CFP Board CEO To Step Down In Early 2026

Table of Contents

[Current CEO's Name]'s Legacy at the CFP Board

[Current CEO's Name]'s tenure as CFP Board CEO has been marked by both significant achievements and considerable challenges. Their leadership has shaped the landscape of financial planning, leaving a lasting impact on the CFP certification and the profession as a whole.

- Successful Initiatives: During their time at the helm, [Current CEO's Name] oversaw [mention specific successful initiatives, e.g., the implementation of new technology for exam administration, strengthening ethical standards, expansion of CFP professional outreach programs]. These initiatives contributed to enhancing the credibility and value of the CFP certification.

- Challenges Overcome: The role of CFP Board CEO is not without its hurdles. [Current CEO's Name] successfully navigated [mention specific challenges, e.g., regulatory changes impacting financial advisors, increased competition from alternative financial planning designations, public perception of the financial industry]. Their ability to steer the CFP Board through these challenges solidified its position in the market.

- Impact on CFP Certification: Under [Current CEO's Name]'s leadership, the CFP certification process underwent [mention any significant changes, e.g., updates to the exam, changes to continuing education requirements]. These adjustments aimed to maintain the rigor and relevance of the CFP mark in a constantly evolving financial landscape.

The Search for a New CFP Board CEO: What to Expect

The selection of a new CFP Board CEO will be a meticulous process, ensuring the appointment of a leader capable of guiding the organization into the future.

- Timeline for the Search: The CFP Board will likely establish a search committee comprising board members, industry experts, and potentially external consultants. The search is expected to take several months, potentially extending into [mention estimated timeframe, e.g., late 2024 and 2025]. A clear timeline will be crucial to ensuring a smooth transition.

- Qualities and Experience: The ideal candidate will possess a diverse skillset, encompassing deep understanding of the financial planning industry, strong leadership capabilities, experience in managing large organizations, and a commitment to upholding the highest ethical standards. Experience in navigating regulatory complexities and driving strategic change will be highly valued.

- Potential Candidates and Speculation: While speculation is inevitable, the CFP Board is likely to prioritize a thorough and confidential search process, avoiding premature announcements of potential candidates. The final decision will depend on the committee's assessment of individual qualifications and alignment with the Board's strategic vision.

Implications for CFP Professionals and Consumers

The change in leadership at the CFP Board holds significant implications for both CFP professionals and the consumers they serve.

- Changes to Certification Process: While major overhauls are unlikely immediately, the new CEO may initiate subtle adjustments to the CFP certification process or requirements based on their vision for the future. This could include changes to continuing education or examination content.

- Enforcement of Ethical Standards: The CFP Board's commitment to ethical conduct is paramount. The incoming CEO's approach to enforcing ethical standards will be closely observed by both professionals and consumers. Strengthening or modifying enforcement mechanisms could be a key focus area.

- Effect on Consumer Confidence: The CFP mark represents a significant guarantee of competency and ethical conduct for consumers seeking financial advice. A smooth transition and clear communication from the CFP Board will be crucial to maintaining consumer confidence in the certification.

Future of the CFP Certification Under New Leadership

The new CFP Board CEO will inherit a robust certification program but will also face the challenge of adapting to evolving industry dynamics.

- Potential Changes in Strategy: The new leader might introduce new strategic initiatives, perhaps focusing on technology integration, expanding global reach, or enhancing educational resources for CFP professionals. Changes in strategy will reflect the new CEO's priorities and vision for the future.

- Focus Areas for the New CEO: Key focus areas could include leveraging technology to improve efficiency and accessibility of the certification process, developing innovative educational programs to address emerging financial trends, and proactively engaging with regulators to shape the future of financial planning.

- Long-Term Implications for the CFP Mark: The long-term value and recognition of the CFP mark will depend heavily on the new CEO's ability to successfully adapt the CFP Board to the changing financial landscape and maintain its position as a leading standard for financial planning professionals.

Conclusion

The departure of [Current CEO's Name] marks a significant turning point for the CFP Board. The search for a new CEO will be a critical process, shaping the future of the CFP certification and its impact on financial planning professionals and consumers. The importance of the CFP certification in upholding ethical standards and ensuring competent financial advice cannot be overstated. The incoming CEO will play a pivotal role in ensuring its continued relevance and value. Stay informed about the ongoing developments regarding the search for the new CFP Board CEO and the future of the CFP certification. Follow our updates on the latest news concerning the CFP Board CEO transition and its implications for financial planning professionals and consumers. Keep checking back for more analysis and insights on the CFP Board CEO succession.

Featured Posts

-

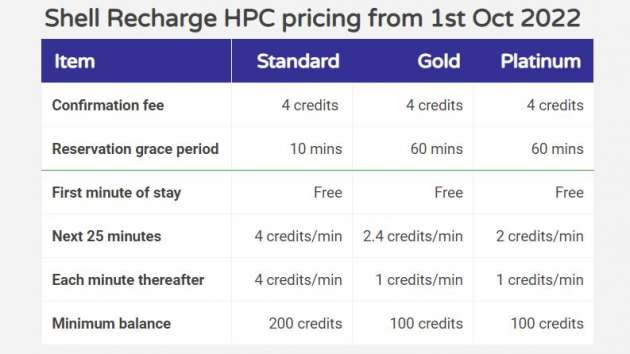

Shell Recharge Raya Promotion Up To 100 Rebate On East Coast Hpc Ev Chargers

May 03, 2025

Shell Recharge Raya Promotion Up To 100 Rebate On East Coast Hpc Ev Chargers

May 03, 2025 -

Fortnite Wwe Skins How To Get Cody Rhodes And The Undertaker

May 03, 2025

Fortnite Wwe Skins How To Get Cody Rhodes And The Undertaker

May 03, 2025 -

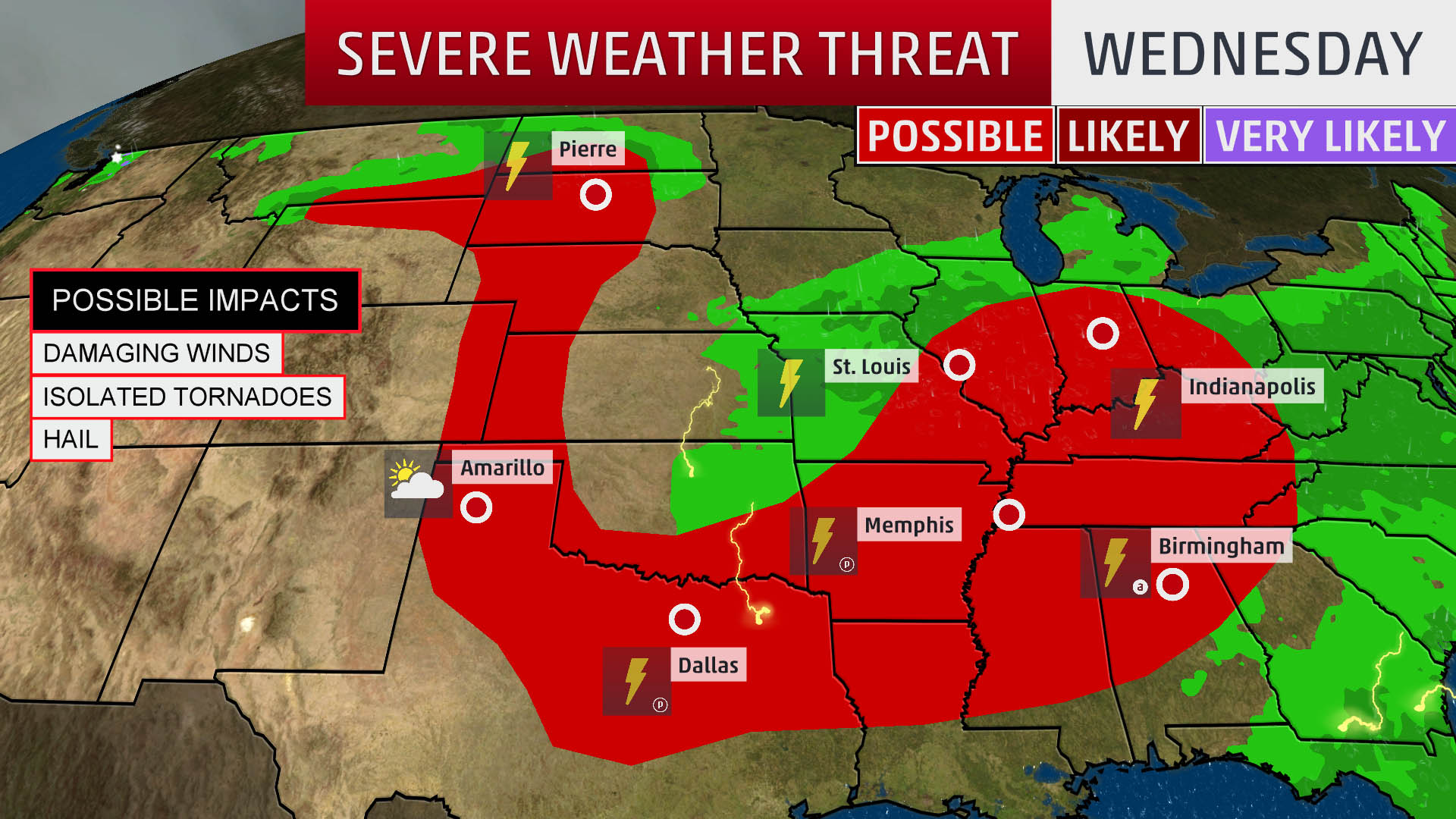

Tulsa Severe Weather Alert Peak Risk Post 2 Am

May 03, 2025

Tulsa Severe Weather Alert Peak Risk Post 2 Am

May 03, 2025 -

Is Milwaukees Rental Market Too Exclusive

May 03, 2025

Is Milwaukees Rental Market Too Exclusive

May 03, 2025 -

Fortnite Server Outage Extended Downtime For Chapter 6 Season 2

May 03, 2025

Fortnite Server Outage Extended Downtime For Chapter 6 Season 2

May 03, 2025

Latest Posts

-

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 04, 2025

Anchor Brewing Companys Legacy 127 Years And Counting To Closure

May 04, 2025 -

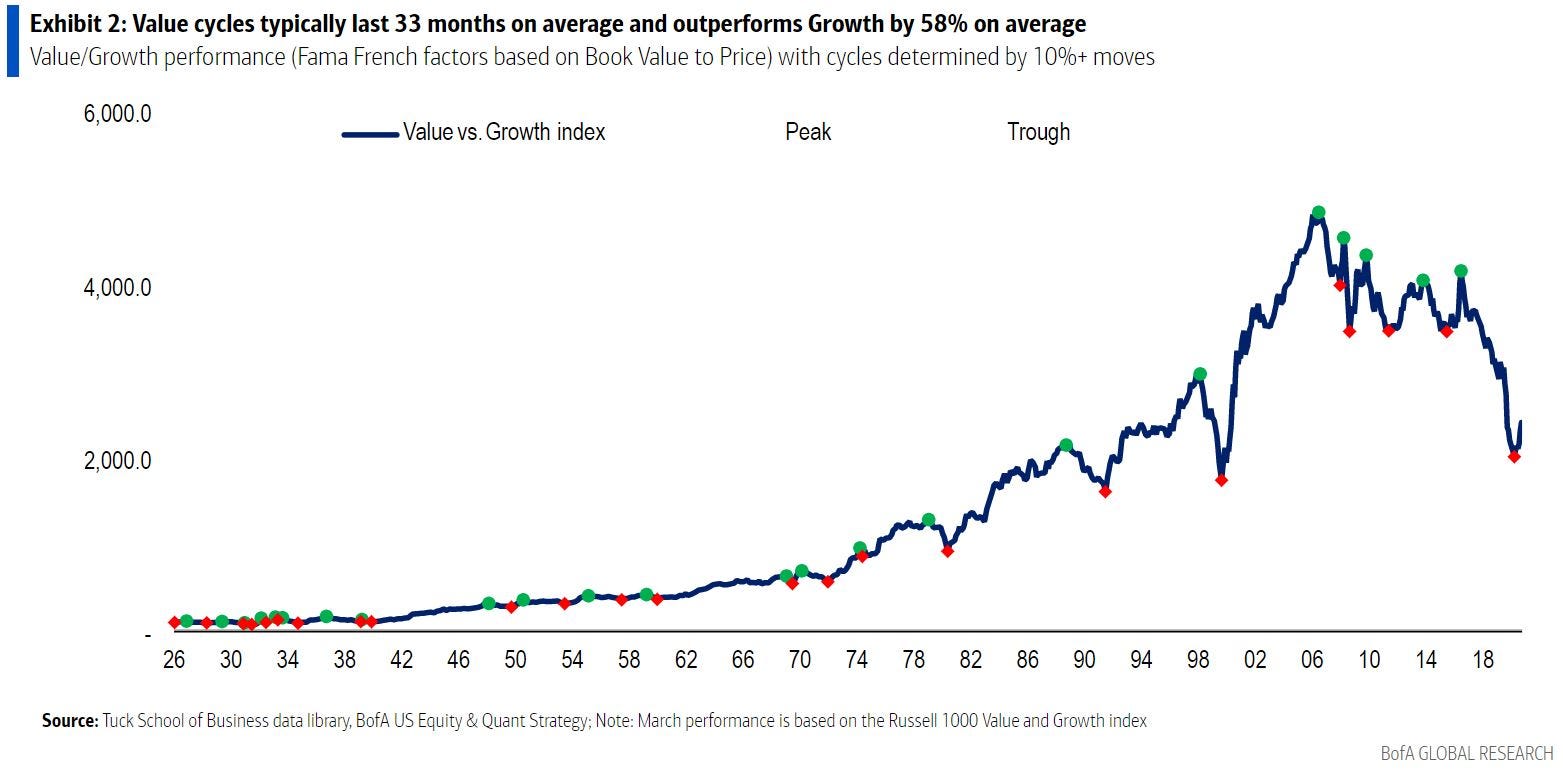

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025

Bof As Rationale Why High Stock Market Valuations Are Not A Cause For Alarm

May 04, 2025 -

Googles Ai Search Algorithm Training Data And Opt Out Considerations

May 04, 2025

Googles Ai Search Algorithm Training Data And Opt Out Considerations

May 04, 2025 -

Middle Managements Contribution To A Thriving Company Culture And Employee Development

May 04, 2025

Middle Managements Contribution To A Thriving Company Culture And Employee Development

May 04, 2025 -

The End Of An Icon Anchor Brewing Company To Close After 127 Years

May 04, 2025

The End Of An Icon Anchor Brewing Company To Close After 127 Years

May 04, 2025