Canadian Unemployment And Interest Rates: Rosenberg's Expert Commentary

Table of Contents

Rosenberg's View on Current Canadian Unemployment

David Rosenberg's recent analysis of the Canadian unemployment situation paints a nuanced picture. While the official unemployment rate might appear relatively stable (insert current unemployment rate from a reputable source like Statistics Canada), Rosenberg often highlights underlying weaknesses within the labor market. He emphasizes that superficial statistics can mask deeper issues. His analysis frequently considers factors beyond the headline number, such as:

- Underemployment: Rosenberg often points out the prevalence of underemployment – individuals working part-time who desire full-time work – which is not fully captured in standard unemployment figures. This adds a layer of complexity to understanding the true health of the Canadian labor market.

- Sectoral Shifts: He analyzes shifts in employment across various sectors, identifying industries experiencing significant job growth or decline. This granular level of analysis reveals which sectors are driving employment gains or losses and provides a more comprehensive picture than overall unemployment figures alone.

- Youth Unemployment: Rosenberg consistently emphasizes the importance of youth unemployment as an indicator of future economic health. High youth unemployment can signal longer-term challenges for the labor market.

Bullet Points:

- Current unemployment rate in Canada: (Insert current rate from Statistics Canada)

- Rosenberg's prediction for unemployment in the coming months/year: (Summarize Rosenberg's prediction, citing the source)

- Key sectors experiencing high/low unemployment: (Mention specific sectors based on Rosenberg's analysis)

- Impact of government policies on unemployment: (Discuss Rosenberg's view on the effectiveness of current government policies)

The Impact of Interest Rate Changes on Canadian Employment

Interest rate adjustments by the Bank of Canada directly influence employment levels in Canada. Higher interest rates typically increase borrowing costs for businesses, leading to reduced investment and potentially slower job creation. Conversely, lower interest rates can stimulate borrowing, investment, and consumer spending, potentially boosting employment. Rosenberg's analysis of the Bank of Canada's actions often considers the potential lag effects of interest rate changes on the economy and the labor market.

Rosenberg's commentary usually assesses the impact of interest rate decisions on various sectors differently. For example, interest rate hikes might disproportionately affect sectors reliant on borrowing, such as housing construction, while others might be less sensitive.

Bullet Points:

- Current Bank of Canada interest rate: (Insert current interest rate)

- Rosenberg's stance on future interest rate adjustments: (Summarize Rosenberg's views on future interest rate changes)

- Potential effects of interest rate changes on different sectors: (Discuss the differential impact on various sectors)

- Impact on consumer confidence and spending: (Explain how interest rate changes influence consumer behavior and spending)

Rosenberg's Predictions for the Canadian Economy

Rosenberg’s overall outlook for the Canadian economy typically incorporates his analysis of various economic indicators, including unemployment rates, inflation, GDP growth, and consumer confidence. His predictions are often cautious, emphasizing potential downside risks.

Bullet Points:

- Rosenberg's projected GDP growth rate: (Cite Rosenberg's prediction with source)

- His inflation forecast: (Cite Rosenberg's inflation forecast with source)

- Key economic indicators he considers crucial: (List the key indicators Rosenberg focuses on)

- Potential downside risks to his forecast (e.g., global recession, geopolitical events): (Mention potential risks highlighted by Rosenberg)

Conclusion

David Rosenberg's analysis of Canadian unemployment and interest rates provides valuable insights into the current economic climate. His emphasis on underlying labor market dynamics and potential downside risks offers a more comprehensive understanding than simply looking at headline unemployment figures. Understanding the intricate relationship between Canadian unemployment and interest rates is vital for businesses to make informed decisions regarding investment and hiring, and for individuals to plan for their financial future. To stay updated on Rosenberg's insightful commentary and analyses on Canadian unemployment and interest rates, we encourage you to subscribe to his newsletter or follow him on social media. The interplay between these two crucial economic indicators continues to shape the Canadian economy, making ongoing analysis essential for navigating the complexities of the market.

Featured Posts

-

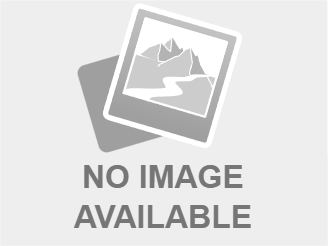

Communique De Presse Sanofi Et L Inauguration De Son Nouveau Site Francais

May 31, 2025

Communique De Presse Sanofi Et L Inauguration De Son Nouveau Site Francais

May 31, 2025 -

Rogart Veterinary Clinics Tain Relocation After Devastating Fire

May 31, 2025

Rogart Veterinary Clinics Tain Relocation After Devastating Fire

May 31, 2025 -

Les Mers Et Les Oceans Au Coeur Du Festival De La Camargue A Port Saint Louis Du Rhone

May 31, 2025

Les Mers Et Les Oceans Au Coeur Du Festival De La Camargue A Port Saint Louis Du Rhone

May 31, 2025 -

Rosemary And Thyme Cultivating And Harvesting Your Own Herbs

May 31, 2025

Rosemary And Thyme Cultivating And Harvesting Your Own Herbs

May 31, 2025 -

Communique De Presse Developpement De Sanofi En France Inauguration D Un Nouveau Site

May 31, 2025

Communique De Presse Developpement De Sanofi En France Inauguration D Un Nouveau Site

May 31, 2025