CFP Board CEO's Retirement: Impact On Financial Planners And The Industry

Table of Contents

Leadership Transition and Potential Policy Shifts

The departure of the CEO marks a pivotal moment for the CFP Board. A new leader will bring their own vision and priorities, potentially leading to significant shifts in the organization's strategic direction and policies. This transition creates uncertainty but also opportunities for positive change. The implications extend to various aspects of the CFP Board's operations:

- Leadership Structure: The selection process for the new CEO will be crucial. The chosen individual's experience, background, and leadership style will significantly influence the Board's future trajectory. Will the new CEO prioritize maintaining the status quo, or will we see bold new initiatives?

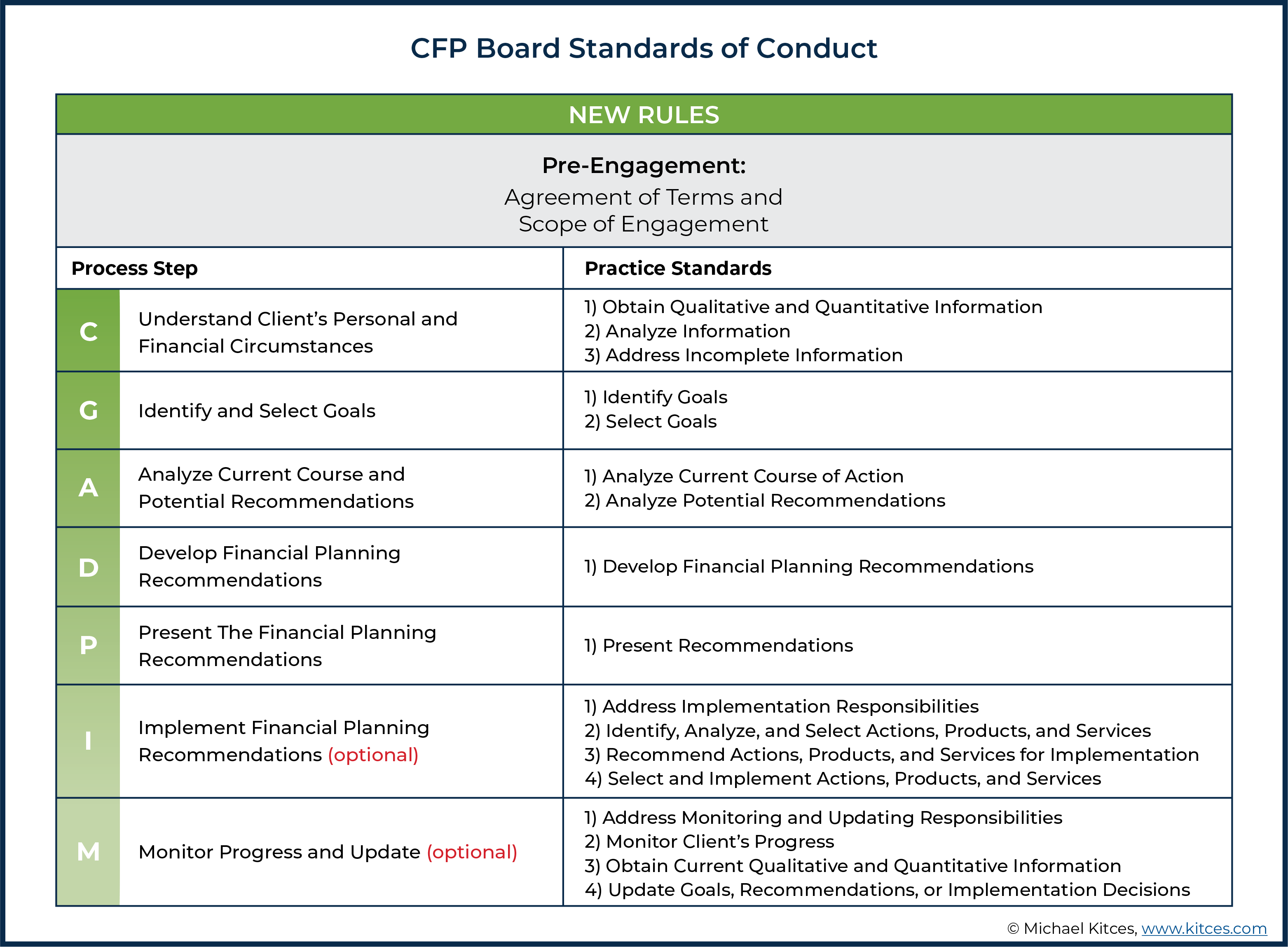

- Strategic Realignment: Expect a review of existing strategies and policies. This might involve a reassessment of the CFP certification process, a shift in focus towards emerging areas within financial planning, or a reevaluation of the enforcement of the CFP Board's ethical standards.

- Policy Changes: Potential alterations include:

- CFP Certification Requirements: The Board might adjust continuing education requirements, introduce new exam components, or refine the existing curriculum to reflect evolving industry trends.

- Focus Areas: The new leadership might emphasize specific areas, such as sustainable investing, fintech integration, or advanced financial planning techniques.

- Ethics and Conduct Enforcement: The approach to enforcing the CFP Board's Code of Ethics and Standards of Conduct could see modifications, potentially leading to stricter or more lenient enforcement procedures.

Impact on CFP Professionals and Certification

The CEO's retirement will directly influence the daily experiences of CFP professionals. The changes implemented by the new leadership will necessitate adaptation and adjustments across the board. This includes:

- Continuing Education: New requirements could necessitate additional training and expenses for CFP professionals to maintain their certification.

- CFP Exam Adjustments: Changes to the exam could impact preparation strategies and potentially the pass rate.

- Liability Insurance: The evolving regulatory landscape may influence the cost and availability of professional liability insurance for CFPs. This is a significant consideration for those practicing independently.

- Value and Prestige of the CFP Certification: The CFP mark is a symbol of trust and competence. Maintaining its value and prestige will be a key focus for the new leadership, as any perceived weakening could affect public confidence.

The Broader Implications for the Financial Planning Industry

The impact of the CFP Board CEO's retirement extends beyond individual CFP professionals. The changes made within the organization will have ramifications for the entire financial planning industry, influencing consumer trust and the overall perception of the profession.

- Consumer Protection: Potential adjustments in regulatory compliance and enforcement could impact consumer protection measures.

- Industry Reputation: Maintaining the reputation and integrity of the CFP designation is crucial for attracting clients and maintaining public confidence.

- Growth and Adaptation: The transition presents opportunities for the industry to adapt to evolving market dynamics, technological advancements, and emerging client needs. This will require proactive measures from financial planners to adapt their services and skills.

Looking Ahead: The Future of the CFP Board

The future of the CFP Board under new leadership presents both challenges and opportunities. The organization must navigate several key factors:

- Adapting to Change: The financial landscape is constantly evolving, demanding the CFP Board to remain agile and responsive to new trends, such as the rise of fintech and the increasing complexity of financial products.

- Technology's Role: The integration of technology will continue to shape the future of financial planning, necessitating changes in education, examination, and practice standards.

- Maintaining Ethical Standards: Upholding high ethical standards and protecting consumers will remain paramount. The CFP Board will need to continue reinforcing its commitment to these core values.

The Lasting Effects of the CFP Board CEO's Retirement

The retirement of the CFP Board CEO represents a significant turning point for the financial planning profession. The leadership transition will bring potential shifts in policy, certification requirements, and the overall landscape of the industry. Navigating these changes will require adaptability, continuous learning, and a commitment to upholding the highest ethical standards. Understanding the implications of the CFP Board CEO's retirement and its impact on financial planners and the industry will be crucial for navigating the evolving landscape and maintaining a competitive edge. Stay updated on the latest developments regarding the CFP Board CEO's retirement and its impact on the future of financial planning.

Featured Posts

-

Kampens Strijd Voor Stroom Kort Geding Tegen Enexis

May 02, 2025

Kampens Strijd Voor Stroom Kort Geding Tegen Enexis

May 02, 2025 -

Trump Tariff Uncertainty Navigating The Complexities For Automakers

May 02, 2025

Trump Tariff Uncertainty Navigating The Complexities For Automakers

May 02, 2025 -

April 16 2025 Lotto Results Winning Numbers

May 02, 2025

April 16 2025 Lotto Results Winning Numbers

May 02, 2025 -

Alec Baldwins Rust A Critical Review Of The Completed Film

May 02, 2025

Alec Baldwins Rust A Critical Review Of The Completed Film

May 02, 2025 -

Is Milwaukees Rental Market Really That Exclusive And Competitive

May 02, 2025

Is Milwaukees Rental Market Really That Exclusive And Competitive

May 02, 2025

Latest Posts

-

Christina Aguilera Addresses Incident Involving Unwanted Kiss From Fan

May 03, 2025

Christina Aguilera Addresses Incident Involving Unwanted Kiss From Fan

May 03, 2025 -

Inappropriate Kiss Fans Actions Towards Christina Aguilera Criticized

May 03, 2025

Inappropriate Kiss Fans Actions Towards Christina Aguilera Criticized

May 03, 2025 -

The Christina Aguilera Transformation A Closer Look At Her Youthful Appearance

May 03, 2025

The Christina Aguilera Transformation A Closer Look At Her Youthful Appearance

May 03, 2025 -

Christina Aguilera A Fans Inappropriate Kiss Sparks Controversy

May 03, 2025

Christina Aguilera A Fans Inappropriate Kiss Sparks Controversy

May 03, 2025 -

Fans In Awe Christina Aguileras Incredible Transformation

May 03, 2025

Fans In Awe Christina Aguileras Incredible Transformation

May 03, 2025