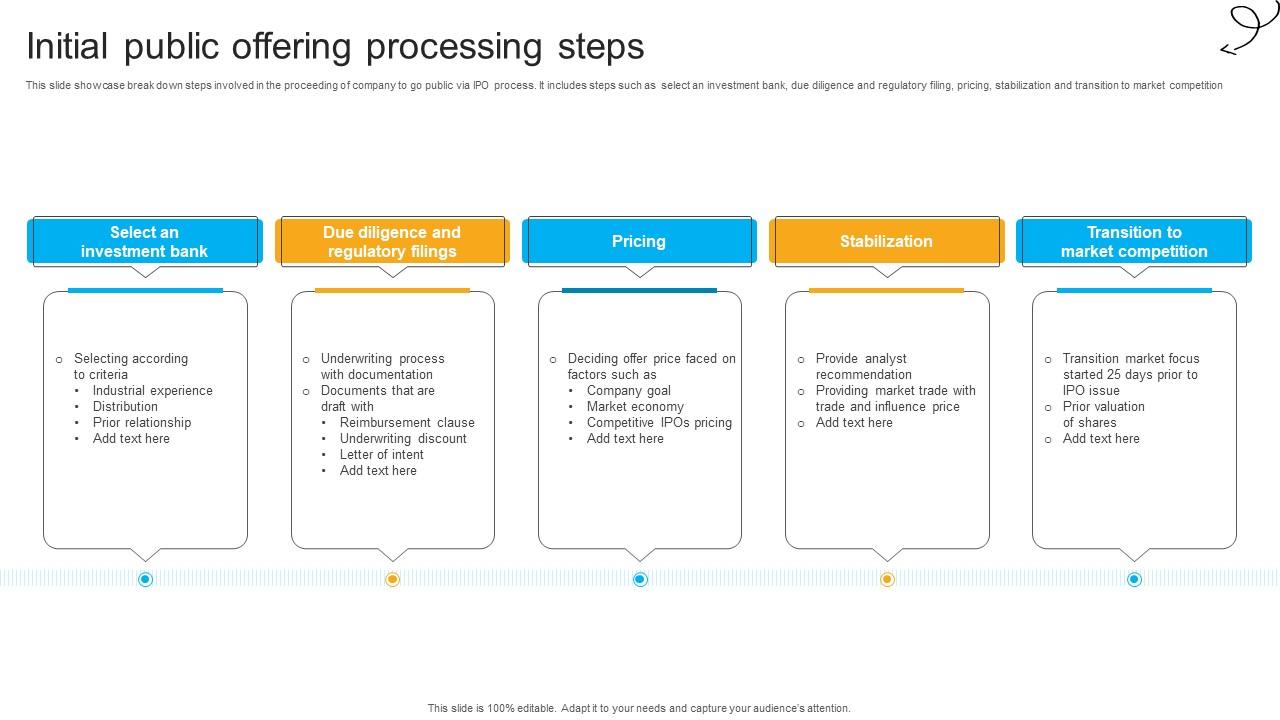

Chime's Initial Public Offering: Examining The Rise Of The Fintech Challenger

Table of Contents

Chime's Business Model and Market Position

Chime's core offering centers around fee-free checking and savings accounts, coupled with a debit card and a user-friendly mobile app. This simple yet effective approach has resonated strongly with its target demographic: millennials, Gen Z, and underserved populations who often find traditional banking institutions expensive and inaccessible. Chime's success can be attributed to its strategic positioning as a neobank, effectively disrupting the traditional digital banking model. Its competitive advantage lies in its seamless user experience, transparent pricing, and focus on financial inclusion.

- Market Share and Growth: Chime boasts millions of active users and continues to experience impressive year-over-year growth, solidifying its position as a major player in the neobank market. Precise market share data is often proprietary, but various reports indicate significant growth projections for the company.

- Key Partnerships and Collaborations: Chime has strategically formed partnerships to expand its offerings and reach a wider customer base. These collaborations often extend its financial services ecosystem, enhancing its appeal to consumers.

- Strengths and Weaknesses: Chime’s strengths are its user-friendly platform, strong brand reputation, and aggressive growth strategy. However, potential weaknesses include its reliance on interchange fees for revenue and the competitive landscape of the fintech sector.

Factors Contributing to Chime's Success

Chime's rise to prominence can be attributed to a combination of factors: its innovative technology and user experience, effective marketing strategies, and the favorable regulatory environment and broader market trends supporting fintech disruption.

- Technology and UX: Chime's mobile-first approach and intuitive app design have created a seamless and enjoyable banking experience, attracting and retaining customers. Its robust technological infrastructure ensures secure and reliable transactions.

- Marketing and Branding: Chime has masterfully cultivated a brand image associated with simplicity, transparency, and financial empowerment. Its targeted marketing campaigns have resonated strongly with its desired demographic. For example, (insert example of a successful marketing campaign here).

- Regulatory Landscape and Market Trends: The increasing demand for accessible and affordable financial services, coupled with evolving regulations, has created a fertile ground for Chime's growth. Fintech disruption is accelerating, pushing traditional banks to innovate or risk losing market share.

Potential Challenges and Risks Associated with the Chime IPO

While a Chime IPO presents significant opportunities, several challenges and risks must be considered.

- Regulatory Hurdles: The fintech sector faces evolving regulations, and compliance remains a crucial aspect for any successful IPO. Chime, like other neobanks, needs to navigate the complexities of financial regulations. Specific concerns include (mention specific regulatory concerns for fintech companies, e.g., data privacy, anti-money laundering compliance).

- Competitive Landscape: The fintech industry is highly competitive, with both established players and emerging startups vying for market share. Chime will face competition from other neobanks, as well as traditional banks that are increasingly adopting digital banking strategies. (Mention specific competitors and their strategies).

- Profitability and Sustainability: While Chime has experienced rapid user growth, achieving sustainable profitability remains a key challenge. The company's revenue model primarily relies on interchange fees, which could be vulnerable to changes in the payments landscape. (Discuss Chime's revenue model and profitability margins in detail).

Valuation and Investor Expectations for the Chime IPO

Determining the appropriate valuation for Chime's IPO is a complex process, dependent on various factors including its projected future growth, market conditions, and comparable company valuations within the fintech sector.

- Comparable Company Valuations: Analyzing the market capitalization of similar fintech companies provides a benchmark for evaluating Chime's potential valuation. (Provide data on market capitalization of similar companies and explain the rationale for choosing these comparables).

- Investor Sentiment: The overall investor sentiment towards fintech companies will significantly impact the success of Chime's IPO. Factors such as economic conditions and investor appetite for risk will influence the pricing and demand for Chime's shares. (Analyze investor sentiment towards fintech companies).

- IPO Pricing and Share Allocation: The IPO pricing and share allocation will be strategically determined to maximize the fundraising while ensuring a successful market debut. This involves considering the current market conditions, investor demand, and the company’s long-term growth strategy.

Conclusion

Chime's journey from a fintech startup to a potential IPO candidate is a testament to its innovative business model, effective marketing strategies, and the growing demand for accessible financial services. The Chime IPO represents a significant milestone, not only for the company but also for the broader fintech sector. While a successful IPO presents immense opportunities, navigating the challenges associated with regulation, competition, and achieving sustainable profitability remains crucial. To stay updated on the Chime IPO and the future of the fintech sector, follow reputable financial news sources and subscribe to industry newsletters. Stay informed about the Chime initial public offering to better understand the evolving dynamics of the fintech landscape and the impact of this significant Fintech IPO.

Featured Posts

-

Potentially Lethal Creamer Recalled Important Information For Michigan Coffee Drinkers

May 14, 2025

Potentially Lethal Creamer Recalled Important Information For Michigan Coffee Drinkers

May 14, 2025 -

Uruguay Lamenta La Muerte De Su Expresidente Jose Mujica A Los 89 Anos

May 14, 2025

Uruguay Lamenta La Muerte De Su Expresidente Jose Mujica A Los 89 Anos

May 14, 2025 -

Bianca Censoris Racy Roller Skating Outfit Bra And Thong

May 14, 2025

Bianca Censoris Racy Roller Skating Outfit Bra And Thong

May 14, 2025 -

Is Kanye West Controlling Bianca Censoris Life An Insider Weighs In

May 14, 2025

Is Kanye West Controlling Bianca Censoris Life An Insider Weighs In

May 14, 2025 -

Country Star George Strait Makes Surprise Dairy Queen Appearance

May 14, 2025

Country Star George Strait Makes Surprise Dairy Queen Appearance

May 14, 2025