Canadian Mortgage Terms: Exploring The Popularity Of Shorter-Term Loans

Table of Contents

The Appeal of Shorter-Term Mortgages in Canada

Shorter-term mortgages, typically ranging from 1 to 5 years, offer several compelling benefits compared to traditional longer-term mortgages (like 25-year mortgages). The core advantage lies in the potential for significant long-term savings and increased financial control.

-

Potential for lower overall interest payments: While your monthly payments might be higher, you'll pay less interest overall because you're paying off the principal faster. This is especially true in periods of rising interest rates. A shorter amortization period directly reduces the total interest accrued over the life of the loan.

-

Faster equity building: A larger portion of your monthly payment goes towards the principal with a shorter-term mortgage, meaning you build equity in your home much quicker. This can be a significant advantage if you plan to sell or refinance in the future.

-

Greater financial flexibility: Paying off your mortgage faster provides more financial flexibility down the line. You might have more disposable income for other financial goals, such as investments or retirement planning.

-

Reduced long-term risk: With a shorter-term mortgage, you're less exposed to fluctuating interest rates over the long term. This minimizes the risk of significantly higher payments if rates rise unexpectedly.

-

Increased control over your finances: The predictability and faster payoff associated with shorter-term mortgages offer a greater sense of control over your financial situation, reducing financial stress.

Understanding Different Shorter-Term Mortgage Options in Canada

Choosing the right type of shorter-term mortgage is crucial. Let's explore the key options:

Open vs. Closed Mortgages

-

Open mortgages: These offer flexibility. You can pay down the principal early without penalty and break your mortgage before the term ends, although you'll typically pay a higher interest rate to reflect this flexibility. Open mortgages can be particularly advantageous for those anticipating significant changes in their financial situation or who want the option of paying it off early.

-

Closed mortgages: These come with a fixed interest rate and term. Early repayment usually incurs penalties. While less flexible, closed mortgages often offer lower interest rates compared to open mortgages, making them attractive to borrowers with stable finances and a clear repayment plan.

-

Considerations for choosing: If you anticipate needing flexibility, an open mortgage might be preferable despite the higher interest rate. However, if stability and a potentially lower interest rate are priorities, a closed mortgage is likely a better fit. The best choice depends entirely on your individual circumstances and risk tolerance.

Variable vs. Fixed Rate Mortgages

-

Variable rate mortgages: Interest rates fluctuate with market changes. This can lead to lower monthly payments initially but also increased uncertainty, as payments might increase if interest rates rise. For shorter terms, the risk of rising rates is reduced because the overall loan duration is shorter.

-

Fixed rate mortgages: These provide predictable monthly payments for the entire term. However, the interest rate might be higher than a variable rate. The stability of fixed payments is attractive for those who prioritize predictable budgeting.

-

Impact on overall cost: The choice between variable and fixed significantly impacts the overall cost of your shorter-term mortgage. Carefully consider your risk tolerance and financial stability when making this decision. Consider consulting with a financial advisor to determine which aligns best with your risk profile.

Factors to Consider Before Choosing a Shorter-Term Mortgage

Before committing to a shorter-term mortgage, carefully assess the following:

Your Financial Situation

-

Consistent income and savings: Ensure you have a stable income and sufficient savings to cover higher monthly payments. A shorter term often means larger monthly payments.

-

Emergency fund considerations: Having a substantial emergency fund is crucial, as unexpected expenses could strain your budget with higher mortgage payments.

-

Potential for increased interest rates: Be prepared for the possibility of interest rate increases, especially if choosing a variable-rate mortgage.

-

Ability to make higher mortgage payments: Can you comfortably afford the potentially higher monthly payments associated with a shorter-term mortgage?

Predicting Future Financial Needs

-

Planning for life events: Consider potential future expenses such as having children, unexpected job changes, or home renovations.

-

Potential need for refinancing: If you anticipate needing to refinance, factor in the costs and potential challenges involved.

-

Long-term financial goals: Align your mortgage choice with your broader financial goals, such as retirement planning or investment strategies.

The Role of a Mortgage Broker

-

Finding the best mortgage rates: Mortgage brokers can compare rates from multiple lenders, ensuring you secure the best possible terms.

-

Navigating mortgage terms and conditions: They can help you understand the complexities of different mortgage options and guide you through the process.

-

Comparing various lenders and their offerings: Brokers provide valuable insights and expertise in the mortgage market, saving you time and effort.

Conclusion

Shorter-term mortgages in Canada offer significant advantages for those seeking faster equity building and potentially lower overall interest costs. However, it's crucial to carefully evaluate your financial situation and future needs before committing. Understanding the differences between open and closed, variable and fixed-rate mortgages is vital for making an informed decision. Consider consulting with a mortgage broker to navigate the complexities and find the best shorter-term mortgage to fit your circumstances. Don't delay in exploring the benefits of shorter-term mortgages Canada; take the first step towards achieving your homeownership goals today!

Featured Posts

-

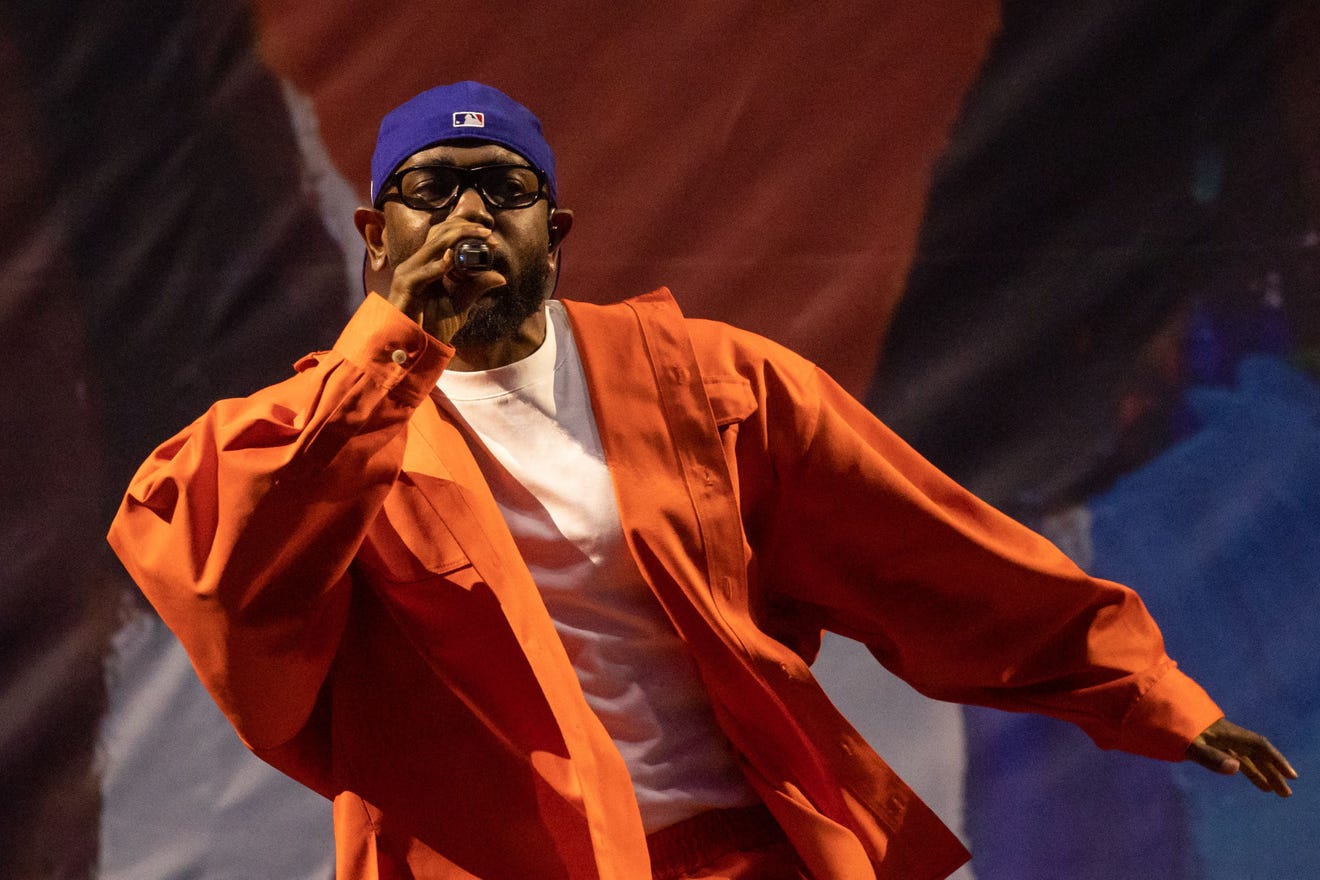

Ddg Unleashes Dont Take My Son A Diss Track Aimed At Halle Bailey

May 06, 2025

Ddg Unleashes Dont Take My Son A Diss Track Aimed At Halle Bailey

May 06, 2025 -

Patrick Schwarzenegger Joins Luca Guadagninos Upcoming Movie

May 06, 2025

Patrick Schwarzenegger Joins Luca Guadagninos Upcoming Movie

May 06, 2025 -

Polska Oboronna Promislovist Nitro Chem Ta Kontrakt Na 310 Mln Zi S Sh A

May 06, 2025

Polska Oboronna Promislovist Nitro Chem Ta Kontrakt Na 310 Mln Zi S Sh A

May 06, 2025 -

Getting To Know The Ross Family Tracee Ellis Ross And Her Relatives

May 06, 2025

Getting To Know The Ross Family Tracee Ellis Ross And Her Relatives

May 06, 2025 -

March 23rd Celtics Vs Trail Blazers Game Time Tv Listings And Streaming Options

May 06, 2025

March 23rd Celtics Vs Trail Blazers Game Time Tv Listings And Streaming Options

May 06, 2025

Latest Posts

-

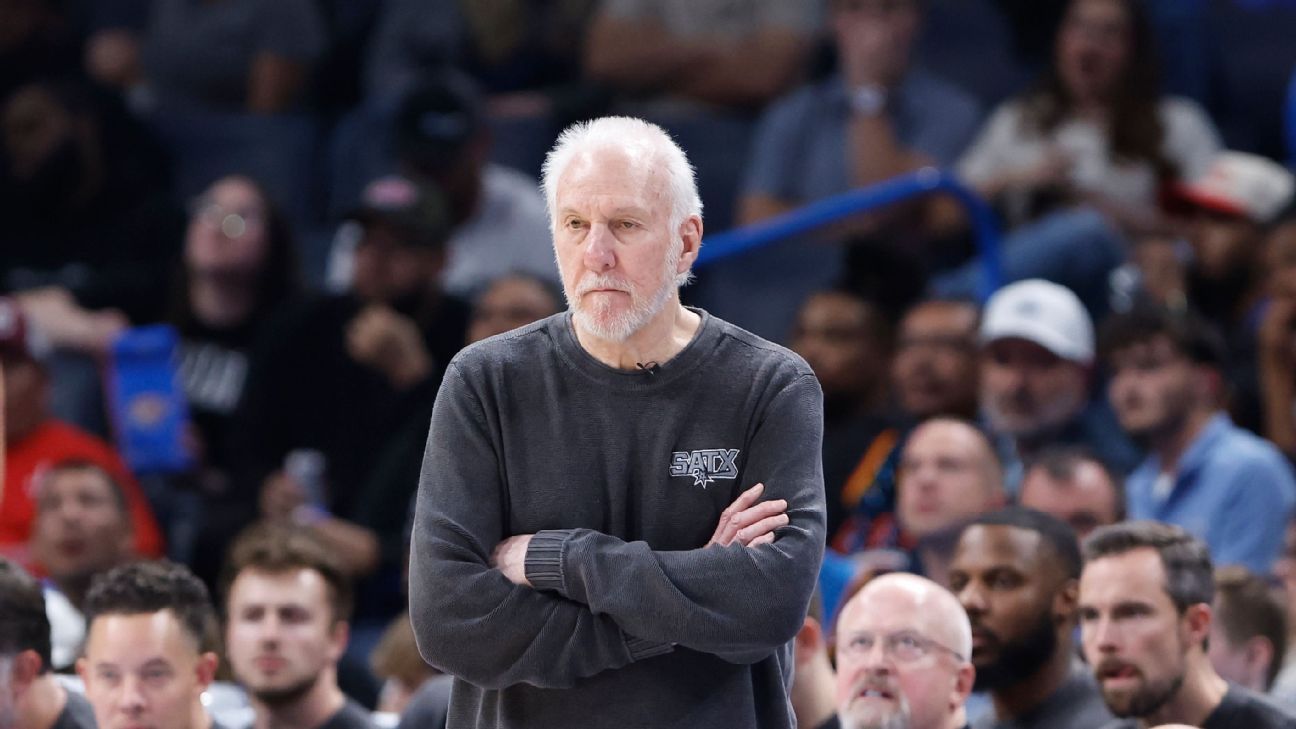

The Spurs Announce Gregg Popovichs Future

May 06, 2025

The Spurs Announce Gregg Popovichs Future

May 06, 2025 -

Popovichs Future With The Spurs Official Announcement

May 06, 2025

Popovichs Future With The Spurs Official Announcement

May 06, 2025 -

Spurs Coach Gregg Popovich Espn Casts Doubt On His Return This Season

May 06, 2025

Spurs Coach Gregg Popovich Espn Casts Doubt On His Return This Season

May 06, 2025 -

Gregg Popovichs Spurs Future The Decision Is In

May 06, 2025

Gregg Popovichs Spurs Future The Decision Is In

May 06, 2025 -

Espn Gregg Popovich Not Expected Back This Season Spurs Coachs Future In Doubt

May 06, 2025

Espn Gregg Popovich Not Expected Back This Season Spurs Coachs Future In Doubt

May 06, 2025