie Nolan Addresses Charlie Dixon Allegations

May 04, 2025

Katie Nolan Addresses Charlie Dixon Allegations

May 04, 2025 -

Fox News And Charissa Thompson Addressing Departure Rumors

May 04, 2025

Fox News And Charissa Thompson Addressing Departure Rumors

May 04, 2025 -

Chris Fallica Condemns Trumps Appeasement Of Putin

May 04, 2025

Chris Fallica Condemns Trumps Appeasement Of Putin

May 04, 2025