China's Automotive Market: A Complex Landscape For Foreign Automakers

Table of Contents

Navigating Regulatory Hurdles in China's Automotive Industry

The regulatory environment governing China's automotive industry is notoriously complex. Foreign automakers face a multitude of hurdles, from stringent emission standards and safety requirements to high import tariffs and bureaucratic licensing processes. Understanding and complying with these regulations is paramount for success.

-

Complex Regulatory Environment: China's automotive standards are rigorous, encompassing emissions (emission standards China), safety, and fuel efficiency. Non-compliance can result in hefty fines and market withdrawal. Keeping abreast of constantly evolving rules is a significant undertaking.

-

High Import Tariffs and Non-Tariff Barriers: Import tariffs on vehicles and components remain substantial, impacting profitability. Beyond tariffs, various non-tariff barriers, such as lengthy customs procedures and complex certification processes, further increase the cost of market entry.

-

Licensing and Approval Processes: Obtaining the necessary licenses and approvals to manufacture, import, and sell vehicles in China can be a lengthy and bureaucratic process. Foreign automakers often need to navigate multiple government agencies and fulfill extensive documentation requirements.

-

Local Content Requirements: China often mandates a certain percentage of locally sourced components in vehicle manufacturing (licensing China automotive). This necessitates establishing local supply chains and partnerships, adding another layer of complexity.

-

Evolving Government Policies: China's automotive policies are subject to change, reflecting the government's evolving priorities. Staying informed about these shifts and adapting strategies accordingly is crucial for long-term success. Foreign automakers need robust monitoring and adaptation strategies to remain compliant.

Understanding the Unique Chinese Consumer

The Chinese consumer is sophisticated and discerning, with preferences that are constantly evolving. Understanding these nuances is key to crafting effective marketing and product strategies.

-

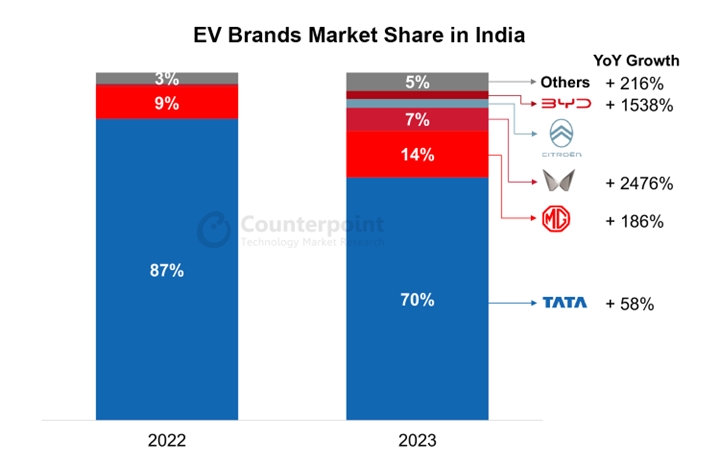

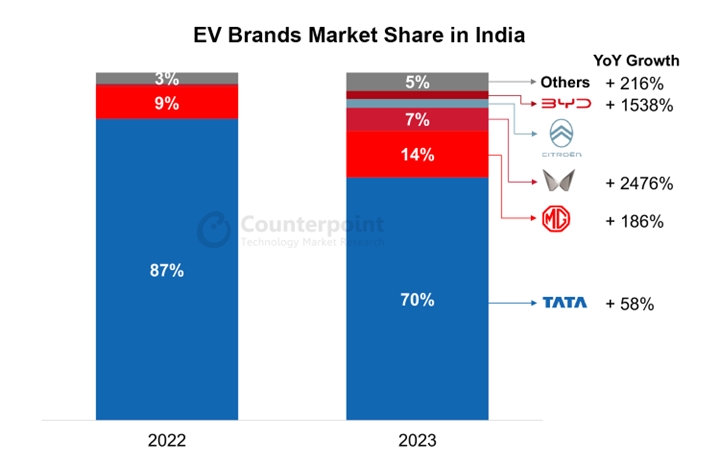

Growing Preference for SUVs and Electric Vehicles: The Chinese automotive market trends strongly towards SUVs and electric vehicles (EVs). This shift in consumer preference presents both opportunities and challenges for foreign automakers.

-

Brand Loyalty and Domestic Preference: While global brands hold significant appeal, many Chinese consumers exhibit strong brand loyalty towards domestic automakers, particularly in certain segments of the market (Chinese consumer preferences).

-

Demand for Advanced Technology: Chinese consumers are increasingly demanding advanced technological features in their vehicles, including connectivity, autonomous driving capabilities, and sophisticated infotainment systems.

-

Regional Variations: Consumer preferences can vary significantly across different regions of China (Chinese automotive market trends). A one-size-fits-all approach is unlikely to succeed.

-

Influence of Online Reviews and Social Media: Online reviews and social media wield considerable influence on purchasing decisions in China. Managing online reputation and engaging with consumers on digital platforms are crucial. The luxury car market China, for instance, is heavily influenced by online sentiment.

The Competitive Landscape: Domestic Giants and Joint Ventures

China's automotive market is fiercely competitive, with both established domestic automakers and a growing number of new energy vehicle (NEV) manufacturers vying for market share. The prevalence of joint ventures significantly shapes the competitive landscape.

-

Intense Domestic Competition: Domestic automakers, such as Geely, Great Wall Motors, and BYD, have become increasingly competitive, leveraging their understanding of the local market and government support.

-

Joint Ventures: A Necessary Path?: Joint ventures (joint ventures China automotive) are often a prerequisite for foreign automakers to enter the Chinese market, providing access to local expertise, distribution networks, and manufacturing capabilities. However, this also necessitates sharing profits and potentially compromising brand control.

-

Balancing Partnerships and Brand Identity: Maintaining brand identity while collaborating with a Chinese partner requires careful management and strategic planning (competition in Chinese automotive market).

-

The Rise of NEV Manufacturers: The rapid growth of NEV manufacturers adds another layer of intense competition. These companies are often more agile and technologically advanced, attracting considerable investment and consumer interest.

-

Strategies for Differentiation: To succeed, foreign automakers need to develop unique strategies to differentiate themselves from both domestic and international competitors. This could involve focusing on specific market segments, offering superior technology, or building strong brand loyalty.

Leveraging Opportunities in the EV Market

China's electric vehicle (EV) market is experiencing explosive growth, presenting significant opportunities for foreign automakers. Government support and technological advancements are driving this rapid expansion.

-

Rapid EV Market Growth: China's EV market is one of the largest and fastest-growing globally (China electric vehicle market). This presents considerable potential for companies willing to invest in this sector.

-

Government Incentives and Policies: The Chinese government provides substantial incentives and policies to support EV adoption, including subsidies, tax breaks, and preferential access to charging infrastructure.

-

Investment in Charging Infrastructure: Significant investments are being made in charging infrastructure, addressing a key barrier to EV adoption. However, challenges remain in ensuring widespread and reliable access, particularly in less developed areas.

-

Opportunities for EV Leadership: Foreign automakers can position themselves as leaders in China's EV market by investing in cutting-edge technologies, establishing strong local partnerships, and tailoring their products to the specific needs of Chinese consumers (government incentives China EV).

-

Battery Supply Chain Challenges: Securing reliable and cost-effective battery supplies remains a challenge for all EV manufacturers, both foreign and domestic. Navigating this complex supply chain is crucial for success.

Conclusion

China's automotive market presents both significant opportunities and substantial challenges for foreign automakers. Success hinges on a deep understanding of the regulatory environment, consumer preferences, and competitive dynamics, alongside a carefully planned strategy for navigating the complexities of the Chinese automotive industry. The rise of the electric vehicle market offers additional opportunities for growth, but requires careful consideration of the specific challenges associated with this segment. For foreign automakers looking to tap into the potential of the world's largest automotive market, thorough market research, strategic partnerships, and a nuanced understanding of China's unique landscape are absolutely crucial for success in China's automotive market. Start planning your strategic entry into China's automotive market today.

Featured Posts

-

Tien Giang Xu Ly Nghiem Vu Bao Mau Bao Hanh Tre

May 09, 2025

Tien Giang Xu Ly Nghiem Vu Bao Mau Bao Hanh Tre

May 09, 2025 -

Anchor Brewing Company Shuts Down A Legacy Ends

May 09, 2025

Anchor Brewing Company Shuts Down A Legacy Ends

May 09, 2025 -

Jack Doohan Fires Back At Colapinto During F1 75 Launch Interview

May 09, 2025

Jack Doohan Fires Back At Colapinto During F1 75 Launch Interview

May 09, 2025 -

Melanie Griffith And Dakota Johnson At The Materialists Film Premiere

May 09, 2025

Melanie Griffith And Dakota Johnson At The Materialists Film Premiere

May 09, 2025 -

Singer Summer Walker Shares Grueling Account Of Difficult Birth

May 09, 2025

Singer Summer Walker Shares Grueling Account Of Difficult Birth

May 09, 2025