China Steel Production Cuts: Impact On Iron Ore Prices

Table of Contents

Reduced Steel Demand: The Primary Driver

China is the world's largest steel producer and consumer. Reduced steel production directly translates to lower demand for iron ore, the primary raw material in steel manufacturing. This decreased demand is the primary mechanism driving down iron ore prices. The connection between Chinese steel consumption and global iron ore demand is undeniable. Any slowdown in Chinese steel production will have a significant effect on the iron ore market, impacting both spot and futures prices.

- Lower construction activity in China impacting steel demand: A slowdown in infrastructure projects and real estate development significantly reduces the need for steel, leading to lower iron ore demand.

- Government regulations aimed at reducing carbon emissions leading to production caps: China's commitment to environmental sustainability has resulted in stricter regulations on steel production, directly impacting output and subsequently iron ore consumption.

- Weakening global economic outlook impacting overall steel consumption: Global economic uncertainty and decreased manufacturing activity in various sectors further contribute to reduced steel demand, putting downward pressure on iron ore prices.

Impact on Iron Ore Prices: Short-Term Volatility

The immediate impact of China's steel production cuts is volatility in iron ore prices. Spot prices are likely to experience significant fluctuations as market participants adjust to the new reality of reduced demand. Iron ore futures contracts will also reflect this uncertainty, with prices fluctuating based on speculation and predictions about future demand. This short-term volatility creates both opportunities and risks for investors and businesses involved in the iron ore market.

- Short-term price drops due to immediate supply glut: Reduced demand leads to a temporary oversupply of iron ore, causing immediate price drops in the spot market.

- Increased price speculation and market uncertainty: The uncertainty surrounding the duration and depth of China's steel production cuts fuels speculation, leading to increased price volatility.

- Potential for price rebounds depending on global steel demand from other countries: Increased steel demand from other countries could partially offset the reduction in Chinese demand, potentially leading to price rebounds.

Long-Term Implications for the Iron Ore Market

The long-term impact of China's steel production cuts on the iron ore market depends on several key factors. The duration of these cuts, the success of government stimulus measures aimed at boosting the economy, and the growth of steel demand in other regions will all play significant roles in shaping the future of the iron ore market. A sustained reduction in Chinese steel production could lead to a fundamental structural shift in the global iron ore landscape.

- Potential for a re-evaluation of iron ore mine production strategies: Producers may need to re-evaluate their production levels and strategies in response to lower long-term demand.

- Increased focus on efficiency and sustainability within the iron ore industry: The industry might see increased focus on improving efficiency and reducing environmental impact to maintain profitability in a potentially less robust market.

- Shift in global iron ore trade patterns and supply chains: The reduced Chinese demand might reshape global iron ore trade patterns, leading to shifts in supply chains and the emergence of new key players.

Alternative Factors Influencing Iron Ore Prices

While China's steel production cuts are a major influence, several other factors contribute to iron ore price fluctuations. These include global supply chain disruptions, production levels in other major iron ore producing countries (such as Australia and Brazil), and broader geopolitical events. Understanding these interconnected factors is crucial for a comprehensive understanding of iron ore market dynamics.

- Weather events impacting iron ore production and transportation: Extreme weather conditions can disrupt both production and transportation of iron ore, impacting supply and prices.

- Geopolitical instability in major producing regions: Political instability or conflicts in major iron ore-producing regions can significantly impact supply and prices.

- Changes in global economic conditions affecting overall demand: Global economic downturns or growth spurts directly influence overall steel demand, impacting iron ore prices.

Conclusion

China's steel production cuts represent a significant development with far-reaching consequences for the iron ore market. While short-term price volatility is expected, the long-term implications require careful consideration. The interplay between reduced steel demand, global supply chains, and other geopolitical factors will determine the future trajectory of iron ore prices. Staying informed about China steel production and its impact on iron ore prices is crucial for anyone involved in the global steel and mining industries. Further analysis of China steel production cuts and their ripple effects on the iron ore market is essential for making sound investment decisions. Understanding the dynamics of China steel production and its impact on iron ore prices is key to navigating this evolving market.

Featured Posts

-

La Fires Price Gouging Allegations Surface Amid Housing Crisis

May 10, 2025

La Fires Price Gouging Allegations Surface Amid Housing Crisis

May 10, 2025 -

Oboronnoe Partnerstvo Frantsii I Polshi Posledstviya Dlya Geopolitiki

May 10, 2025

Oboronnoe Partnerstvo Frantsii I Polshi Posledstviya Dlya Geopolitiki

May 10, 2025 -

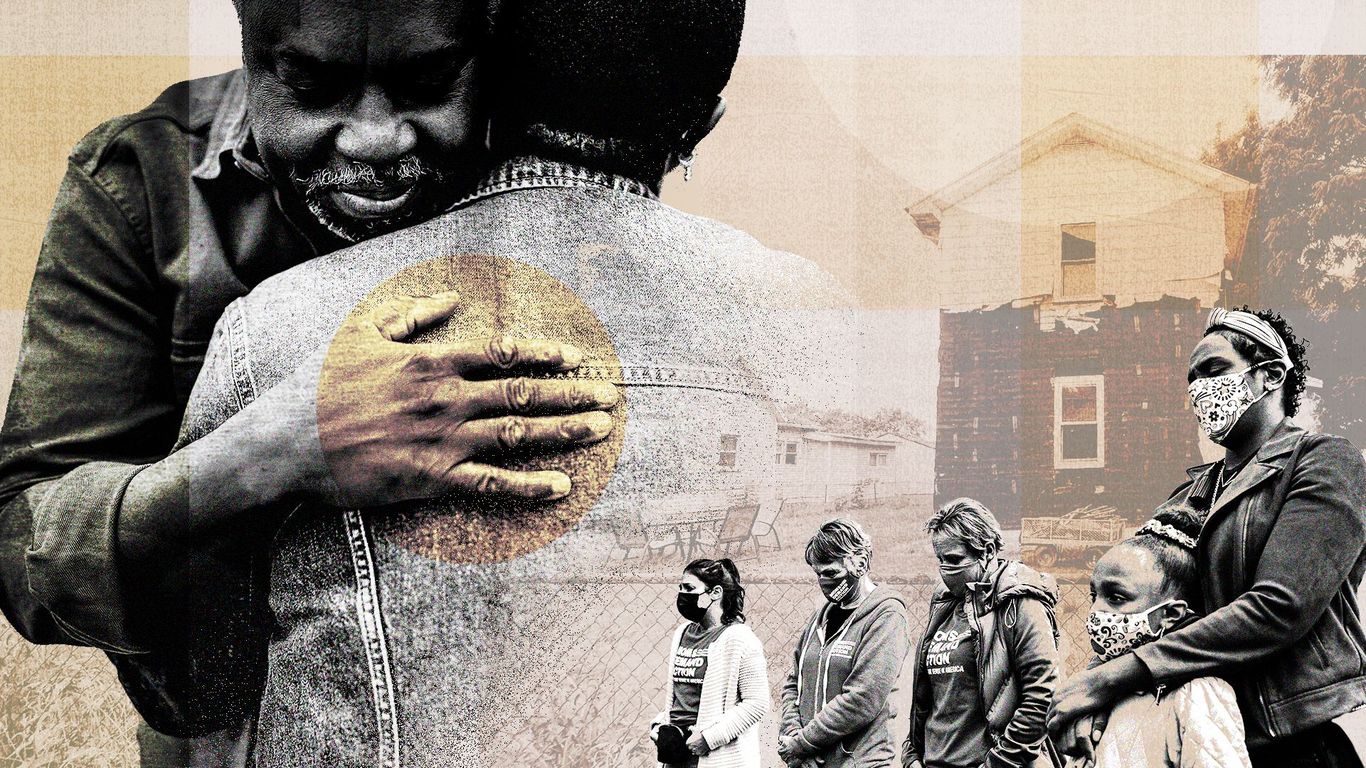

Racial Violence Claims Life Leaving Family In Despair

May 10, 2025

Racial Violence Claims Life Leaving Family In Despair

May 10, 2025 -

Lilysilk And Elizabeth Stewart A Spring Fashion Collaboration Unveiled

May 10, 2025

Lilysilk And Elizabeth Stewart A Spring Fashion Collaboration Unveiled

May 10, 2025 -

Harry Styles Snl Impression A Disappointing Reaction

May 10, 2025

Harry Styles Snl Impression A Disappointing Reaction

May 10, 2025