Chinese Stock Market Rally In Hong Kong: A Deep Dive Into The Recent Surge

Table of Contents

Government Policies and Regulatory Changes Fueling the Rally

The recent surge in the Hong Kong stock market is significantly linked to shifts in government policies and regulatory changes impacting Chinese companies. These changes have breathed new life into previously hesitant investors.

Easing of Regulatory Scrutiny on Tech Giants

The easing of regulatory scrutiny on Chinese tech giants listed in Hong Kong has been a pivotal factor in the recent rally. Previously facing intense regulatory pressure, these companies have seen a significant improvement in their market performance following adjustments to regulations.

- Policy Changes: Examples include relaxed antitrust regulations and a more supportive stance towards technological innovation.

- Stock Price Effects: Many tech giants have seen double-digit percentage increases in their stock prices since the regulatory adjustments. Trading volumes have also increased substantially, indicating renewed investor confidence.

- Investor Sentiment: Analyst predictions reflect a more positive outlook for the tech sector, with many projecting continued growth in the coming quarters. The improved sentiment is directly attributable to the decreased regulatory uncertainty. For example, the Hang Seng Tech Index has shown significant growth since these changes.

Stimulus Measures and Infrastructure Spending

Government stimulus packages and increased infrastructure spending have played a crucial role in boosting market confidence and driving investment across various sectors within the Hong Kong stock market's Chinese component.

- Stimulus Initiatives: The Chinese government has implemented several stimulus measures aimed at boosting economic growth, including tax cuts, increased public spending, and support for specific industries.

- Impact on the Market: These initiatives have injected significant capital into the economy, leading to increased investor confidence and a rise in stock prices across various sectors.

- Economic Data: GDP growth projections have been revised upwards following the implementation of these stimulus packages, further supporting the positive market sentiment. Increased infrastructure investment also indicates a long-term commitment to economic growth.

Macroeconomic Factors Contributing to the Surge

Beyond governmental actions, several macroeconomic factors have contributed to the recent surge in the Chinese stock market within Hong Kong.

Improved Economic Data and Growth Projections

Positive economic indicators from China have fueled optimism and significantly influenced the Hong Kong market. A rebounding Chinese economy naturally boosts related markets.

- Key Economic Indicators: Improved inflation figures, reduced unemployment rates, and increased consumer spending all point towards a strengthening Chinese economy. These indicators are closely correlated with stock market performance.

- Impact on Stock Market: The positive economic data has led to increased investor confidence, resulting in higher stock valuations and increased trading activity.

- Charts and Graphs: Visual representations of these economic trends clearly illustrate their positive impact on the Hong Kong stock market's performance, especially within the Chinese companies listed.

Strengthening Renminbi and Global Investor Sentiment

The strengthening Renminbi and positive global investor sentiment toward emerging markets, particularly China, have further fueled the rally.

- Currency Exchange Rates: A stronger Renminbi makes Chinese assets more attractive to international investors, leading to increased capital inflows and higher stock prices.

- Global Investor Sentiment: Positive global news and a generally optimistic outlook on the global economy have enhanced investor confidence in emerging markets, including China.

- Investor Confidence: Reports from leading financial news outlets and international organizations confirm the improved global investor sentiment and its impact on the Chinese stock market in Hong Kong.

Sector-Specific Performance and Investment Opportunities

The rally has not been uniform across all sectors; certain sectors have outperformed others, creating specific investment opportunities and highlighting potential risks.

High-Performing Sectors and their Growth Potential

Several sectors have experienced exceptional growth within the Hong Kong stock market’s Chinese holdings.

- High-Growth Sectors: The technology, energy, and consumer goods sectors have been among the best performers. This is largely due to a combination of government support and strong underlying market demand.

- Successful Companies: Specific companies within these high-performing sectors have shown significant financial gains, further fueling investor interest and highlighting future growth potential.

- Future Prospects: Analysis suggests these sectors are poised for continued growth, making them attractive investment opportunities for those seeking exposure to the Chinese market through Hong Kong.

Risks and Challenges for Investors

Despite the impressive rally, investors should carefully consider the risks involved.

- Geopolitical Uncertainties: Geopolitical tensions and international relations can impact market stability.

- Regulatory Changes: Future regulatory shifts could negatively impact certain sectors.

- Economic Volatility: The global and Chinese economies are subject to volatility, which impacts investment.

- Risk Mitigation: Diversification across various sectors and asset classes is crucial for mitigating potential losses.

Conclusion

The recent Chinese stock market rally in Hong Kong is a multifaceted phenomenon stemming from a combination of government policies, macroeconomic improvements, and sector-specific performance. While the surge offers substantial opportunities, potential risks demand careful consideration. Understanding the drivers of this rally—from regulatory easing to positive economic indicators and sector-specific growth—is crucial for informed investment decisions. To stay abreast of the latest developments in the Chinese stock market rally in Hong Kong, continuous research into relevant news and economic data is essential. Don’t miss out on the potential—learn more about investing in the dynamic Hong Kong stock market today!

Featured Posts

-

Nbas Investigation Into Ja Morant Key Questions Answered

Apr 24, 2025

Nbas Investigation Into Ja Morant Key Questions Answered

Apr 24, 2025 -

Ohio Train Derailment The Lingering Threat Of Toxic Chemicals In Buildings

Apr 24, 2025

Ohio Train Derailment The Lingering Threat Of Toxic Chemicals In Buildings

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Remarks Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Remarks Boost Markets

Apr 24, 2025 -

Tornado Season And Trumps Cuts A Dangerous Combination Experts Say

Apr 24, 2025

Tornado Season And Trumps Cuts A Dangerous Combination Experts Say

Apr 24, 2025 -

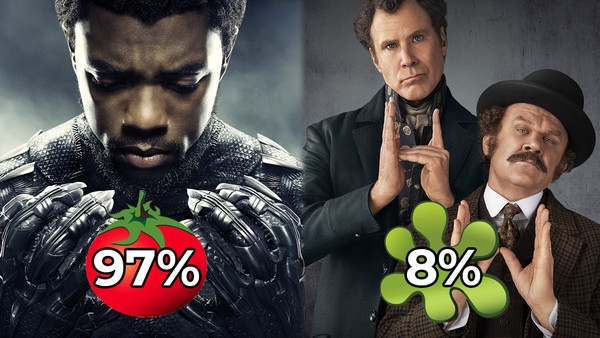

John Travoltas Disturbing Rotten Tomatoes Record

Apr 24, 2025

John Travoltas Disturbing Rotten Tomatoes Record

Apr 24, 2025