Copper Market Outlook: Analyzing China's Trade Stance With The US

Table of Contents

China's Role as a Dominant Copper Consumer

China's massive infrastructure projects, rapid industrialization, and burgeoning electrotechnical sector fuel immense copper demand, making it a price-setter in the global copper market. Chinese copper consumption dwarfs that of other nations, significantly impacting global copper prices. This dominance stems from several key factors:

- Chinese copper consumption: China accounts for over half of global copper consumption, a figure that continues to grow annually.

- Construction boom and renewable energy investments: The ongoing construction boom and significant investments in renewable energy infrastructure, such as wind farms and solar power plants, are driving substantial copper demand in China.

- Government policies boosting copper usage: Government policies promoting electric vehicles (EVs) and smart grids further escalate copper usage, solidifying China's position as the world's largest consumer. These policies are expected to continue driving demand for years to come. This makes understanding Chinese copper demand crucial for any copper price forecast.

The Impact of US-China Trade Relations on Copper Prices

Trade tensions between the US and China, including tariffs and trade disputes, introduce considerable volatility into copper prices. These tensions can disrupt global supply chains, impacting both copper imports and exports. The effects can be multifaceted:

- Trade tariffs and copper costs: Tariffs imposed on copper or copper-related products directly increase costs for both countries, potentially impacting competitiveness and consumer prices.

- Trade disputes and investment uncertainty: Trade disputes can create uncertainty, leading to decreased investment in both countries' infrastructure projects and manufacturing sectors, thus negatively affecting copper demand.

- Geopolitical risks and price volatility: Geopolitical risks and the potential for escalating trade conflicts are key factors that contribute significantly to price volatility in the copper market. Any shifts in the US-China trade relationship require careful monitoring.

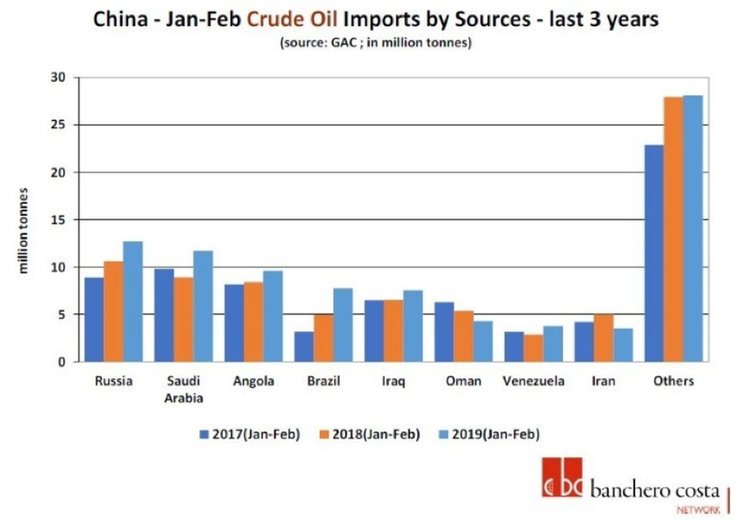

Analyzing China's Copper Import Strategies

China's approach to securing copper supplies plays a crucial role in global copper market dynamics. Its strategies include diversifying import sources and investing heavily in overseas mining projects. This approach has several implications:

- Diversification of copper imports: China actively diversifies its copper imports from various countries to mitigate reliance on any single supplier, ensuring a more stable supply chain.

- Investment in foreign mining projects: Strategic investments in foreign mining projects provide China with greater control over its copper supply, reducing vulnerability to global price fluctuations and geopolitical uncertainties.

- Strategic stockpiling and price influence: China's strategic stockpiling of copper can influence prices and availability on the global market, creating both opportunities and challenges for other copper-consuming nations.

The Influence of Green Technologies on Copper Demand

The global shift toward renewable energy and electric vehicles is a significant driver of copper demand, particularly in China and the US. This green technology push has profound implications for the copper market:

- Copper's role in renewable energy: The manufacturing of wind turbines, solar panels, and electric vehicles requires substantial amounts of copper, driving up demand.

- Government incentives for green technologies: Government incentives and subsidies for green technologies in both countries further stimulate copper demand, creating a positive feedback loop for copper consumption.

- Offsetting trade tensions: The increased demand for copper driven by green technologies could potentially offset some of the negative impacts of trade tensions on the overall copper market.

Predicting Future Copper Market Trends

Analyzing the interplay between China's trade policy, global demand, and supply chain dynamics is crucial for forecasting future copper prices and market trends. Several factors will shape the future outlook:

- Sustained growth in green sectors: Continued growth in renewable energy and electric vehicle sectors points towards robust and sustained copper demand in the coming years.

- Supply chain resilience: The resilience and diversification of the global copper supply chain will be critical in mitigating risks associated with geopolitical events and trade disruptions.

- Geopolitical factors and trade relations: Geopolitical factors and the ongoing evolution of US-China trade relations remain key variables influencing the copper market outlook. Understanding these relationships is paramount for accurate forecasting.

Conclusion

The copper market outlook is inextricably linked to the evolving relationship between China and the US. China's massive copper consumption and strategic trade policies significantly impact global copper prices and supply. Understanding the dynamics of China's trade stance with the US, including its import strategies and the influence of green technologies, is crucial for navigating the complexities of this dynamic market. Staying informed about these key factors is essential for making well-informed decisions. Therefore, continuously monitoring the copper market outlook: analyzing China's trade stance with the US is vital for investors and industry professionals alike.

Featured Posts

-

Ajtmae Mjmwet Shrkae Alymn Mnaqshat Mhmt Dmn Albrnamj Alsewdy Lltnmyt Waliemar

May 06, 2025

Ajtmae Mjmwet Shrkae Alymn Mnaqshat Mhmt Dmn Albrnamj Alsewdy Lltnmyt Waliemar

May 06, 2025 -

Hasil Piala Asia U 20 Iran Hancurkan Yaman 6 0

May 06, 2025

Hasil Piala Asia U 20 Iran Hancurkan Yaman 6 0

May 06, 2025 -

Nba Playoffs Knicks Vs Celtics Prediction Picks And Best Bets For Game 1

May 06, 2025

Nba Playoffs Knicks Vs Celtics Prediction Picks And Best Bets For Game 1

May 06, 2025 -

Halle Bailey The Target Of Ddgs Dont Take My Son

May 06, 2025

Halle Bailey The Target Of Ddgs Dont Take My Son

May 06, 2025 -

Analyzing Buffetts Apple Bet A Case Study In Strategic Investing

May 06, 2025

Analyzing Buffetts Apple Bet A Case Study In Strategic Investing

May 06, 2025

Latest Posts

-

Zaborona Diyalnosti Ofisu Vvs V Baku Ofitsiyna Pozitsiya Azerbaydzhanu

May 06, 2025

Zaborona Diyalnosti Ofisu Vvs V Baku Ofitsiyna Pozitsiya Azerbaydzhanu

May 06, 2025 -

Ofis Vvs V Azerbaydzhani Pripiniv Robotu Detali Ta Reaktsiya

May 06, 2025

Ofis Vvs V Azerbaydzhani Pripiniv Robotu Detali Ta Reaktsiya

May 06, 2025 -

Azerbaydzhan Zakriv Ofis Vvs U Baku Prichini Ta Naslidki

May 06, 2025

Azerbaydzhan Zakriv Ofis Vvs U Baku Prichini Ta Naslidki

May 06, 2025 -

Rast Uvoza Nafte U Hrvatskoj Azerbajdzanska Nafta I Pitanje Ruskog Porijekla

May 06, 2025

Rast Uvoza Nafte U Hrvatskoj Azerbajdzanska Nafta I Pitanje Ruskog Porijekla

May 06, 2025 -

Hrvatski Uvoz Nafte Azerbajdzan Kao Glavni Dobavljac Moguci Ruski Utjecaj

May 06, 2025

Hrvatski Uvoz Nafte Azerbajdzan Kao Glavni Dobavljac Moguci Ruski Utjecaj

May 06, 2025