Chart Of The Week: Evaluating Bitcoin's 10x Multiplier Scenario

Table of Contents

Historical Bitcoin Price Performance and Growth Cycles

Analyzing Bitcoin's history is crucial to understanding its potential for future growth. By studying past bull markets, we can identify patterns and potential indicators for a future 10x Bitcoin multiplier scenario.

Analyzing Past Bull Runs

Bitcoin's history is punctuated by periods of explosive growth, often referred to as bull runs. These bull markets have been characterized by significant price increases and intense market enthusiasm.

- 2011-2013: Bitcoin's price increased from under $1 to over $1,000, a staggering gain. This period was fueled by early adoption and increasing awareness of the technology.

- 2017: A dramatic surge saw Bitcoin reach nearly $20,000, driven by factors like increasing institutional interest and mainstream media coverage.

- 2020-2021: Bitcoin experienced another significant bull run, reaching all-time highs above $60,000. This was fueled by a combination of factors including the COVID-19 pandemic, quantitative easing, and growing institutional adoption.

[Insert chart here illustrating Bitcoin price history, highlighting the bull runs mentioned above. Source should be clearly cited.]

Understanding the drivers behind these past bull runs – including halving events which reduce the rate of new Bitcoin creation, increasing adoption rates among both individuals and institutions, and shifting regulatory landscapes – is crucial to evaluating the possibility of a future 10x Bitcoin multiplier. Analyzing these historical trends provides valuable context for our analysis of a potential Bitcoin price prediction.

Identifying Potential Catalysts for a 10x Multiplier

Several factors could potentially catalyze a 10x price increase for Bitcoin. These catalysts aren't guaranteed, but their presence significantly impacts the likelihood of such a dramatic surge.

- Increased Institutional Adoption: Continued adoption by major financial institutions, hedge funds, and corporations could drive substantial demand.

- Bitcoin ETF Approval: Approval of a Bitcoin exchange-traded fund (ETF) by regulatory bodies would likely boost liquidity and accessibility, attracting a wider range of investors.

- Global Economic Uncertainty: Periods of economic instability can often lead investors to seek alternative, decentralized assets like Bitcoin as a hedge against inflation and currency devaluation.

- Technological Advancements: Developments like improved scalability solutions (e.g., Lightning Network) and enhanced privacy features could further drive adoption and increase the utility of Bitcoin.

Evaluating the Feasibility of a 10x Bitcoin Multiplier

While a 10x Bitcoin multiplier is a compelling prospect, a realistic assessment requires analyzing its implications and potential obstacles.

Market Capitalization Analysis

A 10x price increase would drastically alter Bitcoin's market capitalization. Currently, Bitcoin’s market cap is [Insert current market cap]. A 10x increase would propel its market cap to [Calculate and insert resulting market cap]. This would require significant capital inflow and would place Bitcoin’s market capitalization within the realm of some of the world’s largest companies and asset classes, like gold. This analysis must acknowledge the potential limitations of such a massive increase and consider its impact on the broader cryptocurrency market.

Addressing Potential Risks and Challenges

Several factors could impede or prevent a 10x Bitcoin multiplier scenario:

- Regulatory Hurdles: Increased regulatory scrutiny or outright bans in major jurisdictions could significantly impact Bitcoin's price.

- Macroeconomic Factors: Global economic downturns, inflation, or other macroeconomic events could negatively affect Bitcoin's value, as it's often seen as a risk asset.

- Security Concerns: Major security breaches or vulnerabilities within the Bitcoin network could erode investor confidence.

- Competition from Altcoins: The emergence of competing cryptocurrencies with innovative features could divert investment away from Bitcoin. Bitcoin's market dominance would face a challenge.

- Bitcoin Volatility: Bitcoin's inherent volatility is a double-edged sword. While it allows for significant gains, it also poses substantial risks of sharp price drops.

Technical Analysis and Chart Patterns

Technical analysis and on-chain data offer additional insights into the potential for a Bitcoin 10x multiplier.

Identifying Key Support and Resistance Levels

Technical analysis involves studying price charts and indicators to identify potential price movements. Key support and resistance levels, identified through indicators like moving averages, RSI, and MACD, can suggest potential price reversals or breakouts.

[Insert chart here showing Bitcoin's price with key support and resistance levels marked. Source should be clearly cited.]

Studying chart patterns, such as head and shoulders or triangles, can also provide clues about future price direction. These patterns, when combined with indicators, can offer a more comprehensive picture of Bitcoin's potential trajectory.

Interpreting On-Chain Metrics

On-chain data, such as transaction volume, active addresses, and network hash rate, can provide valuable insights into market sentiment and network activity. Increased transaction volume or a growing number of active addresses often correlate with increased demand and potential price appreciation.

Analyzing on-chain metrics alongside price charts helps to provide a more robust assessment of the underlying strength of the Bitcoin network and its potential for future price growth.

Conclusion

The possibility of a Bitcoin 10x multiplier presents a captivating yet complex scenario. While historical performance suggests Bitcoin's capacity for significant growth, fueled by potential catalysts like increased institutional adoption and technological advancements, substantial risks and challenges remain. A thorough understanding of market capitalization implications, potential regulatory hurdles, and macroeconomic factors is crucial. Careful analysis of technical indicators and on-chain data adds further layers of perspective. Ultimately, the journey to a 10x Bitcoin multiplier is uncertain and hinges on numerous intertwined factors.

Conduct your own thorough research and assess your personal risk tolerance before investing in Bitcoin. Understanding the complexities surrounding Bitcoin's 10x potential is paramount to making informed investment decisions. Continue your research into Bitcoin's 10x multiplier potential with our other articles and resources.

Featured Posts

-

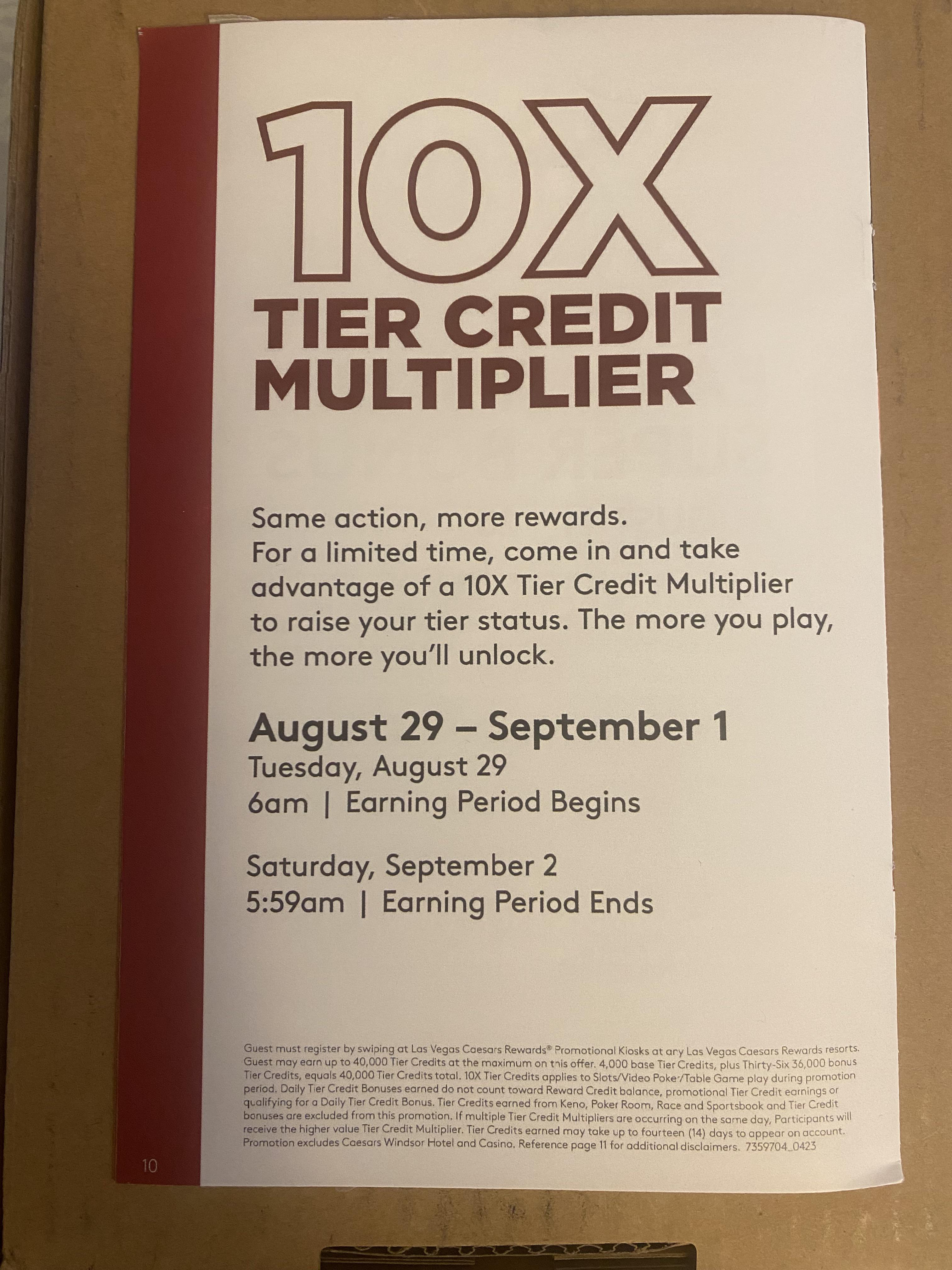

Neymar De Vuelta En Brasil Convocatoria Para Eliminatorias Y Posible Duelo Ante Messi

May 08, 2025

Neymar De Vuelta En Brasil Convocatoria Para Eliminatorias Y Posible Duelo Ante Messi

May 08, 2025 -

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025

Lahwr 5 Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Aelan

May 08, 2025 -

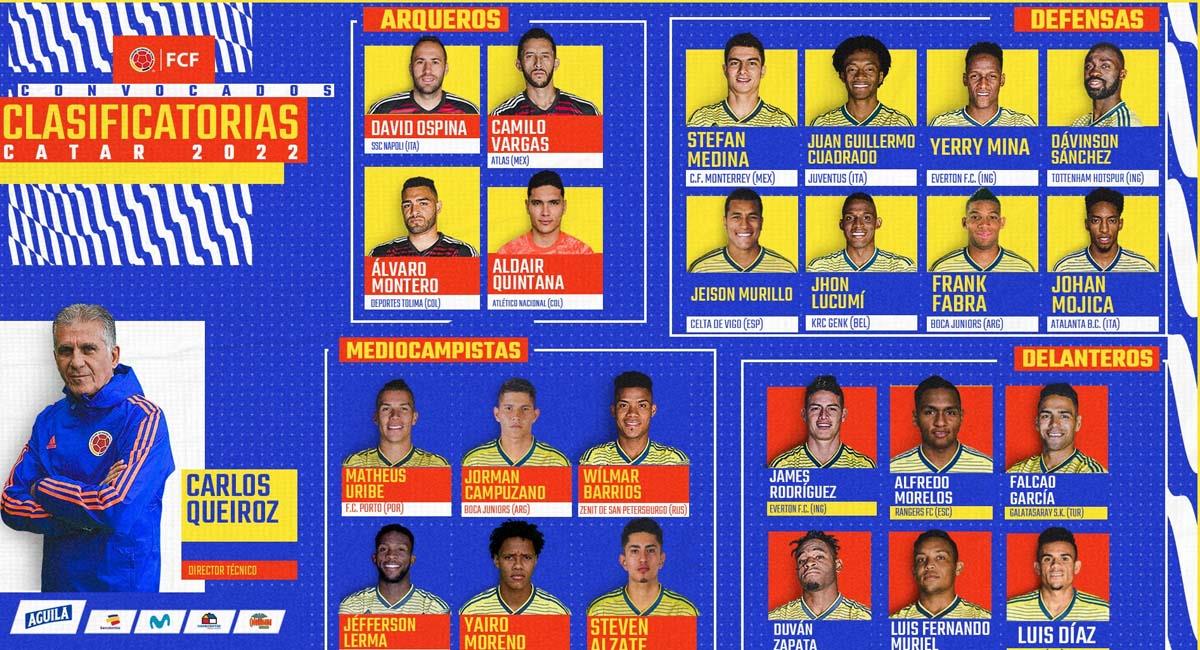

Latest Arsenal News Collymores Assessment Of Artetas Performance

May 08, 2025

Latest Arsenal News Collymores Assessment Of Artetas Performance

May 08, 2025 -

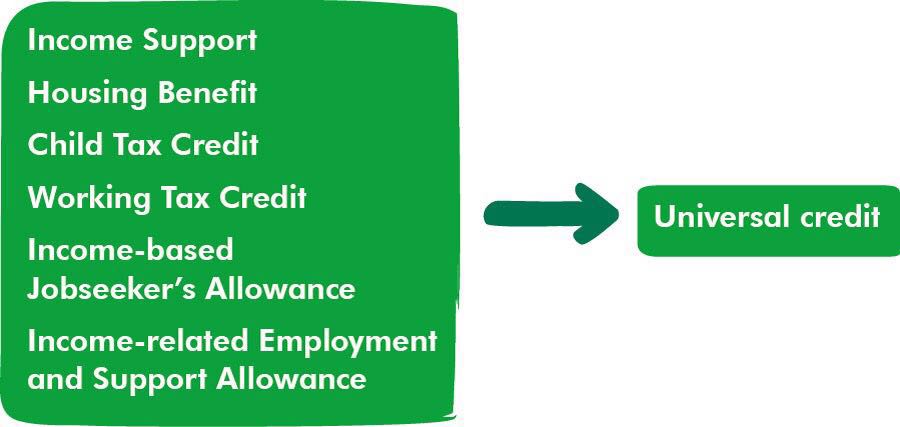

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025 -

Us Canada Trade Talks A Path Towards Coherence

May 08, 2025

Us Canada Trade Talks A Path Towards Coherence

May 08, 2025