Cenovus CEO Dismisses MEG Bid Rumors; Company Focused On Independent Growth Strategy

Table of Contents

Cenovus CEO's Statement and Rationale

In a decisive statement, Cenovus Energy's CEO explicitly rejected speculation of a takeover bid from MEG Energy. While the exact wording wasn't publicly released in detail, sources close to the company indicate the CEO emphasized the inherent value of Cenovus's independent trajectory. The rationale behind this rejection is multifaceted:

-

Financial Considerations: Industry analysts suggest a potential valuation mismatch played a significant role. Cenovus's current market capitalization and debt levels likely made an acquisition less financially attractive. A merger would necessitate careful consideration of shareholder value and potential dilution.

-

Strategic Alignment: The companies' differing corporate cultures and business models likely posed significant integration challenges. Forcing a merger could disrupt ongoing projects and potentially hinder both companies' growth.

-

Focus on Organic Growth: Cenovus's leadership clearly prioritized its existing, robust independent growth strategy. The company believes its current operational plans offer a more sustainable path to long-term profitability and shareholder returns than a potentially disruptive merger.

-

Key Arguments Against Acquisition (summarized):

- Preservation of Cenovus's distinct corporate identity and operational efficiency.

- Superior returns expected from independent investment in existing projects.

- Minimization of integration risks and potential financial instability.

Cenovus's Independent Growth Strategy in Detail

Cenovus Energy's independent growth strategy hinges on several key pillars:

-

Aggressive Oil and Gas Exploration and Production: Cenovus continues to invest heavily in expanding its existing oil sands operations and exploring new opportunities within its core areas of operation. This includes optimizing existing infrastructure and leveraging advanced technology for enhanced oil recovery.

-

Strategic Investments in Renewable Energy: Recognizing the evolving energy landscape, Cenovus is exploring strategic investments in renewable energy sources. While details remain limited, this diversification signifies a commitment to long-term sustainability and reduced carbon emissions.

-

Operational Efficiency and Cost Reduction: Cenovus is implementing rigorous cost-cutting measures and streamlining its operations to enhance efficiency. This focus on maximizing profitability from existing assets is crucial to fueling future growth initiatives.

-

Geographic Expansion (Potential): While not explicitly detailed, future growth might involve strategically expanding into new geographic areas, potentially diversifying their resource portfolio and mitigating risks associated with reliance on a single region.

-

Data Supporting the Strategy: While precise figures are subject to market fluctuations and aren't publicly available in full detail at this time, Cenovus has historically demonstrated a commitment to transparent reporting, and future investor updates are expected to showcase progress.

Market Reaction and Analyst Opinions on Cenovus's Decision

The stock market's initial reaction to Cenovus's rejection of the MEG bid was largely positive. Cenovus's share price experienced a modest increase, suggesting investor confidence in the company's independent growth strategy.

Energy analysts are largely divided in their opinions. Some praise Cenovus's focus on organic growth and operational efficiency, viewing it as a prudent approach in a volatile energy market. Others express concerns about the potential missed opportunities presented by a merger with MEG Energy, especially concerning potential synergies.

"Cenovus's decision showcases a clear focus on shareholder value creation through organic growth," commented [Analyst Name], a senior energy analyst at [Analyst Firm]. "While a merger might have offered short-term gains, the long-term benefits of their independent strategy are potentially more substantial."

Comparison with MEG Energy's Current Strategy

MEG Energy focuses primarily on oil sands production and has a more conservative expansion strategy compared to Cenovus's more diversified approach. This difference in strategic vision likely contributed to the rejection of the potential acquisition.

Conclusion: Cenovus's Independent Path: A Strategic Choice for Future Success

Cenovus Energy's CEO's decisive rejection of the MEG bid underscores the company's unwavering commitment to its independent growth strategy. This strategy, characterized by aggressive exploration, operational efficiency improvements, and strategic investments in renewable energy, positions Cenovus for long-term success in the evolving energy sector. While challenges undoubtedly remain, the company's robust operational framework and investor confidence suggest a promising future. The long-term implications of this independent path remain to be seen, but initial market reactions and analyst commentary suggest it's a calculated risk with potentially substantial rewards.

Stay informed about Cenovus Energy's progress by following their investor relations updates and learn more about their strategic vision for independent growth. Understanding Cenovus's independent growth strategy is crucial for anyone following the Canadian oil and gas industry and its evolution towards a sustainable energy future.

Featured Posts

-

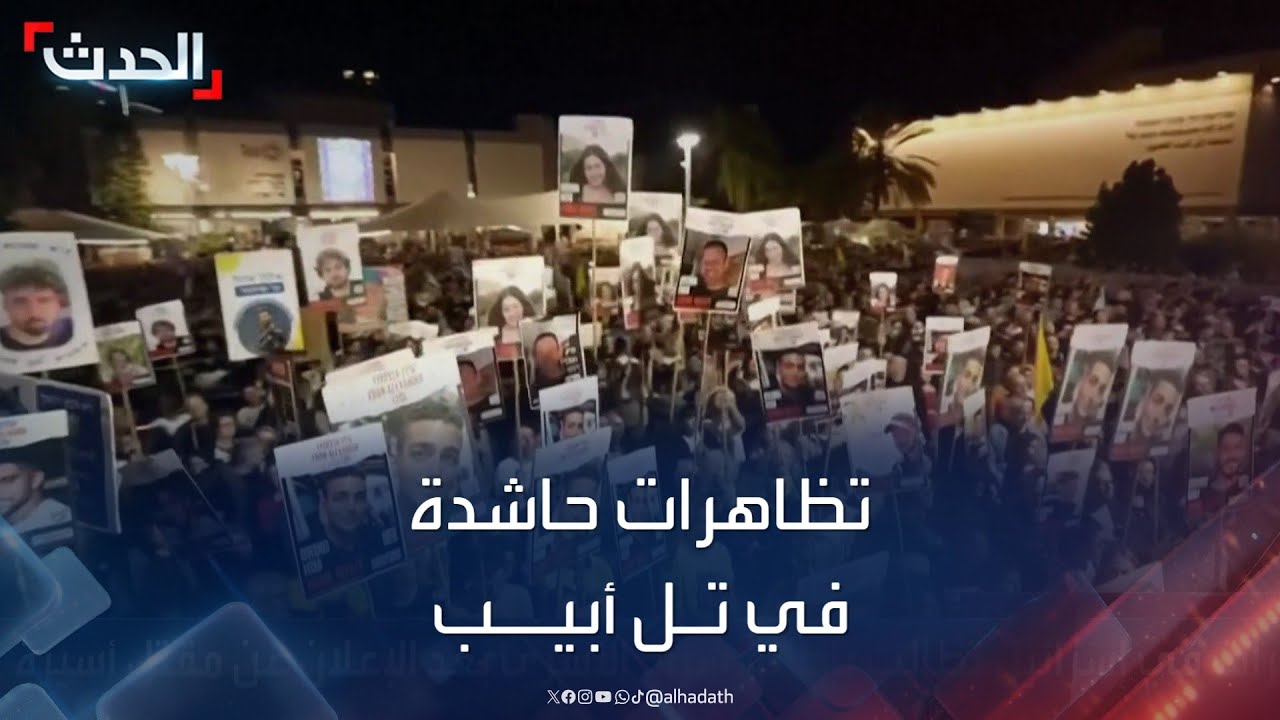

Mzahrat Tl Abyb Mtalb Bitlaq Srah Alasra Ttwasl

May 26, 2025

Mzahrat Tl Abyb Mtalb Bitlaq Srah Alasra Ttwasl

May 26, 2025 -

Atletico Madrid In Sevilla Zaferi Macin Ayrintili Oezeti

May 26, 2025

Atletico Madrid In Sevilla Zaferi Macin Ayrintili Oezeti

May 26, 2025 -

47 Y Mmkf Gde I Kogda Uznat Imena Pobediteley V Moskve

May 26, 2025

47 Y Mmkf Gde I Kogda Uznat Imena Pobediteley V Moskve

May 26, 2025 -

Canada Post Strike Threat Impact On Customers And Business

May 26, 2025

Canada Post Strike Threat Impact On Customers And Business

May 26, 2025 -

Etoile On Amazon Prime Gideon Glicks Standout Role

May 26, 2025

Etoile On Amazon Prime Gideon Glicks Standout Role

May 26, 2025

Latest Posts

-

Giannis Antetokounmpos Head Grab Post Game Handshake Incident Explained

May 28, 2025

Giannis Antetokounmpos Head Grab Post Game Handshake Incident Explained

May 28, 2025 -

Sacramento Kings Vs Indiana Pacers Injury Report Whos In And Whos Out

May 28, 2025

Sacramento Kings Vs Indiana Pacers Injury Report Whos In And Whos Out

May 28, 2025 -

Pacers Beat Nets In Overtime Mathurin Leads The Charge

May 28, 2025

Pacers Beat Nets In Overtime Mathurin Leads The Charge

May 28, 2025 -

Mathurins Heroics Pacers Edge Nets In Overtime Thriller

May 28, 2025

Mathurins Heroics Pacers Edge Nets In Overtime Thriller

May 28, 2025 -

Game 4 Ejection Mathurin And Hunters Altercation In Pacers Cavaliers Series

May 28, 2025

Game 4 Ejection Mathurin And Hunters Altercation In Pacers Cavaliers Series

May 28, 2025