Canadian Tire-Hudson's Bay Merger: Opportunities And Challenges

Table of Contents

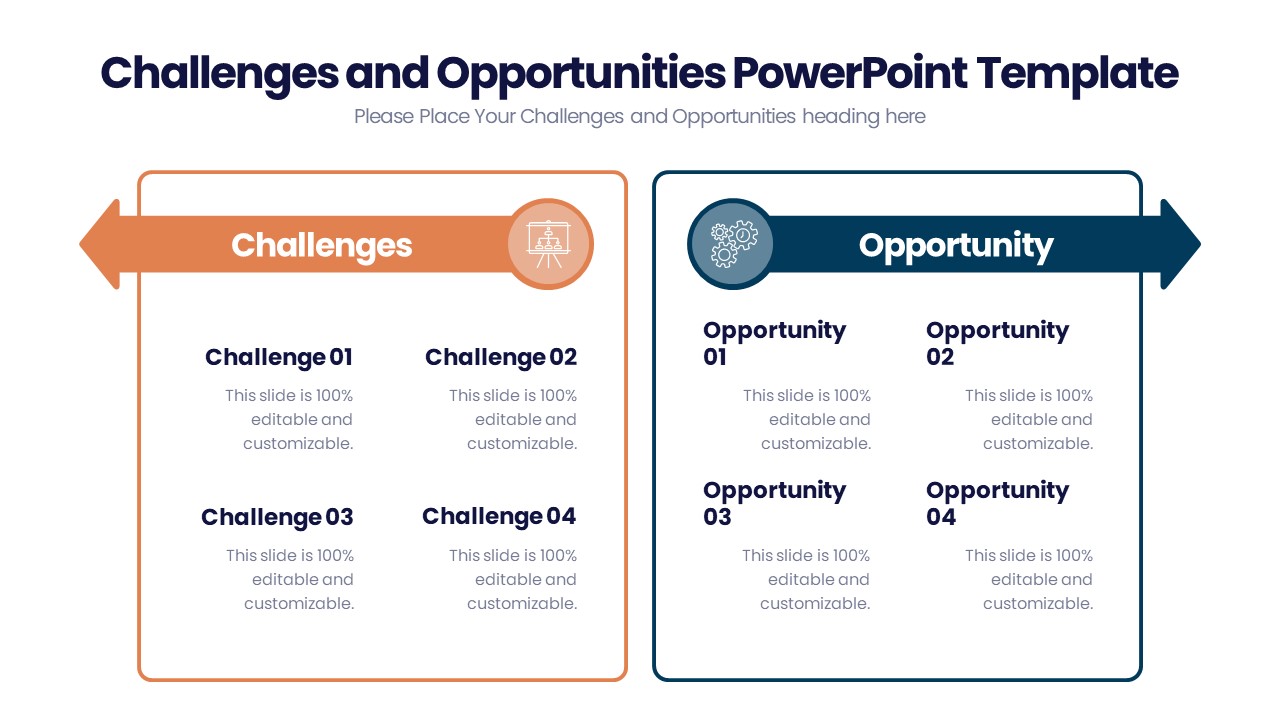

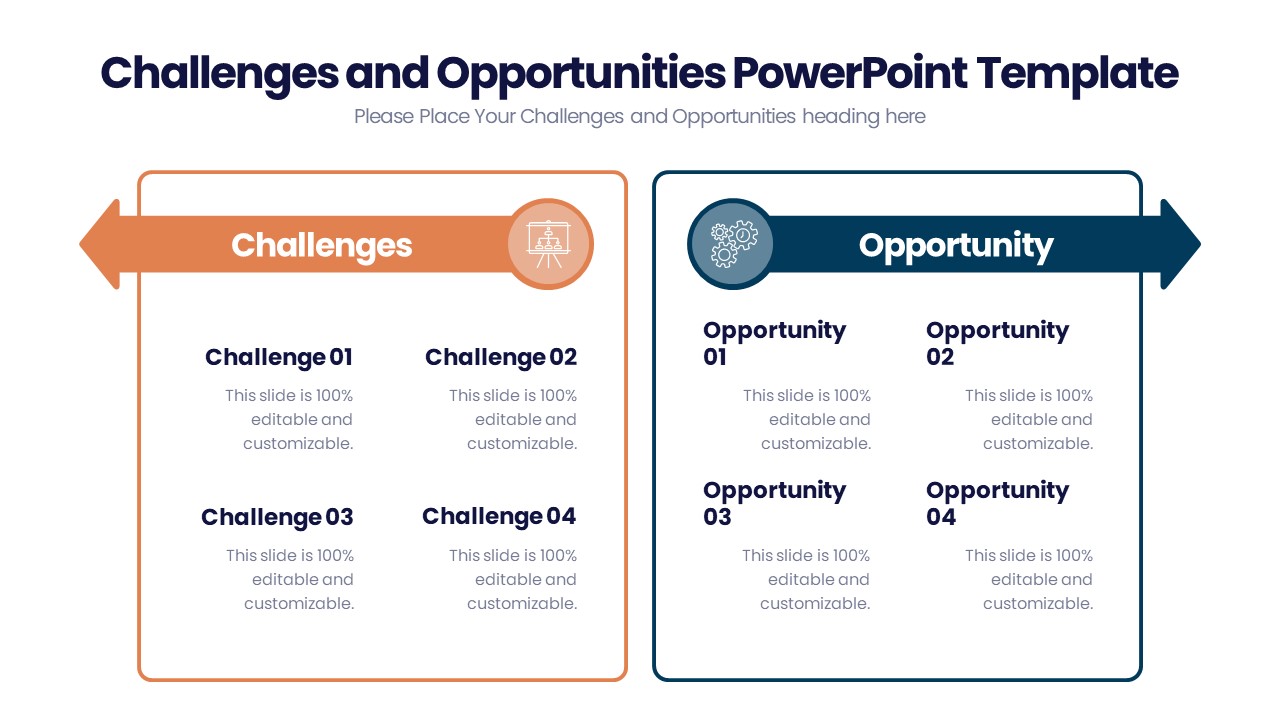

Synergies and Opportunities for Growth

The Canadian Tire-Hudson's Bay merger presents several compelling opportunities for growth and expansion. By combining their strengths, these retail giants can achieve significant synergies and reshape the Canadian market.

Expanded Market Reach and Customer Base

This merger offers unprecedented access to new customer segments and geographic areas. The combined entity will boast a significantly expanded customer base, leading to:

- Increased brand awareness: The combined marketing power will amplify brand visibility across a wider demographic.

- Cross-promotion opportunities: Canadian Tire's loyal customer base can be exposed to Hudson's Bay's offerings, and vice-versa, driving sales across both brands.

- Leveraging existing customer loyalty programs: Integrating loyalty programs can create a more comprehensive and rewarding experience for customers, fostering increased engagement and spending.

By combining their reach, the merged entity could penetrate new market segments, perhaps targeting younger demographics or expanding into previously underserved geographic regions. Canadian Tire’s strong presence in smaller towns and cities, coupled with Hudson's Bay’s established urban footprint, could create a truly nationwide retail presence.

Enhanced Supply Chain and Operational Efficiency

Combining the operational infrastructure of two large retailers offers substantial potential for cost savings and efficiency improvements. This includes:

- Consolidation of distribution centers: Reducing the number of distribution facilities can lead to significant cost savings in warehousing, transportation, and inventory management.

- Optimized inventory management: Shared data and analytics can lead to more precise demand forecasting and optimized inventory levels, minimizing waste and maximizing profitability.

- Shared resources (e.g., technology, procurement): Consolidating IT systems and leveraging collective bargaining power for procurement can lead to considerable cost reductions.

Streamlining these processes will be crucial. Effective integration of IT systems, logistics, and supply chains will be essential to realizing these cost savings and improving overall operational efficiency.

Diversification of Product Offerings

The merger allows for significant diversification of product offerings, creating a one-stop shop for a wider range of consumer needs:

- Combining Hudson's Bay's fashion and home goods with Canadian Tire's sporting goods and automotive products: This expanded product portfolio can attract a wider customer base and increase revenue streams.

- Potential for new product lines or services: The combined company may explore new opportunities in areas like home improvement, outdoor recreation, or even financial services, leveraging the synergies between their existing offerings.

This diversification reduces reliance on any single product category, creating a more resilient and profitable business model.

Challenges and Potential Risks

While the opportunities are significant, the Canadian Tire-Hudson's Bay merger also presents several potential challenges and risks that need careful consideration.

Integration Difficulties and Cultural Differences

Merging two large organizations with distinct corporate cultures can be fraught with challenges:

- Potential conflicts in management styles: Integrating different management philosophies and operational procedures requires careful planning and execution.

- Challenges in integrating IT systems: Consolidating IT infrastructure and data systems can be complex, time-consuming, and costly.

- Employee morale and retention: Addressing employee concerns and ensuring a smooth transition for staff from both companies is crucial to maintaining productivity and morale.

A comprehensive integration plan that addresses these issues from the outset is essential to mitigate potential conflicts and disruptions.

Regulatory Hurdles and Antitrust Concerns

The merger will undoubtedly face regulatory scrutiny from the Competition Bureau of Canada:

- Competition Bureau review: The regulatory body will assess the merger's potential impact on competition within the Canadian retail market.

- Potential divestitures: To address antitrust concerns, the merged company may be required to divest certain assets or business units.

- Consumer impact assessment: The Bureau will also evaluate the potential impact of the merger on consumers, including pricing and product availability.

Navigating this regulatory process successfully will be crucial for the merger's completion.

Financial Risks and Debt Burden

The financial implications of the merger are significant:

- Merger costs: The costs associated with integrating two large organizations can be substantial.

- Potential for increased debt: Financing the merger may lead to increased debt levels, increasing financial risk.

- Impact on shareholder value: The success of the merger will ultimately impact shareholder value, requiring careful financial management.

A thorough financial analysis and risk assessment are essential to ensure the long-term financial health and stability of the merged entity.

Conclusion: Assessing the Future of the Canadian Tire-Hudson's Bay Merger

The Canadian Tire-Hudson's Bay merger presents a compelling blend of opportunities and challenges. While the potential for increased market share, operational efficiencies, and product diversification is significant, overcoming integration hurdles, navigating regulatory scrutiny, and managing financial risks will be crucial for success. Addressing these challenges proactively will be key to maximizing the opportunities presented by this transformative Canadian retail merger. We encourage you to share your thoughts on the Canadian Tire-Hudson's Bay merger and its potential impact on the Canadian retail sector. What are your predictions for the future of this significant alliance in the Canadian retail landscape, considering the complexities of this Hudson's Bay and Canadian Tire combination? What are your thoughts on the broader implications of this major Canadian retail merger?

Featured Posts

-

L Ia Au Service De L Ecriture Des Cours Inspires D Agatha Christie Succes Ou Echec

May 20, 2025

L Ia Au Service De L Ecriture Des Cours Inspires D Agatha Christie Succes Ou Echec

May 20, 2025 -

Taiwan Shifts To Lng Nuclear Exit Fuels Energy Demand

May 20, 2025

Taiwan Shifts To Lng Nuclear Exit Fuels Energy Demand

May 20, 2025 -

Dusan Tadic In Fenerbahce Deki Etkisi Tarihe Gecen Bir Baslangic

May 20, 2025

Dusan Tadic In Fenerbahce Deki Etkisi Tarihe Gecen Bir Baslangic

May 20, 2025 -

Man Utd Close To Signing World Class Striker Agents Arrival Fuels Speculation

May 20, 2025

Man Utd Close To Signing World Class Striker Agents Arrival Fuels Speculation

May 20, 2025 -

Inside Michael Strahans Strategic Interview Acquisition During A Ratings Battle

May 20, 2025

Inside Michael Strahans Strategic Interview Acquisition During A Ratings Battle

May 20, 2025

Latest Posts

-

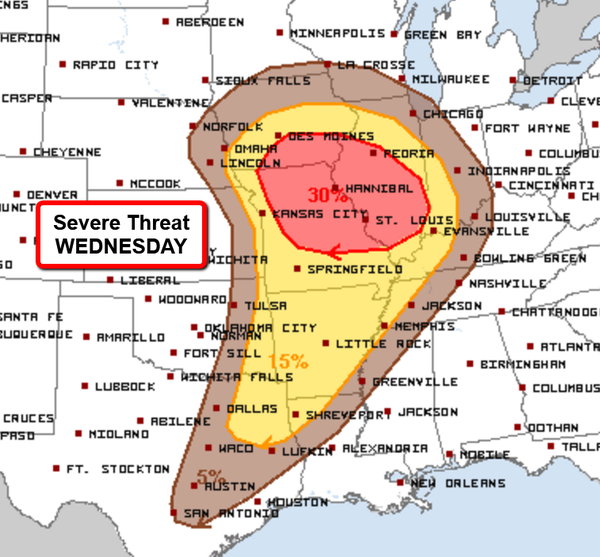

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025 -

Ftv Lives A Hell Of A Run A Deep Dive Into The Story

May 20, 2025

Ftv Lives A Hell Of A Run A Deep Dive Into The Story

May 20, 2025 -

Investigation Into Washington County Breeder Following 49 Dog Removal

May 20, 2025

Investigation Into Washington County Breeder Following 49 Dog Removal

May 20, 2025 -

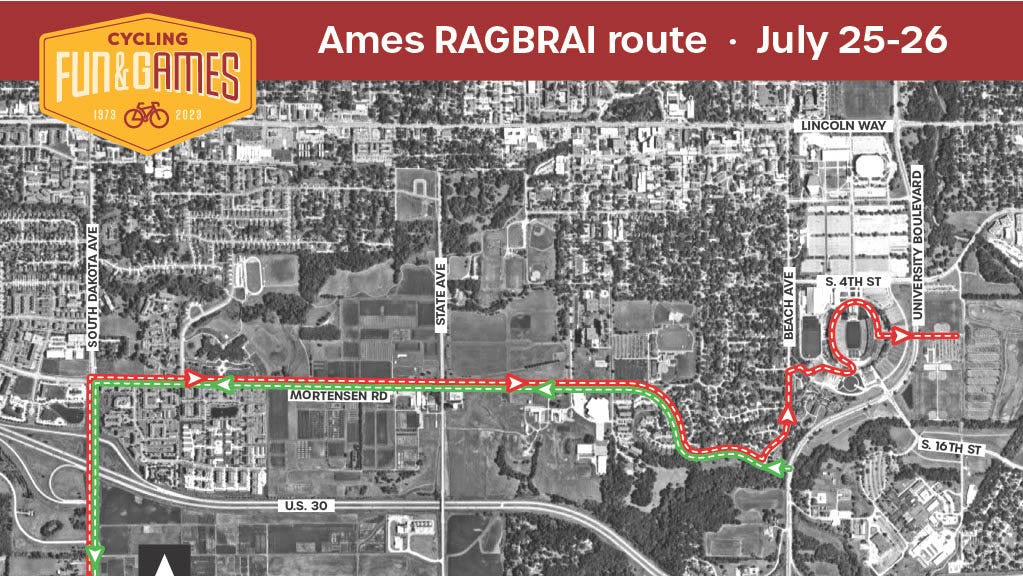

A Cyclists Dedication Scott Savilles Ragbrai And Commute Experiences

May 20, 2025

A Cyclists Dedication Scott Savilles Ragbrai And Commute Experiences

May 20, 2025 -

The Power Of Resilience Protecting Your Mental Health

May 20, 2025

The Power Of Resilience Protecting Your Mental Health

May 20, 2025