China's Lithium Tech Export Curbs: Implications For Eramet And The Market

Table of Contents

China's Dominance in Lithium Processing and Technology

China's influence on the lithium market isn't merely significant; it's dominant. This dominance stems from both its control over the lithium refining process and its advanced technologies in lithium processing.

China's Control over the Lithium Refining Process

China boasts a substantial share of the global lithium refining capacity. Estimates suggest that China refines over 60% of the world's lithium, processing lithium ore into battery-grade lithium chemicals.

- Market Share: China's dominance is exemplified by its control of crucial processing steps, such as lithium carbonate and lithium hydroxide production. This gives it significant leverage in the global market.

- Key Players: Companies like Ganfeng Lithium, Tianqi Lithium, and Sichuan Yahua are leading the way in lithium technology and refining, solidifying China's position.

The Strategic Importance of Lithium-ion Battery Technology

Lithium-ion battery technology is the cornerstone of the burgeoning electric vehicle and renewable energy sectors. Without efficient and cost-effective lithium-ion batteries, the widespread adoption of EVs and large-scale energy storage systems remains a distant prospect.

- Strategic Goals: China's export restrictions can be seen as a strategic move to secure its position in the EV and renewable energy markets, fostering domestic industries and potentially limiting competition.

- Global Impact: This strategic focus, however, comes at a cost, potentially creating supply chain bottlenecks and price volatility for downstream manufacturers globally.

Impact of Export Restrictions on Downstream Manufacturers

The export restrictions on lithium-related technologies directly affect companies reliant on Chinese-processed lithium and related materials. This impact translates to potential supply shortages, leading to increased prices for lithium-ion batteries and potentially hindering the expansion of the EV market.

Eramet's Exposure and Strategic Response to China's Export Curbs

Eramet, a significant player in the mining and processing of raw materials for batteries, is not immune to the implications of China's export curbs. Understanding Eramet's reliance on Chinese supply chains and its potential strategic responses is crucial.

Eramet's Reliance on Chinese Supply Chains

While Eramet is actively involved in mining operations globally, the extent of its reliance on Chinese suppliers for lithium and related materials needs further investigation. A detailed analysis of Eramet’s sourcing strategies and current partnerships with Chinese companies is vital to assess the potential impact of the export restrictions.

- Existing Partnerships: A transparent evaluation of Eramet's existing contracts and dependencies on Chinese processors and suppliers is critical in determining the potential losses.

- Quantitative Impact: The potential impact on Eramet's production, profitability, and future investment plans must be quantified to accurately assess the risks.

Potential Diversification Strategies for Eramet

Eramet needs to adopt multiple strategies to mitigate risks related to China’s export curbs. This necessitates exploring alternative sourcing options and investing in domestic processing capacity.

- Alternative Sourcing: Diversifying its supply chains to include countries like Australia, Chile, and Argentina, which possess significant lithium reserves, is paramount.

- Investment in Upstream and Downstream: Investing in upstream lithium mining or downstream battery manufacturing presents opportunities for greater control and resilience.

Broader Market Implications of China's Lithium Export Policies

The implications of China's lithium export policies extend far beyond Eramet and ripple through the entire global lithium market.

Price Volatility and Market Instability

The export restrictions are already causing increased price volatility in the lithium market. The potential for further price shocks and market manipulation is a significant concern.

- Price Fluctuations: The unpredictability of lithium prices creates challenges for battery manufacturers and EV producers, affecting their planning and profitability.

- Market Manipulation: The concentrated nature of the lithium refining industry in China raises concerns about the potential for market manipulation.

Geopolitical Implications and Trade Tensions

China's actions have significant geopolitical implications and have the potential to exacerbate trade tensions between China and other countries.

- Retaliatory Measures: Other nations might impose retaliatory measures, further complicating the global lithium market and potentially escalating trade disputes.

- International Cooperation: This situation underscores the need for enhanced international cooperation in securing access to critical minerals and ensuring fair market practices.

Accelerated Development of Alternative Technologies

The uncertainty caused by China's dominance could spur increased investment and research into alternative battery technologies that don't rely on lithium.

- R&D Investment: The current situation could accelerate the development and adoption of alternative energy storage solutions, such as sodium-ion or solid-state batteries.

Conclusion: Navigating the Shifting Sands of the Lithium Market: Implications for Eramet and Beyond

China's lithium tech export curbs have significant implications for Eramet and the global lithium market. The dominance of China in lithium refining presents challenges for downstream manufacturers, creating price volatility and supply chain risks. Eramet and other companies need to diversify their sourcing strategies and invest in alternative technologies to mitigate these risks. This necessitates a proactive approach to secure supply chains and ensure resilience in the face of geopolitical uncertainty. Staying informed about the evolving situation and monitoring future developments related to China's lithium export policies is crucial for conducting effective lithium market analysis and navigating the complexities of the lithium supply chain and the future of lithium. Understanding these implications is crucial for companies seeking to thrive in the rapidly evolving lithium market.

Featured Posts

-

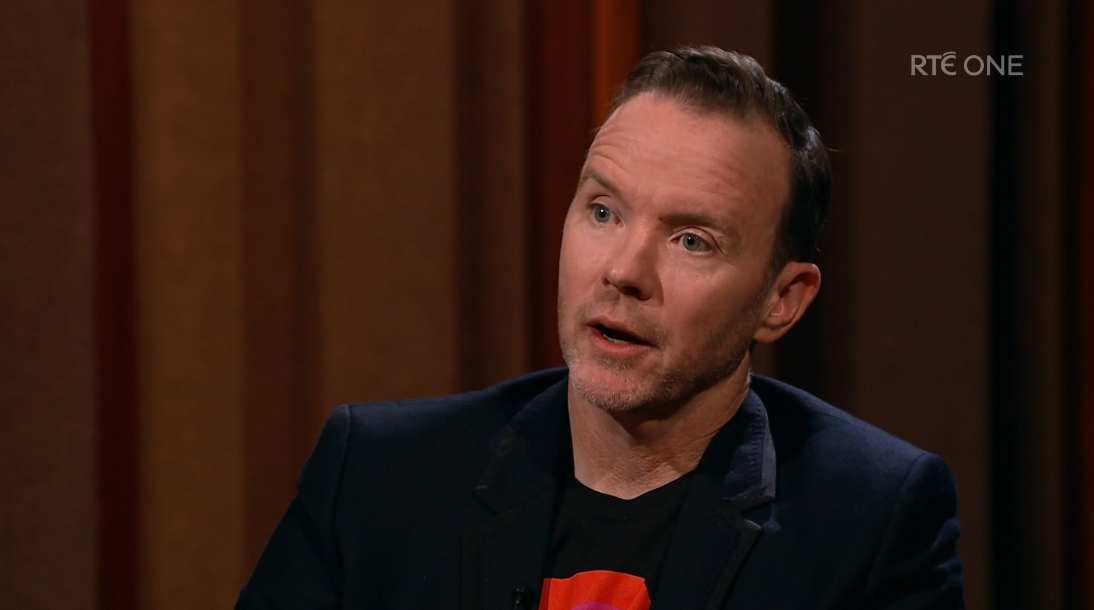

The Private Life Of Tommy Tiernans Wife From Career Management To Vatican City

May 14, 2025

The Private Life Of Tommy Tiernans Wife From Career Management To Vatican City

May 14, 2025 -

The Kanye West Bianca Censori Relationship A Power Imbalance

May 14, 2025

The Kanye West Bianca Censori Relationship A Power Imbalance

May 14, 2025 -

Tommy Fury Update Molly Mae Hagues Response To His Confession

May 14, 2025

Tommy Fury Update Molly Mae Hagues Response To His Confession

May 14, 2025 -

Madrid Open Potapova Upsets Zheng Qinwen

May 14, 2025

Madrid Open Potapova Upsets Zheng Qinwen

May 14, 2025 -

Tommy Tiernans Rarely Seen Wife Steps Back From Managing His Career

May 14, 2025

Tommy Tiernans Rarely Seen Wife Steps Back From Managing His Career

May 14, 2025