Coinbase (COIN) And Riot Platforms (RIOT): A Comparative Stock Market Analysis

Table of Contents

Coinbase (COIN) Stock Analysis

Business Model and Revenue Streams

Coinbase's primary function as a leading cryptocurrency exchange generates revenue through various streams. Coinbase revenue is largely driven by Coinbase transaction fees, charged on cryptocurrency trades executed on their platform. They also generate income through subscription services offered to institutional clients and through interest earned on assets held in custody. Coinbase boasts a substantial user base and holds a significant Coinbase market share within the global cryptocurrency exchange landscape. Understanding crypto exchange fees and their impact on Coinbase's profitability is crucial for any investment analysis.

Financial Performance and Growth

Analyzing COIN financial performance requires examining several key metrics. Coinbase earnings and revenue growth have fluctuated significantly, reflecting the inherent volatility of the cryptocurrency market. The COIN stock price is heavily influenced by factors such as overall market sentiment towards cryptocurrencies and regulatory developments. Tracking cryptocurrency market capitalization and its correlation with COIN's performance provides valuable insights.

Risks and Challenges

Investing in COIN stock carries inherent risks. COIN risk factors include:

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, posing potential challenges to Coinbase's operations and profitability. Changes in cryptocurrency regulation can significantly impact COIN stock price.

- Cryptocurrency Market Volatility: The price of cryptocurrencies is highly volatile, directly affecting trading volume and, consequently, Coinbase's revenue. A volatile crypto market translates to increased risk for investors.

- Competition: The cryptocurrency exchange market is competitive, with new players constantly emerging. Intense competition in crypto can put pressure on Coinbase's market share and profitability.

Bullet Points:

- Coinbase's revenue growth rate has shown considerable variation year-over-year.

- Coinbase has established significant partnerships with institutional investors and financial institutions.

- Recent news regarding regulatory scrutiny or new product launches directly affects COIN's short-term stock price.

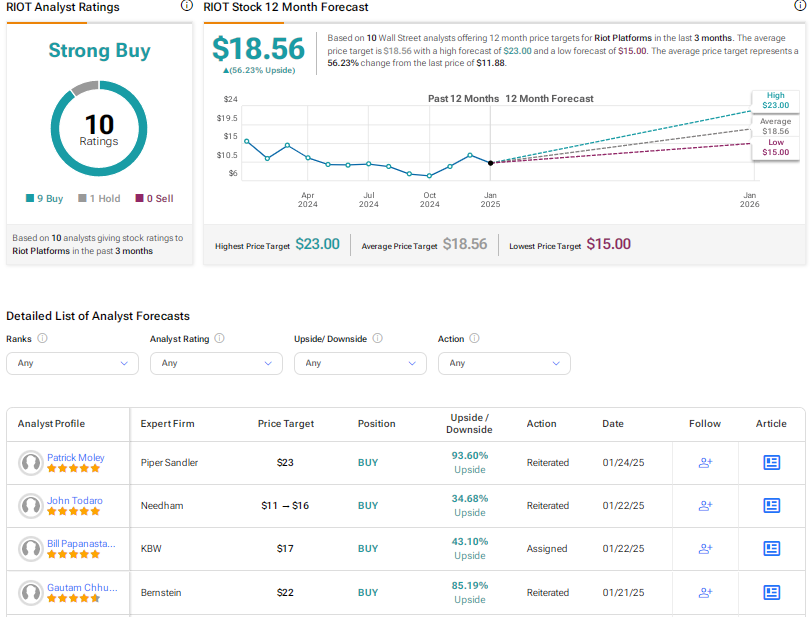

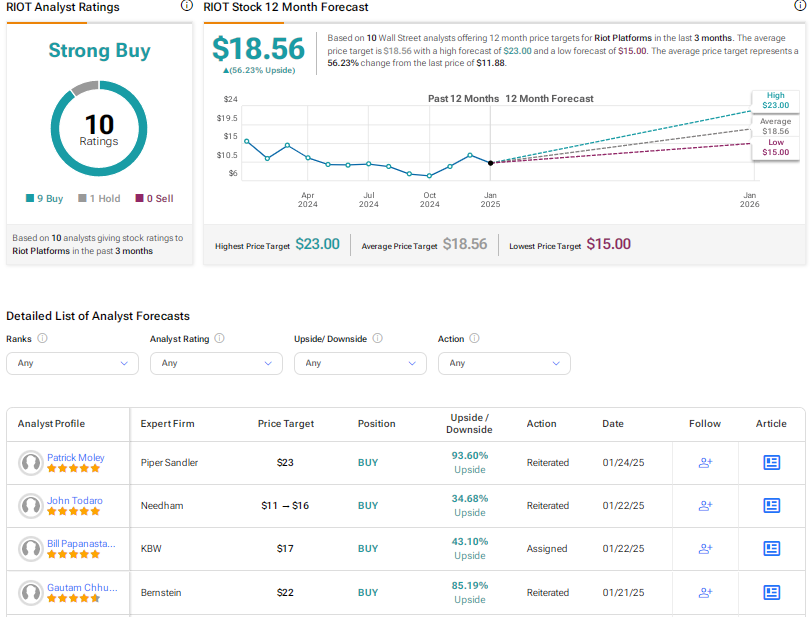

Riot Platforms (RIOT) Stock Analysis

Business Model and Bitcoin Mining Operations

Riot Platforms is a publicly traded Bitcoin mining company. Its Bitcoin mining operations involve large-scale mining farms equipped with specialized hardware to validate Bitcoin transactions and earn Bitcoin rewards. Understanding Riot Platforms mining capacity, measured in hash rate, and its geographical distribution is essential. Crypto mining hardware investment and energy consumption significantly affect the company's profitability and Bitcoin mining profitability.

Financial Performance and Bitcoin Holdings

RIOT financial performance is closely tied to the price of Bitcoin. Bitcoin mining revenue is generated from the Bitcoin rewards earned through mining, while the value of Riot Platforms Bitcoin holdings impacts the overall balance sheet and net worth. Analyzing the relationship between Bitcoin price impact on RIOT is critical for any potential investor.

Risks and Challenges

Investing in RIOT stock carries substantial risks. RIOT risk factors include:

- Bitcoin Price Volatility: The price of Bitcoin is highly volatile, directly impacting the profitability of Bitcoin mining operations and the value of Riot's Bitcoin holdings. Bitcoin price volatility impact is a major concern.

- Energy Costs: Bitcoin mining is energy-intensive, and fluctuations in energy prices directly affect operating costs and profitability. High energy costs for mining can significantly impact margins.

- Competition: The Bitcoin mining industry is competitive, with numerous companies vying for market share. Competition in Bitcoin mining can lead to reduced profitability for individual miners.

Bullet Points:

- Riot Platforms' hash rate and mining efficiency are key indicators of their operational performance.

- Their expansion plans involve investing in new mining facilities, increasing their mining capacity.

- Sharp fluctuations in Bitcoin's price directly affect RIOT's quarterly profitability.

Comparative Analysis: COIN vs. RIOT

| Feature | Coinbase (COIN) | Riot Platforms (RIOT) |

|---|---|---|

| Business Model | Cryptocurrency Exchange | Bitcoin Mining |

| Revenue Source | Transaction fees, subscriptions, custody | Bitcoin mining rewards, Bitcoin holdings |

| Key Risk | Regulatory uncertainty, market volatility, competition | Bitcoin price volatility, energy costs, competition |

| Growth Potential | Expanding user base, new product offerings | Expanding mining capacity, Bitcoin price appreciation |

Coinbase's revenue stream is more diversified compared to Riot Platforms, which is heavily reliant on the Bitcoin price. Coinbase has higher regulatory exposure, while Riot faces risks related to energy costs and the efficiency of its mining operations. A risk-averse investor might prefer Coinbase due to its somewhat more established and diversified business model, while a risk-tolerant investor seeking higher potential returns might favor Riot Platforms. Choosing between a crypto exchange vs mining stock depends entirely on your investment comparison preferences.

Conclusion: Investing in Coinbase (COIN) and Riot Platforms (RIOT): A Final Verdict

This comparative analysis reveals that both Coinbase and Riot Platforms offer unique investment opportunities within the cryptocurrency sector, but each carries its own set of risks. Coinbase benefits from a broader revenue model and established brand recognition, while Riot Platforms' success hinges heavily on the Bitcoin price. The best choice depends on your individual investment comparison needs and risk tolerance. Remember, this analysis does not constitute financial advice. Conduct your own thorough research on Coinbase (COIN) and Riot Platforms (RIOT) stocks before making any investment decisions.

Featured Posts

-

Olivia Rodrigo And The 1975 Glastonbury 2024 Headliners

May 03, 2025

Olivia Rodrigo And The 1975 Glastonbury 2024 Headliners

May 03, 2025 -

April 12 2025 Lotto And Lotto Plus Winning Numbers

May 03, 2025

April 12 2025 Lotto And Lotto Plus Winning Numbers

May 03, 2025 -

Play Station 6 Mrajet Shamlt Llmyzat Walthsynat

May 03, 2025

Play Station 6 Mrajet Shamlt Llmyzat Walthsynat

May 03, 2025 -

Reform Uks Surprising Stance Farage Prefers Snp Victory In Holyrood

May 03, 2025

Reform Uks Surprising Stance Farage Prefers Snp Victory In Holyrood

May 03, 2025 -

L Emotion De Macron Apres Son Entretien Avec Les Victimes De L Armee Israelienne

May 03, 2025

L Emotion De Macron Apres Son Entretien Avec Les Victimes De L Armee Israelienne

May 03, 2025

Latest Posts

-

Us Stanley Cup Playoff Viewership Down Despite Increased International Appeal

May 04, 2025

Us Stanley Cup Playoff Viewership Down Despite Increased International Appeal

May 04, 2025 -

Nhl Playoff Picture A Breakdown Of Fridays Important Games

May 04, 2025

Nhl Playoff Picture A Breakdown Of Fridays Important Games

May 04, 2025 -

Stanley Cup Playoffs Ratings Dip Despite International Interest

May 04, 2025

Stanley Cup Playoffs Ratings Dip Despite International Interest

May 04, 2025 -

Analyzing Fridays Nhl Games Impact On Playoff Race

May 04, 2025

Analyzing Fridays Nhl Games Impact On Playoff Race

May 04, 2025 -

Nhl Standings Crucial Friday Matchups And Playoff Scenarios

May 04, 2025

Nhl Standings Crucial Friday Matchups And Playoff Scenarios

May 04, 2025