Canadian Tire And Hudson's Bay: Exploring The Rationale Behind The Acquisition

Table of Contents

Expanding Market Reach and Diversification

Canadian Tire, a long-standing giant in the Canadian retail scene, enjoys significant dominance in the automotive and sporting goods sectors. However, its market reach has limitations. The Hudson's Bay acquisition allows Canadian Tire to dramatically diversify its product portfolio and target new customer demographics. This strategic move significantly expands Canadian Tire's reach beyond its traditional customer base.

- Access to a New Customer Base: Hudson's Bay boasts a well-established customer base with different demographics and spending habits than Canadian Tire's core clientele. This provides access to a lucrative, higher-spending market segment.

- Expansion into Higher-End Retail: The acquisition allows Canadian Tire to enter the higher-end retail market, previously untouched by its existing offerings. This move positions them to compete more effectively with luxury retailers.

- Cross-Selling and Bundled Promotions: The combined entity can leverage cross-selling opportunities. Imagine bundled promotions combining Canadian Tire's automotive products with Hudson's Bay home goods, creating attractive packages for consumers.

- Strategic Geographic Expansion: Hudson's Bay's presence in key urban locations provides Canadian Tire with strategic geographic expansion opportunities, allowing for increased market penetration in densely populated areas.

Synergies and Cost Savings

The merger of Canadian Tire and Hudson's Bay presents significant opportunities for synergy and cost reduction. By integrating operations, the combined entity can achieve significant economies of scale.

- Shared Logistics and Supply Chains: Combining distribution networks can significantly reduce transportation costs and streamline the supply chain, leading to improved efficiency and profitability.

- Combined Marketing Campaigns: A unified marketing strategy can target a broader customer base, maximizing reach and minimizing marketing expenses through economies of scale.

- Increased Purchasing Power: The combined entity’s increased purchasing volume will translate into better deals and discounts from suppliers, further enhancing profitability.

- Streamlined Back-Office Operations: Combining back-office functions, such as accounting and human resources, will lead to significant cost savings and increased operational efficiency.

Real Estate and Property Values

Hudson's Bay owns a portfolio of prime real estate in major Canadian cities. This real estate represents a significant asset in the acquisition.

- Revenue Generation from Property: The value of these properties extends beyond their current use. Canadian Tire can explore options like redevelopment, property rentals, or even integrating Canadian Tire stores into existing Hudson's Bay locations.

- Long-Term Investment: The acquisition secures a valuable long-term investment in prime urban real estate, providing potential for future revenue streams and growth.

- Strategic Location Integration: The existing Hudson's Bay locations in prime shopping districts offer an excellent opportunity to integrate Canadian Tire stores, enhancing visibility and accessibility to customers.

Competitive Landscape and Market Share

The Canadian retail industry is fiercely competitive. The Canadian Tire and Hudson's Bay acquisition significantly enhances Canadian Tire's competitive position.

- Increased Market Share: The combined entity commands a larger market share, offering greater competitive strength against major rivals like Walmart and Loblaws.

- Enhanced Supplier Relationships: Increased market share provides stronger bargaining power with suppliers, leading to more favorable pricing and terms.

- Adaptability to Changing Preferences: The broader product range and diversified customer base allow for a more effective response to evolving consumer preferences and market trends.

Potential Challenges and Risks

While the acquisition offers significant potential, challenges and risks need to be carefully considered.

- Integration Challenges: Merging two distinct corporate cultures and operational systems is a complex undertaking and requires effective management to avoid disruptions.

- Brand Identity and Customer Loyalty: Maintaining the distinct identities of both brands while integrating operations is crucial to prevent customer alienation and maintain brand loyalty.

- Financial Strain: The acquisition represents a significant financial investment. Effective management of the integration process is essential to mitigate the risks of overextension and financial strain.

Conclusion: The Long-Term Implications of the Canadian Tire and Hudson's Bay Acquisition

The Canadian Tire and Hudson's Bay acquisition is a bold strategic move driven by the desire for market diversification, synergy, and enhanced competitive positioning. While significant benefits are anticipated, integration challenges and risks need careful management. The long-term success of this merger will depend on effective execution of the integration strategy and adaptation to changing market dynamics. What are your thoughts on the Canadian Tire and Hudson's Bay acquisition and its potential impact on the Canadian retail industry? Share your opinions and insights in the comments section below. Let's discuss the future strategies for this newly formed retail giant!

Featured Posts

-

E60m Asking Price For Alejandro Garnacho Amidst Transfer Speculation

May 28, 2025

E60m Asking Price For Alejandro Garnacho Amidst Transfer Speculation

May 28, 2025 -

Rayan Cherki Liverpools Potential Summer Acquisition

May 28, 2025

Rayan Cherki Liverpools Potential Summer Acquisition

May 28, 2025 -

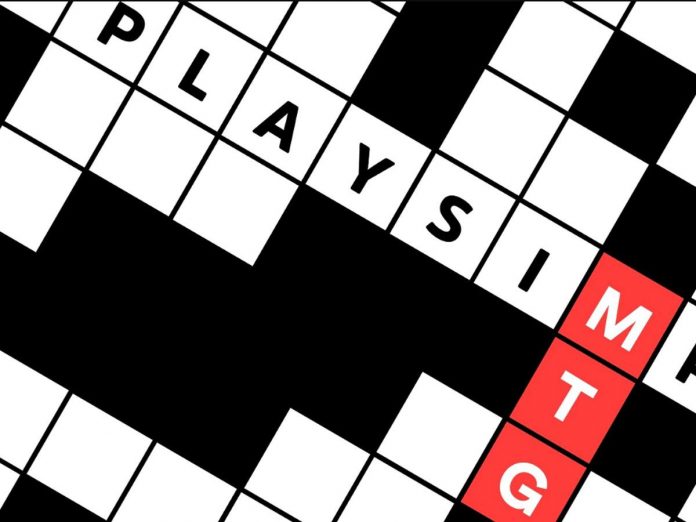

Will History Repeat Itself Comparing Spring 1968 To Spring 2024 And Summer Drought Forecasts

May 28, 2025

Will History Repeat Itself Comparing Spring 1968 To Spring 2024 And Summer Drought Forecasts

May 28, 2025 -

Nadals Last Roland Garros Sabalenka Secures The Title

May 28, 2025

Nadals Last Roland Garros Sabalenka Secures The Title

May 28, 2025 -

Giannis Antetokounmpos Head Grab Post Game Handshake Incident Explained

May 28, 2025

Giannis Antetokounmpos Head Grab Post Game Handshake Incident Explained

May 28, 2025

Latest Posts

-

Bts Jins Promise A Speedy Return After Coldplay Seoul Concert Appearance

May 30, 2025

Bts Jins Promise A Speedy Return After Coldplay Seoul Concert Appearance

May 30, 2025 -

El Episodio De Run Bts Con Jin Una Pelicula De Accion

May 30, 2025

El Episodio De Run Bts Con Jin Una Pelicula De Accion

May 30, 2025 -

Servicio Militar De Bts Predicciones Sobre Su Fecha De Regreso A Los Escenarios

May 30, 2025

Servicio Militar De Bts Predicciones Sobre Su Fecha De Regreso A Los Escenarios

May 30, 2025 -

Cuando Volvera Bts El Impacto Del Servicio Militar En Su Regreso

May 30, 2025

Cuando Volvera Bts El Impacto Del Servicio Militar En Su Regreso

May 30, 2025 -

Run Bts Jin De Bts Protagoniza Una Emocionante Pelicula De Accion

May 30, 2025

Run Bts Jin De Bts Protagoniza Una Emocionante Pelicula De Accion

May 30, 2025