China's Steel Industry Slowdown: The Effect On Iron Ore Supply And Prices

Table of Contents

Reduced Steel Demand in China

The decreased demand for steel in China is the primary driver of the current market instability. Several factors contribute to this slowdown:

-

Slowdown in China's Real Estate Sector: The once-booming Chinese real estate market, a significant consumer of steel, has cooled considerably. Stricter government regulations aimed at curbing excessive debt and speculation have led to a decline in construction activity, directly impacting steel consumption. This has resulted in a significant decrease in demand for steel used in high-rise buildings, residential complexes, and infrastructure projects. Data from the National Bureau of Statistics of China reveals a sharp drop in housing starts and completion rates in recent quarters.

-

Reduced Infrastructure Spending: While China continues to invest in infrastructure, the pace of spending has slowed compared to previous years. This reduced investment translates to less demand for steel in projects like roads, bridges, and railways. Government policies focusing on optimizing existing infrastructure rather than large-scale expansion further contribute to this decline. Analysis of government spending reports reflects a shift in priority towards more sustainable and efficient infrastructure development.

-

Weakening Overall Economic Growth: China's overall economic growth has moderated, impacting various sectors and reducing the overall demand for steel across the board. The transition from an export-led economy to a more domestically driven model is also contributing to this slower growth, influencing steel demand from manufacturing and other industries. Economic indicators like GDP growth and industrial production figures point towards a slower growth trajectory.

-

Government Policies Aimed at Curbing Carbon Emissions: China's commitment to achieving carbon neutrality is leading to policies that encourage the use of alternative materials and promote sustainable development. This includes stricter environmental regulations on steel production, potentially leading to production cuts and a decreased supply of steel in the market. The implementation of carbon emission caps and stricter environmental standards significantly affect steel production capacity.

Impact on Iron Ore Supply

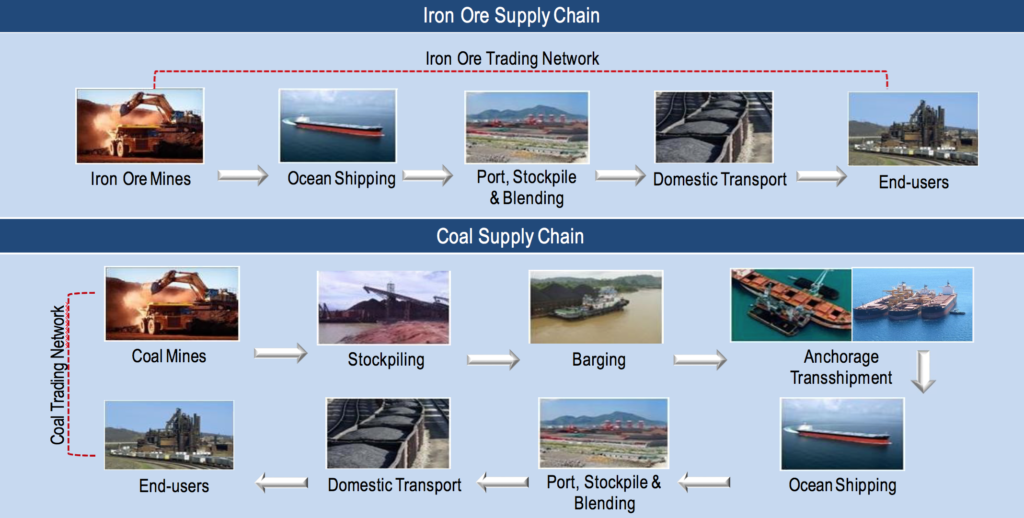

The reduced steel demand in China directly impacts iron ore supply chains globally. Iron ore, a crucial raw material in steel production, experiences a corresponding decrease in demand.

-

Decreased Demand for Iron Ore Imports: Major iron ore suppliers like Australia and Brazil are facing decreased demand for their exports to China. This has led to lower prices and increased competition amongst producers. The volume of seaborne iron ore shipments to China has shown a noticeable decline in recent months.

-

Potential for Reduced Iron Ore Mining Activity: Facing lower demand, iron ore mining companies may adjust their operations to reduce mining activity. This could lead to job losses and investment cutbacks in the mining sector. Some mining companies are already announcing adjustments to their production schedules in response to reduced demand.

-

Implications for Iron Ore Shipping and Logistics: The reduced demand for iron ore translates into less shipping activity, impacting the logistics sector involved in transporting this crucial commodity. This leads to lower freight rates and potential challenges for shipping companies. The overall impact on the shipping industry's profitability is significant.

-

Response of Major Iron Ore Producers: Major iron ore producers are responding to the changing market conditions by adjusting their production levels, exploring new markets, and focusing on operational efficiencies to remain competitive in the face of decreased Chinese demand. Strategies include cost-cutting measures, diversification of export markets, and investment in technological advancements to improve efficiency.

Fluctuations in Iron Ore Prices

The slowdown in China's steel industry is directly correlated with significant fluctuations in iron ore prices.

-

Analysis of Recent Price Trends and Volatility: Iron ore prices have experienced considerable volatility in recent times, reflecting the fluctuating demand from China. Prices have fallen significantly compared to their peak levels, creating uncertainty in the market.

-

Factors Impacting Price Beyond Demand: Besides demand, other factors influence iron ore prices, including geopolitical events (e.g., disruptions to supply chains due to international conflicts), currency fluctuations, and speculation in the futures market. These factors contribute to the overall volatility of iron ore prices.

-

Implications for Investors and Businesses: The fluctuating iron ore prices present challenges and opportunities for investors and businesses operating in the sector. Effective hedging strategies become crucial to mitigate risk.

-

Potential Future Price Forecasts: Future iron ore prices depend on various economic scenarios. A sustained recovery in China's economy could lead to increased demand and higher prices, while a prolonged slowdown could result in further price declines. Forecasts vary widely depending on the assumptions made about future economic growth and government policies.

Global Implications of the Slowdown

The slowdown in China's steel industry has far-reaching global implications beyond just iron ore prices.

-

Impact on Global Steel Prices: Reduced demand from China impacts global steel prices, affecting steel producers and consumers worldwide. The global steel market becomes more competitive as supply surpasses demand.

-

Ripple Effects on Other Related Industries: The slowdown creates ripple effects on industries linked to steel production, such as mining equipment manufacturers and logistics companies. These industries face reduced demand and potential economic challenges.

-

Geopolitical Implications of Reduced Chinese Demand: Reduced Chinese demand can shift global trade dynamics and create opportunities for other steel-producing nations to fill the gap, leading to potential geopolitical shifts in the global steel market.

Conclusion

The slowdown in China's steel industry is undeniably impacting iron ore supply and prices. Reduced steel demand, largely driven by a slowdown in the real estate sector, reduced infrastructure spending, weakening economic growth, and government policies promoting sustainable development, has led to decreased iron ore imports, potential production cuts, and significant price volatility. The global implications are significant, affecting steel prices, related industries, and international trade dynamics. Staying informed about the evolving situation in China's steel industry is crucial for anyone involved in or impacted by the iron ore market. Continue your research by exploring resources from organizations like the World Steel Association and the International Monetary Fund for further insights into China's steel industry slowdown and its effects on iron ore markets.

Featured Posts

-

Police Investigating Fatal Collision Involving Two Pedestrians In Elizabeth City

May 10, 2025

Police Investigating Fatal Collision Involving Two Pedestrians In Elizabeth City

May 10, 2025 -

Should You Invest In Palantir Technologies Stock Right Now

May 10, 2025

Should You Invest In Palantir Technologies Stock Right Now

May 10, 2025 -

Hyatt Hotel Project Threatens Historic Broad Street Diner

May 10, 2025

Hyatt Hotel Project Threatens Historic Broad Street Diner

May 10, 2025 -

Top College Towns In Michigan Why City Name Stands Out

May 10, 2025

Top College Towns In Michigan Why City Name Stands Out

May 10, 2025 -

Elizabeth Line Strike Action Dates And Affected Tube Lines In February March

May 10, 2025

Elizabeth Line Strike Action Dates And Affected Tube Lines In February March

May 10, 2025