Carney's Economic Transformation: A Generational Shift?

Table of Contents

Carney's Focus on Climate Change and Sustainable Finance

Carney's emphasis on integrating environmental considerations into financial decision-making represents a paradigm shift. His advocacy for sustainable finance and the crucial role of central banks in addressing climate change has arguably redefined the scope of economic governance.

Integrating ESG Factors into Financial Decision-Making

Carney championed the incorporation of Environmental, Social, and Governance (ESG) factors into financial risk assessment and investment strategies. This move reflects a growing awareness of the financial implications of climate change and other sustainability issues.

- Policies promoting sustainable finance: The establishment of the Task Force on Climate-related Financial Disclosures (TCFD) is a prime example, pushing for greater transparency in climate-related financial reporting. Other initiatives included promoting green bonds and encouraging responsible investment practices.

- Long-term impact: Integrating ESG factors aims to protect future generations' financial well-being by mitigating climate-related risks and promoting long-term sustainability. The exponential growth of ESG investing, with trillions of dollars now managed under ESG mandates, underscores the increasing importance of this approach.

The Role of Central Banks in Addressing Climate Change

Carney argued forcefully that central banks have a crucial role to play in mitigating climate risks, a position previously less prevalent. He advocated for incorporating climate-related scenarios into financial stress tests and for actively managing the transition to a low-carbon economy.

- Central bank actions: Under Carney's influence, several central banks began incorporating climate-related scenarios into their stress tests, assessing the financial stability implications of climate change. This proactive approach marks a notable departure from traditional central banking functions.

- Effectiveness and limitations: While the effectiveness of these approaches is still being evaluated, the integration of climate considerations into central bank mandates is undeniably a significant step. However, challenges remain in accurately modeling climate-related risks and in coordinating global action.

Monetary Policy Innovations under Carney's Leadership

Carney's tenure was marked by innovative monetary policy approaches, particularly in response to challenging economic conditions. His use of forward guidance and unconventional monetary policies shaped the response to the global financial crisis and its aftermath.

Forward Guidance and Unconventional Monetary Policy

Carney's extensive use of forward guidance, clearly communicating the Bank of England's intentions regarding future interest rate adjustments, aimed to enhance the effectiveness of monetary policy. This, combined with the use of unconventional tools, proved instrumental in navigating economic uncertainty.

- Unconventional monetary policies: Quantitative easing (QE), a significant expansion of the money supply through asset purchases, was employed to stimulate economic activity during periods of low growth.

- Effectiveness and consequences: While QE proved effective in boosting liquidity and lowering borrowing costs, its long-term consequences, including potential inflationary pressures and asset bubbles, continue to be debated. The effectiveness of forward guidance also varied depending on the economic context and the credibility of the central bank's communication.

Maintaining Price Stability in a Changing Economic Landscape

Carney's leadership spanned a period of significant economic challenges, including Brexit and the global economic slowdown following the 2008 financial crisis. His policies aimed to maintain price stability while navigating these uncertainties.

- Economic challenges: The vote to leave the European Union presented unique challenges for the Bank of England, impacting both inflation and economic growth. Global economic slowdowns also added further complexity.

- Long-term consequences: The policies adopted during this period aimed to mitigate the negative impacts of these challenges, but their long-term consequences are still unfolding, including potential impacts on national debt and economic competitiveness.

Reforms in Financial Regulation under Carney's Influence

Carney's influence extended to significant reforms in financial regulation, focusing on strengthening financial stability and addressing systemic risks.

Strengthening Financial Stability

Significant measures were implemented to enhance the resilience of the financial system, particularly in the banking sector.

- Regulatory changes: Increased capital requirements for banks, designed to improve their ability to absorb losses, are a prime example of these reforms. These measures were implemented in response to the 2008 financial crisis and aimed to prevent future crises.

- Impact on preventing future crises: While the full impact of these reforms is still to be seen, they significantly increased the perceived stability and resilience of the global banking system, minimizing potential future risks.

Addressing Systemic Risk

Carney actively focused on identifying and mitigating systemic risks—those that could threaten the stability of the entire financial system.

- Initiatives aimed at reducing systemic risk: These included initiatives to improve the oversight of shadow banking and to enhance the regulation of systemically important financial institutions.

- Long-term implications: These measures are intended to prevent future financial crises by reducing the interconnectedness of financial institutions and improving regulatory oversight. The success of these measures will depend on ongoing vigilance and adaptation to the evolving financial landscape.

Conclusion: Assessing the Generational Impact of Carney's Economic Transformation

Carney's economic policies represent a multifaceted transformation. His emphasis on sustainable finance and the integration of climate change into financial decision-making constitutes a significant departure from traditional approaches. The long-term consequences of his monetary policy innovations and regulatory reforms remain to be seen, but they have undeniably reshaped the landscape of economic governance. While the full generational impact remains to be determined, the integration of ESG factors and the acknowledgement of climate risks as central economic concerns represent a paradigm shift. This proactive approach to financial stability, acknowledging the interconnectedness of environmental and economic factors, potentially sets a new standard for future generations of economic policymakers.

Continue the discussion: Share your thoughts on whether Carney's economic transformation truly represents a generational shift. Use #CarneysLegacy to join the conversation.

Featured Posts

-

Qua Xua Quen Mat Nay Hot Lai Gia 60 000d Kg Huong Vi Doc Dao

May 04, 2025

Qua Xua Quen Mat Nay Hot Lai Gia 60 000d Kg Huong Vi Doc Dao

May 04, 2025 -

Vegas Golden Knights Stanley Cup Contenders

May 04, 2025

Vegas Golden Knights Stanley Cup Contenders

May 04, 2025 -

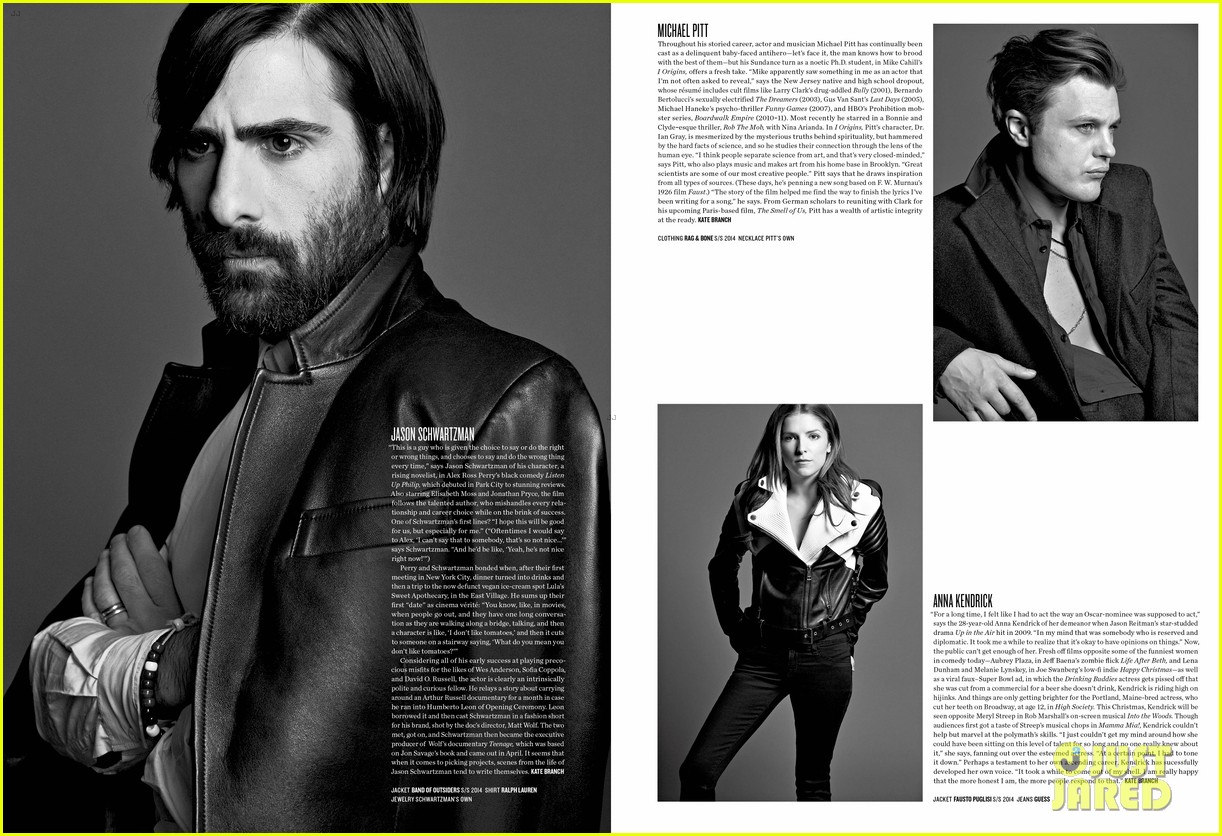

I Want Anna Kendricks Glittering Shell Crop Top This Summer

May 04, 2025

I Want Anna Kendricks Glittering Shell Crop Top This Summer

May 04, 2025 -

Kivinin Kabugu Yenir Mi Faydalari Zararlari Ve Tueketim Yoentemleri

May 04, 2025

Kivinin Kabugu Yenir Mi Faydalari Zararlari Ve Tueketim Yoentemleri

May 04, 2025 -

A Timeline Exploring The Rumored Conflict Between Blake Lively And Anna Kendrick

May 04, 2025

A Timeline Exploring The Rumored Conflict Between Blake Lively And Anna Kendrick

May 04, 2025

Latest Posts

-

Ufc 314 Co Main Event Prediction Analyzing Chandler Vs Pimblett

May 04, 2025

Ufc 314 Co Main Event Prediction Analyzing Chandler Vs Pimblett

May 04, 2025 -

Chandler Vs Pimblett Ufc 314 Co Main Event Fight Breakdown And Betting Odds

May 04, 2025

Chandler Vs Pimblett Ufc 314 Co Main Event Fight Breakdown And Betting Odds

May 04, 2025 -

Paddy Pimblett Calls Dustin Poiriers Retirement Idiot Was He Right

May 04, 2025

Paddy Pimblett Calls Dustin Poiriers Retirement Idiot Was He Right

May 04, 2025 -

Ufc 314 Co Main Event Chandler Vs Pimblett Odds And Predictions

May 04, 2025

Ufc 314 Co Main Event Chandler Vs Pimblett Odds And Predictions

May 04, 2025 -

Paddy Pimblett Raises Concerns About Michael Chandlers Conduct Before Ufc 314 Fight

May 04, 2025

Paddy Pimblett Raises Concerns About Michael Chandlers Conduct Before Ufc 314 Fight

May 04, 2025