Climate Risk: A New Factor In Home Loan Qualification

Table of Contents

Increased Scrutiny of Flood-Prone Areas

Rising sea levels and increased flood frequency:

Rising sea levels and the increased frequency of severe weather events are significantly impacting property values and lender assessments. These changes translate to a higher risk for lenders, influencing their decisions on loan applications.

- Increased insurance premiums: Properties in flood-prone areas face drastically higher insurance premiums, making them less attractive to both buyers and lenders.

- Stricter lending criteria: Lenders are implementing stricter criteria for loans on properties located in high-risk flood zones, often requiring larger down payments or higher interest rates.

- Potential for loan denial: In some cases, loans for properties in areas with significant flood risk may be denied altogether.

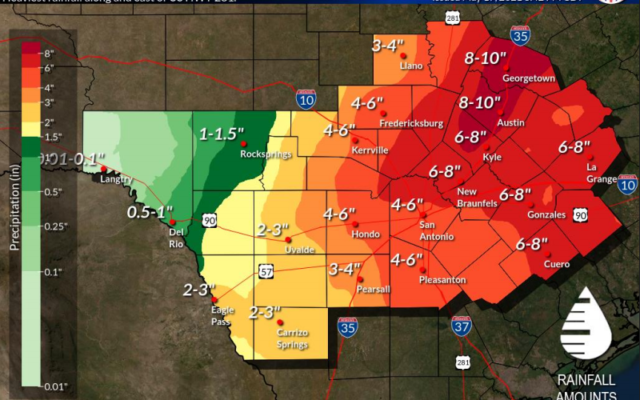

Several coastal regions are experiencing a dramatic increase in flood risk. For instance, areas along the Gulf Coast of the United States and parts of the Netherlands are facing increasingly frequent and severe flooding, leading to stricter regulations and higher insurance costs. Keywords like flood risk assessment, flood insurance, coastal properties are becoming increasingly important in the mortgage industry.

Government regulations and flood maps:

Government agencies, such as the Federal Emergency Management Agency (FEMA) in the United States, play a crucial role in determining flood risk. FEMA flood maps are used by lenders to assess the risk associated with a particular property.

- Changes to flood zone designations: Updates to flood maps can reclassify properties into higher-risk zones, leading to stricter lending requirements.

- Impact on mortgage insurance premiums: The flood zone designation directly impacts the cost of mortgage insurance premiums, adding to the overall cost of homeownership.

- Updated risk assessments: Lenders are increasingly relying on sophisticated risk assessment models that incorporate climate projections and historical flood data to evaluate loan applications.

[Link to FEMA flood map website] (Replace with actual link)

Wildfire Risk and Home Loan Approval

Increased wildfire frequency and intensity:

The frequency and intensity of wildfires are increasing globally, significantly impacting property values and insurance availability. This presents a substantial challenge for both homeowners and lenders.

- Damage to properties: Wildfires can cause extensive damage to homes and surrounding infrastructure, leading to significant rebuilding costs.

- Increased rebuilding costs: The cost of rebuilding after a wildfire can be substantially higher than the original property value due to increased demand for materials and labor.

- Difficulty securing insurance: Securing insurance for properties in high-risk wildfire zones is becoming increasingly difficult, with many insurers refusing to offer coverage or charging exorbitant premiums.

- Potential for loan defaults: The combination of property damage, high rebuilding costs, and difficulty securing insurance increases the risk of loan defaults for lenders.

Keywords such as wildfire risk assessment, defensible space, fire-resistant materials are now key considerations in mortgage applications.

Location and proximity to wildfire zones:

The location of a property relative to wildfire zones significantly impacts loan approval and insurance rates. Properties situated near forested areas or in areas with a history of wildfires face stricter lending requirements.

- Higher interest rates: Lenders may charge higher interest rates to compensate for the increased risk associated with properties in high-fire-risk zones.

- Stricter lending requirements: More stringent underwriting criteria are applied to loans for properties in high-risk areas, often including larger down payments or higher credit score requirements.

- Increased down payment requirements: Lenders may require larger down payments to mitigate their risk, making homeownership less accessible for some buyers.

California and parts of Australia are examples of regions experiencing a heightened risk of wildfires, leading to stricter lending practices.

Extreme Weather Events and Loan Applications

Heatwaves, droughts, and hurricanes:

Extreme weather events, such as heatwaves, droughts, and hurricanes, are becoming more frequent and severe, impacting property values and mortgage applications.

- Damage to infrastructure: Extreme weather can cause significant damage to infrastructure, including roads, bridges, and utilities, impacting property values and livability.

- Decreased property values: Properties affected by extreme weather events often experience a decrease in value due to damage or perceived risk.

- Potential for loan defaults: Damage from extreme weather events can lead to loan defaults if homeowners are unable to repair or rebuild their properties.

Keywords like extreme weather risk, climate resilience, property damage are critical for understanding the impact on the mortgage industry.

Impact on infrastructure and utility access:

Reliable infrastructure, including access to water, electricity, and transportation, is crucial for a property's value and livability. Lenders assess the vulnerability of infrastructure when evaluating loan applications.

- Access to water, electricity, and transportation: Disruptions to essential services due to extreme weather can significantly impact property value and desirability.

- Impact on property value and livability: Properties lacking access to reliable utilities or situated in areas vulnerable to infrastructure damage may be deemed higher risk.

- Lender assessment of infrastructure vulnerability: Lenders are increasingly incorporating assessments of infrastructure vulnerability into their risk models, considering factors like proximity to critical infrastructure and the resilience of local utilities.

Mitigating Climate Risk When Applying for a Home Loan

Due diligence and property research:

Conducting thorough research before purchasing a property is crucial for mitigating climate risk.

- Check flood maps, wildfire risk assessments, and local climate change projections: Utilize publicly available resources and consult with experts to understand the potential risks associated with a particular property.

- Consult with real estate professionals: Experienced real estate agents familiar with local climate risks can provide valuable insights and guidance.

Disclosure of potential climate risks:

Transparency with lenders is vital. Open communication about potential climate risks associated with a property will build trust and facilitate a smoother loan application process.

- Open communication with lenders: Disclosing known risks proactively demonstrates responsible homeownership and can help avoid complications later.

- Providing accurate information about potential risks: Accurate and complete information helps lenders assess the risk accurately and make informed decisions.

Investing in climate-resilient features:

Investing in energy-efficient appliances and climate-adaptive measures can improve a property's resilience and reduce long-term costs.

- Reduced insurance premiums: Climate-resilient features can lead to lower insurance premiums as they demonstrate a commitment to mitigating risks.

- Potential for lower energy costs: Energy-efficient upgrades can significantly reduce utility bills.

- Increased property value: Climate-resilient properties are generally more attractive to buyers, potentially increasing their long-term value.

Conclusion

Climate risk is rapidly becoming a significant factor in home loan qualification. Understanding the potential impact of climate change on property values and insurance is crucial for prospective homebuyers. By conducting thorough research, disclosing potential risks, and investing in climate-resilient features, you can improve your chances of securing a home loan. Don't let climate risk derail your homeownership dreams – take proactive steps to mitigate these risks and secure your future. Learn more about how climate risk assessments are shaping the mortgage industry and how you can prepare for a successful application.

Featured Posts

-

Adressage Des Batiments A Abidjan Comment Identifier Les Numeros

May 20, 2025

Adressage Des Batiments A Abidjan Comment Identifier Les Numeros

May 20, 2025 -

Bbc To Turn Agatha Christies Endless Night Into A Tv Series

May 20, 2025

Bbc To Turn Agatha Christies Endless Night Into A Tv Series

May 20, 2025 -

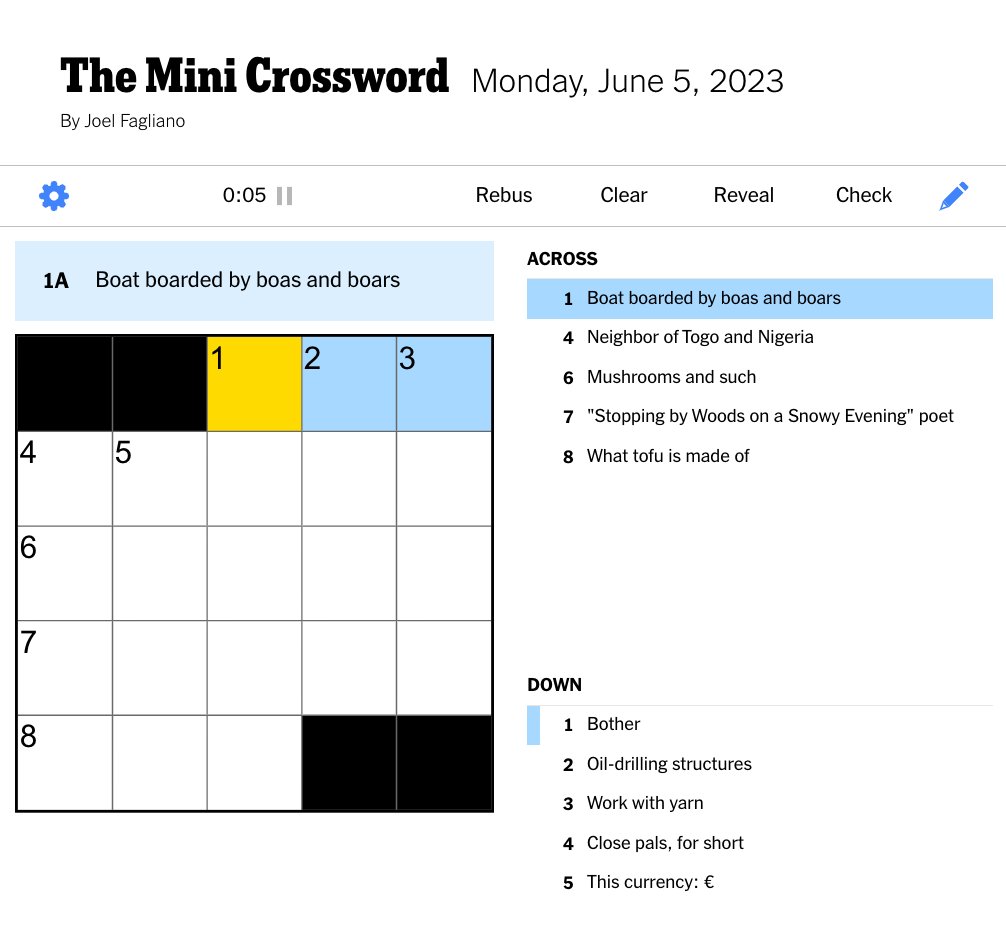

Nyt Mini Crossword Answers For March 13 2025

May 20, 2025

Nyt Mini Crossword Answers For March 13 2025

May 20, 2025 -

Improved Wireless Headphones A Buyers Guide

May 20, 2025

Improved Wireless Headphones A Buyers Guide

May 20, 2025 -

Nyt Mini Crossword Today Hints And Answer For March 5 2025

May 20, 2025

Nyt Mini Crossword Today Hints And Answer For March 5 2025

May 20, 2025

Latest Posts

-

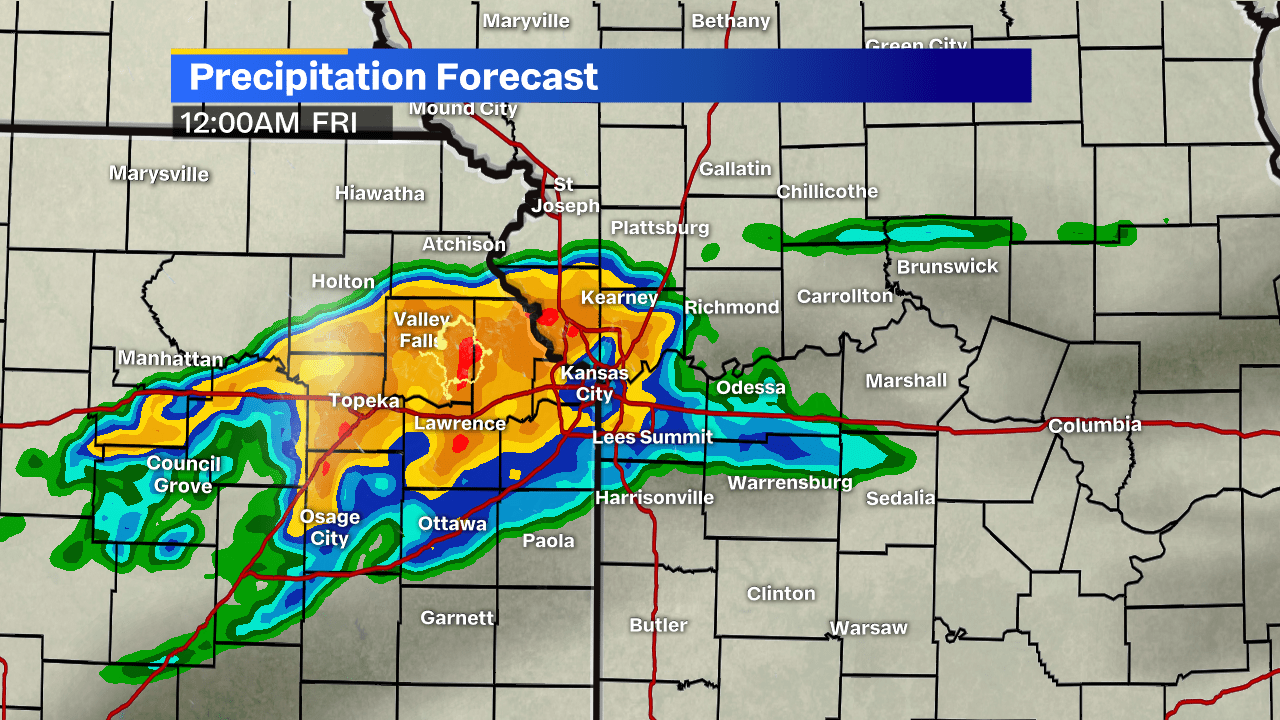

Mild Temperatures Little Rain Chance Your Weekend Forecast

May 20, 2025

Mild Temperatures Little Rain Chance Your Weekend Forecast

May 20, 2025 -

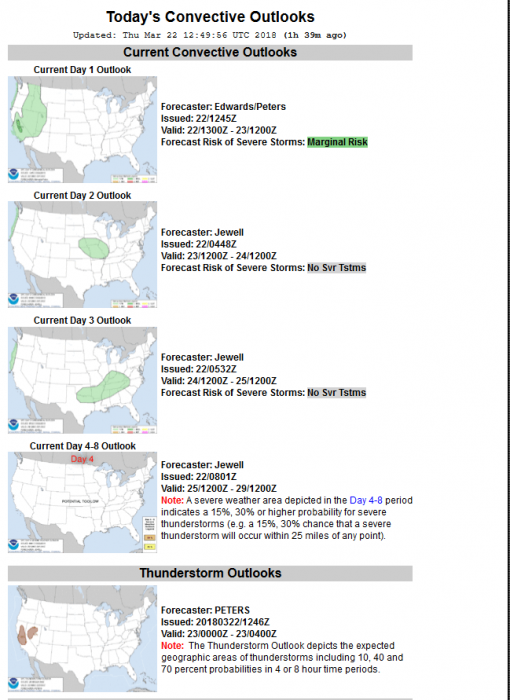

Severe Weather Outlook Storm Chance Tonight Monday Impact

May 20, 2025

Severe Weather Outlook Storm Chance Tonight Monday Impact

May 20, 2025 -

Resilience And Mental Health Building Strength Not Bitterness

May 20, 2025

Resilience And Mental Health Building Strength Not Bitterness

May 20, 2025 -

Overnight Storm Threat Severe Weather Possible Monday

May 20, 2025

Overnight Storm Threat Severe Weather Possible Monday

May 20, 2025 -

Storm Chance Overnight Severe Weather Potential Monday

May 20, 2025

Storm Chance Overnight Severe Weather Potential Monday

May 20, 2025