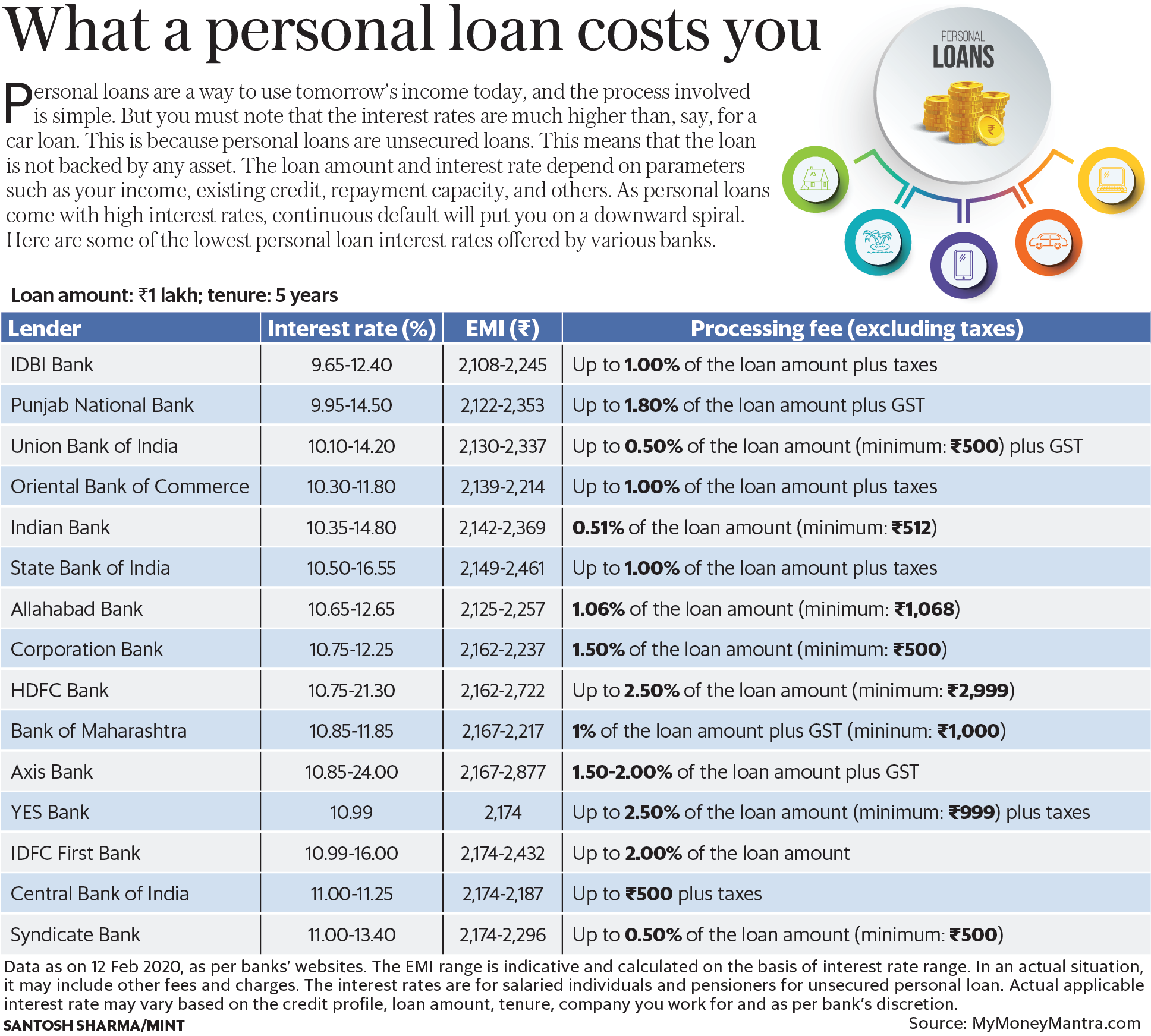

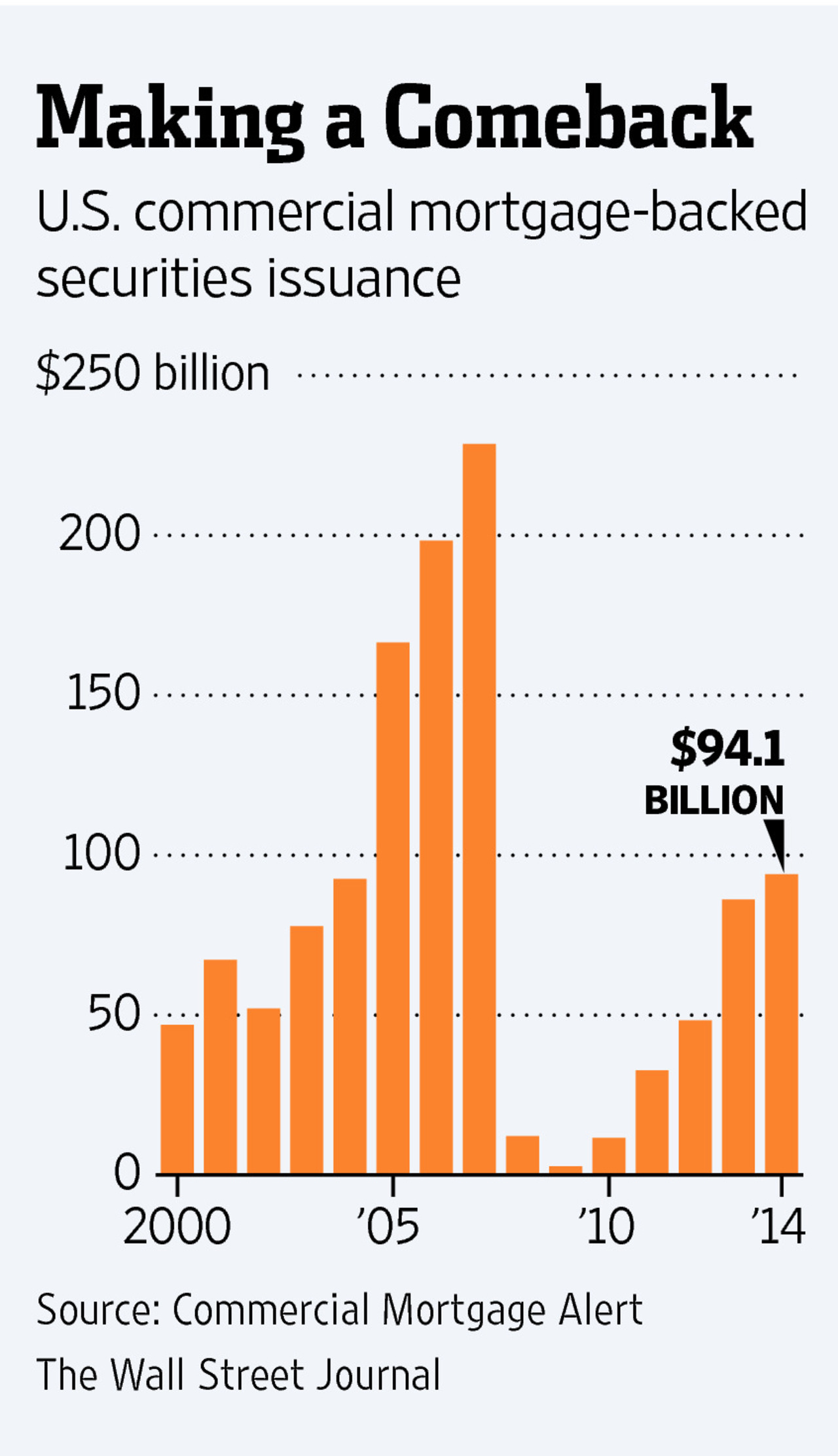

Compare Today's Best Personal Loan Interest Rates

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several key factors influence the personal loan interest rates you'll qualify for. Understanding these factors is the first step towards securing a low-interest loan. Knowing what impacts your rate allows you to improve your chances of getting a better deal. Key factors include your credit score, loan amount, loan term, debt-to-income ratio, and the type of lender you choose.

-

Credit Score: Your credit score is the most significant factor determining your personal loan interest rate. A higher credit score (700+ is generally considered excellent) typically qualifies you for significantly lower interest rates. Lenders view a high credit score as an indicator of responsible financial behavior, reducing their risk. Aim for a good credit score to unlock the best rates. Improving your credit score involves paying bills on time, keeping credit utilization low, and maintaining a healthy mix of credit accounts.

-

Loan Amount: Larger loan amounts often come with slightly higher interest rates. Lenders perceive larger loans as higher risk, so they may charge a premium to compensate. If possible, borrow only the amount you truly need to minimize the interest you'll pay over the life of the loan.

-

Loan Term: The length of your loan term directly impacts your monthly payments and the total interest you pay. Shorter loan terms (e.g., 12-24 months) usually mean higher monthly payments but lower overall interest paid. Longer terms (e.g., 36-60 months) generally have lower monthly payments but significantly higher total interest. Carefully weigh the benefits of lower monthly payments against the higher overall cost.

-

Debt-to-Income Ratio (DTI): Your debt-to-income ratio (DTI) represents the percentage of your gross monthly income that goes towards debt payments. A lower DTI shows lenders you can effectively manage your finances, potentially leading to better rates. Reducing your DTI before applying for a loan can improve your chances of securing a lower interest rate.

-

Type of Lender: Different lenders – banks, credit unions, and online lenders – offer varying rates and terms. Banks often have more stringent requirements but may offer competitive rates for those who qualify. Credit unions typically offer member-focused benefits, potentially including lower rates. Online lenders often provide a streamlined application process but may have higher rates or fees. Shop around and compare offers from multiple lenders to find the most suitable option.

-

Interest Rate Type: Understand the difference between fixed and variable interest rates. Fixed interest rates remain the same throughout the loan term, providing predictability. Variable interest rates fluctuate based on market conditions, offering potential savings but also increased uncertainty. Choose the interest rate type that best aligns with your risk tolerance and financial goals.

How to Compare Personal Loan Interest Rates Effectively

Comparing personal loan interest rates effectively is crucial to securing the best deal. Utilizing online tools and employing strategic comparison techniques will help you find the lowest rates. Don't rush the process; careful comparison saves you money in the long run.

-

Use Online Comparison Tools: Many reputable websites offer free tools to compare rates from multiple lenders simultaneously. These tools help you quickly filter options based on your needs and preferences, saving you time and effort. Be sure to use tools that are known for accuracy and transparency.

-

Check Lender Websites Directly: While comparison websites are helpful, always verify the information you find on those sites by visiting the lenders' websites directly. Rates and terms can change, so ensuring you have the most up-to-date information is vital.

-

Read the Fine Print: Carefully review loan agreements for hidden fees or prepayment penalties. Understanding all the terms and conditions before signing is crucial to avoiding unexpected costs.

-

Consider Pre-qualification: Pre-qualifying allows you to see potential rates without significantly impacting your credit score. This helps you narrow your search and avoid unnecessary hard inquiries on your credit report.

-

Negotiate: Don't hesitate to negotiate with lenders, especially if you have a strong credit profile and multiple offers. Lenders are often willing to work with borrowers who demonstrate a strong commitment to repayment.

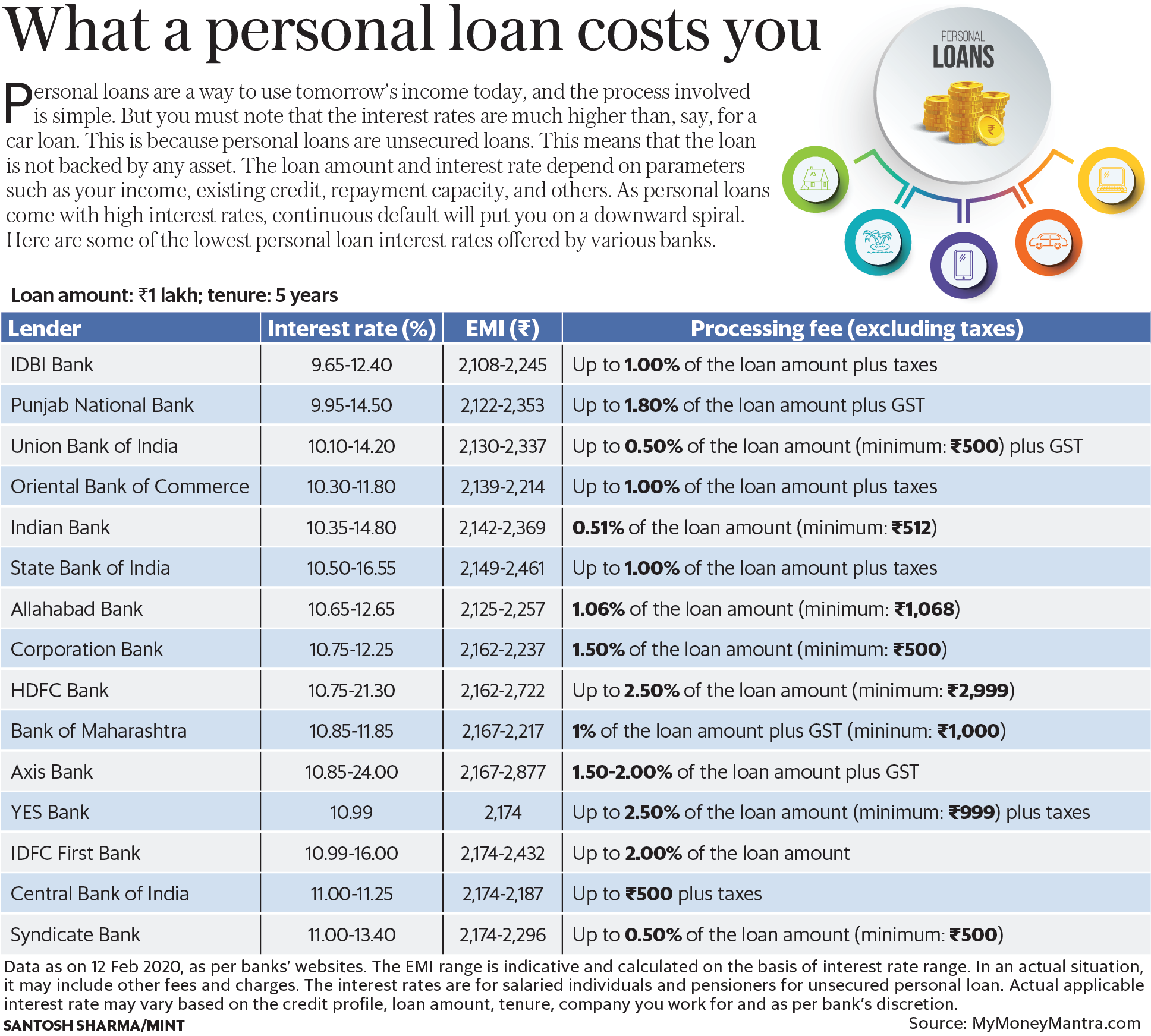

Understanding APR (Annual Percentage Rate)

The Annual Percentage Rate (APR) reflects the total cost of borrowing, including interest and fees. It's a crucial factor to consider when comparing loan offers. A lower APR indicates a more affordable loan.

- The APR incorporates all charges associated with the loan, giving you a clear picture of the total cost. Comparing APRs allows for a true apples-to-apples comparison of different loan offers, even if the stated interest rates appear similar. Don't focus solely on the interest rate; always consider the APR.

Finding the Best Personal Loan Rates for Your Situation

The best personal loan rates for your situation depend on several factors, including your credit score and the type of loan you need. Understanding your options is key to finding the most suitable loan product.

-

Credit Score Impact: Individuals with excellent credit scores will typically secure the lowest rates. Those with less-than-perfect credit may need to explore options for borrowers with bad credit, which often come with higher interest rates.

-

Secured vs. Unsecured Loans: Secured loans (backed by collateral, such as a car or savings account) usually offer lower rates but carry a higher risk of asset loss if you default. Unsecured loans don't require collateral but generally have higher interest rates.

-

Loan Purpose: Lenders may offer specialized rates for specific purposes like debt consolidation or home improvements. Clearly stating the purpose of your loan during the application process can potentially secure a better rate.

Conclusion

Finding the best personal loan interest rates requires careful research and comparison. By understanding the factors affecting rates, utilizing online tools, and negotiating effectively, you can secure the most affordable loan for your financial needs. Don't settle for the first offer you receive – take the time to compare today's best personal loan interest rates and make an informed decision. Start comparing personal loan rates now and secure the financial future you deserve!

Featured Posts

-

Waspada Tren Kawin Kontrak Dengan Bule Di Bali Ancaman Bagi Warga Lokal

May 28, 2025

Waspada Tren Kawin Kontrak Dengan Bule Di Bali Ancaman Bagi Warga Lokal

May 28, 2025 -

Pittsburgh First Stop On Padres Extensive Road Trip

May 28, 2025

Pittsburgh First Stop On Padres Extensive Road Trip

May 28, 2025 -

Garnacho To Atletico Madrid Transfer Speculation Mounts

May 28, 2025

Garnacho To Atletico Madrid Transfer Speculation Mounts

May 28, 2025 -

Avrupa Da Bomba Transfer Ingiliz Kuluebue Anlasmaya Cok Yakin

May 28, 2025

Avrupa Da Bomba Transfer Ingiliz Kuluebue Anlasmaya Cok Yakin

May 28, 2025 -

Arraez Injured Dodgers On Fire A Look At The Competitive Nl West

May 28, 2025

Arraez Injured Dodgers On Fire A Look At The Competitive Nl West

May 28, 2025

Latest Posts

-

Programma Tileorasis Kyriaki 16 Martioy 2024

May 30, 2025

Programma Tileorasis Kyriaki 16 Martioy 2024

May 30, 2025 -

Nissans Electric Plans Could The Primera Make A Comeback

May 30, 2025

Nissans Electric Plans Could The Primera Make A Comeback

May 30, 2025 -

Ta Kalytera Programmata Tis Kyriakis 16 Martioy

May 30, 2025

Ta Kalytera Programmata Tis Kyriakis 16 Martioy

May 30, 2025 -

The Return Of The Nissan Primera An Electric Future

May 30, 2025

The Return Of The Nissan Primera An Electric Future

May 30, 2025 -

Olokliromenos Odigos Tileoptikon Metadoseon 16 3

May 30, 2025

Olokliromenos Odigos Tileoptikon Metadoseon 16 3

May 30, 2025