Choppy Trading Session: Sensex And Nifty 50 End Unchanged

Table of Contents

Factors Contributing to the Choppy Trading Session

Market volatility was the defining characteristic of today's trading session. Several factors contributed to this uncertainty, creating a turbulent environment for investors. These included:

-

Global Economic Headwinds: Concerns surrounding persistent inflation in major economies and the subsequent impact of interest rate hikes by central banks globally played a significant role. Negative economic indicators from overseas markets often ripple through to the Indian stock market, impacting investor sentiment.

-

Domestic Political Developments: Ongoing political discussions and policy announcements at the domestic level also influenced investor decisions. Uncertainty surrounding key policy changes can lead to market fluctuations as investors adjust their positions.

-

Sectoral Performance Divergence: The IT sector witnessed a relatively subdued performance due to global tech sector concerns, while the banking sector displayed some resilience. FMCG stocks showed mixed trends, reflecting differing consumer sentiments. This sectoral divergence contributed to the overall market volatility.

-

Rupee Fluctuations: The Indian Rupee's movement against major global currencies added another layer of complexity. Exchange rate volatility can impact the profitability of businesses with significant foreign exchange exposure and influence investor perceptions of risk.

-

Mixed Earnings Announcements: While some companies announced strong earnings, others disappointed, leading to selective buying and selling pressures across different sectors. This uneven performance fuelled the choppy trading environment.

Keywords: market volatility, economic indicators, geopolitical risks, sectoral trends, rupee fluctuations, earnings announcements.

Analysis of Sensex and Nifty 50 Performance

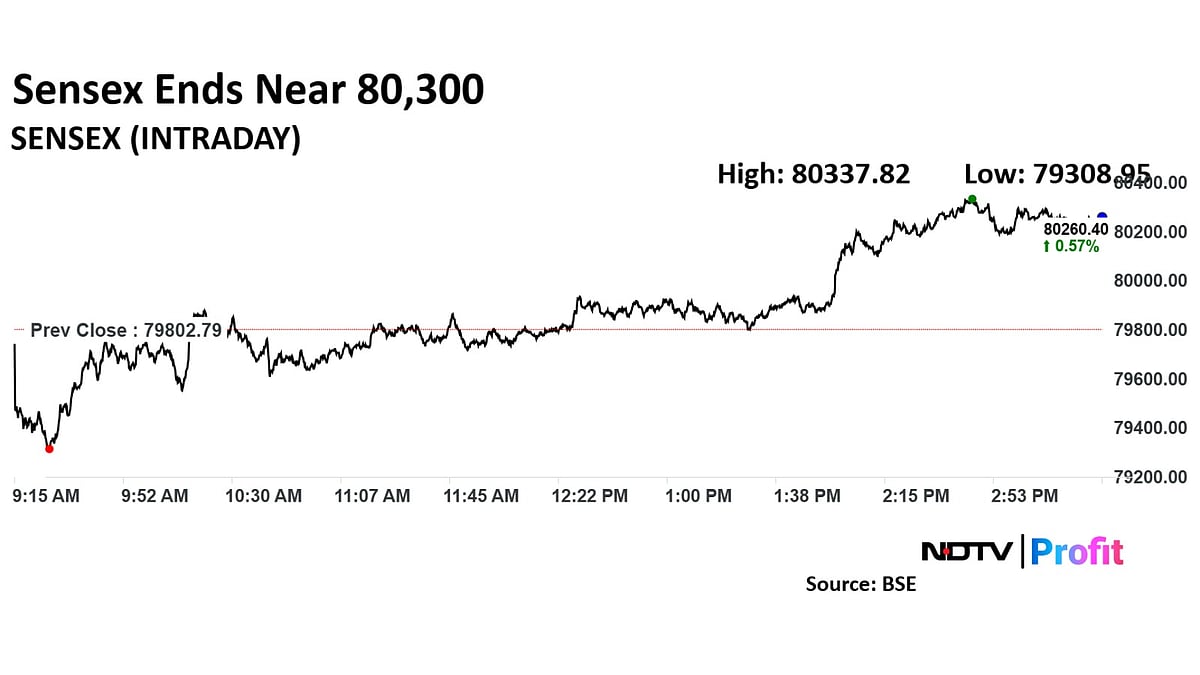

The Sensex and Nifty 50 displayed significant intraday volatility, with the Sensex reaching an intraday high of [Insert High Value] and a low of [Insert Low Value], while the Nifty 50 saw an intraday high of [Insert High Value] and a low of [Insert Low Value]. Despite these fluctuations, both indices closed virtually unchanged, reflecting a balance between buying and selling pressures.

[Insert Chart/Graph visualizing Sensex movement throughout the day] [Insert Chart/Graph visualizing Nifty 50 movement throughout the day]

While certain sectors, such as [mention specific sectors], showed relative strength, others, including [mention specific sectors], underperformed. This uneven sectoral performance highlighted the complexities within the broader market trends.

Keywords: Sensex movement, Nifty 50 performance, intraday trading, index volatility, market charts, sectoral performance.

Impact on Investor Sentiment

The unchanged closing prices, despite the choppy trading session, resulted in mixed investor sentiment. While some investors remained optimistic about the long-term outlook, others expressed concerns about the heightened market volatility. Trading volumes [mention whether volumes were high or low and explain the significance], suggesting [explain the implication of high/low volumes]. The overall market psychology seemed cautious, reflecting uncertainty about the future direction of the market.

Keywords: investor sentiment, market confidence, trading volume, market psychology, risk aversion.

Expert Opinions and Predictions

Market analysts offered diverse perspectives on the day's events and future prospects. [Insert quote from a market analyst, mentioning their name and affiliation]. They suggest that [summarize the analyst's prediction]. Another expert, [Insert quote from another analyst, mentioning their name and affiliation], believes that [summarize this analyst's prediction]. Potential catalysts for future market movements include [mention potential future events that could impact the market].

Keywords: market analysis, expert opinion, market forecast, trading predictions, market outlook.

Conclusion: Navigating the Choppy Waters of the Indian Stock Market

Today's trading session underscores the inherent volatility of the Indian stock market. The Sensex and Nifty 50 experienced a period of choppy trading, ultimately closing with minimal net change. Several factors, including global economic uncertainty, domestic political developments, and sectoral performance variations, contributed to this volatility. The impact on investor sentiment was mixed, with cautious optimism prevailing. Understanding these factors and staying informed about market news is crucial for making informed investment decisions.

For short-term investors, navigating choppy trading requires vigilance and adaptability. Long-term investors should maintain a focus on their investment strategies while remaining aware of the prevailing market conditions. To stay ahead of the curve, regularly follow market updates, analyze expert opinions, and maintain a diversified investment portfolio. By carefully considering these factors, you can better navigate the choppy waters of the Indian stock market.

Featured Posts

-

Bot Governor Appointment Key To Addressing Thailands Tariff Issues

May 10, 2025

Bot Governor Appointment Key To Addressing Thailands Tariff Issues

May 10, 2025 -

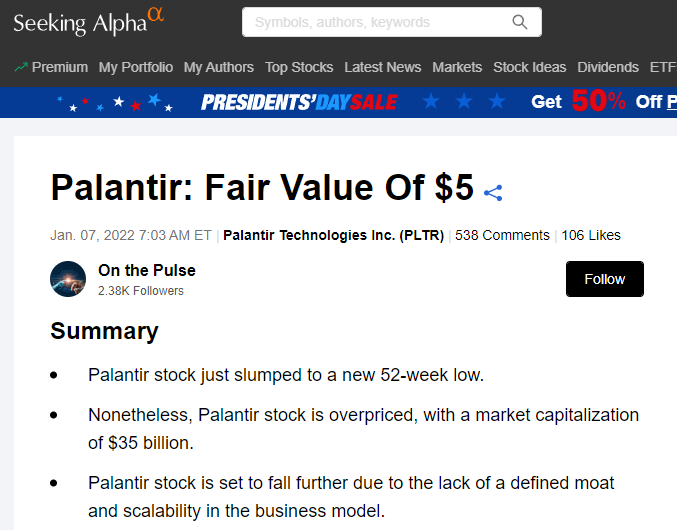

Palantir Stock 30 Drop Analysis And Investment Advice

May 10, 2025

Palantir Stock 30 Drop Analysis And Investment Advice

May 10, 2025 -

The Harry Styles Soundalike Benson Boone Responds To Critics

May 10, 2025

The Harry Styles Soundalike Benson Boone Responds To Critics

May 10, 2025 -

Palantir Plunges 30 Should You Buy The Dip

May 10, 2025

Palantir Plunges 30 Should You Buy The Dip

May 10, 2025 -

Sycamore Gap Tree Vandalism Two Men Found Guilty

May 10, 2025

Sycamore Gap Tree Vandalism Two Men Found Guilty

May 10, 2025