Chainalysis Expands AI Capabilities With Alterya Acquisition

Table of Contents

Enhanced Blockchain Investigations with AI

Alterya's acquisition brings substantial advancements to Chainalysis's existing blockchain analysis capabilities. The integration of Alterya's AI-powered technology significantly improves the speed, accuracy, and efficiency of investigations.

Improved Transaction Monitoring

Chainalysis's already robust transaction monitoring capabilities receive a substantial boost with Alterya's technology. This means:

- Increased speed and accuracy of transaction analysis: AI algorithms can process vast amounts of data far faster than human analysts, identifying suspicious patterns indicative of money laundering or other financial crimes with greater precision.

- Improved detection of complex money laundering schemes: Sophisticated schemes involving layering and obfuscation techniques are more easily uncovered through Alterya's advanced pattern recognition capabilities. The AI can detect subtle anomalies that might be missed by human analysts.

- Reduced manual review workload for investigators: By automating the identification of high-risk transactions, Alterya frees up investigators to focus on the most complex and crucial cases, increasing overall efficiency.

Advanced Risk Scoring and Prioritization

The integration of Alterya's AI significantly improves Chainalysis's risk scoring models. This leads to:

- More efficient allocation of resources to high-risk cases: Investigations can be prioritized based on accurate risk assessments, ensuring that limited resources are used effectively.

- Proactive identification of emerging threats: AI can identify patterns and anomalies that indicate new or evolving money laundering techniques, allowing for a proactive response.

- Reduced false positives: More accurate risk scoring leads to fewer false alarms, saving investigators time and improving the overall accuracy of their investigations.

Automated KYC/AML Compliance

Alterya's technology streamlines KYC/AML compliance processes for businesses, making it easier to meet stringent regulatory requirements. This includes:

- Automated customer due diligence: AI can automate the verification of customer identities and addresses, reducing manual effort and speeding up the onboarding process.

- Simplified compliance reporting: The system can automatically generate compliance reports, ensuring accuracy and reducing the administrative burden.

- Reduced compliance costs: Automation of compliance processes reduces the time and resources required, resulting in significant cost savings for businesses.

Expanding Chainalysis's Product Suite and Market Reach

The Alterya acquisition isn't just about enhancing existing tools; it significantly expands Chainalysis's product suite and market reach.

Synergies Between Chainalysis and Alterya

The acquisition brings powerful technological synergies. Specifically:

- Integration of Alterya's AI algorithms into Chainalysis's platform: This integration creates a more powerful and comprehensive platform for blockchain analysis.

- Expansion of data sources and analysis capabilities: Alterya's technology complements and expands Chainalysis's existing data sources and analytical capabilities.

- Enhanced user experience for Chainalysis clients: The integration will provide a more user-friendly and efficient experience for Chainalysis's clients.

New Market Opportunities

This enhanced capability opens exciting new markets for Chainalysis:

- Attracting new clients in the financial services sector: The improved compliance tools make Chainalysis a more attractive solution for financial institutions needing robust AML/KYC compliance.

- Expanding into new geographical markets: The improved technology allows Chainalysis to serve a wider range of international clients with varying regulatory needs.

- Providing enhanced solutions for law enforcement agencies: The advanced investigative tools provide law enforcement with more effective weapons in the fight against cryptocurrency-related crime.

Implications for the Future of Blockchain Security and Regulatory Compliance

The Chainalysis-Alterya merger has profound implications for the future of blockchain security and regulatory compliance.

Strengthening the Fight Against Financial Crime

This acquisition strengthens the fight against cryptocurrency-related financial crime by:

- Improved detection and prevention of illicit activities: The enhanced AI capabilities allow for faster and more accurate detection of suspicious activities.

- Enhanced collaboration between public and private sectors: The improved tools facilitate better information sharing and collaboration between law enforcement and private sector companies.

- Increased transparency in the cryptocurrency market: Improved monitoring and detection of illicit activities contribute to greater transparency and trust in the cryptocurrency ecosystem.

Setting New Standards for Regulatory Compliance

The enhanced capabilities set a new benchmark for regulatory compliance:

- More robust KYC/AML frameworks: Chainalysis's enhanced tools will contribute to the development of more robust and effective KYC/AML frameworks.

- Improved data sharing and collaboration: The improved capabilities enable better data sharing and collaboration between different regulatory bodies.

- Increased confidence in the cryptocurrency ecosystem: By improving security and compliance, Chainalysis helps foster greater trust and confidence in the cryptocurrency ecosystem.

Conclusion

The Chainalysis acquisition of Alterya marks a significant advancement in leveraging AI for blockchain analysis, promising enhanced capabilities in financial crime investigations, regulatory compliance, and overall security within the cryptocurrency sector. This strategic move signifies a commitment to improving the safety and transparency of the blockchain ecosystem. To learn more about how Chainalysis is using AI to lead the way in blockchain analysis and strengthen the fight against financial crime, visit [Chainalysis Website Link]. Stay ahead of the curve in cryptocurrency investigations and regulatory compliance by exploring the advanced capabilities of Chainalysis's AI-powered solutions.

Featured Posts

-

Now Torontos Detour Exploring Nosferatu The Vampyre

Apr 27, 2025

Now Torontos Detour Exploring Nosferatu The Vampyre

Apr 27, 2025 -

Open Thread February 16 2025 Your Thoughts And Ideas

Apr 27, 2025

Open Thread February 16 2025 Your Thoughts And Ideas

Apr 27, 2025 -

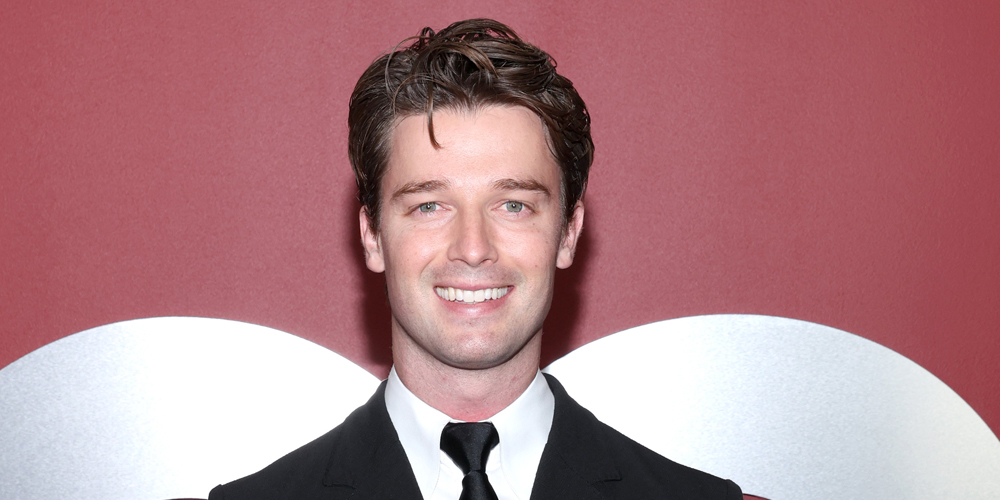

Patrick Schwarzeneggers White Lotus Role A Surprise Ariana Grande Music Video Appearance

Apr 27, 2025

Patrick Schwarzeneggers White Lotus Role A Surprise Ariana Grande Music Video Appearance

Apr 27, 2025 -

Descartada Una Favorita En Indian Wells Analisis Del Resultado

Apr 27, 2025

Descartada Una Favorita En Indian Wells Analisis Del Resultado

Apr 27, 2025 -

A Pre 2025 Review Of Horse Deaths At The Grand National

Apr 27, 2025

A Pre 2025 Review Of Horse Deaths At The Grand National

Apr 27, 2025

Latest Posts

-

Xs Financial Restructuring Analyzing The Impact Of Musks Debt Sale

Apr 28, 2025

Xs Financial Restructuring Analyzing The Impact Of Musks Debt Sale

Apr 28, 2025 -

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025 -

2000 Yankees Season Posadas Home Run Ends Royals Threat

Apr 28, 2025

2000 Yankees Season Posadas Home Run Ends Royals Threat

Apr 28, 2025 -

Remembering 2000 Posadas Crucial Homer Against The Royals

Apr 28, 2025

Remembering 2000 Posadas Crucial Homer Against The Royals

Apr 28, 2025 -

Posadas Blast Stifles Royals Surge A 2000 Yankees Diary Entry

Apr 28, 2025

Posadas Blast Stifles Royals Surge A 2000 Yankees Diary Entry

Apr 28, 2025