China Life's Investment Strength Fuels Profit Increase

Table of Contents

Strategic Investment Portfolio Diversification

China Life's success stems from a highly diversified investment portfolio, carefully constructed to balance risk and reward. This strategic approach mitigates potential losses while maximizing returns across various asset classes.

Real Estate Investments

China Life has made significant inroads in the real estate sector, strategically investing in both Tier 1 and Tier 2 cities across China. This geographical diversification minimizes exposure to localized market fluctuations. Key projects have yielded substantial returns, contributing significantly to overall investment performance.

- Successful Ventures: Investment in prime commercial properties in major metropolitan areas like Beijing and Shanghai have generated strong rental income and capital appreciation.

- Tier 2 City Expansion: Investments in rapidly developing Tier 2 cities have provided high-growth potential, further diversifying their portfolio and reducing reliance on top-tier markets.

- Contribution to Returns: Real estate investments currently account for approximately X% (replace X with actual data if available) of China Life's total investment returns.

Equities and Bonds

China Life's equity and bond portfolio demonstrates a sophisticated approach to asset allocation. A balanced strategy, focused on risk management and sector-specific opportunities, ensures stability and growth.

- Equity Sector Allocation: The portfolio is strategically distributed across key sectors including technology, financials, and consumer goods, reflecting a diversified approach to market exposure.

- Bond Investment Strategy: China Life leverages bond investments to generate stable, predictable income streams, acting as a crucial buffer against market volatility within their China Life investment strategy.

- Performance Data: (Insert data illustrating the performance of the equity and bond portfolios, e.g., average annual returns over the past X years).

Alternative Investments

Recognizing the potential for higher returns, China Life has also ventured into alternative investments, including private equity and infrastructure projects. This forward-thinking approach strengthens their China Life investment performance.

- Rationale: Diversification into alternative assets helps to further reduce overall portfolio risk and capture growth opportunities not readily available in traditional markets.

- Significant Partnerships and Returns: (Include details of any successful partnerships or investments in this sector, if publicly available).

- Risk-Reward Profile: While carrying higher risk, these investments offer potentially significant returns, contributing positively to the overall performance of the portfolio.

Robust Risk Management Framework

China Life’s impressive investment performance isn't solely based on aggressive strategies; it's underpinned by a robust risk management framework.

Sophisticated Risk Assessment

China Life employs sophisticated methodologies to identify and mitigate potential investment risks. Their assessment considers various factors:

- Market Volatility: Continuous monitoring of market trends and fluctuations allows for proactive adjustments to the investment portfolio.

- Regulatory Changes: China Life's team stays abreast of evolving regulatory landscapes to ensure compliance and optimize investment strategies.

- Geopolitical Factors: Global events and geopolitical shifts are carefully considered to minimize potential negative impacts on investments.

- Risk Mitigation Strategies: Hedging techniques and diversification across asset classes are crucial elements of China Life's risk management strategy.

Experienced Investment Team

China Life boasts an experienced investment team with deep expertise in navigating complex market dynamics. Their collective knowledge and skill are instrumental in generating strong returns.

- Key Personnel: (If publicly available, mention key figures and their expertise).

- Role in Investment Success: The team’s proactive approach to identifying opportunities and mitigating risks directly contributes to China Life’s investment success.

Impact of Favorable Macroeconomic Conditions

While China Life's internal strategies are crucial, the favorable macroeconomic environment in China has also played a significant role in their success.

Government Policies

Supportive government policies within China have created a positive environment for investment and growth within the insurance and investment sectors.

- (Mention specific policies, for example, those promoting infrastructure development or encouraging foreign investment, that have positively impacted China Life).

Economic Growth

China's robust economic growth has provided a fertile ground for investment, contributing significantly to China Life's investment returns.

- (Provide data illustrating the correlation between China's GDP growth and China Life's investment performance, if available).

Conclusion: China Life’s Investment Strength: A Catalyst for Future Success

China Life's remarkable profit increase is a direct result of its strategic investment decisions, a robust risk management framework, and the benefit of favorable macroeconomic conditions. Their diversified portfolio, coupled with a highly skilled investment team, positions them for continued success. The company’s dedication to a balanced investment strategy and proactive risk management has proven to be a winning formula. Explore China Life's investment opportunities and discover the success story behind their impressive growth. Invest in China Life and be a part of their future.

Featured Posts

-

Targets Decision To Scale Back Dei Efforts Analysis Of The Negative Consequences

Apr 30, 2025

Targets Decision To Scale Back Dei Efforts Analysis Of The Negative Consequences

Apr 30, 2025 -

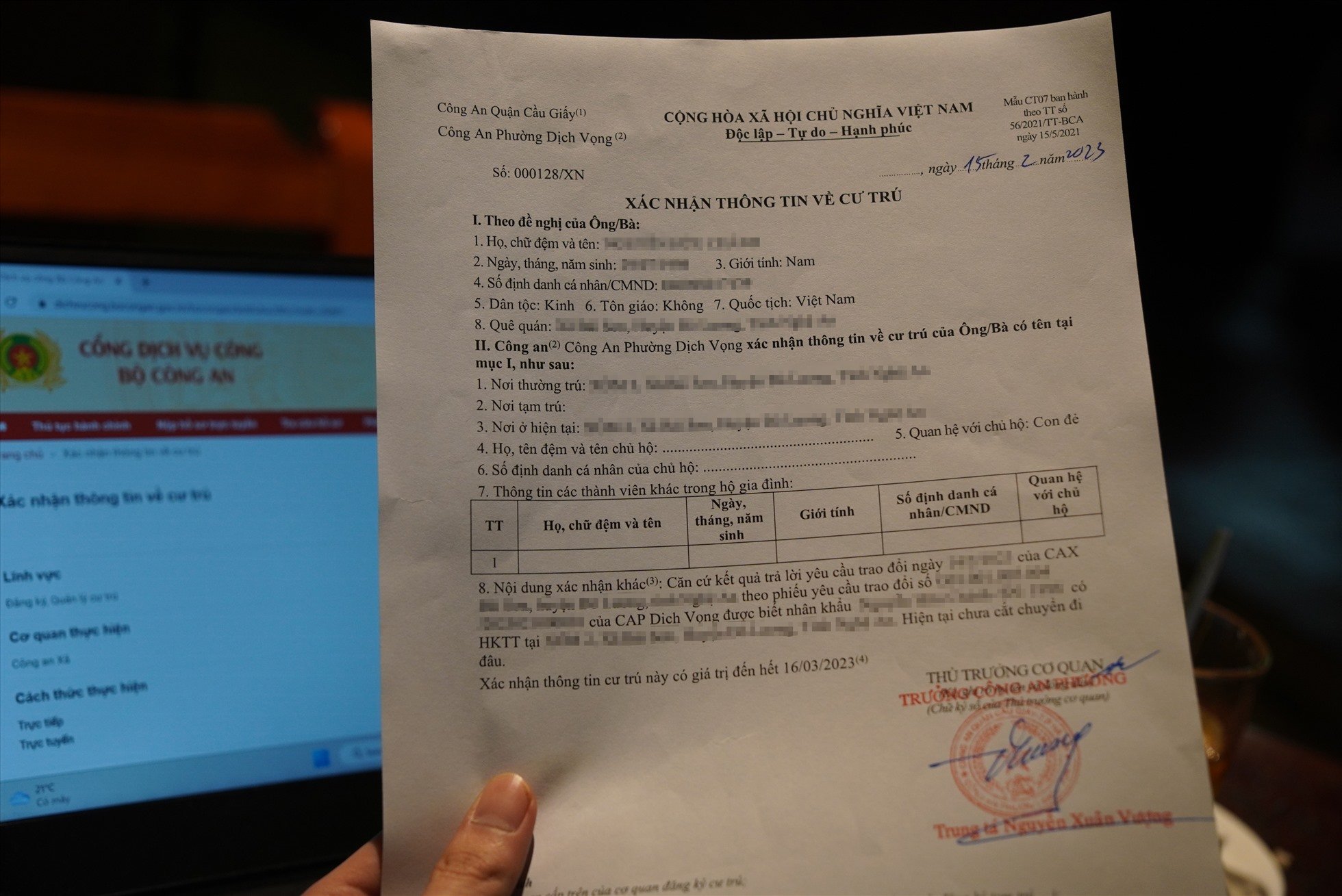

Than Trong Truoc Khi Dau Tu Xac Minh Thong Tin Cong Ty Ky Luong

Apr 30, 2025

Than Trong Truoc Khi Dau Tu Xac Minh Thong Tin Cong Ty Ky Luong

Apr 30, 2025 -

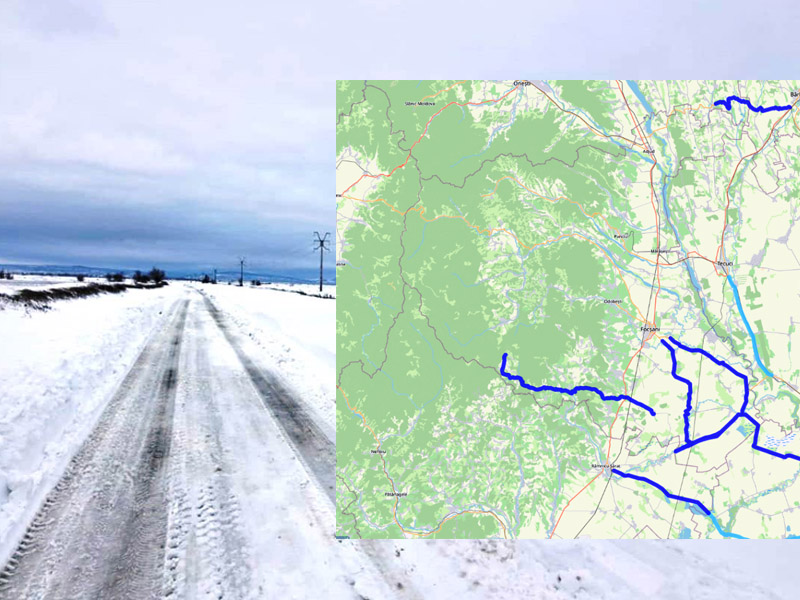

Dosarele X Redeschise Investigatie Jurnalistica De La Viata Libera Galati

Apr 30, 2025

Dosarele X Redeschise Investigatie Jurnalistica De La Viata Libera Galati

Apr 30, 2025 -

Alteawn Yezz Slslt Mmyzth Dd Alshbab

Apr 30, 2025

Alteawn Yezz Slslt Mmyzth Dd Alshbab

Apr 30, 2025 -

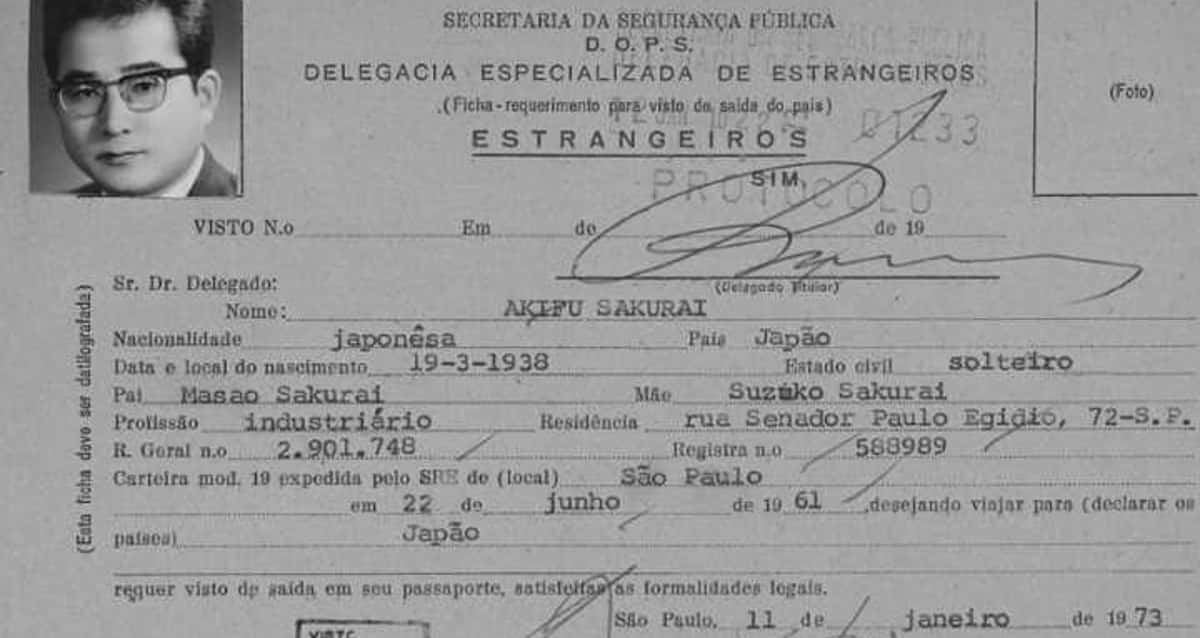

Famosos Que Vieram Ao Brasil Sem Avisar Mais Que Angelina Jolie

Apr 30, 2025

Famosos Que Vieram Ao Brasil Sem Avisar Mais Que Angelina Jolie

Apr 30, 2025