Compare Personal Loan Rates Today & Choose The Right Loan

Table of Contents

Understanding Personal Loan Rates and APR

Before you start comparing personal loan rates, it's essential to understand the difference between the interest rate and the APR (Annual Percentage Rate). The interest rate is the basic cost of borrowing money, expressed as a percentage of the loan amount. However, the APR includes the interest rate plus other fees associated with the loan, such as origination fees, late payment fees, and potentially even prepayment penalties. The APR gives you a more accurate picture of the true cost of borrowing.

Several factors influence your personal loan interest rate:

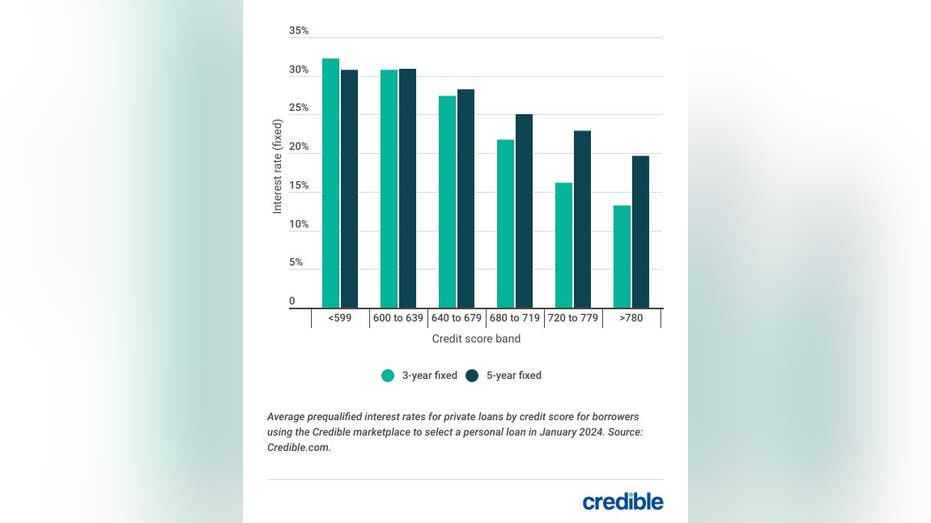

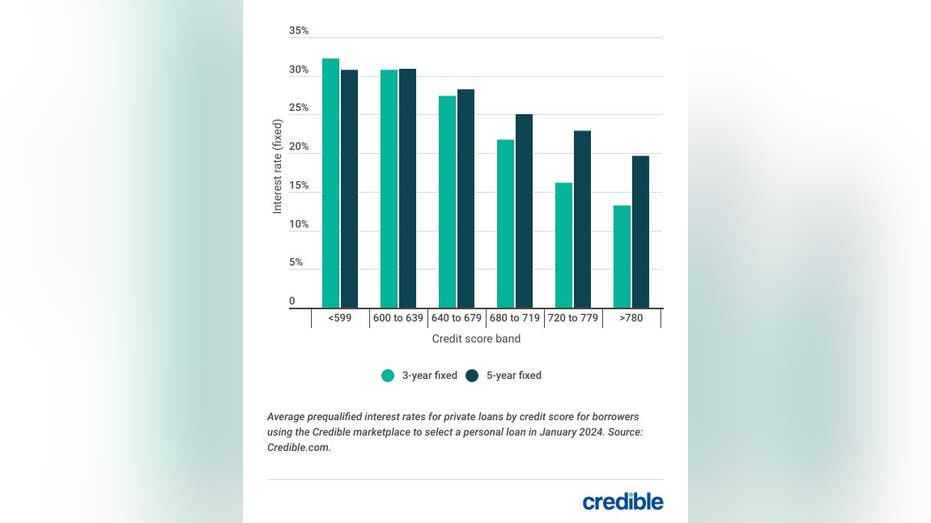

- Credit Score: Higher credit scores generally lead to lower interest rates. Lenders view borrowers with good credit as less risky. Improving your credit score before applying can significantly impact the rates you qualify for.

- Loan Amount: Larger loan amounts may have slightly higher rates because they represent a greater risk to the lender.

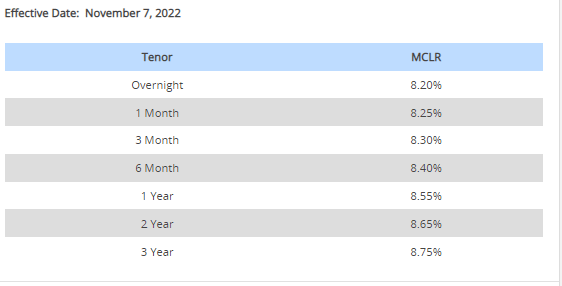

- Loan Term: Shorter loan terms usually mean higher monthly payments but lower overall interest paid because you're paying off the loan principal faster. Longer loan terms result in lower monthly payments but higher overall interest paid.

- Hidden Fees: Hidden fees can significantly impact the true cost of your loan. Always carefully review the loan agreement to understand all associated charges.

Where to Compare Personal Loan Rates

Comparing personal loan rates requires exploring various resources. Each option has its own set of advantages and disadvantages:

- Online Lenders: Online lenders often offer competitive rates and a streamlined application process. They can often process applications and disburse funds quickly. However, the lack of personal interaction might be a drawback for some.

- Banks and Credit Unions: Banks and credit unions may offer personalized service and potentially lower rates for existing customers, especially those with a long and positive banking history. However, their application processes can sometimes be lengthier.

- Comparison Websites: Comparison websites allow you to quickly see rates from multiple lenders side-by-side. This saves you time and effort, but be aware that the information presented might not always be entirely up-to-date.

- Directly Contacting Lenders: While time-consuming, directly contacting various lenders can allow for personalized rate quotes and potentially better negotiation opportunities.

Remember to always check lender reviews before applying to gauge their reputation and customer service quality.

Factors to Consider Beyond Interest Rates

While the interest rate is a crucial factor, it's not the only aspect to consider when choosing a personal loan. Several other elements can significantly impact your overall experience:

- Loan Term: The loan term directly impacts your monthly payment amount and the total interest paid over the life of the loan. Carefully consider your budget and repayment capacity when selecting a term.

- Fees: Origination fees, late payment fees, prepayment penalties, and other charges can add significantly to the overall cost of your loan. Scrutinize the loan agreement carefully to understand all associated fees.

- Repayment Options: Some lenders may offer flexible repayment options, such as the ability to make extra payments without penalty. This can help you pay off your loan faster and reduce the total interest paid.

- Prepayment Penalties: Be aware of any prepayment penalties the lender might impose if you pay off the loan early. These can negate some of the benefits of paying off your debt quickly.

Improving Your Chances of Getting a Lower Personal Loan Rate

You can improve your chances of securing a lower personal loan rate by taking proactive steps:

- Improve Your Credit Score: Paying down existing debts, keeping your credit utilization ratio low, and monitoring your credit report regularly to dispute any errors can significantly boost your credit score.

- Shop Around: Compare offers from multiple lenders to find the most competitive rates.

- Consider a Co-Signer: Adding a co-signer with a strong credit history can improve your eligibility for a lower rate.

- Negotiate: Don't hesitate to negotiate with the lender for a better rate, particularly if you have a strong credit history and a compelling reason for needing a lower rate.

Conclusion

Comparing personal loan rates is crucial for securing the best possible terms. By understanding the factors influencing interest rates and carefully considering all aspects of a loan—including fees, loan terms, and repayment options—you can make an informed decision that aligns with your financial goals. Remember to check your credit report, compare offers from multiple lenders, and factor in all fees involved before committing to a loan.

Start comparing personal loan rates today and find the right loan for your needs! Don't delay – secure the best personal loan rates and begin your project now! Use our resources to find the perfect personal loan offer.

Featured Posts

-

Italian Open 2024 Sinners Return After Doping Ban Clears Grand Slam Participation

May 28, 2025

Italian Open 2024 Sinners Return After Doping Ban Clears Grand Slam Participation

May 28, 2025 -

Applying For Finance Loans A Practical Guide To Interest Rates Emis And Tenure

May 28, 2025

Applying For Finance Loans A Practical Guide To Interest Rates Emis And Tenure

May 28, 2025 -

Man Utd News 50m Asset Sale Signals Potential Transfer

May 28, 2025

Man Utd News 50m Asset Sale Signals Potential Transfer

May 28, 2025 -

National Lottery Jackpot Winner From Broadstairs Plans Mauritius Getaway

May 28, 2025

National Lottery Jackpot Winner From Broadstairs Plans Mauritius Getaway

May 28, 2025 -

Prakiraan Cuaca Besok Di Jawa Barat Hujan Hingga Sore Hari

May 28, 2025

Prakiraan Cuaca Besok Di Jawa Barat Hujan Hingga Sore Hari

May 28, 2025

Latest Posts

-

Manila Bays Vibrancy A Sustainable Future

May 30, 2025

Manila Bays Vibrancy A Sustainable Future

May 30, 2025 -

Harmful Algal Bloom Crisis Threat To Californias Marine Life

May 30, 2025

Harmful Algal Bloom Crisis Threat To Californias Marine Life

May 30, 2025 -

Red Tide Crisis On Cape Cod Current Status And Impact

May 30, 2025

Red Tide Crisis On Cape Cod Current Status And Impact

May 30, 2025 -

California Coast Algae Bloom Impacts On Marine Ecosystems

May 30, 2025

California Coast Algae Bloom Impacts On Marine Ecosystems

May 30, 2025 -

Roastable Roots A Country Diary Foraging Adventure

May 30, 2025

Roastable Roots A Country Diary Foraging Adventure

May 30, 2025