Cenovus CEO Downplays Merger Speculation, Prioritizes Organic Expansion

Table of Contents

Dismissal of Merger Rumors and Focus on Organic Growth

Recent market chatter has suggested potential merger and acquisition (M&A) activity involving Cenovus Energy. However, the CEO has directly dismissed these rumors, emphasizing the company's dedication to an organic expansion strategy. This decision is based on several factors.

-

Direct quotes from the CEO downplaying merger talks: While specific quotes may require accessing recent press releases or transcripts, the overall message consistently highlights the belief that internal growth offers superior value and less risk than pursuing acquisitions in the current market. Statements often emphasize the strength of existing operations and future potential for increased production.

-

Explanation of the current market conditions: The current energy market is characterized by significant volatility and uncertainty regarding future oil prices and regulatory changes. A merger, at this juncture, might be considered too risky, diluting shareholder value rather than enhancing it. Organic growth allows for more controlled expansion and better risk management.

-

Details on Cenovus’ current operational capabilities: Cenovus possesses considerable assets and operational expertise, particularly in the oil sands region. These existing capabilities offer a strong foundation for significant internal growth and production optimization. Expansion within these proven areas presents less risk than venturing into unfamiliar territories through an acquisition.

-

Highlighting the cost-effectiveness and reduced risk: Organic expansion is generally viewed as a more cost-effective strategy than mergers and acquisitions. Avoiding the high premiums often associated with acquisitions allows for more efficient capital allocation and minimizes the integration risks often associated with large-scale mergers.

Cenovus' Strategic Priorities for Organic Expansion

Cenovus's organic expansion strategy is built on several key pillars: operational efficiency, strategic capital allocation, and a commitment to sustainable growth practices.

-

Specific examples of operational improvements: This could include initiatives like streamlining production processes, implementing advanced analytics for optimizing well performance, and improving the efficiency of oil sands extraction techniques. Quantifiable examples of these improvements (e.g., percentage increase in efficiency, reduction in operating costs) should be cited from company reports.

-

Details on planned investments in existing assets and exploration projects: Cenovus's strategic plan will undoubtedly involve investments in its existing oil sands operations, upgrading facilities, and potentially exploring new opportunities within its existing acreage. Details about these investments, including budget allocations and anticipated timelines, would be necessary for a complete picture.

-

Discussion on the company's commitment to sustainable practices and ESG factors: Increasingly, investors and consumers are concerned about environmental, social, and governance (ESG) factors. Cenovus's commitment to reducing its carbon footprint, improving its social license to operate, and implementing strong corporate governance principles is a key element of its long-term strategy.

-

Explanation of how this strategy aligns with long-term shareholder value creation: Ultimately, the goal of any corporate strategy is to increase shareholder value. Cenovus needs to clearly articulate how its organic expansion strategy, focusing on efficiency, sustainability, and controlled growth, contributes to this objective.

Investment in Technology and Innovation for Enhanced Efficiency

Cenovus recognizes the crucial role of technology and innovation in achieving its organic growth targets.

-

Examples of new technologies: This could include the adoption of advanced analytics, automation in oil sands extraction, the use of artificial intelligence for predictive maintenance, and investments in carbon capture and storage technologies.

-

Discussion on the company's investment in research and development: Cenovus's commitment to R&D is a clear indicator of its long-term commitment to technological advancement and operational efficiency. Details on R&D spending and partnerships would reinforce this commitment.

-

Potential impact of technology on reducing operating costs and environmental footprint: The adoption of these new technologies is expected to lead to significant cost reductions, improve operational efficiency, and reduce Cenovus's environmental impact. Quantifiable data supporting these claims would be highly beneficial.

Potential Challenges and Risks Associated with Organic Growth

While organic growth presents several advantages, it is not without its challenges and risks.

-

Analysis of the potential challenges: Maintaining consistent growth in a volatile energy market presents a significant challenge. Factors such as fluctuating oil prices, regulatory hurdles, and intense competition will impact Cenovus's ability to achieve its organic growth targets.

-

Discussion of the risks associated with reliance on internal growth: Over-reliance on internal growth can limit a company's ability to quickly respond to market opportunities or address unforeseen challenges. Diversification through acquisitions might offer a more robust strategy in the long term.

-

Strategies that Cenovus is implementing to mitigate these challenges and risks: Cenovus will need to outline specific strategies to manage these risks, including hedging strategies for oil price volatility, proactive regulatory engagement, and continuous improvement in operational efficiency.

Conclusion

Cenovus Energy's decision to prioritize organic expansion over mergers reflects a strategic shift towards internal growth and operational efficiency. While this approach presents challenges, the company's focus on technological innovation, sustainable practices, and efficient capital allocation positions it for long-term success. This commitment to organic growth distinguishes Cenovus’s strategy in the competitive energy sector.

Call to Action: Stay informed about Cenovus Energy’s progress in its commitment to organic growth and its ongoing strategic initiatives by following our updates on the company’s advancements in sustainable energy solutions and operational efficiencies. Learn more about Cenovus’s organic expansion strategy and its impact on the future of the energy industry.

Featured Posts

-

Dow Jones Gains Momentum Positive Pmi Impacts Market

May 25, 2025

Dow Jones Gains Momentum Positive Pmi Impacts Market

May 25, 2025 -

Ealas Grand Slam Debut In Paris A Look Ahead

May 25, 2025

Ealas Grand Slam Debut In Paris A Look Ahead

May 25, 2025 -

West Ham United Submits Bid For Kyle Walker Peters

May 25, 2025

West Ham United Submits Bid For Kyle Walker Peters

May 25, 2025 -

Michael Schumachers Driving Style Aggressive Or Unfair

May 25, 2025

Michael Schumachers Driving Style Aggressive Or Unfair

May 25, 2025 -

Analyse Europese Aandelen En De Recente Beweging Tegenover Wall Street

May 25, 2025

Analyse Europese Aandelen En De Recente Beweging Tegenover Wall Street

May 25, 2025

Latest Posts

-

David Hockney A Bigger Picture Exploring The Artists Vision

May 25, 2025

David Hockney A Bigger Picture Exploring The Artists Vision

May 25, 2025 -

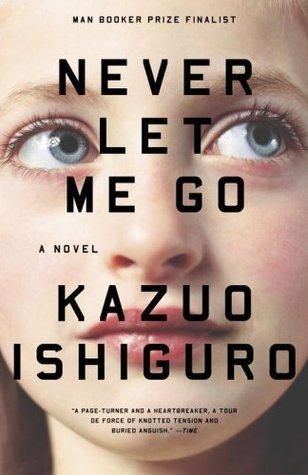

The Imaginative Landscapes Of Kazuo Ishiguro Memory Forgetting And Narrative

May 25, 2025

The Imaginative Landscapes Of Kazuo Ishiguro Memory Forgetting And Narrative

May 25, 2025 -

Remembering And Forgetting The Role Of Memory In Kazuo Ishiguros Fiction

May 25, 2025

Remembering And Forgetting The Role Of Memory In Kazuo Ishiguros Fiction

May 25, 2025 -

Roland Whites Imagine The Academy Of Armando Bbc 1 Review Funny Business

May 25, 2025

Roland Whites Imagine The Academy Of Armando Bbc 1 Review Funny Business

May 25, 2025 -

Kazuo Ishiguros Novels A Study Of Memory Forgetting And The Power Of Imagination

May 25, 2025

Kazuo Ishiguros Novels A Study Of Memory Forgetting And The Power Of Imagination

May 25, 2025