China's Sinograin To Auction Imported Soybeans: Addressing Supply Shortages

Table of Contents

The Growing Demand for Soybeans in China

China's insatiable appetite for soybeans stems from a confluence of factors. The country's booming livestock industry, fueled by a rising middle class with increased protein consumption, demands vast quantities of soybean meal for animal feed. Simultaneously, the burgeoning food processing sector requires substantial amounts of soybean oil for cooking and other applications. Furthermore, government policies promoting livestock farming have amplified this demand, contributing to the relentless growth in soybean consumption.

However, domestic soybean production faces significant constraints. Limited arable land, coupled with unpredictable weather patterns and climate change impacts, restricts the potential for increased domestic output. This reality underscores China's heavy dependence on soybean imports to meet its enormous demand.

- Rising protein consumption: China's burgeoning middle class is consuming more meat and dairy products, driving up demand for soybean meal.

- Increased demand for soybean oil and meal: The food processing industry, fueled by economic growth, requires more soybean oil and meal for various products.

- Government policies promoting livestock farming: Government initiatives supporting livestock production have further amplified the demand for soybean meal.

- Land limitations and climate constraints: Limited arable land and unpredictable weather patterns hinder domestic soybean production.

Sinograin's Role in Managing Soybean Imports

Sinograin, a state-owned enterprise (SOE), plays a pivotal role in China's agricultural sector, responsible for managing grain reserves and ensuring national food security. Its upcoming soybean auction is a strategic move to stabilize the market and address the current supply shortage. By directly injecting significant quantities of imported soybeans into the market, Sinograin aims to mitigate price volatility and ensure sufficient supply for processors and livestock farmers.

The auction process itself will likely involve a competitive bidding system, with the volume and types of soybeans offered reflecting the current market needs. The auction's impact will extend beyond the immediate buyers, potentially affecting smaller importers and domestic soybean farmers who compete in the market.

- Sinograin's role in ensuring food security: The SOE is mandated to maintain stable food supplies and prices.

- The mechanism of Sinograin's auction process: Details of the bidding process, volume, and soybean types are crucial to understanding its impact.

- Potential impact on smaller importers and domestic soybean farmers: The auction could influence market share and profitability for other players in the soybean market.

Impact of the Soybean Auction on Prices and Market Stability

The Sinograin soybean auction is anticipated to have a multifaceted impact on soybean prices and market stability. In the short term, the injection of a large volume of soybeans into the market could ease price pressures, potentially leading to a decrease in domestic soybean prices. However, the long-term effects remain to be seen and will depend on factors such as global supply and demand dynamics, and the overall effectiveness of government policies.

The auction will also reverberate throughout the global soybean market. Competing soybean exporters, such as Brazil, the United States, and Argentina, will keenly observe its outcome and adjust their strategies accordingly. The interplay between government policies, international trade relations, and market speculation will determine the extent of price fluctuations and market volatility.

- Potential price fluctuations due to supply and demand dynamics: The sheer volume of soybeans offered could influence short-term price trends.

- Impact on competing soybean exporters: Global soybean market dynamics will be affected by the outcome of the auction.

- The role of government policies and trade relations: Government intervention and international trade agreements will influence the long-term impact.

Long-Term Strategies for Soybean Security in China

China's reliance on imported soybeans presents a vulnerability in its food security strategy. To mitigate this risk, the country is exploring various long-term solutions. These include investing in agricultural technology and research to improve domestic soybean yields, optimizing land use and adopting sustainable farming practices, and exploring alternative protein sources to reduce dependence on soybeans. Strengthening international collaborations on soybean supply chains is also a crucial component of this strategy.

- Investment in agricultural technology and research: Developing improved soybean varieties and farming techniques is key to boosting domestic production.

- Land use optimization and sustainable farming practices: Efficient land management and environmentally friendly farming methods are essential for increasing yields.

- Exploring alternative protein sources: Diversifying protein sources can reduce reliance on soybeans.

- Strengthening international collaborations on soybean supply chains: Collaborating with other countries to secure stable soybean supplies is crucial.

Conclusion: China's Sinograin Soybean Auction: A Step Towards Securing Supply

Sinograin's soybean auction is a critical short-term measure to alleviate immediate supply shortages in China's soybean market. The auction's impact on domestic prices and the global soybean market will be closely watched. However, this action is only one piece of a much larger puzzle. China's long-term strategy requires a multi-pronged approach that includes increased domestic production, technological advancements, and diversified protein sources. To better understand the evolving landscape of China's food security strategy, follow the developments in the China soybean market, learn more about Sinograin's strategies for managing soybean imports, and stay updated on the impact of the Sinograin soybean auction. The future of China's soybean supply and its global implications remain a critical area of observation.

Featured Posts

-

Trumps Sanctions Against Wilmer Hale Overturned A Legal Victory For Muellers Former Firm

May 29, 2025

Trumps Sanctions Against Wilmer Hale Overturned A Legal Victory For Muellers Former Firm

May 29, 2025 -

Live Nation Faces Setback In Portland Oregon Attorney Generals Response

May 29, 2025

Live Nation Faces Setback In Portland Oregon Attorney Generals Response

May 29, 2025 -

Tfawl Ardny Bshan Atfaqyat Almyah Aljdydt Me Swrya Frs Wthdyat

May 29, 2025

Tfawl Ardny Bshan Atfaqyat Almyah Aljdydt Me Swrya Frs Wthdyat

May 29, 2025 -

Blake Shelton On Morgan Wallens Snl Incident A Strong Reaction

May 29, 2025

Blake Shelton On Morgan Wallens Snl Incident A Strong Reaction

May 29, 2025 -

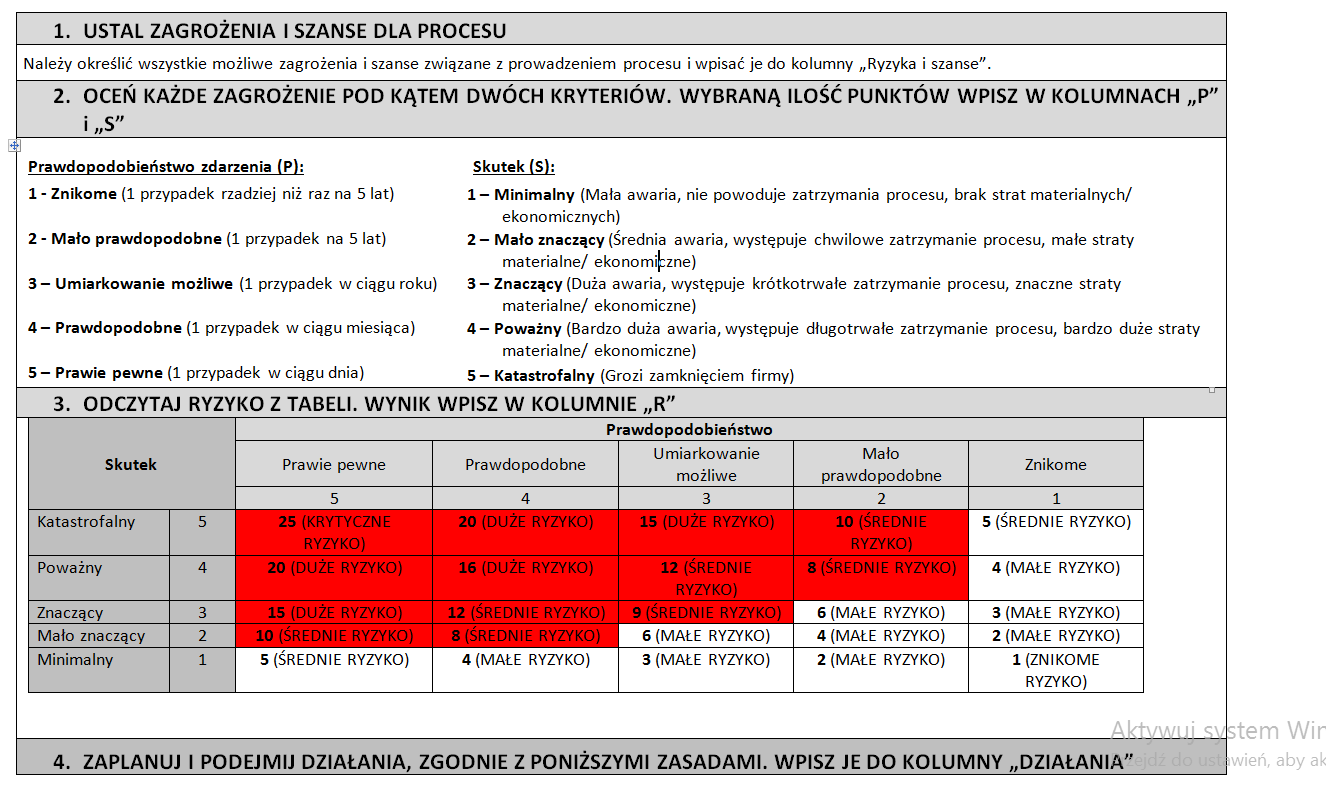

Analiza Ryzyka Czy Flagowa Inwestycja Pcc Zostanie Opozniona I Podrozeje

May 29, 2025

Analiza Ryzyka Czy Flagowa Inwestycja Pcc Zostanie Opozniona I Podrozeje

May 29, 2025

Latest Posts

-

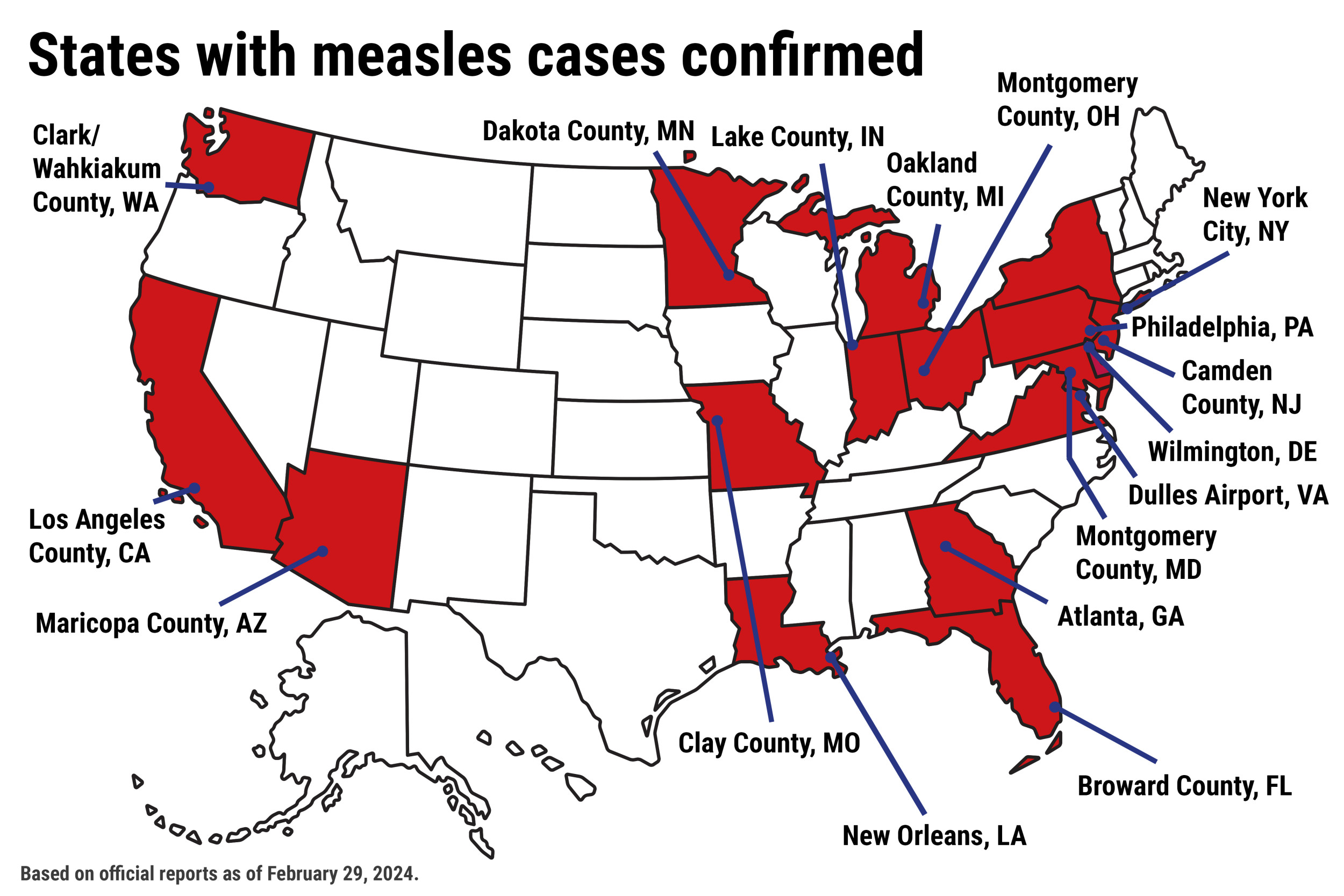

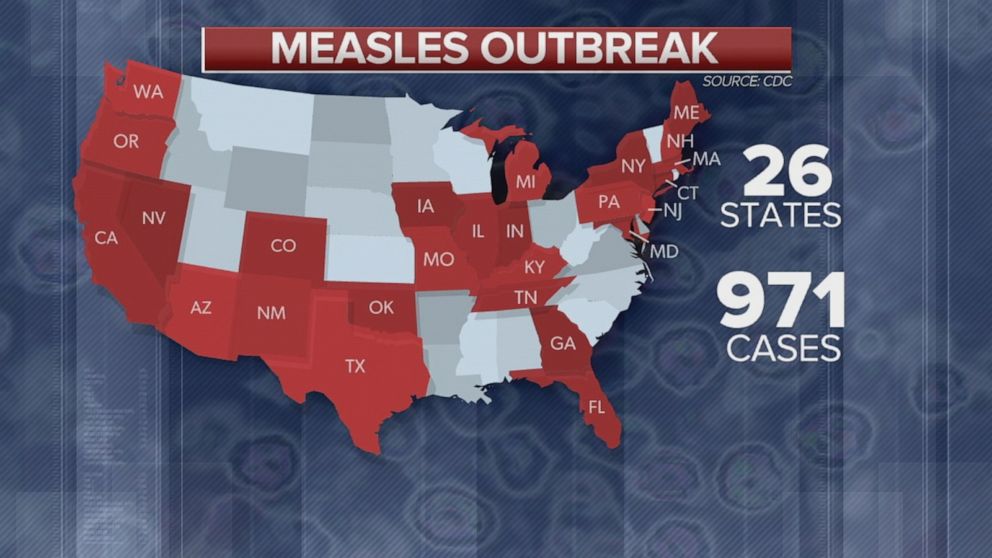

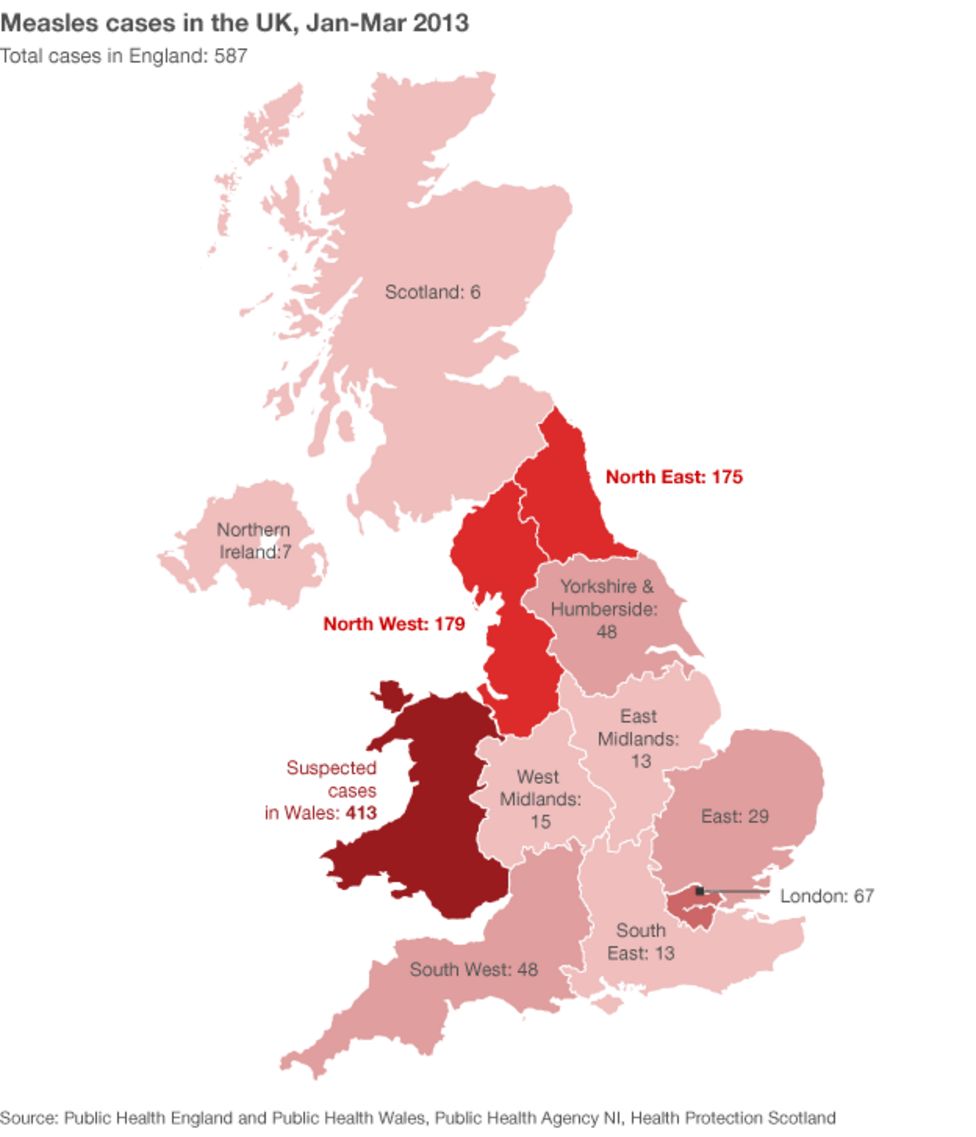

Increase In Texas Measles Cases Separate Clusters Emerge

May 30, 2025

Increase In Texas Measles Cases Separate Clusters Emerge

May 30, 2025 -

2025 Measles Cases In Virginia Second Case Reported Public Health Response

May 30, 2025

2025 Measles Cases In Virginia Second Case Reported Public Health Response

May 30, 2025 -

Public Health Officials Report Six More Measles Cases In Kansas

May 30, 2025

Public Health Officials Report Six More Measles Cases In Kansas

May 30, 2025 -

Texas Measles Outbreak Triggers Cases In Israel Health Officials Respond

May 30, 2025

Texas Measles Outbreak Triggers Cases In Israel Health Officials Respond

May 30, 2025 -

Odra Wysokie Ryzyko Powtorzenia Katastrofy Ekologicznej

May 30, 2025

Odra Wysokie Ryzyko Powtorzenia Katastrofy Ekologicznej

May 30, 2025