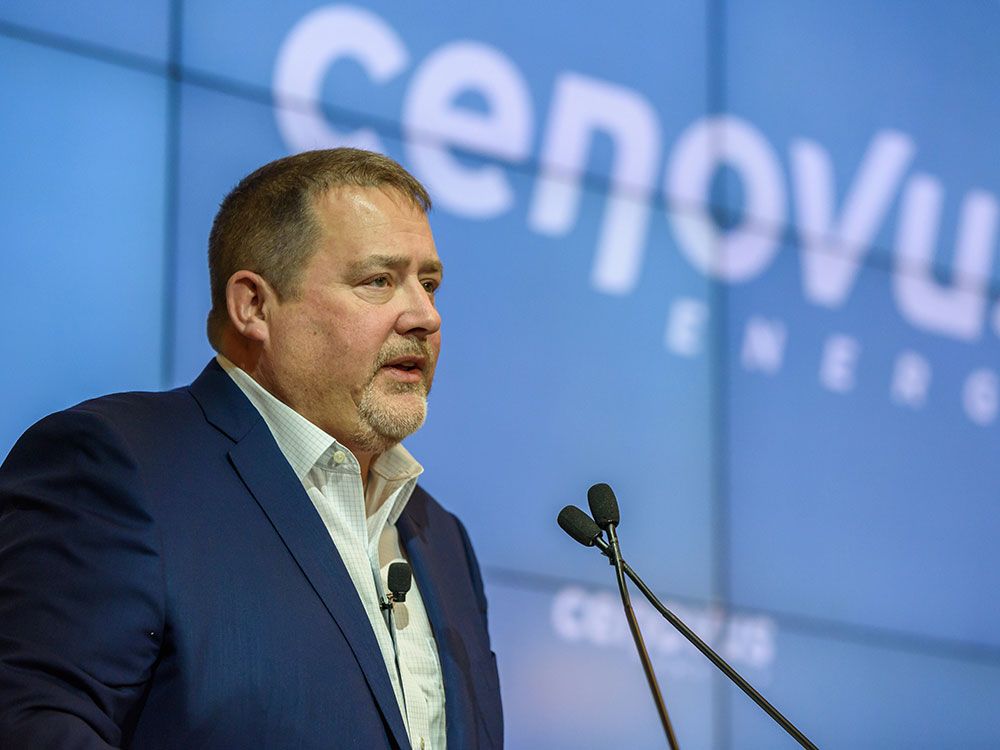

Cenovus CEO: Low Probability Of MEG Acquisition; Organic Growth Takes Center Stage

Table of Contents

Pourbaix's Stance on MEG Acquisition

Cenovus's decision to forgo the acquisition of MEG Energy is a significant development in the Canadian energy M&A landscape. Alex Pourbaix's statements have clearly indicated a low likelihood of such a deal. Several factors contribute to this stance.

-

Valuation Concerns: Pourbaix likely cited concerns about MEG Energy's current valuation, deeming it too high relative to Cenovus's assessment of its intrinsic value. This suggests a disciplined approach to capital allocation, prioritizing investments with a higher potential return.

-

Integration Challenges: Merging two significant players in the Canadian oil sands sector presents substantial operational and logistical integration challenges. Pourbaix may have acknowledged the complexity and potential disruptions associated with integrating MEG Energy's assets and operations into Cenovus's existing infrastructure.

-

Regulatory Hurdles: Acquisitions of this magnitude often face scrutiny from regulatory bodies. Potential antitrust concerns or other regulatory hurdles could have played a significant role in Cenovus's decision to avoid the complexities and uncertainties of a lengthy regulatory process.

-

Financial Position: Cenovus's current financial strength may not warrant a major acquisition right now. The company may prefer to focus on strengthening its balance sheet and using capital for projects with a more immediate and predictable return. A large acquisition like MEG Energy would place a significant strain on its resources.

Cenovus's Commitment to Organic Growth

Instead of pursuing external acquisitions, Cenovus is doubling down on its organic growth strategy. This approach centers on enhancing existing operations and expanding production capacity through internal investments.

-

Oil Sands Production Optimization: Cenovus is prioritizing investments to optimize its existing oil sands operations. This includes improving extraction efficiency, reducing operational costs, and increasing production from existing assets.

-

Upstream Operations Expansion: Significant capital expenditures are allocated to expand upstream operations. This could involve drilling new wells, enhancing infrastructure, and expanding exploration activities in promising areas within the existing portfolio.

-

Exploration and Production: Cenovus is actively exploring new opportunities within its existing licenses and seeking to identify promising areas for future production growth. This commitment to exploration ensures a long-term supply of resources to support future production increases.

-

Capital Allocation Strategy: A key aspect of Cenovus's organic growth strategy is a disciplined approach to capital allocation. The company is prioritizing projects with the highest potential returns and focusing resources on areas with the greatest potential for growth. This strategic allocation ensures efficient use of resources to maximize value creation.

For example, investments in [mention specific projects, if available] are directly contributing to this organic growth strategy. The expected increase in production and efficiency improvements from these initiatives will significantly impact Cenovus’s bottom line.

Implications for Investors and the Energy Sector

Cenovus's strategic shift towards organic growth will have significant implications for investors and the wider Canadian energy sector.

-

Cenovus Stock Price: The market's reaction to this decision will depend on its success in delivering on its organic growth targets. Successful execution could lead to a positive impact on Cenovus's stock price, reflecting investor confidence in the company's long-term prospects. However, any setbacks in achieving these growth targets may negatively impact investor sentiment and the stock price.

-

Investor Sentiment: The success of the organic growth strategy will be crucial in shaping investor sentiment. Demonstrating consistent progress in achieving production increases, efficiency improvements, and cost reductions will be key to maintaining investor confidence.

-

Canadian Energy Sector: Cenovus's decision reflects a broader trend in the Canadian energy sector, where some companies are prioritizing organic growth over large-scale acquisitions in a period of fluctuating energy prices and potential economic uncertainties.

-

Competitive Landscape: This strategic shift will also affect the competitive landscape within the Canadian oil and gas sector. While potentially reducing the pace of industry consolidation, it highlights a focus on operational efficiency and resource optimization as key competitive advantages.

Conclusion:

Cenovus Energy's strategic decision to prioritize organic growth over the acquisition of MEG Energy reflects a cautious yet focused approach to maximizing shareholder value. While avoiding the risks associated with a large acquisition, the success of this strategy hinges on the effective execution of its ambitious organic growth plans. This requires consistent delivery on projected production increases, cost reductions, and operational efficiency improvements.

Call to Action: Stay informed on Cenovus Energy's progress in its commitment to organic growth and the ongoing developments within the Canadian oil and gas sector. Follow our updates for further insights into Cenovus's strategic decisions and their impact on the energy market. Learn more about Cenovus's organic growth strategy and its impact on the future of the company.

Featured Posts

-

Martin Compstons Glasgow A Los Angeles Feel In A New Thriller

May 26, 2025

Martin Compstons Glasgow A Los Angeles Feel In A New Thriller

May 26, 2025 -

Met Gala 2025 The Naomi Campbell And Anna Wintour Controversy

May 26, 2025

Met Gala 2025 The Naomi Campbell And Anna Wintour Controversy

May 26, 2025 -

Google Vs Open Ai A Deep Dive Into I O And Io

May 26, 2025

Google Vs Open Ai A Deep Dive Into I O And Io

May 26, 2025 -

Mit Vollgas In Die Bundesliga Der Hsv Aufstieg

May 26, 2025

Mit Vollgas In Die Bundesliga Der Hsv Aufstieg

May 26, 2025 -

Tim Cooks Troubles A Challenging 2023 For Apples Ceo

May 26, 2025

Tim Cooks Troubles A Challenging 2023 For Apples Ceo

May 26, 2025

Latest Posts

-

Uproxx Music 20 An Exclusive Interview With Simone Joy Jones

May 27, 2025

Uproxx Music 20 An Exclusive Interview With Simone Joy Jones

May 27, 2025 -

Duchess Of Yorks Covid 19 Ppe Offer Inquiry Testimony

May 27, 2025

Duchess Of Yorks Covid 19 Ppe Offer Inquiry Testimony

May 27, 2025 -

Watch Aew Double Or Nothing 2025 Start Time And Streaming Options

May 27, 2025

Watch Aew Double Or Nothing 2025 Start Time And Streaming Options

May 27, 2025 -

Aew Double Or Nothing 2025 Your Complete Guide To The Ppv

May 27, 2025

Aew Double Or Nothing 2025 Your Complete Guide To The Ppv

May 27, 2025 -

Aew Double Or Nothing 2025 Preview When And Where To Watch

May 27, 2025

Aew Double Or Nothing 2025 Preview When And Where To Watch

May 27, 2025