Check Your Savings: Could HMRC Owe You Money?

Table of Contents

Common Reasons HMRC Might Owe You Money

Several reasons could mean HMRC owes you a tax refund. Let's explore some of the most common scenarios:

Overpaid Income Tax

Overpaying income tax happens more often than you might think. This can be due to various reasons, including changes in your circumstances or errors in your tax code.

- Changes in circumstances: Getting married and utilizing the marriage allowance, changing jobs, or starting a new job with a different tax code can all affect your tax liability.

- Incorrect tax codes: An incorrect tax code provided by your employer can result in too much tax being deducted from your salary.

- Self-assessment inaccuracies: Mistakes on your self-assessment tax return, whether intentional or unintentional, can lead to overpayment or underpayment of tax. For example, forgetting to claim a relevant tax relief.

Unclaimed Tax Reliefs and Allowances

Many people are unaware of the various tax reliefs and allowances they're eligible for. Claiming these can significantly reduce your tax bill and potentially result in a substantial tax rebate.

- Marriage Allowance: If you're married or in a civil partnership, and one partner earns less than the personal allowance, you might be able to transfer some of their allowance to the higher-earning partner.

- Childcare vouchers: If you used childcare vouchers before 2018, you might be able to claim tax relief on the contributions.

- Pension contribution relief: Contributions to a registered pension scheme can qualify for tax relief, reducing your taxable income.

- Gift Aid: If you donate to a registered charity, you can reclaim the tax the charity paid on your donation. This is often overlooked.

Errors in Your Tax Return

Mistakes on your self-assessment tax return are a common reason for tax overpayments or underpayments. Accurate record-keeping is crucial to avoid errors.

- Incorrect income figures: Failing to accurately report all your income sources can lead to underpayment or overpayment.

- Incorrect expenses: Overstating or understating business expenses on your self-assessment tax return can have a significant impact on your tax liability.

- Missing deductions: Forgetting to claim allowable deductions for your business expenses can lead to you paying more tax than necessary.

How to Check if HMRC Owes You Money

There are several ways to check if HMRC owes you money:

Accessing Your HMRC Online Account

The easiest way is through your HMRC online account. This provides a detailed overview of your tax calculations.

- Step 1: Go to the HMRC website and log in to your online account.

- Step 2: Navigate to your tax summaries and review your income tax calculations for previous years.

- Step 3: Look for any potential discrepancies or areas where you might have overpaid.

- Step 4: Check if any tax reliefs or allowances have been applied correctly.

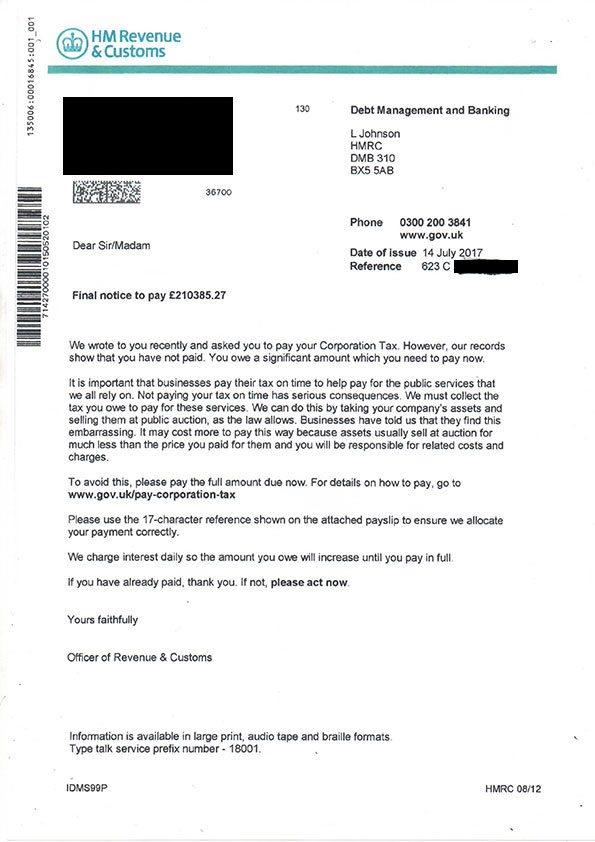

Contacting HMRC Directly

If you have difficulty accessing your online account or need further clarification, contact HMRC directly.

- Phone: Call the HMRC helpline (check their website for the most up-to-date number).

- Letter: Send a written enquiry to the appropriate HMRC address (details available on their website).

- Online: Use the HMRC website's online contact form.

Claiming Your Refund

Once you've identified a potential overpayment, you need to claim your refund.

The Claim Process

Claiming a tax refund involves submitting a claim form to HMRC. This usually involves providing supporting documentation, such as payslips or bank statements. Processing times vary, but you should receive communication from HMRC after your claim is submitted.

- Step 1: Gather all necessary documentation.

- Step 2: Complete the relevant HMRC claim form.

- Step 3: Submit your claim form to HMRC via post or online.

What to Expect After Submitting Your Claim

After submitting your claim, HMRC will review your documentation and process your request. You should receive confirmation of receipt and a notification once your claim is processed, indicating whether it has been successful. Be prepared for potential delays.

Conclusion: Check Your Savings – Don't Miss Out on Your HMRC Refund

Many individuals are entitled to an HMRC tax refund due to overpaid income tax, unclaimed tax reliefs, or errors on their tax returns. Regularly checking your tax details is crucial to ensure you're not missing out on potential savings. Take action today! Check your HMRC online account or contact HMRC directly to see if you're eligible for a tax rebate. Don't miss out on your potential tax refund – check your savings today and see if HMRC owes you money!

Featured Posts

-

Chinese Grand Prix 2024 Hamilton And Leclercs Race Defining Contact

May 20, 2025

Chinese Grand Prix 2024 Hamilton And Leclercs Race Defining Contact

May 20, 2025 -

Vtoroy Rebenok Dzhennifer Lourens Podtverzhdeno

May 20, 2025

Vtoroy Rebenok Dzhennifer Lourens Podtverzhdeno

May 20, 2025 -

The Return Of Agatha Christie A New Bbc Venture

May 20, 2025

The Return Of Agatha Christie A New Bbc Venture

May 20, 2025 -

Biarritz Decouvrir Les Nouveaux Restaurants Et Chefs

May 20, 2025

Biarritz Decouvrir Les Nouveaux Restaurants Et Chefs

May 20, 2025 -

Dusan Tadic Sari Lacivertli Tarihe Damga Vurdu Mu

May 20, 2025

Dusan Tadic Sari Lacivertli Tarihe Damga Vurdu Mu

May 20, 2025

Latest Posts

-

Jennifer Lawrence Zivot S Dvoje Djece

May 20, 2025

Jennifer Lawrence Zivot S Dvoje Djece

May 20, 2025 -

Rodenje Drugog Djeteta Jennifer Lawrence Sve Sto Znamo

May 20, 2025

Rodenje Drugog Djeteta Jennifer Lawrence Sve Sto Znamo

May 20, 2025 -

Novo Dijete Jennifer Lawrence Objava I Prve Fotografije

May 20, 2025

Novo Dijete Jennifer Lawrence Objava I Prve Fotografije

May 20, 2025 -

Jennifer Lawrence Majcinstvo I Nova Beba

May 20, 2025

Jennifer Lawrence Majcinstvo I Nova Beba

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Kada I Gdje Se Dogodio Dogadaj

May 20, 2025

Drugo Dijete Jennifer Lawrence Kada I Gdje Se Dogodio Dogadaj

May 20, 2025